[ad_1]

PercyAlban/iStock Unreleased via Getty Images

Today, we continue the discussion of the value factor in passive investing with an article on the iShares US Small Cap Value Factor ETF (SVAL), a comparatively novel financials-heavy exchange-traded fund with a rather peculiar, sophisticated investment strategy incorporating balance sheet quality screen more likely to minimize the risk of value traps percolating into the portfolio and then dragging total returns down.

Incepted in October 2020, SVAL has amassed a portfolio of around $178 million; its standardized yield is approximately 1.4%, with distributions made quarterly. For a fund executing a complicated multi-step value strategy, it has a fairly adequate expense ratio of only 20 bps.

Investment strategy

Investors seeking multi-faceted value strategies mindful of quality would likely appreciate the one SVAL has.

The fund tracks the equally-weighted Russell 2000 Focused Value Select Index, which has a few complicated screens designed to filter out stocks with a precarious financial position and poor liquidity while favoring those with “prominent value characteristics.”

Please take notice that SVAL uses a representative sampling strategy, which gives it flexibility regarding deciding to purchase all the index constituents or try something different, depending on the market environment or any other considerations.

The underlying index methodology is labyrinthine, full of intricate issues, which I will try to explain as succinctly as possible.

- The selection pool is the Russell 2000 Index. A fifth of its constituents having the weakest liquidity (measured as 60-day average daily volume traded) is filtered out at step one.

- On step two, 12-month trailing realized volatility is assessed. To ensure the index is not prone to abrupt price swings, 20% of most volatile names are removed.

- The third step is about quality and resilience as the Total debt/Total assets ratio is used to identify overleveraged companies. One-fifth of the Russell 2000 with the highest TD/TA, and, hence, the relatively elevated balance sheet risks has to chance to join the value factor index.

- That liquid, less volatile, and adequately leveraged names face a sentiment score test. In a nutshell, if its EPS upgrades for current and next fiscal years exceed downgrades, a stock has a positive score and thus can proceed to the final stage.

- At this point, stocks are ranked based on a weighted composite score encompassing three multiples: P/B, P/E, and Price/Cash Flows. After that, the top 250 are selected and then assigned equal weights “to form a baseline or target composition.”

- Finally, the underlying index is reviewed monthly and rebalanced in cases discussed in greater depth in the prospectus and the FTSE Russell methodology document.

Returns the strategy has been capable of delivering

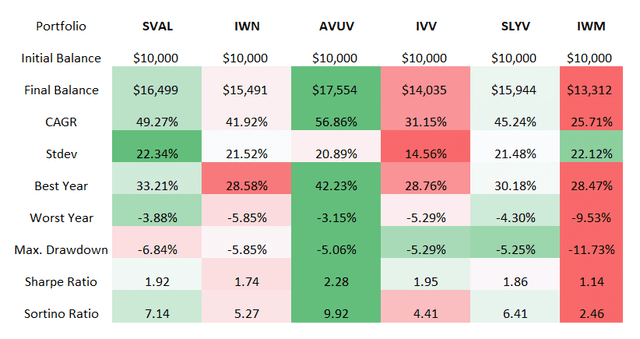

As the data below illustrate, SVAL delivered an over 49% compound annual growth rate from 31 October 2020 to 31 January 2022. Most peers, namely the fund tracking its parent index (IWM), the iShares Russell 2000 Value ETF (IWN), as well as SPDR Portfolio S&P 500 Value ETF (SLYV), and the U.S. market represented by the iShares Core S&P 500 ETF (IVV) have failed to keep pace with it.

Created by the author using data from Portfolio Visualizer

Importantly, this solid CAGR was delivered without excessive risk, as illustrated by the Sharpe and Sortino ratios being amongst the best in the group. The only disappointment I see here is its elevated standard deviation of 22.3%; it should be noted that this is one of the reasons for its Risk grade being lackluster at the moment.

However, SVAL was outperformed by the Avantis U.S. Small Cap Value Fund (AVUV), the leader in the selected group, with the highest return, lowest risk, though a bit too high volatility that exceeds IVV’s.

With a significant degree of certainty, we can say that SVAL’s phenomenal performance was fuelled by the capital rotation, a tectonic shift from the pandemic champs to cyclicals that began precisely when the ETF started trading, in November 2020, thanks to the vaccine news. So, the moment appeared to be tremendously opportune (I have explained what happens when an ETF is launched in a totally inopportune moment in the recent article), thus I am skeptical that such massive alpha is to be replicated regularly going forward, even considering the value style has been back in vogue this year while growth stocks have been reeling.

A deeper delve into the portfolio

The SVAL portfolio had 269 equity holdings as of February 14, with the top ten stocks accounting for ~8.9%.

It should be noted that like a few other small-cap ETFs, SVAL does have a footprint in the mid-cap echelon, and a sizeable one as around ~42% of the portfolio is invested in companies with market values above $2 billion, with the most expensive name in the mix being WESCO International (WCC), a ~$6.6 billion B2B distribution, logistics, and supply chain solutions provider.

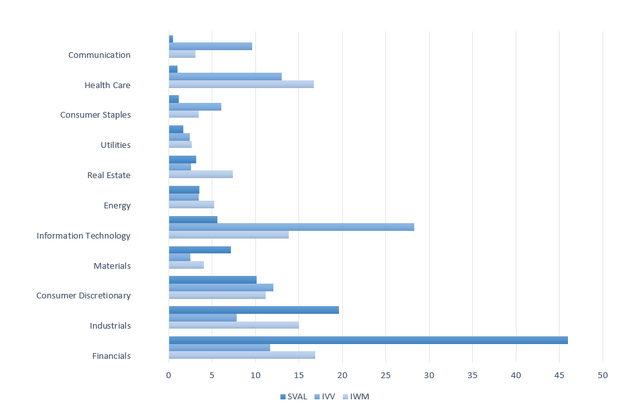

The chart below illustrates that compared to both IWM and IVV, SVAL is the most financials-heavy, with only minor exposure (~5.6%) to the tech sector. Compared to IWM, it also overweights industrials, materials, while almost entirely ignoring healthcare with just around 1% allocation. I believe that is probably the consequence of the volatility screen; small-size healthcare companies are mostly early-stage biotechs that are prone to staggering price swings.

Created by the author using data from IVV, IWM, SVAL

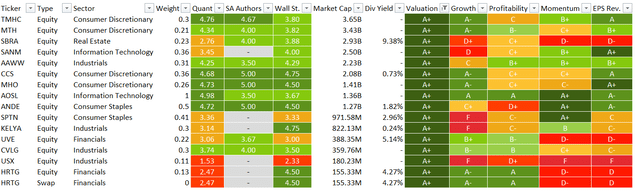

Using the Quant data, I have found 154 stocks exhibiting value characteristics in the SVAL portfolio, including those 16 names with an A+ rating shown below in the table.

Created by the author using data from Seeking Alpha and the fund

Unfortunately, the weight of stocks with at least a B- rating does not exceed 56%, which is not ideal for a value ETF, though still substantial considering most peers focusing on large/mid-cap underappreciated equities typically have slightly above 30%.

~14.8% of its holdings are overpriced, with Valuation grades below D+ (15.6% with swaps included). Again, not perfect, but acceptable.

We know that SVAL’s benchmark does not compromise on leverage, but does that translate into the overall higher quality of the portfolio (i.e., steady margins and returns on capital)? The profitability factor is of paramount importance for undervalued stocks from the mid/small-cap segment, as there is a high risk that a cheap company with poor quality is nothing but a value trap (or will become such).

So as expected, quality is relatively soft, as only ~30% of the holdings have at least B- Quant Profitability rating. This is way lower than 80% I consider optimal.

But is the profitability of SVAL’s holdings that bad? Not necessarily. First, close to 50% have C (+/-) grades, which points to the fact their EBIT, EBITDA, cash flows, ROTC, etc., are more or less on par with the sector medians, with no dramatic deviations to the downside.

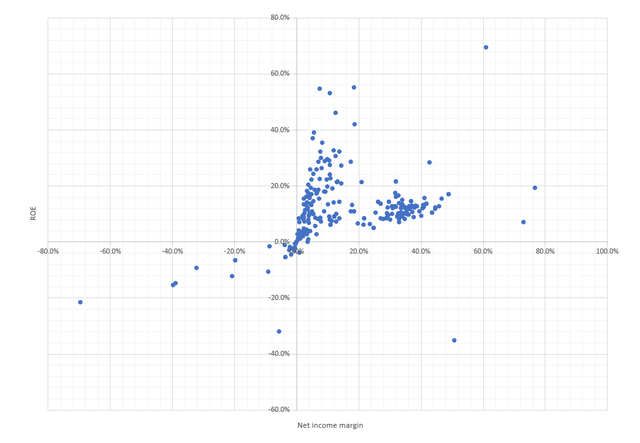

Second, the scatter plot below shows almost all the holdings have positive Returns on Equity and net income margins.

The chart covers ~98% of the holdings (The author’s creation. Data from Seeking Alpha and the fund)

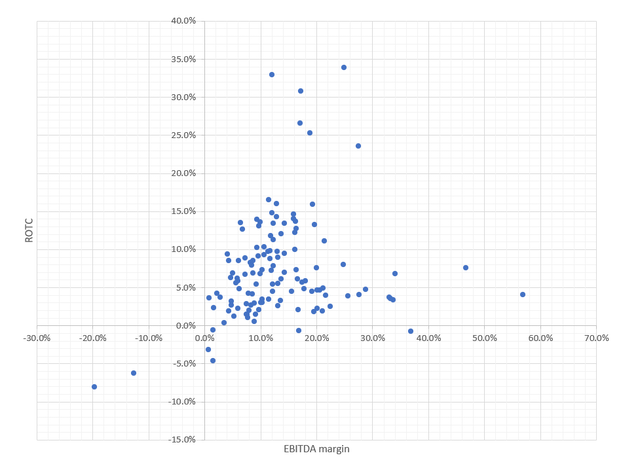

The next chart focuses on Return on Total Capital and EBITDA margin (real estate and financials are removed; the chart covers ~50.3% of the holdings).

Created by the author using data from Seeking Alpha and the fund

As it can be seen, almost all companies analyzed have healthy EBITDA margins (hence, they at least cover opex), with positive ROTC. Unfortunately, only a few have ROTC of at least above 15%, but it is expectable for cheap small-size stocks.

Final thoughts

In sum, I would say that SVAL did succeed in its attempt to create an equity basket of significantly underpriced small-size stocks, though there is always room for improvement. What I especially appreciate is that, unlike the Russell 2000 Value index, its benchmark does not ignore cash flows, while the former relies only on P/B, a suboptimal multiple.

It should not be overlooked that its equity basket is essentially a mid/small-cap mix and not a small-cap pure play.

Next, although its exposure to the Profitability factor is way lower compared to bellwether ETFs like IVV (i.e., typically in excess of 95%), I would not say that returns of capital and margins of its current holdings are worthy of serious concern.

I believe this ETF deserves deeper inspection by value investors seeking exposure to the small size factor via funds that are not burdened by companies with fragile balance sheets, though I am by no means saying SVAL is the best ETF in its segment as despite the fairly buoyant environment last year, it still underperformed AVUV. So though I am positive about the value style overall, I would opt for a Hold rating this time.

[ad_2]

Source links Google News