[ad_1]

Data by YCharts

Data by YCharts

The Invesco S&P High Beta ETF (SPHB) has dished out plenty of volatility over the last two years, but not much in the way of reward for investors. That pattern has the potential to reverse soon if the major indexes (SPY, DIA, QQQ, IWM) break out of their trading ranges to the upside.

I put forth evidence in a prior piece that perhaps the far more popular low-volatility ETF (SPLV) is getting ahead of itself, and that in relative terms it looks to be time to consider a shift.

SA Essential – September 9

Looking at the right-hand column, we can see that SPHB’s beta is not that high relative to SPY. 1.31-1.36 is not so exaggerated. I suspect this is on account of the fact that while the names that comprise the index individually carry higher betas, the composite beta is tamped down due to diversification.

Can SPHB Outperform The SPY?

Morningstar

It sure can. The Morningstar data above shows calendar year returns for the SPHB, as well as ranking in the category (large blend) and index (Russell 1000 TR). The ETF began trading in May 2011. Since that time, it bested the index in 2012, 2013, and 2016.

Data by YCharts

Data by YCharts Data by YCharts

Data by YCharts

I am cherry-picking those dates. I lined them up as best I could with the start and ending times of prolonged periods of falling volatility and surging stocks.

In its season, SPHB can offer an unleveraged way of delivering extra oomph to one’s portfolio, without having to overthink the daily reset on leveraged ETPs.

So Why The Underperformance?

SPHB just doesn’t do well when things get choppy.

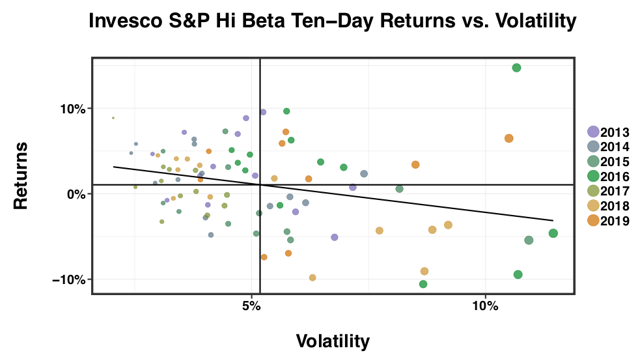

Yahoo! Finance – compiled by author, non-overlapping Ten-Day returns

Many people accept that rising volatility means that returns are going to suffer. That can be true, but it doesn’t statistically hold up as well as one might expect.

In the case of SPHB, however, we have a regression line that strongly suggests that higher volatility does lead to subpar performance.

Data by YCharts

Data by YCharts

Allow me to once again cherry-pick, this time unfavorable dates. Remember that the beta on SPHB above was 1.3x? Notice that the return profile on the ETF was 400% as bad as that of the S&P during its downturn in mid-to-late 2015.

Selecting high-beta names in a market meltdown can amount to catching a lot of falling knives all at once. The fund appears to be one where you want to cut your losses early, or even to consider shorting (yes, according to Fund Sponsor Invesco, the shares can be shorted).

Are We Entering a Run-Up Phase?

As ever, it’s anyone’s guess as to whether we are approaching a new run to all-time highs or a further breakdown. That never changes. There are no options available on SPHB, and so you cannot play the ETF from that direction.

I don’t want to mince words that the [July 2015 – Feb 2016] and the [Sep 2018 – Dec 2018] drawdowns demonstrate that this fund cannot weather the storm, and the beta appears to understate the attendant risk.

We are entering the 2020 election cycle. Nonfinancial corporations are borrowing cheap money at record levels, and some of that new debt will likely bolster earnings (for a while at least) and perhaps spur more share repurchases. The tone of trade talks is getting calmer, and the Fed is predicted to keep cutting rates. All that, and seasonality is about to improve.

So while we can never predict the direction of volatility, it may be worthwhile to consider that some of the pieces are falling into place for a generalized calming. If that is your outlook, then you ought to consider gearing into a low-expense, passive, transparent, liquid, and non-leveraged product like SPHB.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I have owned SPHB in the past, and I’m giving it another hard look here. I do not currently hold the shares.

[ad_2]

Source link Google News