[ad_1]

Leonid Sorokin

With the whirlwind of negative economic and market news year to date, it’s very tempting to buy into an ETF named aptly as the Invesco S&P 500 High Dividend Low Volatility Portfolio ETF (NYSEARCA:SPHD). The ETF focuses on the top 50 companies scored by a combination of low price volatility and also reliable dividends within the S&P 500 universe. It’s quite reasonable for investors desire stable prices as well as consistent cash flow during a major downturn.

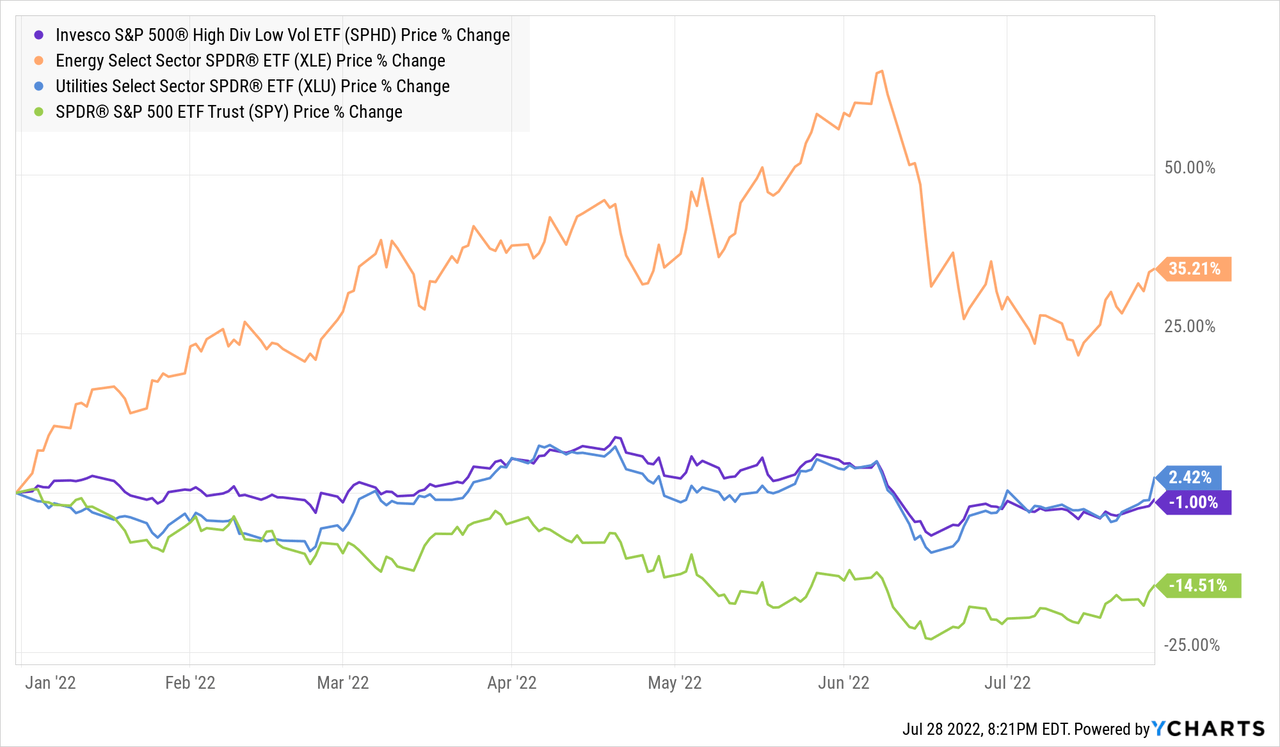

Indeed, year to date, SPHD has done quite well in weathering the interest rate and recession risks so far. SPHD is down only about 1-2% YTD while the SP 500 is down around 20% and the Nasdaq-100 has hovered around 25-30% down.

However, there are several reasons why I believe holding SPHD will actually be risky going forward in this recessionary environment and that the current YTD performance is actually just a temporary anomaly.

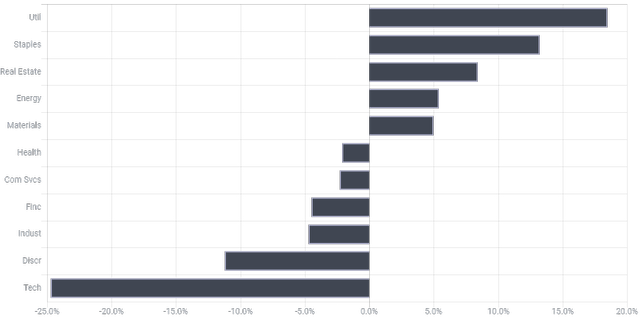

SPHD’s selection criteria leads it to overweight dividend paying sectors and underweight other sectors. As you can see, there is significantly more weight placed on industries that happened to have done well this year, utilities and energy, which tend to thrive in inflationary environments.

SPHD minus SPY Industries (ETF Research Center)

However, as recession risks loom, energy often crashes as oil demand collapses (occurred in both 2008 and 2020). The energy stocks as represented by XLE have already seen a major correction in early June and that has reflected in SPHD also beginning to drop after staying stable for the first half of the year.

SPHD is also most heavily concentrated in utilities (XLU) with about 20% weight in utilities vs 3% in S&P 500. The correlation between XLU and SPHD is extremely high.

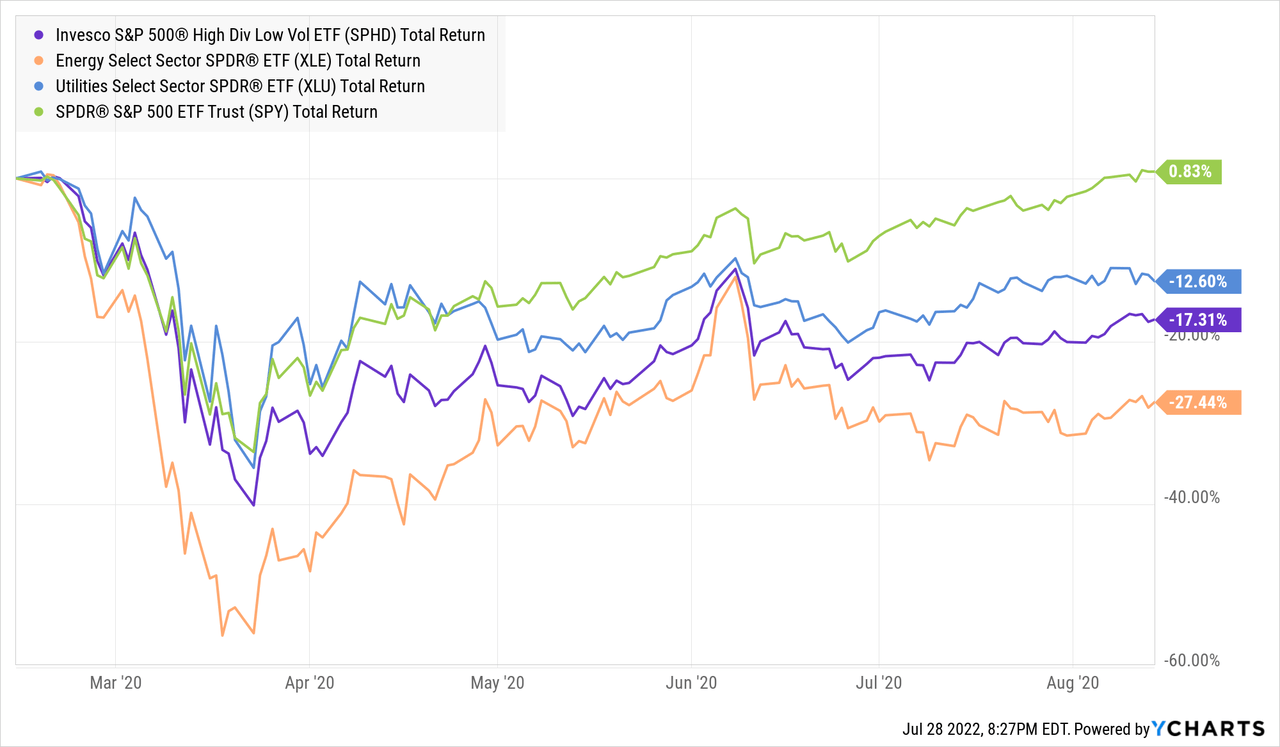

Looking back in the last recession in 2020, we can see that energy and utilities, as well as SPHD itself performed extremely poorly, even with dividend reinvestment factored in, compared to the S&P 500. XLE and XLU were highly volatile which dragged SPHD down much further than SPY (-40% vs -33%) during the initial crash. After a few months, SPY recovered but SPHD was still down 17%.

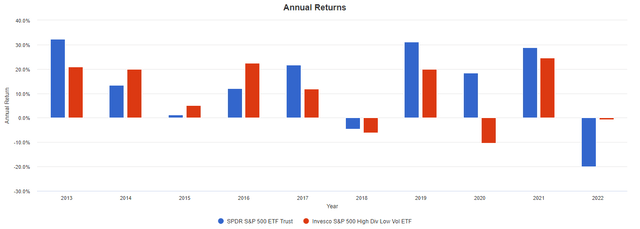

The annual return of SPHD since inception has also varied quite a bit, similarly to how SPY returns. Annual returns have ranged as high as 25% but also as low as -10%, with not much consistency from year to year. In fact, per Portfolio Visualizer, SPHD has had higher 1, 3, and 5 year standard deviation in returns than SPY. This is hardly “low volatility”.

Annual Return SPY vs SPHD (Portfolio Visualizer)

In addition, per Portfolio Visualizer, an investment into $10,000 of SPHD at inception would result in $26,000 with dividends reinvested but $31,000 for SPY in the same time period. The higher return and lower volatility of SPY gives it a significantly higher risk-adjusted return than SPHD.

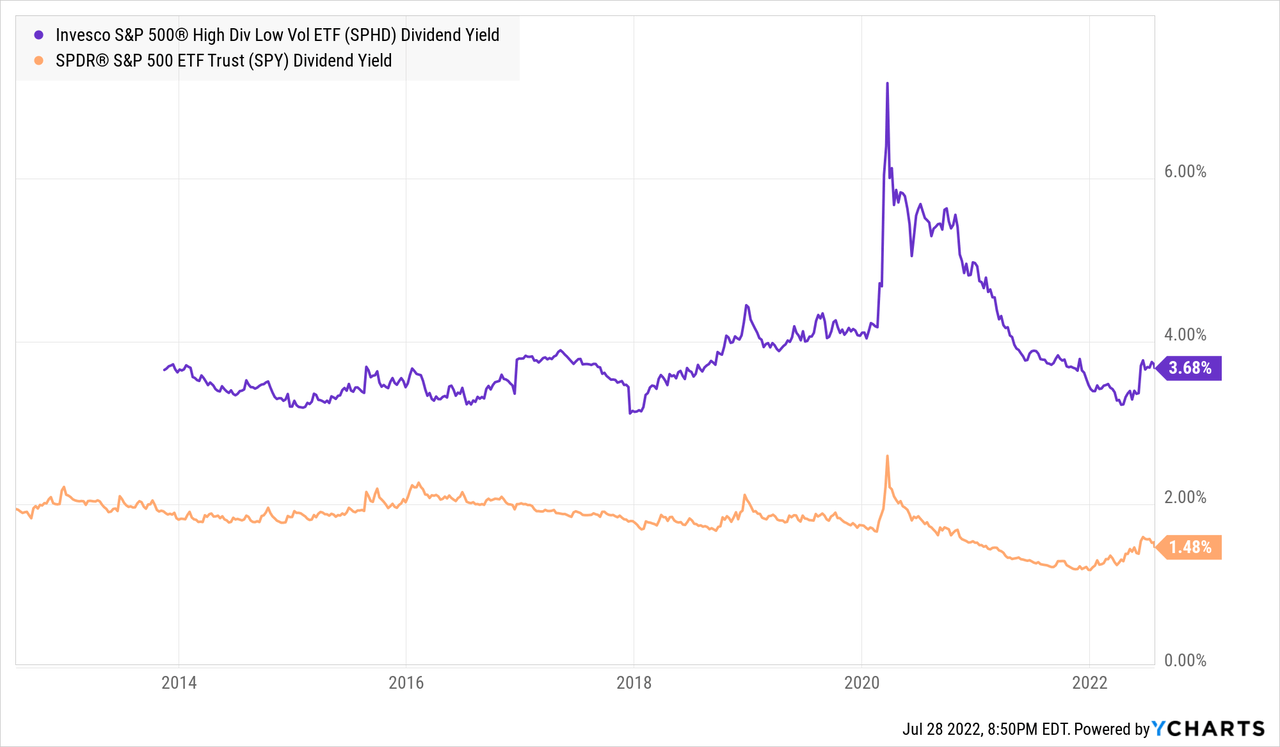

Income investors may still want to rely on SPHD for its higher dividend income and can live with the price volatility. SPHD has indeed paid a higher dividend rate than SPY consistently.

However, one must realize that in a recession, dividend and value stocks in general are hit the hardest. Dividends get cut, and then the attractiveness of the stock plummets. This is doubly compounded by research showing that at the onset of a recession and during low interest rate environments, investors pay a high price for dividend and value stocks, driving up the risk of overpaying, leading to significantly poorer returns as the recession plays out.

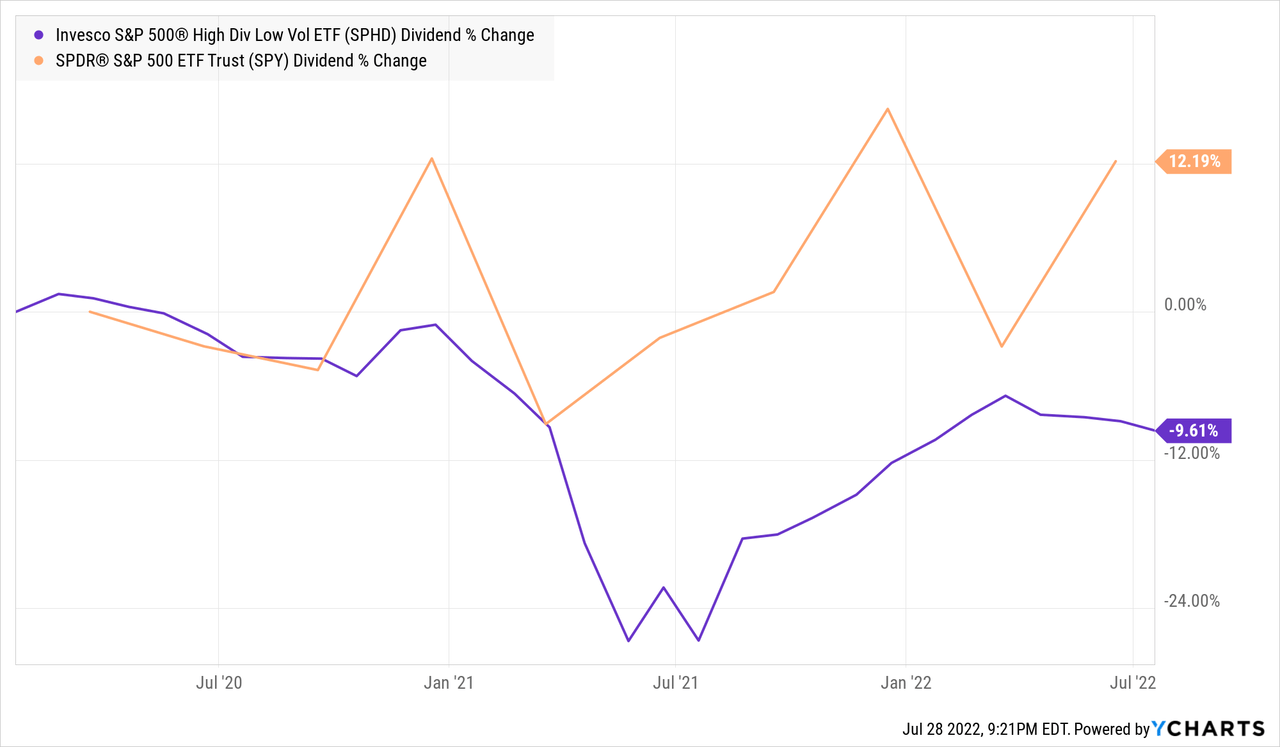

SPHD’s dividend has been seeing the effects of the COVID-19 shutdowns play out even years later. The dividend payment trended down throughout 2020 and half of 2021 and has yet to recover to pre-COVID levels. An upcoming recession could prevent it from reaching pre-COVID levels for a long time as there was another dip in dividends in the most recent quarter, likely due to economic contractions. In contrast, SPY fully recovered its dividends fairly quickly and has grown its dividend 12% since pre-COVID.

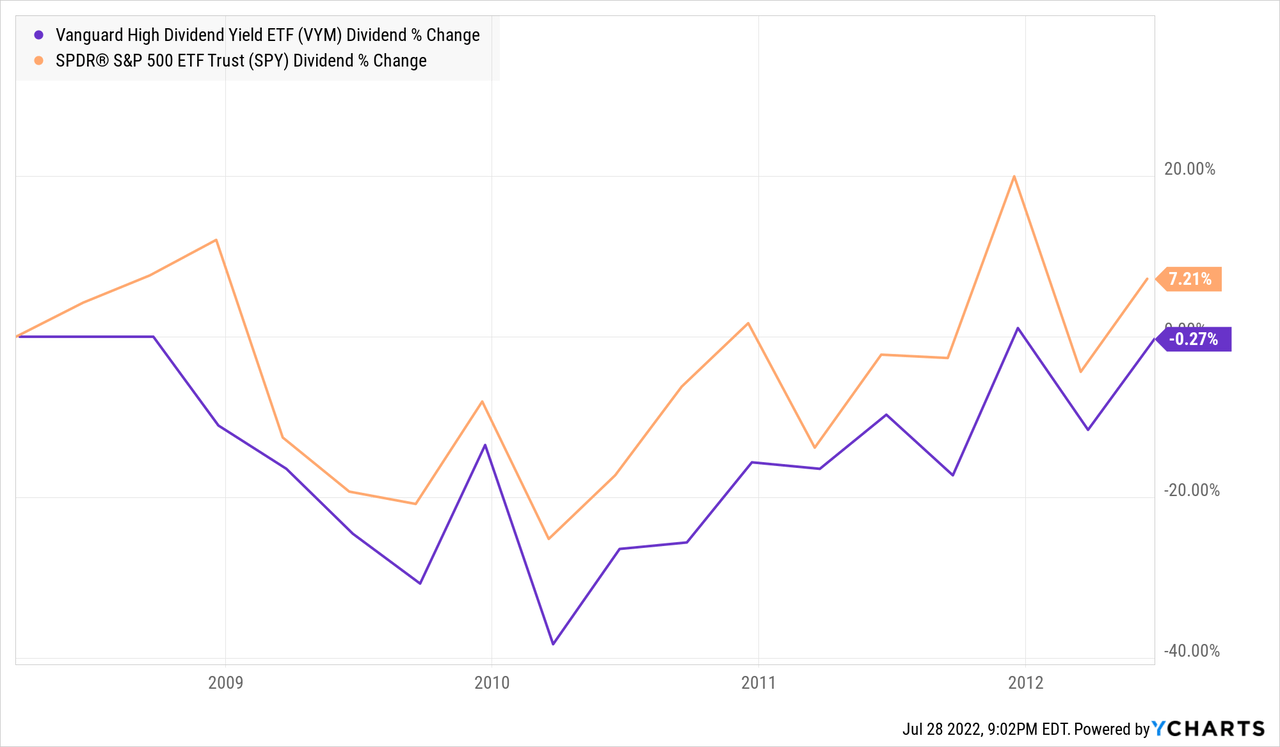

Looking at a similar high quality dividend ETF, the Vanguard High Dividend Yield ETF (VYM), dividends here were also slashed in the 2008 crisis, bottoming 40% from previous highs and not recovering until late 2012. Investors investing in SPY itself instead of focusing on high dividend yields had less impact on dividends and also had dividends recover much quicker.

Overall, SPHD is unlikely to provide continued price stability as it has in the past half year. Its sector concentration into dividend paying industries is already starting to unravel in price performance. During recessions, dividend paying companies are often hit the hardest due to having to slash dividends. SPHD’s dividend also has not recovered to pre-COVID levels and other comparable dividend ETFs took several years to recover dividend payouts after the 2008 crisis. Investors seeking safety in the upcoming recession should likely look elsewhere.

[ad_2]

Source links Google News