[ad_1]

cemagraphics

Not all of us have sold all our tech stocks to seek the comfort of cash and there are various reasons for this as I will further elaborate in this thesis. Along the same lines, as buy and hold investors, we are not used to shorting stocks to make money like traders normally do. However, with so many economic uncertainties, whether it is high inflation or recession risks, it is important to think differently and opt for a hedging mechanism. This can be achieved through the ProShares UltraPro Short QQQ ETF (NASDAQ:SQQQ), which is normally used by traders to short the tech stocks held by the Invesco QQQ ETF (QQQ).

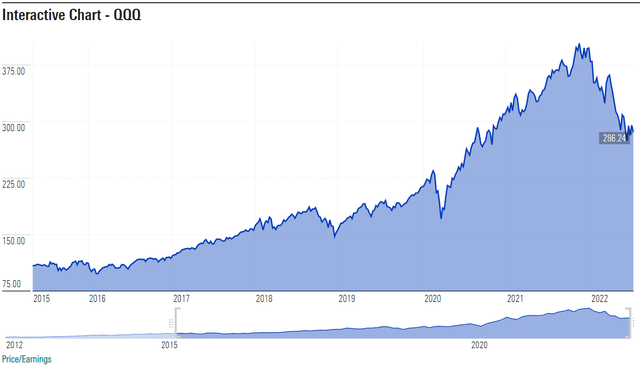

Hence SQQQ moves in the opposite direction to QQQ, delivering a 28% upside during the last year while the latter suffered a 21% loss.

Comparison of price returns for QQQ and SQQQ (www.seekingalpha.com)

This loss has prompted many to wonder whether this is a simple correction or the start of a year-long bear market. To provide an answer, I analyze how tech stocks are performing in light of current financial conditions.

The Status of Tech Stocks

The sporadic gains in the Nasdaq sometimes lead you to believe that the correction is over, but, considering the high degree of volatility being witnessed tends to show that the tech sector is still adapting to a sustained inflationary environment. In this respect, tightening of the monetary supply together with the accompanying rate hike is weighing heavily on the valuations of technology stocks.

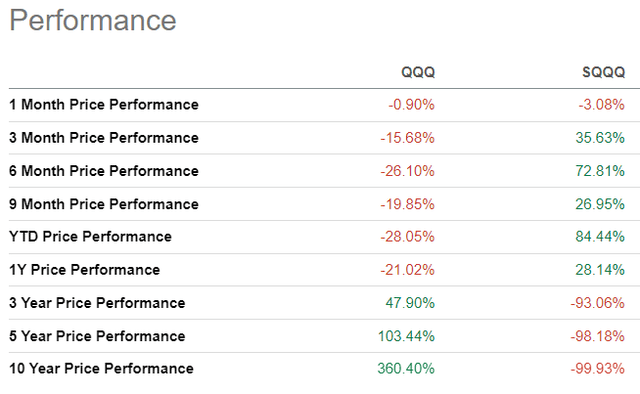

For this matter, higher expenses are pressuring profitability, and given that tech stocks have inherited high price-to-earnings multiples thanks to the Covid crisis, it is becoming increasingly difficult for them to justify these valuations. As seen in the interactive chart below, QQQ has suffered from a significant downside in 2022.

QQQ price and its P/E charts (www.morningstar.com)

At the same time, the P/E ratio also slid as shown in the Price/Earnings chart above, to 22.3x, but still remains higher than its 2020’s value.

Growing uncertainty over the economy’s growth trajectory as consumers cut down on expenses is also expected to weigh on the earnings outlook, with the sector being highly dependent on consumer discretionary spending. Any problematic earnings print could be exacerbated by a rotation in expenditure from tech into the services economy including travel as more people venture away from their homes instead of spending their money on online gaming.

Looking into valuations, not all tech stocks are overvalued and there are some which are benefiting from the secular trend of digital transformation to continue delivering double-digit growth. On top, they have pricing power or the ability to pass on additional service delivery costs to customers, thereby maintaining their profit margins. Two examples are Synopsys (NASDAQ:SNPS) and ASE Technology (NYSE:ASX) which I covered recently but there are many more.

However, if there is further deterioration in economic conditions, which results in a lasting structural deterioration in the outlook for the sector, these stocks will not be immune to downside contagion risks from unprofitable tech stocks. Thus, even the best tech stock is not immune to volatility.

Hedging with SQQQ including Returns and Risks

This is where hedging becomes important in order to remain invested while at the same time taking advantage of volatility in order to offset or limit losses on individual stocks. For investors, QQQ tracks the Nasdaq-100 index, which holds the 100 largest non-financial companies listed on the Nasdaq. Conversely, the ProShares ETF with more than 84.5% of assets dedicated to the IT, consumer discretionary, and communication services sectors, seeks to provide investors with gains that correspond to three times the inverse (-3x) of the daily performance of the Nasdaq-100 Index, or indirectly to QQQ.

For illustration purposes and referring to the introductory chart, I computed the table below which includes the price performances at various periods. Assuming a $1,000 investment in SQQQ, one-year gains (excluding fees and commissions) are equivalent to $1,281 today. In the meantime, a more savvy investor could have reaped $1,728 for a six months term, thereby making capital gains of $728 again excluding fees. Thus, it is the time frame for which SQQQ’s shares are held that determines the net gains, in contrast to a buy and hold strategy, where the dividends obtained, are continually reinvested as part of total returns.

Comparison of price performances. (www.seekingalpha.com)

The timing factor is key and is illustrated by the three and five years price performances which essentially show that for hedging to work when shorting tech stocks, it is essential not to adopt a buy and hold strategy and bail out after prolonged signs of an economic recovery.

An example of the importance of timing can be obtained by learning from the one-month price performance of the Ultrashort ETF which essentially shows that its objective to provide -3x times the returns of QQQ has failed. Well, the reason for this is that SQQQ aims to provide gains on a daily basis, or for a single day. Now, when considered over a longer period, there is a phenomenon called compounding which comes into play, whereby due to the high degree of volatility of QQQ within a period of time, in this case, one month, investors can suffer from losses on highly leveraged ETFs.

At this stage, it becomes important to mention that it is also because of the compounding effect that QQQ delivered only a 28% upside and not a 63% one after QQQ suffered from a 21% loss as shown in the introductory chart. More details about compounding are in my thesis on the ProShares UltraPro Short S&P 500 ETF (SPXU) in October last year.

The Trading Strategy

Now, just like when putting your hard-earned money into stocks, you do due diligence in order to increase the probability of making a profitable trade, there are three factors to consider: alternative hedges, momentum, and financial conditions.

First, looking at alternatives, there are other hedging mechanisms like investing in gold or bonds. However, as seen by negative year-to-date performances of the SPDR Gold Trust ETF (GLD) and the Vanguard Total Bond Market ETF (BND), these do not seem to be working up to now. Thus, I stick to SQQQ.

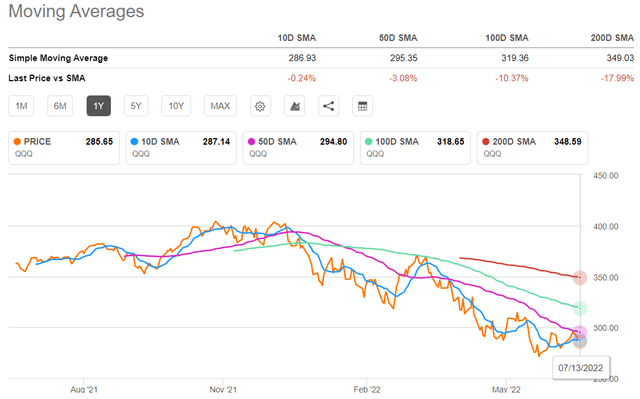

Second, for momentum, I consider the moving averages for QQQ, which I use as guidance for buying SQQQ shares. In this respect, QQQ’s stock price at $285.65 is now below its 10-day moving average of $287.14 as shown in the chart below. This indicates a downtrend for the short term. Now, for this trend to be sustained, the 50-day SMA which is currently at around $294.8 will have to come near and even fall below QQQ’s share price.

Moving Averages for QQQ (www.seekingalpha.com)

The probability that this price action will happen is reinforced by the third factor or financial conditions. For this purpose, the inflation rate is a concern due to the Consumer Price Index increasing by a record 9.1% over the last 12 months in June or 0.3% above the Dow Jones estimate. The adverse market reaction to the CPI news shows that investors could be pricing for a 100 bp rate hike this month instead of 75 bp. This is because the Federal Reserve has already shown a strong intent to fight inflation, and, as I explained above, the more the Fed is hawkish, the worse it gets for tech stocks.

Conclusion

Consequently, an investment in SQQQ makes sense, but, in light of resilience in the jobs market amid indications of a slowdown in economic growth, it can happen that the Fed raises rates as per initial expectations, or 75 bp. This in turn would imply an upside in tech stocks or QQQ. In these circumstances, investors should be ready for a downside in the value of SQQQ. Still, with the earnings season kicking in, the ProShares ETF should see a net upside amid abrupt fluctuations.

[ad_2]

Source links Google News