[ad_1]

DNY59/E+ via Getty Images

The U.S. Federal Reserve controls short-term interest rates, but buyers and sellers in the U.S. bond market determine rates further out along the yield curve. While the Fed began increasing the Fed Funds rate in March and started reducing its swollen balance sheet in June, the bond market had been falling over the past two years. The central bank’s balance sheet reduction lowers government and mortgage-backed securities holdings, putting upward pressure on interest rates for deferred maturities.

U.S. 30-Year fixed-rate conventional mortgages were below the 3% level at the end of 2021, and they recently peaked at nearly 5.5%, a significant increase. At 5.5% a $300,000 mortgage costs around $625 more each month. Rates are trending higher with the decline in the bond market. The iShares 20+ Year Treasury Bond ETF product (NASDAQ:TLT) moves higher and lower with the long-term US government bond market. On Friday, June 3, the APS was short the TLT ETF.

The long-term bond futures reached a multi-year low in early May

When the Federal Reserve and U.S. Department of the Treasury blamed rising prices on pandemic-related supply chain bottlenecks and repeatedly said inflation was “transitory,” throughout 2021, the U.S. long bond said they were full of baloney and consolidated, waiting for the economists to wake up.

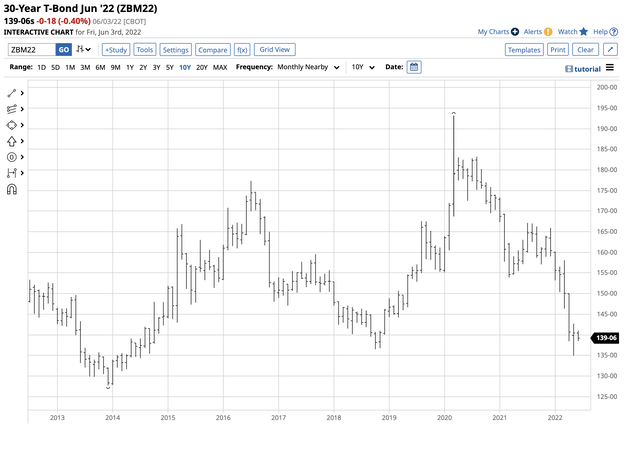

Long-Term Chart of the US 30-Year Treasury Bond Futures (Barchart)

The chart highlights the U.S. 30-Year Treasury bond futures traded in a range from 153-29 to 167-04 from March through December 2021. As the consumer and producer price indices rose to the highest levels in over four decades in late 2021 and early 2022, the floor fell out from under the bond market, and the Fed and Treasury decided that inflation was a clear and present danger and was not at all “transitory.” The Fed began increasing the Fed Funds rate in March 2022 and accelerated the hikes in May. Moreover, quantitative tightening, or reducing the central bank’s swollen balance sheet, began in June 2022.

The chart shows the long bond futures reached a low of 134-30 in May, a level not seen in nearly eight years since July 2014.

An anemic bounce runs into resistance

The long bond futures fell to a level where the bearish sentiment created an oversold condition. Even the most aggressive bearish trends experience sudden and sharp upside corrections.

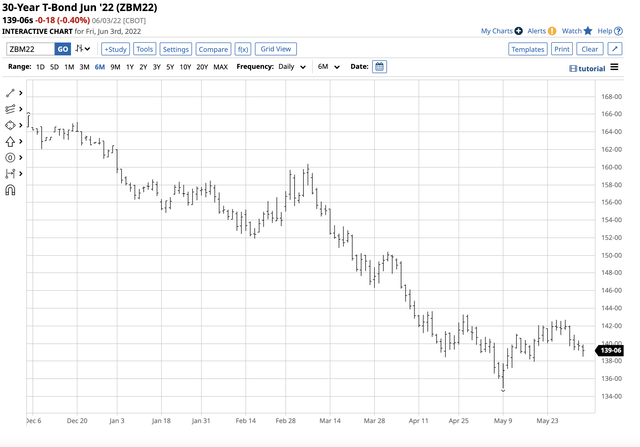

Medium-Term Chart of the June US 30-Year Treasury Bond Futures (Barchart)

The chart shows the bounce from the May 9, 134-30 low to 142-22 on May 25. After stalling around that level for a few days, the bonds ran out of buying and were at the 139-06 level at the end of last week.

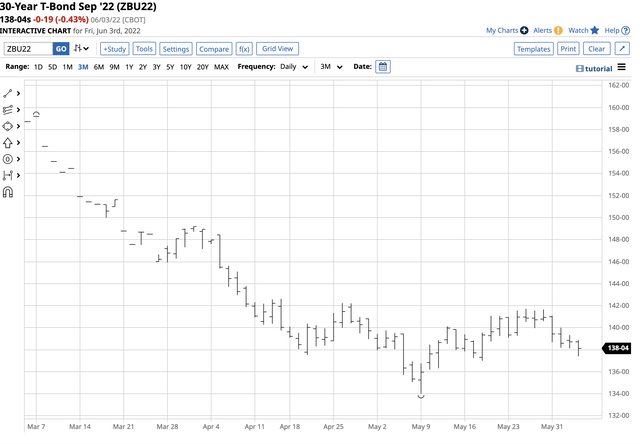

Short-Term Chart of the September US 30-Year Treasury Bond Futures (Barchart)

The chart shows the now active month September US 30-Year Treasury bond futures fell to 134-01, bounced to 141-23, and were at the 138-04 level on Friday, June 3. The bear market rally ran into resistance, and the downtrend resumed in late May and early June.

The Fed is far behind the inflationary curve-Supply-side macroeconomic dynamics support higher rates and lower bond futures

The bond market and markets across all asset classes are now waiting to hear from the U.S. Federal Reserve. At the next FOMC meeting on June 15, the expectations are for another fifty-basis point increase in the Fed Funds Rate to lift it to a band between 1.25% and 1.50%. At that level, the Fed remains far behind the inflationary curve. The most recent CPI and PPI data remained at the highest levels since the early 1980s, with core CPI excluding food and energy at the 6.5% level. In April, the nominal CPI was at 8.3%, and the PPI came in with an 11% rise on a year-on-year basis. Therefore, lifting the Fed Fund Rate to 1.25% to 1.50% is a drop in the bucket if the May data is anywhere close to the April CPI and PPI.

Last week’s employment report showed that payrolls rose 390,000 in May as companies continue to hire. The unemployment rate held at 3.5%. While average hourly wages rose slightly less than expected, they were still 5.2% higher than the previous year. The central bank’s mandate is full employment and stable prices. The jobs report is good news for the Fed, but inflation remains more than problematic. A fifty-point hike is a given, but inflationary pressures continue to rise as the Fed Funds Rate is far too low.

Meanwhile, the Fed’s monetary policy tools are impotent when considering that inflation comes from the economy’s supply side. The war in Ukraine, sanctions on Russia, and Russian retaliation have pushed nearly NYMEX crude oil prices to the $119 per barrel level at the end of last week. While crude oil remains below its 2008 high, gasoline moved into uncharted territory last week, with the price at over the $4.20 per gallon wholesale level on June 3. At over $8.50 per MMBtu, natural gas has increased by nearly six-fold from the June 2020 low. Rising energy prices fuel inflation and monetary policy tools create a situation where all the central bank can do is sit on the sidelines and watch the economic devastation.

Last week, Janet Yellen, the former Fed chief and Secretary of the Treasury, admitted she made a mistake in characterizing inflation as “transitory.” What the Fed and Treasury have not owned up to is that the tidal wave of liquidity caused by artificially low interest rates and tsunami of government stimulus planted the inflationary seeds that sprouted during the second half of 2020. Those seeds bloomed in 2021 and are growing like wild weeds in 2022. Had the brilliant economists realized their actions would lead to rising prices in 2021, they would have been in front of the war in Ukraine, which has fueled the inflationary wildfire from the supply side. However, they are now forced to employ demand-side monetary policy for what has become a supply-side problem.

Moreover, the shift in U.S. energy policy under the Biden administration only adds more fuel to the fire. The administration has doubled down on its green path for energy, with the President explaining that the pain of higher gasoline and fuel prices is a price for the transition. Strategic Petroleum Reserve releases are a band-aide that has not worked with gasoline at a record high. The only answer to the supply side issues would be a reversal of the current energy policy path, which is unlikely under the current administration.

The TLT follows the bond market higher and lower

The U.S. bond market sees all, and the bearish trend reflects the inflationary spiral. The iShares 20+ Year Treasury Bond ETF product (TLT) moves higher and lower with the long bond futures.

Medium-Term Chart of the TLT ETF Product (Barchart)

The chart shows the trend of lower highs and lower lows in the TLT, with the latest low of $112.62 in May. At the $116.03 level at the end of last week, TLT is not far from the lowest level since November 2018, which was $111.89 per share.

At the $116.03 level, TLT had over $18.309 billion in assets under management. The ETF trades an average of over 20.78 million shares each day and charges a 0.15% management fee. TLT is a highly liquid product in a downtrend.

The APS is short TLT

As of June 3, 2022, the trend in TLT shares was lower. The APS was short TLT shares as the trend is always your best friend in all markets. APS holds highly-liquid and optionable stocks and ETF products. TLT is a component as it meets the strategy’s requirements. At $116.03 per share, the ETF has been trending to the downside, making lower highs and lower lows.

Following trends via an algorithmic system requires strict adherence to rules. We do not attempt to pick bottoms or tops in any markets and are typically short at bottoms and long at tops. Taking the most significant percentage out of trends requires removing emotional impulses from trading and investing. We ignore fundamentals, news, and all of the daily noise. Our signals are never intraday, and they can only change at the end of a session. Our system does not get caught up in the daily frenetic trading activity. News and noise are at a frenzied level with the war in Ukraine, inflation raging, and pundits opining on the central bank’s next move. We ignore the noise. The APS is always long or short its components.

The price of any asset is always the correct price because it is the level where buyers and sellers meet in a transparent environment, the marketplace. Crowd behavior that determines trends can be the optimal market approach across all asset classes. As of June 3, the crowd’s wisdom points to a bearish trend in TLT. The APS will issue a buy signal for the TLT ETF product when the trend changes. Bonds are on the front lines of the war against inflation, and interest rates will likely continue to trend higher, putting pressure on the bond market and the TLT ETF product.

[ad_2]

Source links Google News