[ad_1]

(Source)

Tell me if this sounds familiar; a large and well-known company, led by a charismatic CEO with a flair for branding, disrupts a mature industry dominated by a handful of big players, consequently sending its share price to new heights and making itself the darling of the investment community? Yes, it’s an investment trope so common and occurs with such cyclical regularity that Howard Marks should write a book about it, but we’ll give you a hint. The stock begins with the letter “T.” If you guessed Tesla (TSLA) you were close, but we were talking about T-Mobile (TMUS), which, like Tesla, is another large-cap stock led by a strong CEO who has managed to defy the skeptics and deliver substantial returns for investors despite not being in the largest market index, the S&P 500. Of course, the tale of Tesla has taken a dark turn, and recent events have us wondering if T-Mobile is about to follow it down the rabbit hole.

Comparing T-Mobile to Tesla might seem a big stretch, given the obvious differences between the two companies, but they do share one very important attribute generally overlooked by investors. Both are excluded from the S&P 1500, which populates S&P’s size and style universe, among the most common reference indexes in the ETF world and, most importantly, in this case, the S&P 500. Just three funds linked to the S&P 500 – SPY, VOO, and IVV – have over $500 billion in assets, or 1/6th of all ETF assets in the U.S. Being locked out of those funds makes Tesla and T-Mobile underowned by ETFs relative to other companies of their size, and while that might not hurt their stock prices in the short term, it has other consequences, side-effects which could hurt their investors, especially if the market begins to turn against their story.

More Than Just Price Support

We will be the first to admit that ETF ownership is probably pretty far down on the list of things most investors watch for before hitting the “buy” button, although we expect that attitude to change as ETF assets continue to grow, thanks to their combination of low fees and high liquidity. And, with over $3.8 trillion in ETF assets in the U.S. alone, they are taking over a vital role in the marketplace.

It would be nice to argue that the primary benefit of high ETF ownership is price support, but a more readily available benefit is providing both liquidity and a volatility cushion, especially when your investment thesis is being challenged. ETFs are well known for being “informationally insensitive” investors in that their transactions are typically dictated by the creation and redemption of shares along with periodic rebalancings or reconstitutions that follow a known, set procedure. They buy when they have to and not off of a portfolio manager’s whim, which makes them suppliers of liquidity to the market, helping reduce the volatility from active investors. Of course, investors typically don’t care about liquidity or volatility when the general price trend is in your favor, but it’s something they crave when the story goes the other way.

Consider Tesla which we talked about in a post in early March called ETF Inclusion Of Tesla: Profits Over Production, where we discussed how the company’s exclusion from S&P 500 had reduced the percentage of its market cap owned by ETFs by almost 50% compared to its rivals. The impact was probably only marginal at best when Tesla was still in the rapid growth phase of the business cycle that investors love. The promise of rapid growth and industry domination, and the subsequent increase in the value of the company, likely had a far bigger impact on share price than widespread ETF ownership. No matter what else you might think of Elon Musk, the man certainly knows how to promote, and for a brief time, Tesla was worth more than either Ford (NYSE:F) or GM (NYSE:GM) despite producing only a tiny fraction of the cars they could make in a year.

As mathematician Blaise Pascal once said, “The heart has its reasons which reason knows nothing of…”

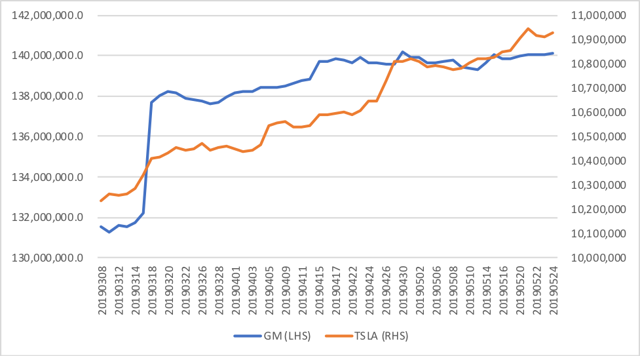

But while it may not have offered much price support, higher ETF ownership (or perhaps broader is a better term) might have helped dampen some of the volatility TSLA investors have endured over the last few years. According to Morningstar, TSLA has a three-year historical volatility (here using standard deviation of returns) of 38.38% compared to 10.82% for SPY and 22.95% for General Motors through 4.30.19.

You can see in the chart below what that kind of high volatility can do to the share price of a company. Violent moves in both directions as the stock endured a multi-year trade range which included steep drawdowns that would have left an investor who went long at the start of the period at the breakeven point. In fact, investors had been poorly compensated even before Tesla’s awful showing at the start of 2019 as a GM shareholder would’ve see almost the same return but had to endure one third less volatility in the process.

In fact, TSLA and GM have both seen an increase in the number of outstanding shares held by ETFs so far this year although with some significant differences in who was doing the buying.

Since our March 8th article through May 24th, ETFs have increased their ownership of Tesla by nearly 700k shares, a roughly 6.1% increase even as the price cratered by over 32%. That may sound like a much-needed dose of life support until you consider that Tesla’s average daily trade volume is nearly 11.5 million shares, which makes that 700k share increase slightly more than 5% of what the stock trades every day. And, the bulk of it didn’t come from passive funds mindlessly supplying liquidity but from a series of actively managed ETFs from Ark ETFs with one fund, the Ark Innovation ETF (ARKK) increasing its investment in Tesla by over 300K shares in that period. So, that boost in ETF ownership wasn’t the result of a quarterly rebalance or formulaic investment program but an opportunistic investment that can be sold as quickly as it was bought.

By contrast, GM also saw a boost in its ETF ownership measured by shares held during that same period of roughly 6.6% although, unlike Tesla, it largely came via passive funds that already held it, but there was a new allocation of over 5 million shares by iShares Select Dividend ETF (DVY). DVY only reconstitutes itself annually, making this a long-term position in just one of several dividend funds that hold GM, and if the market continues to lose steam or trade sideways, could dividend funds be big winners from new asset flows?

The Man in the Magenta Shirts:

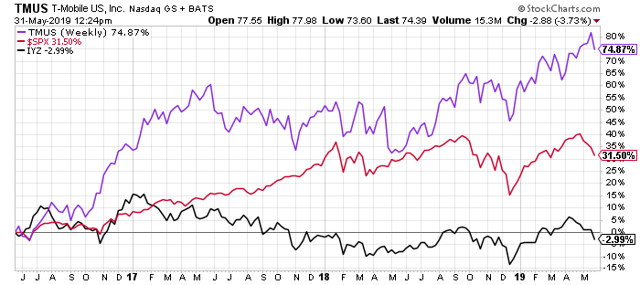

So, how is any of this relevant to the investment prospects for T-Mobile? After all, T-Mobile has continued to pound higher in 2019 where it’s now up 35% YTD compared to just under 8% for the iShares Telecommunications ETF (IYZ) and has stretched its three and five year annualized returns to levels that Tesla fanboys can only dream of!

A picture may be worth a thousand words, but for the more mathematically inclined, T-Mobile has delivered a three-year annualized return of over 21% compared a negative .3% for IYZ and even stretching it to the five-year mark, the annualized return for T-Mobile is still over 17% compared to just 1.5% for IYZ!

What’s even more impressive is that T-Mobile has done this while having a relatively small amount of its outstanding shares held by ETFs with just slightly more than 3% in the hands of 124 different funds. By comparison, GM has roughly 10% of its shares held by over 181 equity funds, including those S&P 500 replicators, and which we just showed have been taking down more shares as investors begin looking for defensive equity alternatives.

Of course, the reason why T-Mobile is doing so well has little to do with ETF ownership and everything to do with the fact that it has posted strong subscriber growth in a mature and highly competitive market thanks to the leadership of a very charismatic leader, John Legere. With his magenta shirts and outsized personality, he’s been able to use a mix of promotions and price cuts to undermine his rivals and help T-Mobile more than doubled its subscriber base since the beginning of 2013 while maintaining profitability as its 1Q 19 earnings report announcing a new record for EBITDA (T-Mobile Reports Accelerated Customer Growth, All-Time Record-Low Churn, and Best Ever Q1 Financial Results) points out.

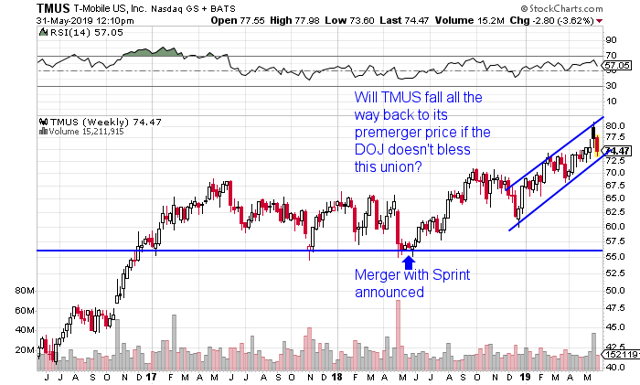

But if you look at that cumulative return chart of T-Mobile versus the broader market, you’ll see that the stocks upward movement had been seriously restrained by the spring of 2018. Seeking Alpha’s dedicated T-Mobile watchers could probably identify any number of reasons for the flagging performance such as whether the company could continue to meet growth projections or the emerging threat of cable companies entering the wireless market, but one thing is for sure, the announcement of an all-stock merger with smaller rival Sprint (S) has been well-received by the market! We’d assume it’s because the rationale for the merger, the need to achieve economies of scale to build out a 5G network, makes sense to the market along with investor confidence in Legere, and investors have boosted both stocks up over 30% this year, but unfortunately, they aren’t the only ones who matter.

Not Their First Rodeo:

Those recent events that we alluded to at the start of this update have to do a series of articles about T-Mobile’s upcoming merger with Sprint, a combination of the #3 and #4 telecommunications companies that promises to deliver the economics of scale both need to survive in a 5G world. This isn’t T-Mobile’s first appearance in the merger rodeo. It’s been a perennial merger target or partner, first with AT&T in 2011 and then with Sprint in 2014, but this is the first time that it’s gotten approval from one of the two necessary bodies to seal the deal. Ajit Pai, chairman of the Federal Communications Commission has publicly come out in favor of a merger as benefiting customers with the Department of Justice has indicated that it has serious doubts about whether a bigger T-Mobile would mean less competition, and higher prices, in the mobile market.

After all, the reason they’ve tried this dance before is because it failed to work the first time. Back in the early-Legere era, Sprint and T-Mobile tried to merge and ultimately failed for exactly the same reason that an attempt by AT&T to buy T-Mobile failed in 2011, market competition. The telecommunications industry is a textbook case of an industry that demands a tremendous amount of capital just to maintain operations, which makes achieving economies of scale incredibly important but would also seem to inevitably lead to a marketplace with only a few competitors. Reluctant to cede price setting ability to Verizon (NYSE:VZ) and AT&T, the Department of Justice and the FCC have historically rejected any attempts by the big four to merge their way to a monopoly. Buying up a smaller competitor like MetroPCS, sure, but try to achieve market domination and you’re asking for trouble.

That logic sunk AT&T’s buyout of T-Mobile in 2011 although the fact it has since managed to thrive while also putting downward pressure on industry prices seems to have confirmed the DOJ’s logic, but the question is whether a merger is any more acceptable now than in 2014? T-Mobile is certainly sparing no expense to make the deal happen, including booking multiples nights at various Trump-owned properties when its executives come to D.C. to pitch their deal! Reports have been flying that DOJ might nix the deal unless a series of measures are agreed to, including spinning of enough assets including valuable spectrum to set up a new fourth telecom company, seemingly defeating the very purpose of the deal!

Being forced to spin-off assets, or surrender spectrum to the government to be distributed to a potential tie-up of Comcast (NASDAQ:CMCSA) and Charter (NASDAQ:CHTR) would leave investors to ponder a very sad, but ultimately very Tesla-like moment, what do you do when your investment fairy-tale comes to an end? Judging by their share prices, investors have been putting their hopes into a merger and if that is blocked, does that leave the #3 and #4 telecom companies without a strategy and facing serious capital outlays for their 5G networks?

Well, it might look a little something like this, where T-Mobile is in danger of sharply underperforming both the S&P 500 this week, thanks to the rumors swirling that the DOJ might insist on some serious changes to the merger terms to let the deal happen.

How far T-Mobile might fall depends on “invested” the market is with the merger story.

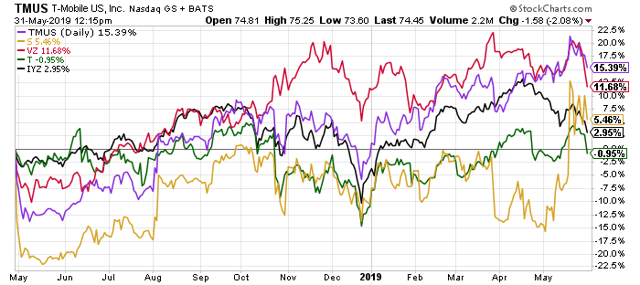

Managing Expectations:

Now, all investor expectations are tied up into a single story, strength through merger, which, along with Tesla-like light ETF ownership, has us concerned that investors could be in for serious disappointment although with the big difference that T-Mobile is at least profitable and not overly levered, so it has some room to maneuver. Still, you can see in the chart below that T-Mobile has traded much more in line with a mega-cap rival like Verizon since the merger was announced, so much so that it’s had a significant impact on volatility.

T-Mobile may have distinctly light ETF ownership but is the company more volatile than AT&T or Verizon over a longer-term time period? In fact, the immediate answer is surprisingly no as the volatility (measured by standard deviation of weekly returns) over the last three years has been relatively tame for ranging from 17.53% for Verizon to 18.18% for T-Mobile according to our friends at Morningstar.com. But if you look at a longer time frame before merger mania took charge and you get a different story. T-Mobile’s trailing five-year standard deviation is upwards of 25% higher than either of its larger rivals clocking in at 20.95% compared to 16% for AT&T and 17% for Verizon. That can be hard to visualize until you consider the returns of the stock over the last five years.

Everyone loves volatility when your price is going up, like in 2013, when T-Mobile more doubled in value, and again in 2015 and 2016, when T-Mobile was up over 45% per year! But what about when the trend is going the other way like in 2014 when it lost 20% of its value? Just like Tesla, T-Mobile can have periods of sharp moves in both directions, thanks to the lack of liquidity and volatility cushioning that comes from higher ETF ownerships.

That’s why when investors stretch their gaze to the ten-year annualized returns, T-Mobile’s performance looks decidedly less impressive, outperforming IYZ by 140 bps annually, but at the price of substantially higher volatility. According to Morningstar, IYZ had a 10-year historical volatility of 15% versus almost 40% for T-Mobile! Long-term investors need some serious intestinal fortitude to stick with a stock like that and which is why we’re worried that most aren’t seriously considering the possibility that the merger might not happen.

Conclusion:

So, is it time to run screaming from T-Mobile? That depends on how well you can read the DOJ and whether they’ll finally give their blessing to this, but the more important lesson is that investors always need to be aware of who’s supplying the liquidity that keeps spreads reasonable and volatility low and whether they’ll continue to be there if and when the story that drives the stock price starts a dark chapter.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Assumptions, opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. ETF Global LLC (“ETFG”) and its affiliates and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively ETFG Parties) do not guarantee the accuracy, completeness, adequacy or timeliness of any information, including ratings and rankings and are not responsible for errors and omissions or for the results obtained from the use of such information and ETFG Parties shall have no liability for any errors, omissions, or interruptions therein, regardless of the cause, or for the results obtained from the use of such information. ETFG PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall ETFG Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information contained in this document even if advised of the possibility of such damages.

ETFG ratings and rankings are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. ETFG ratings and rankings should not be relied on when making any investment or other business decision. ETFG’s opinions and analyses do not address the suitability of any security. ETFG does not act as a fiduciary or an investment advisor. While ETFG has obtained information from sources they believe to be reliable, ETFG does not perform an audit or undertake any duty of due diligence or independent verification of any information it receives.

This material is not intended as an offer or solicitation for the purchase or sale of any security or other financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Any opinions expressed herein are given in good faith, are subject to change without notice, and are only correct as of the stated date of their issue. Prices, values, or income from any securities or investments mentioned in this report may fall against the interests of the investor and the investor may get back less than the amount invested. Where an investment is described as being likely to yield income, please note that the amount of income that the investor will receive from such an investment may fluctuate. Where an investment or security is denominated in a different currency to the investor’s currency of reference, changes in rates of exchange may have an adverse effect on the value, price or income of or from that investment to the investor.

[ad_2]

Source link Google News