[ad_1]

designer491/iStock via Getty Images

The iShares 10-20 Year Treasury Bond ETF (NYSEARCA:TLH) is how people used to speculate on rate declines with as much leverage from duration as possible. Like all types of leverage effects, it is now turning against the TLH investor as the Fed commits to rate hikes. The declines of the TLH ETF seem underdone as of now. With the rate hikes that have come, and those that we can expect as productive capacity remains tight and inflation propagates, much more declines in our opinion should have already happened. We would avoid this ETF.

Breakdown of TLH

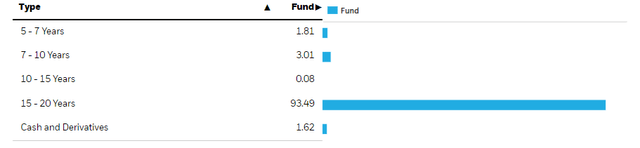

As a portfolio of long-term treasury securities, we can safely say there’s no risk on the credit side as treasury bonds are the de facto standard for a risk-free asset. The caveat is that risk in that case only refers to credit risk, with duration risk still being a major problem. Look at the maturity profile for the TLH.

Maturity Profile (iShares.com)

Headline maturities are almost all at least 15 years. When looking at the detailed holdings, we find the exact duration to be 13.8 years on a weighted average basis. The rule of thumb with duration is that every 1% rise in reference rates should be associated to a duration x 1% decline in the value of a bond. With the TLH duration being 13.8 the implied rate hike for the 25% YTD decline of TLH is only about 2%. Rate hikes have actually been to the tune of 3.5%, and we may very well have 2% more in rate hikes, if not more. We think a 40% decline or more in the TLH would be reasonable given its duration from the beginning of the rate hiking cycle and the new Fed narrative, and this is being generous about how inflation may evolve in the longer term.

The YTM of the ETF is about 4.1%, which is very close to the overall 20Y treasury rate. The yield curve isn’t very steep at the moment, which implies that markets think that rates will decline again and somewhat soon. We don’t think that this will happen. With both cost-push and demand-push inflation at the moment, and with labor inflation cementing the beginning of a wage-price spiral in inflation, inflation is going to be very challenging to tackle. Rates will have to come up a lot in the medium term to tackle it, and if productive capacities are still affected by long-term growth in international hostilities and the loss of productive capacity as supply chains get onshored and economic integration reverses, those rates will likely have to say somewhat high to keep inflation under control.

Remarks

Another thing to consider is that many investors are learning that the markets are actually a very competitive place when there isn’t a permanent bull market. Asset prices had seen inflation the last 10 years where consumer prices have been flat. If the marginal propensity for households to invest falls because of protracted issues affecting every asset class, that inflation in asset classes from pure liquidity growth and nothing else could come out of market multiples and be continued fuel for inflation.

The yield curve and the price of TLH are somewhat in step, which is why the market is valuing TLH as such, but we think that the risk of entering into a period of higher baseline rates with no return to the previous levels, which by the way were a part of proclaimed new normal, is too high, and a steeper yield curve could be expected, and further hits to these longer-term treasuries as well. With duration being correlated to sensitivity to further hikes, and therefore both directional and fundamental arguments to avoid TLH, we think duration risk should be heeded here.

While we don’t often do macroeconomic opinions, we do occasionally on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

[ad_2]

Source links Google News