[ad_1]

AK2

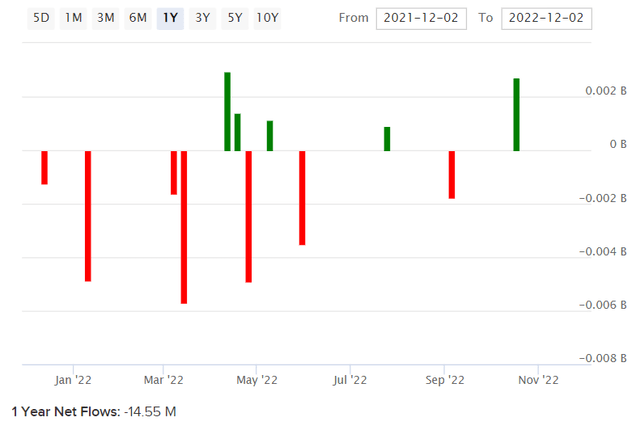

iShares MSCI Global Silver Miners ETF (BATS:SLVP) is an exchange-traded fund that provides investors with access to publicly-listed silver mining companies. The expense ratio is 0.39%, with assets under management of $193 million as of December 5, 2022. That makes the fund relatively unpopular. The fund’s benchmark index is the MSCI ACWI Select Silver Miners Investable Market Index; SLVP seeks to replicate the performance of its benchmark. Net fund flows have been negative over the past year (see below), although activity has mostly been muted (a variance of only $15 million).

ETFDB.com

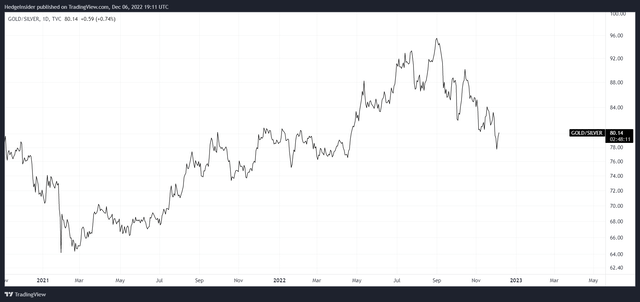

Equity markets have mostly fallen over 2022, and inflationary pressures have been elevated. This would typically be a market regime in which precious metals would rally. Having said that, gold is typically viewed as the classic safe haven within the precious metals complex. Silver is usually considered the riskier option. The gold/silver ratio can rise during risk-off periods, and fall during risk-on periods (alternatively, substantial moves in the gold/silver ratio can sometimes serve as an interesting and unconventional leading indicator of the same risk-on/risk-off activity).

In any case, the gold/silver ratio has generally appreciated since early 2021 through to mid-to-late 2022, which was potentially signalling increasing risk-off sentiment. This weaker sentiment potential was realized in equity markets from the beginning of 2022, and has mostly continued through to present, notwithstanding recent short-lived equity rallies. More positively (as a possible leading indicator of risk-on activity), the gold/silver ratio has been falling since the start of September 2022.

TradingView.com

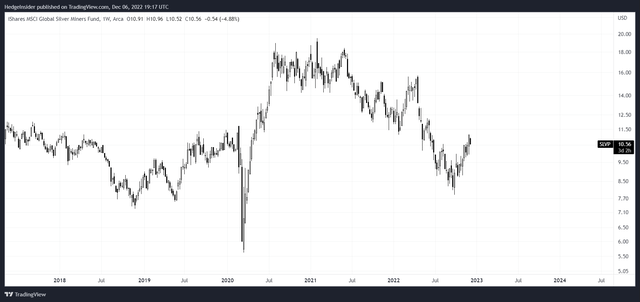

However, silver prices have been mostly flat since mid-2020 (see below). Therefore, SLVP is not currently enjoying a silver bull market.

TradingView.com

Nevertheless, flat or relatively steady prices is better than falling prices. Silver prices have been somewhat volatile recently, but mostly you can see a medium-term trading range establishing itself; silver prices are still above pre-pandemic levels. Meanwhile, SLVP shares are not (see below).

TradingView.com

It could be the case that SLVP offers potentially greater value than investing in silver more directly (whether via physical purchases, futures, or otherwise). It is very difficult to guess where silver prices will go next. However, one simple point that many forget is that mining companies are not “long metals” but rather short; they are literally in the business of selling the metals that they are mining, and hence weaker prices are not necessarily bad. Lower trading volumes are bad. Higher and rising prices tend to correspond with higher trading volumes, but the relationship is imperfect. This means that SLVP is not necessarily poorly positioned.

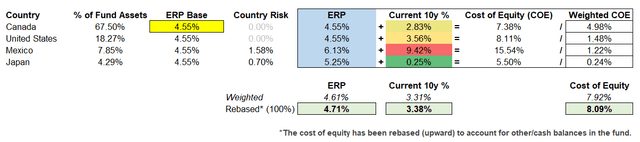

Before valuing SLVP, we need to get an idea of the fund’s risk-free rate. I have calculated this as follows, based on the fund’s four core geographic exposures (Canada at 67.50%; United States at 18.27%; Mexico at 7.85%; Japan at 4.29%). I have used research from Professor Damodaran for country risk premiums, and used 10-year government bond yields as base risk-free rates for each geography.

Author’s Calculations

In summary, an appropriate cost of equity is 8.09% for SLVP (per my calculations), with a weighted risk-free rate (included) of 3.38%.

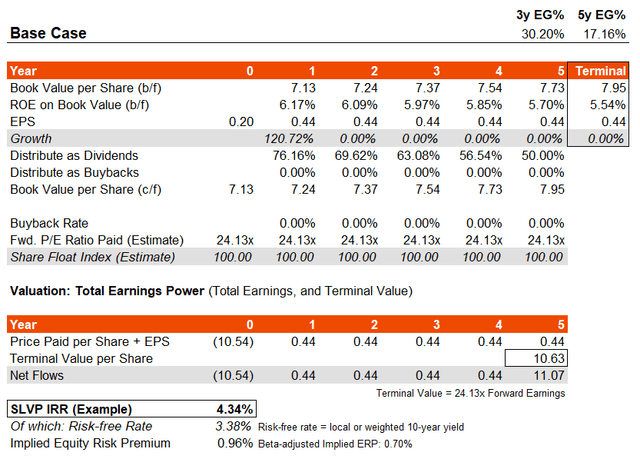

The most recent factsheet (cited earlier) for SLVP is as of November 30, 2022, which reported trailing and forward price/earnings ratios of 53.26x and 24.13x, respectively, with a price/book ratio of 1.49x and an indicative dividend yield of 1.43%. Those figures imply a forward return on equity of 6.17%, which is low, and a dividend distribution rate of 76.16%.

While Morningstar’s consensus analyst estimate for three- to five-year average earnings growth will not be perfect, since they likely cannot predict long-term silver prices reliably, its figure of 6.87% is a reasonable base. Still, MSCI’s reference price/earnings ratios suggest massive earnings growth on a forward one-year basis, clearly owing to high sensitivity of earnings relative to fluctuating silver prices.

Given the high earnings growth measured on an unadjusted basis in year one, my earnings growth rates are going to be relatively meaningless over the forecast period. However, what I will assume is that SLVP’s portfolio generates at least a 5% return on equity going forward. Given that the fund’s fair cost of equity is likely over 8% as measured before, I can only assume that the fund’s portfolio will manage a 5% minimum return on equity over the long term (or the entire portfolio would conceivably go out of business in the long run). I’ll also assume a falling earnings distribution rate to 50%. In essence, all of this results in a 0% earnings growth rate after year one.

Author’s Calculations

If one wanted to be even more conservative, one could argue that year two earnings growth could even dip into negative territory after the first year, to bring average earnings growth well below my figures. More likely, my figures are probably already on the conservative side; I’d expect returns on equity to actually hit 8% or more over the long run. Nevertheless, I always like to take a conservative view if I can (still within the bounds of reason). In this case, the headline IRR result is only 4.34%, which results in a tiny sliver of an equity risk premium of just 0.96%. This would indicate significant downside potential, with a price/book of closer to 1x than the present ratio of circa 1.50x (and arguably even a sub-1x price/book).

Another factor is the forward price/earnings ratio, which is already high at 24.13x (as implied by the fund’s benchmark index) in spite of a large bounce-back in forward one-year earnings growth. If you assume a cost of equity of 8% in the long run, and a 2% earnings growth rate to perpetuity, that would imply a long-term earnings multiple of 16.67x (the inverse of 8% less 2%). That suggests even more downside potential, on top of the concerning low IRR implied from the model above.

In summary, while I cannot predict silver prices (and nor can analysts, reliably), one can assume that both silver mining companies will remain in demand in the long run, but that returns on equity are likely to be modest (bar an unexpected technological break-through). Therefore, given all available information today, no matter where we are in the business cycle, I think that SLVP is fundamentally overvalued. I would actually take a strong bearish view at present prices. The risk/reward seems uniquely bad.

One other way besides technology/large operational improvements, in which I could be wrong, is if silver prices rally strongly over the next few years. However, I would continue to hold a bearish view, as I would not want to assume that this will occur in order to validate the present share price of SLVP. At best, it is likely that strong/rising prices (projected) would merely take us close to fair value for SLVP. The conservative view is to assume stable prices.

[ad_2]

Source links Google News