[ad_1]

wsmahar

About one year ago I wrote about the iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT), a long-term treasury bond index ETF. In that article, I claimed that TLT offered investors few, if any, benefits. Yields were at rock-bottom levels, so income, potential capital gains, and prospective total returns were all quite low. Rising inflation also exposed the fund and its investors to capital losses, and blunted its effectiveness as a market hedge.

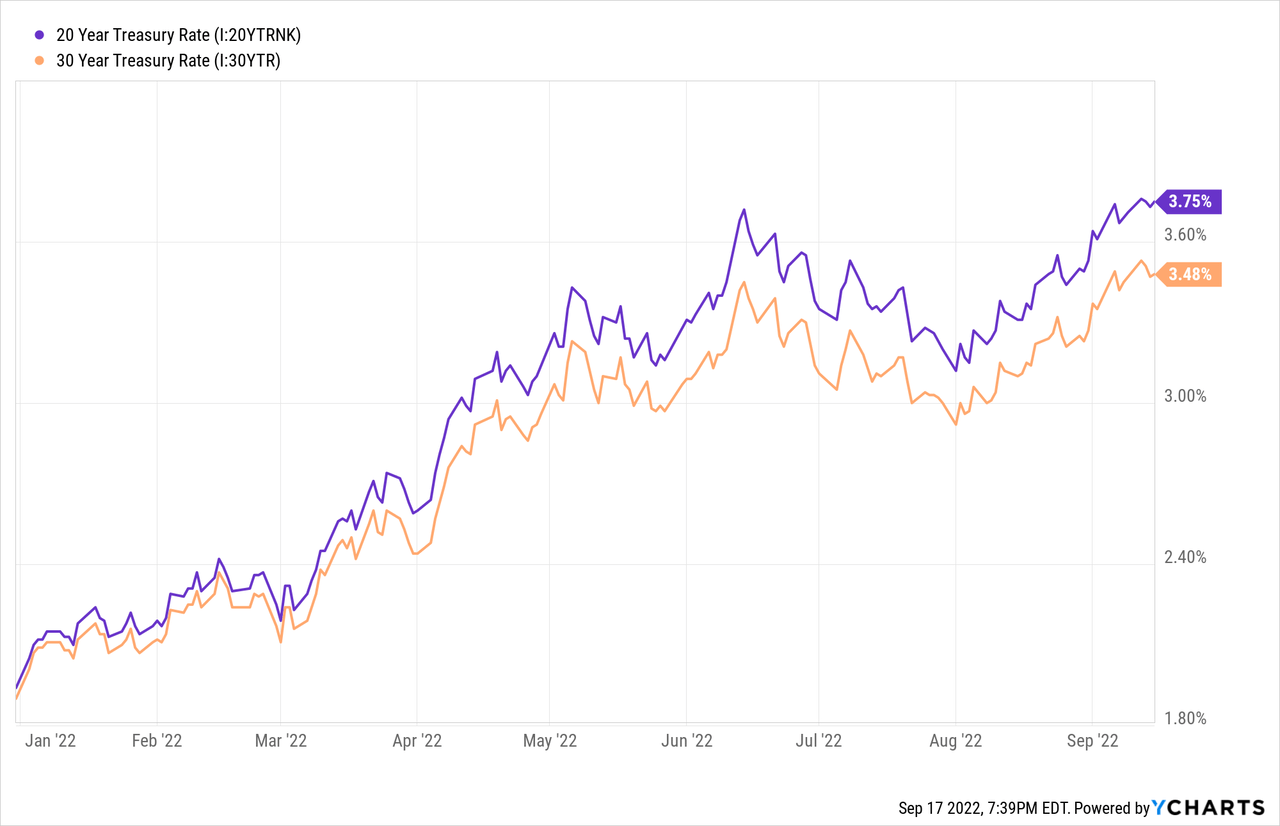

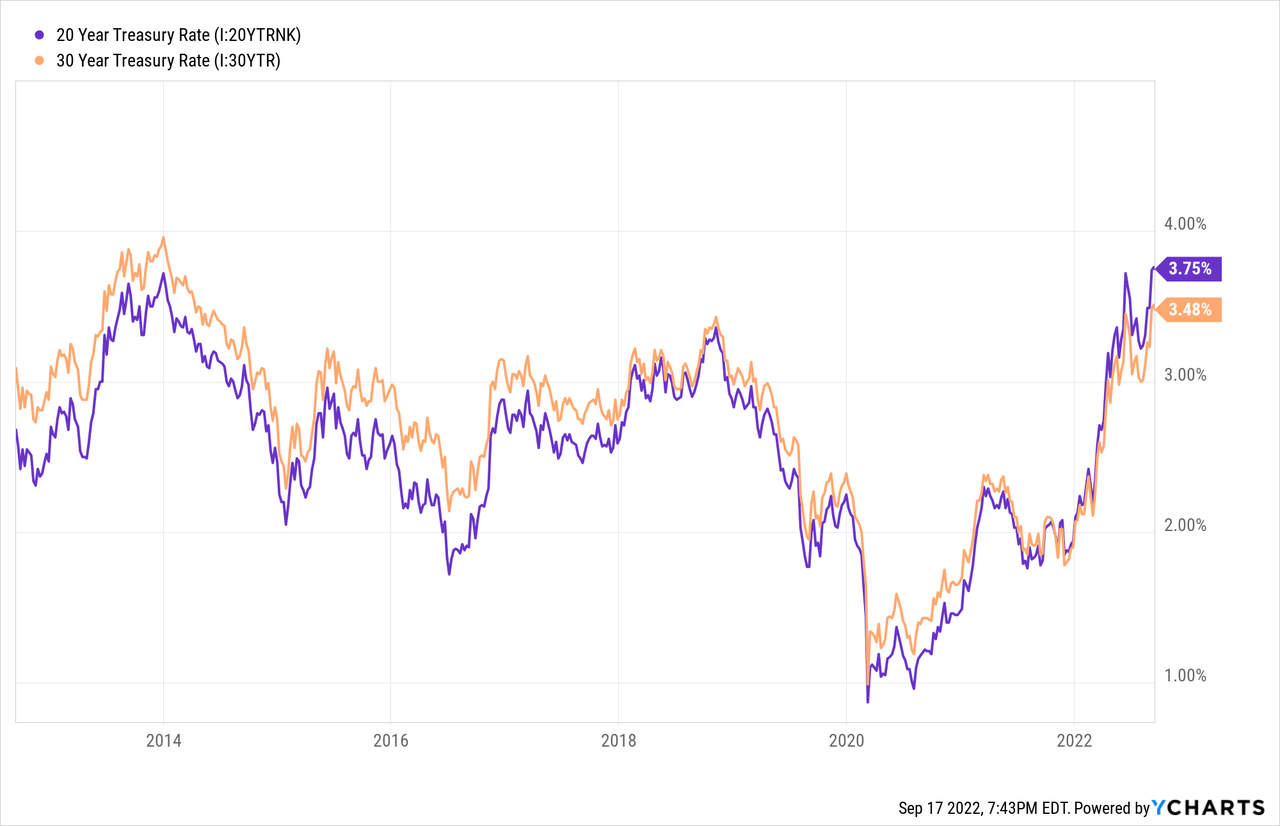

Since then, inflation has skyrocketed, long-term treasury rates have almost doubled, and TLT has seen significant losses. By now, treasury rates have mostly normalized, with long-term treasury rates oscillating between 3.0% and 3.5%. As such, TLT is now fairly valued relative to historical averages, making the fund a reasonable investment opportunity. I would not invest in treasuries, including TLT, until inflation normalizes, but conditions for said asset class have markedly improved in the past few months, and are nearing buy levels.

TLT – Overview and Analysis

TLT invests in treasuries with remaining maturities greater than 20 years, meaning long-term treasuries. These securities have several important characteristics. Three stand out, their: safe, dependable dividends, effectiveness as an equity market hedge, and their significant interest rate risk. Let’s have a look at these three characteristics.

TLT – Safe Dividends

TLT invests in long-term treasuries. Treasuries are backed by the full faith and credit of the United States Federal Government, the strongest, most credit-worthy institution in the world. Treasuries are the safest investment asset in the world, and carry effectively no credit risk. Treasuries offer investors safe, dependable dividends, a significant benefit for the fund and its shareholders.

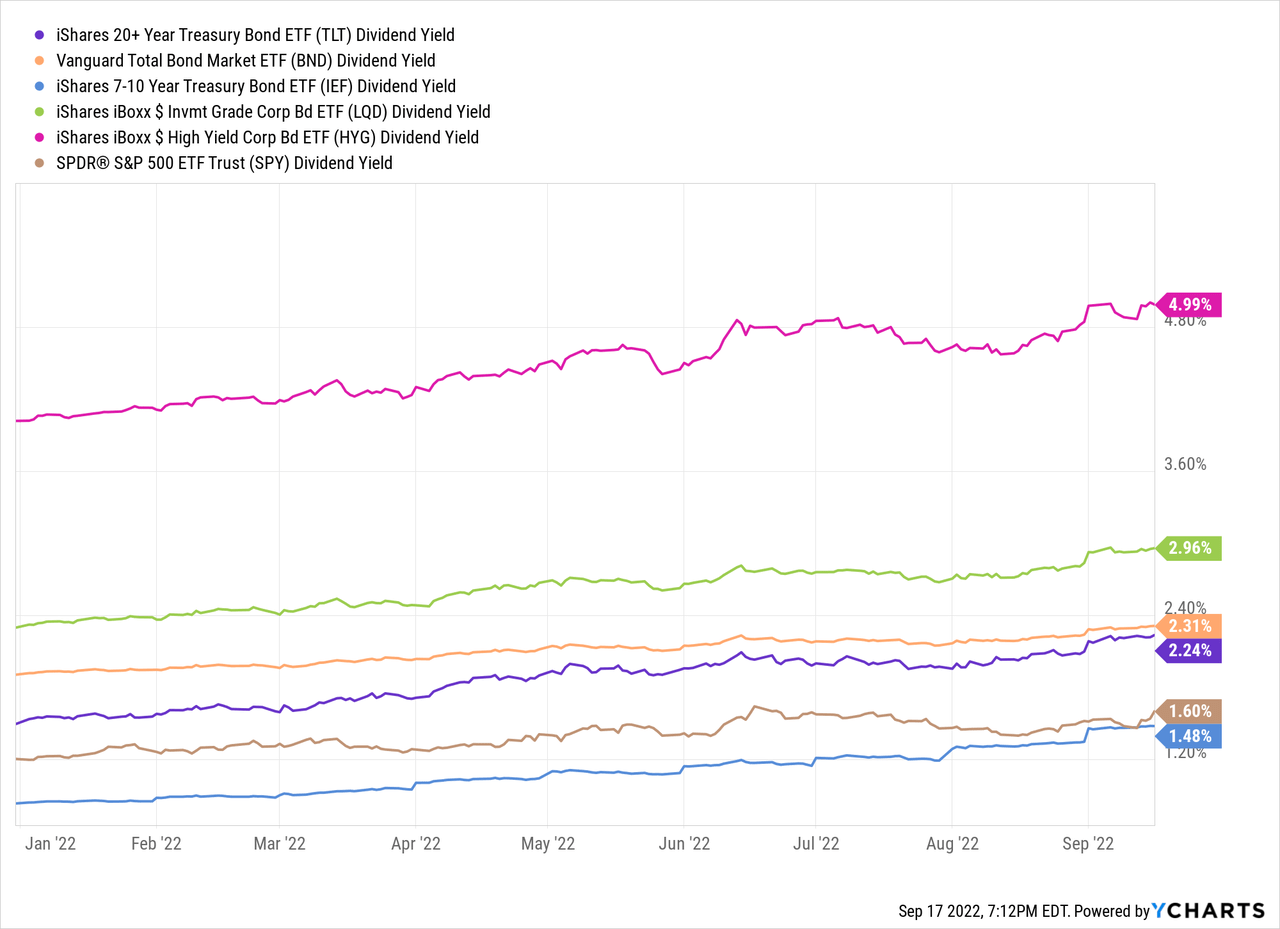

On a more negative note, safe dividends tend to be quite low dividends, as investors are generally willing to finance creditworthy institutions at favorable rates. Long-term treasuries might carry slightly higher yields due to their long maturities, but the difference is rarely significant. TLT itself currently yields 2.2%, an incredibly low yield, and relatively low for a bond fund. Of the major bond sub-asset classes, only medium-term maturity treasuries yield less than TLT, due to the fund’s longer-term maturities. The fund’s yield is somewhat higher than the S&P 500’s 1.6% yield, but the difference is not all that significant. TLT’s yield is quite low, and significantly below average.

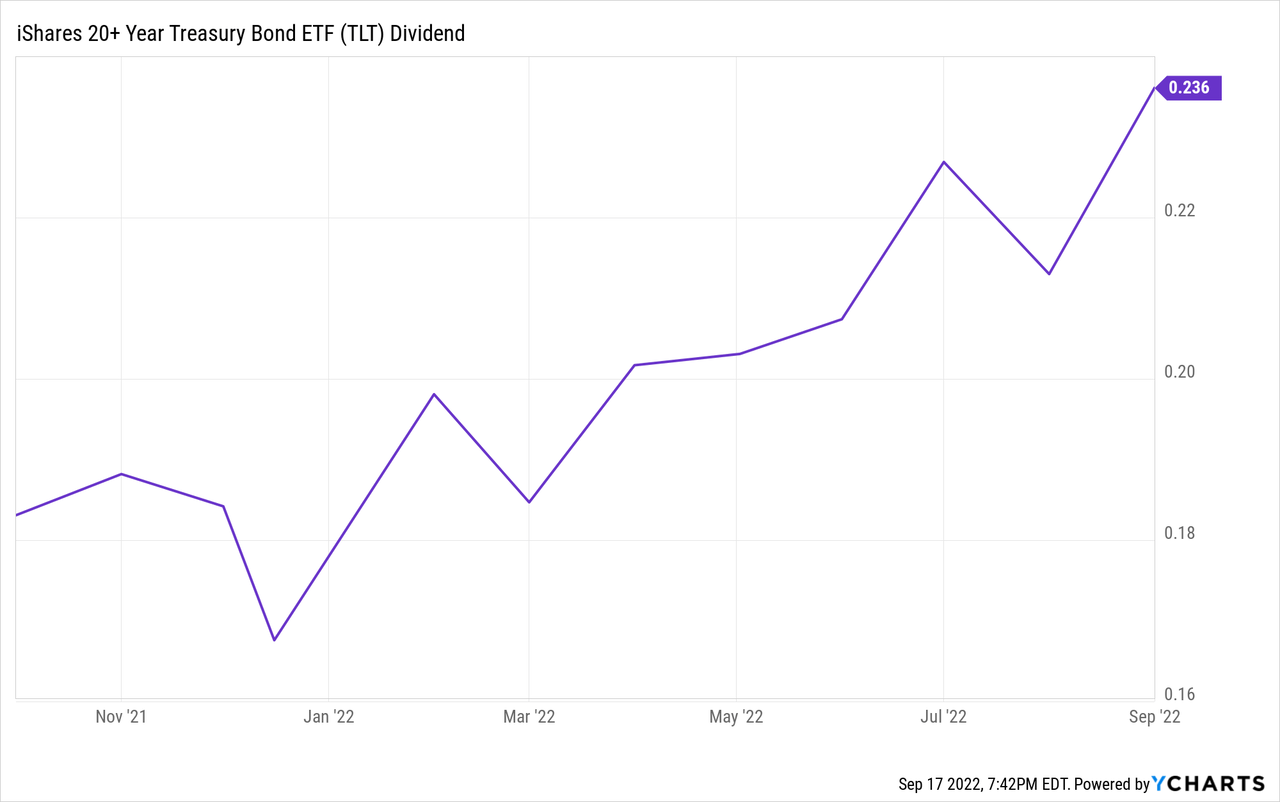

Higher treasury rates mean higher coupons for TLT, which should ultimately result in dividend hikes and higher yields. This has been the case for the past twelve months, as expected.

TLT offers investors safe, dependable, but low, dividends. TLT currently yields 2.2%, but yields should increase to around 3.6% in the coming months, in line with historical averages. TLT’s yield might not be all that high, but it is an incredibly safe, dependable, source of income, and credit risk is effectively zero, all benefits for the fund and its shareholders.

TLT – Equity Market Hedge

Treasuries generally outperform during downturns, recessions, and equity bear markets. This makes them strong, effective equity hedges, and a strong complement to an investor’s equity holdings.

Let’s go through a quick explanation of the above.

There is a recession. Federal Reserve decides to lower rates, to stimulate the economy through increased investment (corporate debt) and spending (credit cards), especially centered on construction / housing (mortgage rates). Importantly, interest rates only go down for newly issued securities. Older bonds, issued when interest rates were higher, maintain their higher yields (there are exceptions, but TLT is not one). As interest rates down, investors gravitate towards older, higher-yielding bonds and treasuries, bidding up their price. TLT is basically 100% older, higher-yielding treasuries, and so generally sees strong capital gains during downturns and recessions.

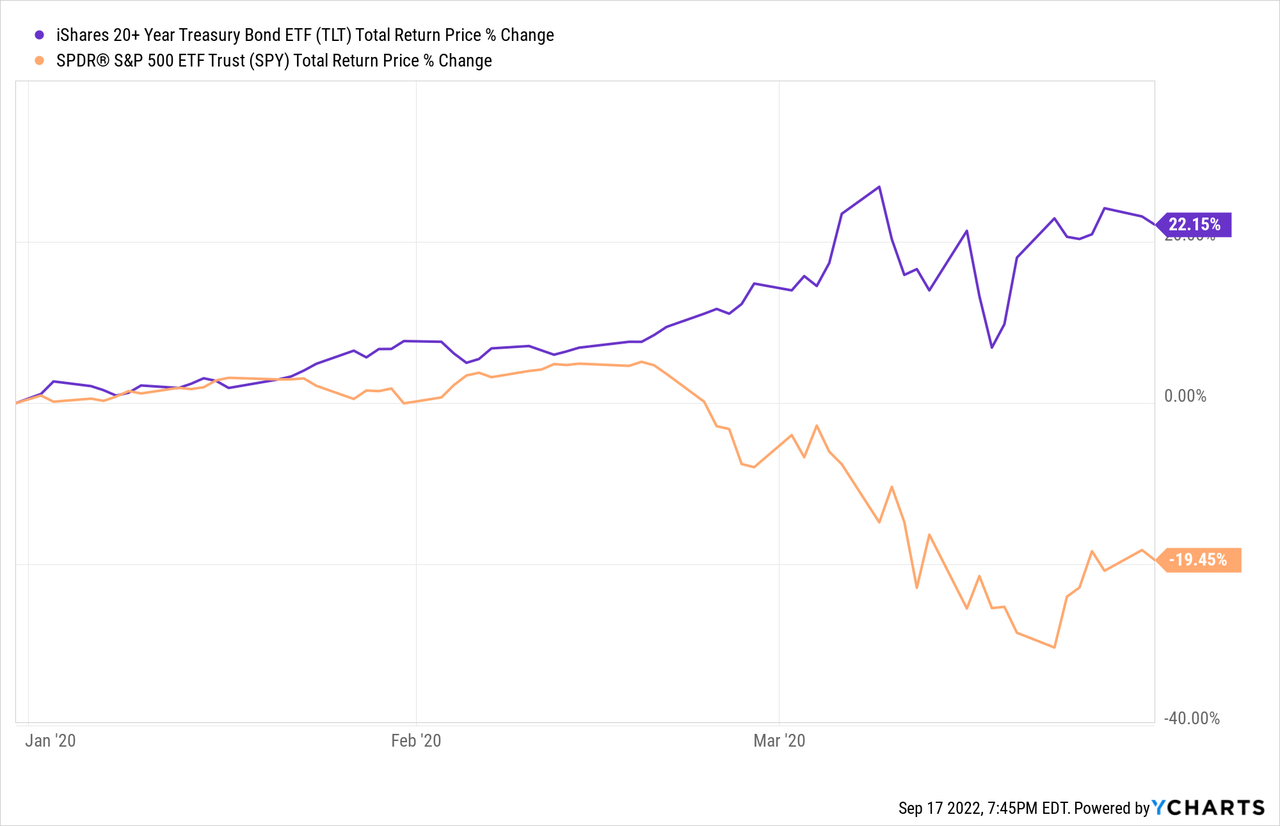

This was the case during 1Q2020, the onset of the coronavirus pandemic, and the most recent recession. TLT was up by around 20%, equities were down by roughly the same.

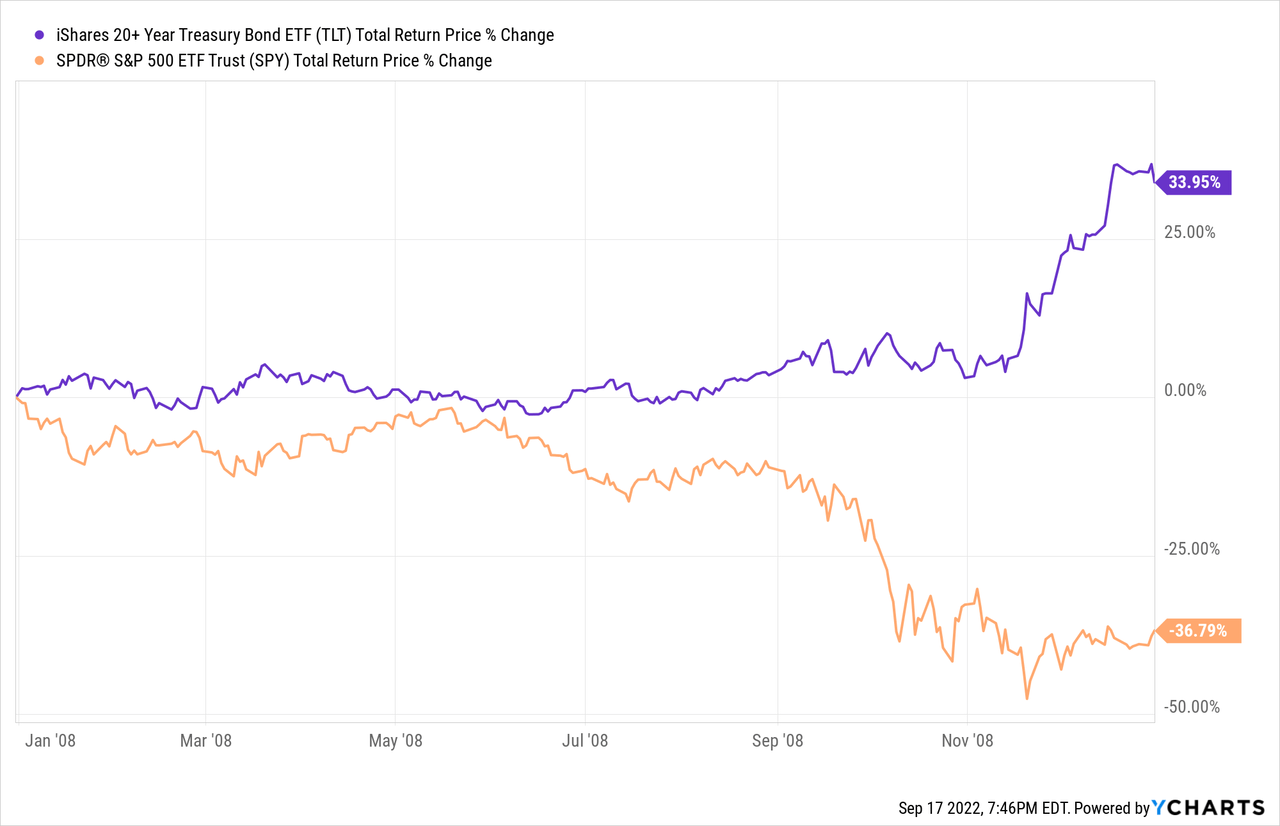

It was also the case during the past financial crisis.

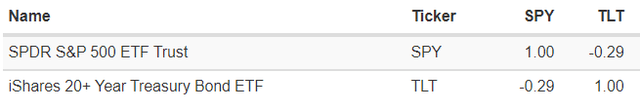

In general, treasuries are negatively correlated to equites, so the pattern above holds. When equities are down, treasuries are up. When equities are up, treasuries are down.

In bold, the correlation between these two asset classes since inception.

Portfolio Visualizer

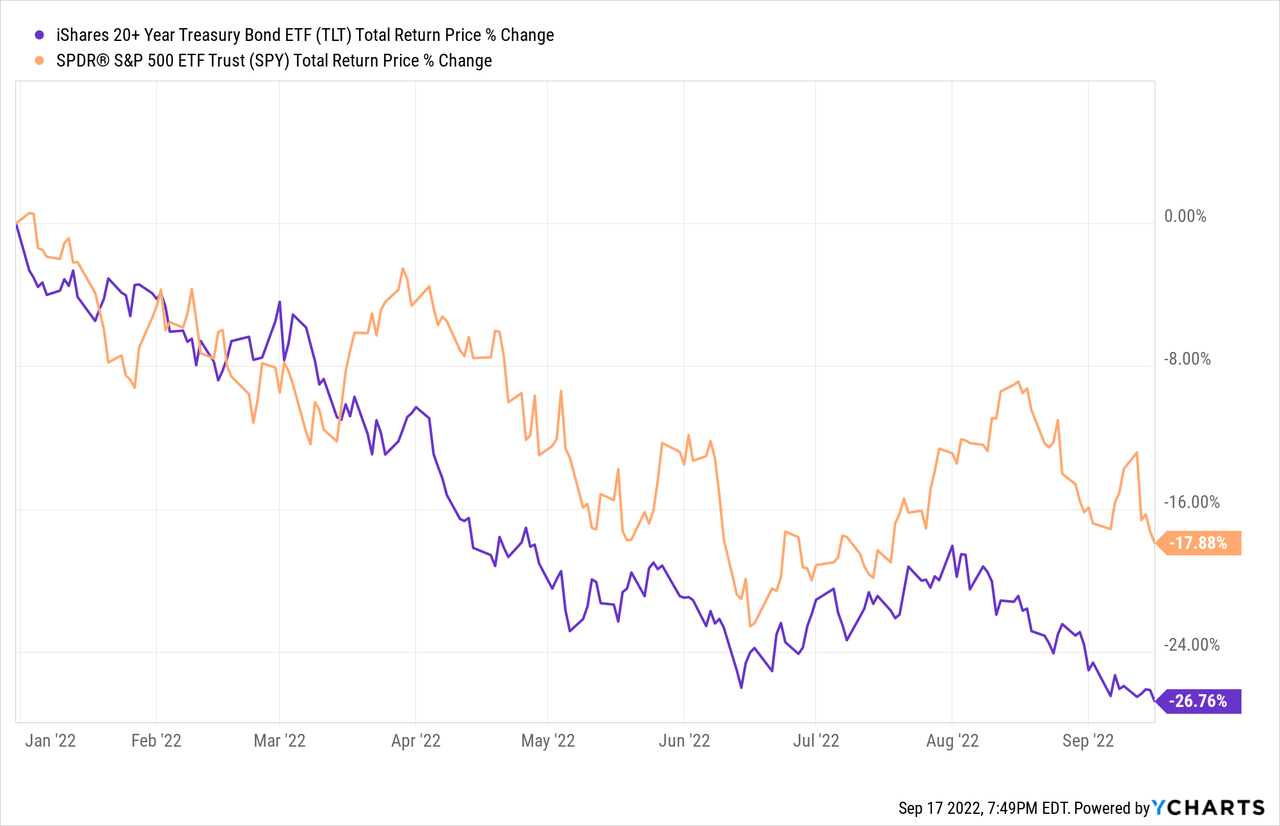

Importantly, equities and treasuries are generally inversely correlated, but there are exceptions, and inflationary periods are one. When inflation is high, the Federal Reserve tends to significantly increase interest rates. Higher rates leads to selling pressure on older bonds, as investors flock to higher-yielding newer issues. Bond prices go down, meaning (temporary) capital losses for bond investors. Higher rates leads to selling pressure on equities too, as higher rates tends to have a negative impact on earnings, and as higher rates cause valuations to cheapen. Equity prices go down. Both bonds and equities see capital losses when inflation and interest rates increase. This has been the case YTD, and for close to a year too.

generally

TLT – Interest Rate Risk

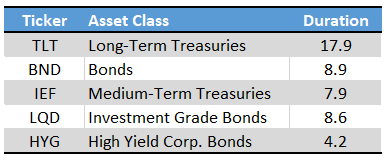

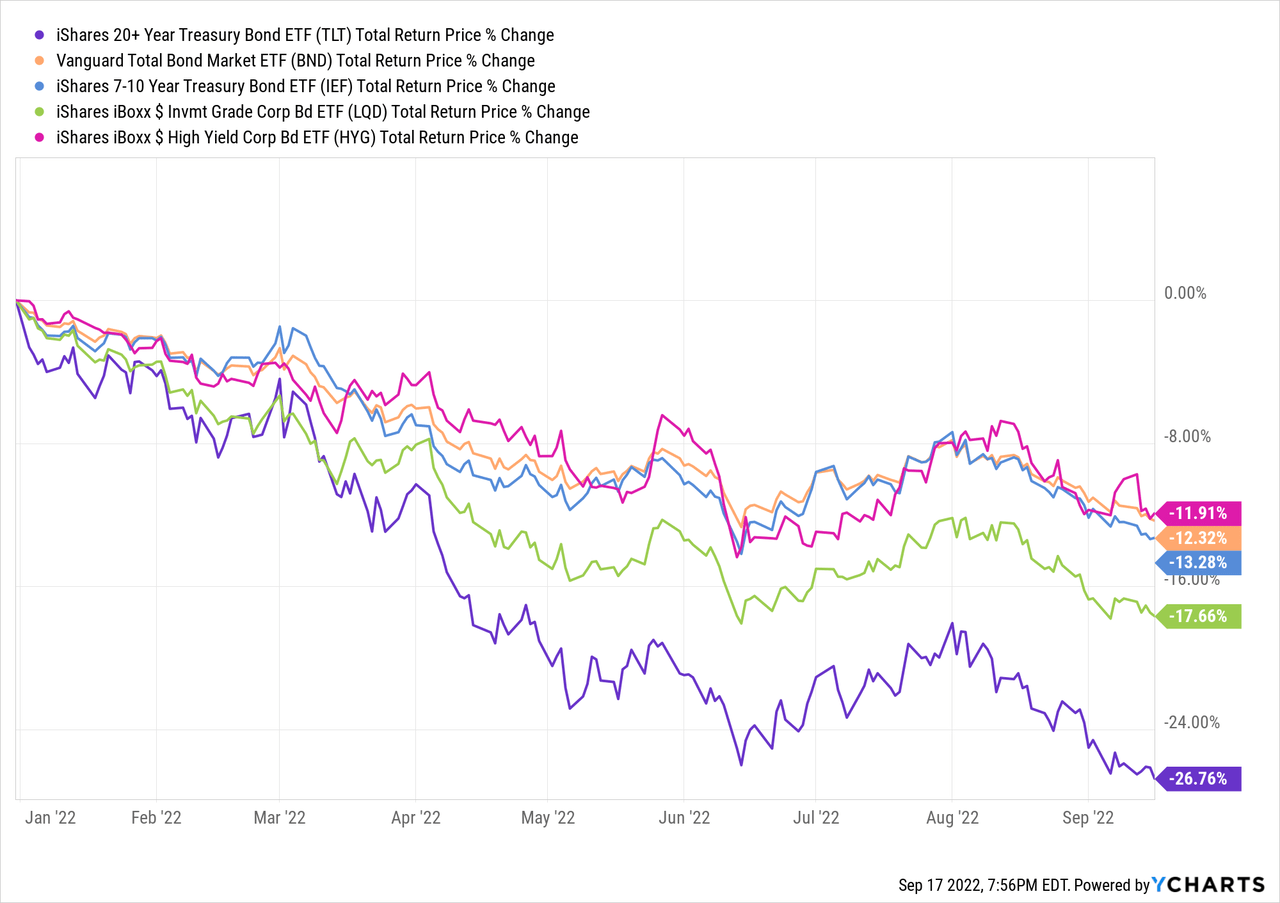

As mentioned previously, bonds tend to see losses when interest rates increase, a common occurrence when inflation is high. In general terms, short-term bonds see fewer losses from higher interest rates, as lower-yielding short-term bonds can be quickly replaced with higher-yielding newer issues. Long-term bonds see higher losses, for the opposite reasons. Interest rate risk can be measured using a metric called duration, with higher duration figures equaling higher interest rate risk. TLT itself sports a duration of 17.9, an incredibly elevated figure, and significantly higher than that of its peers.

Fund Filings – Chart by author

TLT’s high duration means the fund should suffer significant losses and underperform relative to its bond peers when interest rates increase. This has been the case YTD, as expected.

TLT’s elevated duration is a significant risk and negative for the fund and its shareholders.

Conclusion – Hold

TLT currently offers investors a historically average yield. The fund seems fairly valued, but long-term treasuries are a subpar investment when inflation is high, as it currently is. As such, I would not invest in TLT at the present time, but the fund is quickly nearing buy levels.

[ad_2]

Source links Google News