[ad_1]

Fritz Jorgensen/iStock via Getty Images

Thesis

With 30-year risk-free rates closing in on their 2018 highs, an investor should start outlining a game plan for exiting short long-dated bond positions and a target yield to exit. Inflation is indeed still high, but peaking, and financial conditions have already front-run the Fed, having tightened considerably since the start of the year.

We are of the opinion that the bulk of the rates move is behind us and the “easy money” in the ProShares Short 20+ Year Treasury ETF (NYSEARCA:TBF) has already been made. There are numerous calls on the street regarding the end of the slide in treasury prices. While long end rates might navigate a little higher from here, we think 4% is the ceiling for this point in the yield curve, and the market will start pricing in a Fed easing in the autumn, once tentative recessionary signals become more poignant. A savvy investor would do well to start planning an exit from TBF with a specific target for long-dated yields in mind.

Performance

TBF is up more than 25% on a year to date basis:

YTD Performance (Seeking Alpha)

As long end rates moved higher, the product delivered its mandate of delivering daily investment results, before fees and expenses, that correspond to the inverse (-1x) of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index.

Since the start of the Covid-19 pandemic, the fund is almost flat:

3-Year Return (Seeking Alpha)

The fund is not a buy-and-hold vehicle, but rather a tool to utilize in a monetary tightening environment, since it provides for a good hedge against long duration assets in an investor’s portfolio. On a long term basis, we do expect the fund to be negative given its high management fee of 0.92% that gets subtracted every year from its performance profile.

Holdings

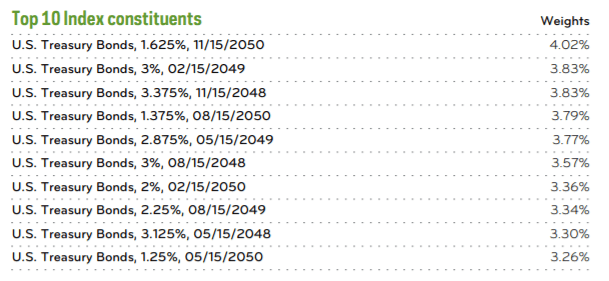

TBF provides the inverse total return of the ICE U.S. Treasury 20+ Year Bond Index. The ICE index includes publicly issued U.S. Treasury securities that have a remaining maturity greater than twenty years and have $300 million or more of outstanding face value, excluding amounts held by the Federal Reserve (i.e., if certain issuances are held mostly by the Fed because of the QE program, then they are not included here). In addition, the securities in the underlying index must be fixed-rate and denominated in U.S. dollars. The underlying index is weighted by market capitalization. Currently the top index constituents are:

Holdings (Fund Fact Sheet)

Historic Interest Rates

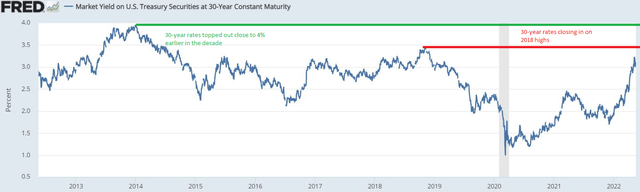

30-year rates are closing in on their 2018 highs of 3.43%:

30-Year Rates (The Fed)

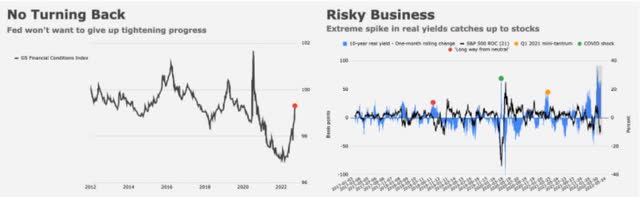

Earlier in the decade, long-dated rates topped out at 3.93%. We think we are going to revisit the 2018 levels but not the 2013 ones. Ultimately, the move in rates is driven by the Fed and their tightening of financial conditions in order to contain inflation. We feel the market has already done this, and as Goldman Sachs illustrates, financial conditions are well underway to reach constrained levels:

Financial Conditions (GS)

With leading indicators stagnating and an escalation of recessionary discussions for 2023, the Fed does not have a lot of maneuvering space. The move higher in rates in our opinion is closer to being over than the market anticipates. The Fed wanted mortgage rates to go higher to cool the housing market, and they have. Once they start unwinding the MBS balance sheet holdings, mortgage rates are going to continue to be constrained.

While corporate balance sheets are healthy, and the need to place long-term debt at these higher levels is going to be moderate for the next few years, higher long-term rates are going to take a toll on new capital projects and investments. It will take a few months for higher rates to percolate down to the real economy, but in our view anything above 4% is going to take a significant toll on the economy.

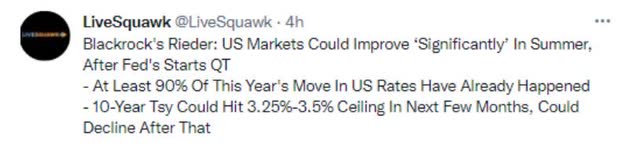

A higher number of market analysts now believe the bulk of the rates move higher is now behind us:

Rates Move (BlackRock)

With BlackRock and Morgan Stanley in the camp of a rates normalization implied by current market levels, investors should start thinking about trimming treasury shorts.

Conclusion

The market did not anticipate the violent reset higher in long-dated rates experienced in 2022. With 30-year rates closing in on their 2018 highs, many market analysts are now of the opinion that at least 90% of the move higher is behind us.

TBF has been a great vehicle to express a higher long-dated rates view, with the fund being up more than 25% year to date. A retail investor who utilized the vehicle to hedge their portfolios, or simply take advantage of a higher rates view, should now start thinking about closing the trade. An investor should set a target on 30-year rates and plan an exit from TBF when that target is hit.

[ad_2]

Source links Google News