[ad_1]

Vertigo3d/E+ via Getty Images

The iShares Global REIT ETF (NYSEARCA:REET) is exactly what it says on the tin: a global REIT index ETF. REET provides investors with broad exposure to global real estate companies, and so is significantly more diversified than most REIT funds, most of which invest in U.S. REITs exclusively. REET’s diversified holdings make the fund a buy, and one which is mostly appropriate for investors looking to diversify their real estate investments into international markets.

REET – Basics

- Investment Manager: BlackRock

- Expense Ratio: 0.14%

- Dividend Yield: 3.1%

- Total Returns CAGR 5Y: 7.3%

REET – Overview

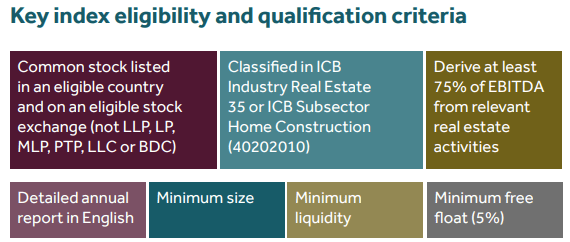

REET is a global REIT index ETF. It is administered by BlackRock, the largest investment managers in the world. The fund tracks the FTSE EPRA Nareit Global REITS Net Total Return Index, an index of these same securities. It is a relatively simple market-cap index, investing in all applicable real estate companies meeting a basic set of liquidity, size, float, structure, and industry classification criteria. Key criteria are as follows.

FTSE

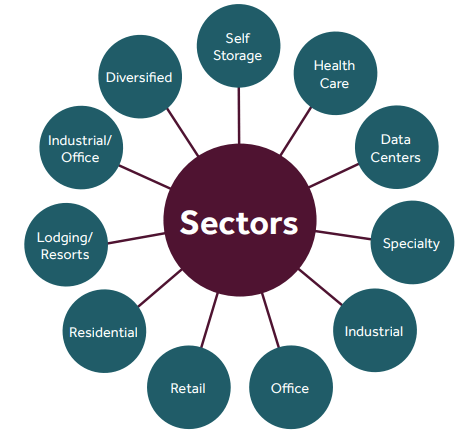

REET’s underlying index includes REITs from all relevant industry sectors. These are as follows.

FTSE

REET’s underlying index is quite broad, which results in a well-diversified fund. REET provides investors with exposure to 346 different real estate companies, a strong figure, and significantly higher than average for a REIT fund. As an example, the iShares U.S. Real Estate ETF (IYR), REET’s U.S. counterparty, only invests in 86 REITs. Most REIT funds focus on U.S. securities, and so have a similar number of holdings as IYR. REET invests in international real estate companies too, leading to a large, more diversified, portfolio.

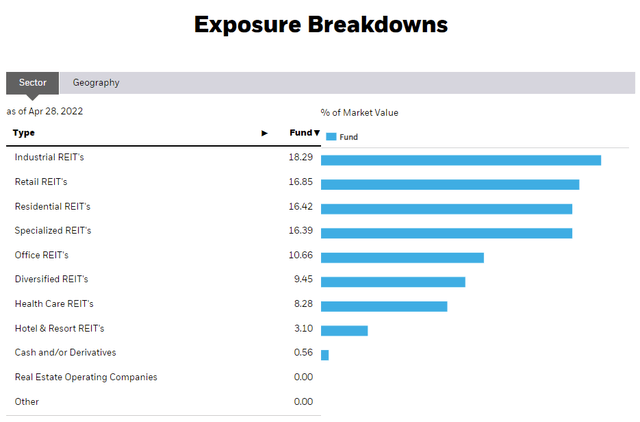

REET’s portfolio includes investments in most relevant REIT industry segments. The fund is somewhat overweight the old-economy industrial, retail, and residential sectors. REET’s comparatively high retail weight is particularly risky, as the sector is on a long-term secular decline due to the ongoing shift towards e-commerce and online retail offerings. Retail real estate has underperformed in the U.S. for decades and will likely underperform moving forward as well. As REET is not significantly overweight retail this isn’t a significant negative, but it is a negative nonetheless.

REET Corporate Website

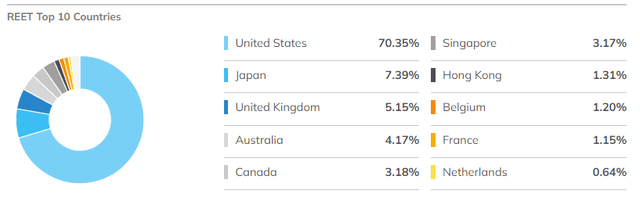

REET’s portfolio includes real estate companies from 10 different countries, all comparatively safe developed markets. The fund is significantly overweight U.S. REITs, due to the size of the country’s economy and equity markets, and as the REIT structure is particularly common in the U.S.

ETF.com

REET is an incredibly well-diversified fund, much more so than most of its peers. Diversification reduces portfolio risk and volatility, is a significant benefit for REET and its shareholders, and is the fund’s key differentiator.

REET – Expected Performance Analysis

In my opinion, REET’s expected future performance is quite strong, for several reasons.

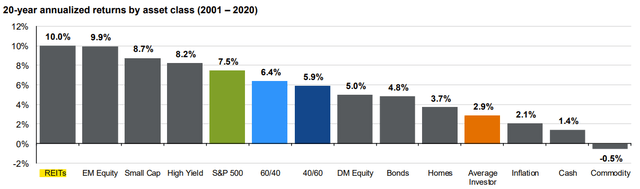

First, is the fact that real estate itself is the best-performing long-term asset class in the world. Real estate outperforms equities, bonds, commodities, and everything in between. Insofar as the trend continues, and I see no reason to think it won’t, real estate will continue to post strong, market-beating returns moving forward. REET provides investors with broad-based exposure to real estate, and so should perform in-line with said asset class.

J.P. Morgan Guide to the Markets

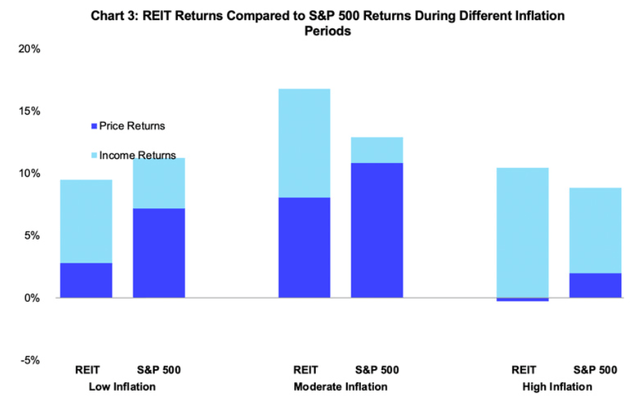

Second, is the fact that real estate companies tend to perform reasonably well when inflation is high. The explanation is simple. Inflation means rising prices, including rising real estate prices, which are self-evidently beneficial for real estate companies. The relationship is not direct, but mediated by market sentiment and broader economic conditions, but it is there, and reasonably strong. As per NAREIT, REITs outperform equities when inflation is higher, as expected.

NAREIT

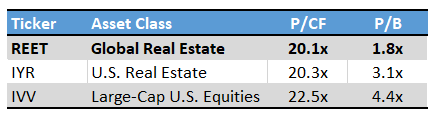

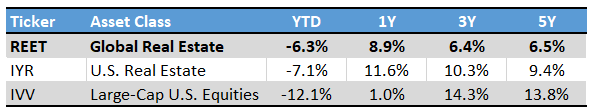

Third, the fund’s valuation is comparatively cheap, although only slightly so. REET’s PB ratio of 1.8x is significantly lower than that of both U.S. real estate and equity indexes. Comparatively cheap real estate prices are incredibly important for funds like REET, although it is not clear that book values reflect these (due to accelerated amortization schedules). REET’s P/CF ratio of 20.1x is effectively identical to that of U.S. real estate indexes, but slightly lower than PE ratios for U.S. equities. Seems clear that REET’s valuation is slightly cheaper than those of its peers, a small benefit for the fund and its shareholders.

Fund Filings – Chart by author

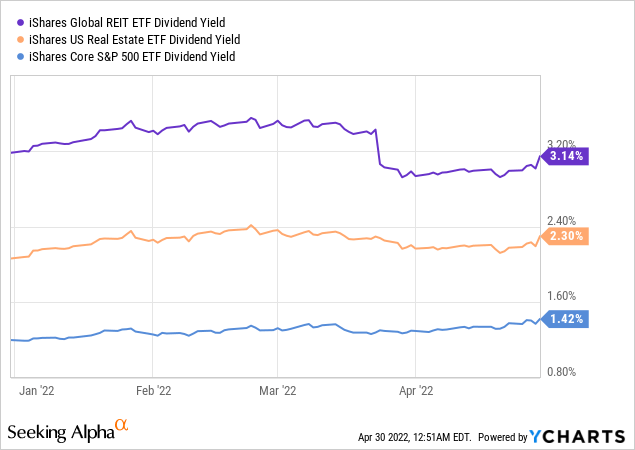

Fourth, REET’s 3.1% dividend yield is slightly higher than that of relevant U.S. real estate and equity indexes. REET’s yield is not incredibly high, but it is slightly higher than average, which ultimately benefits the fund and its shareholders.

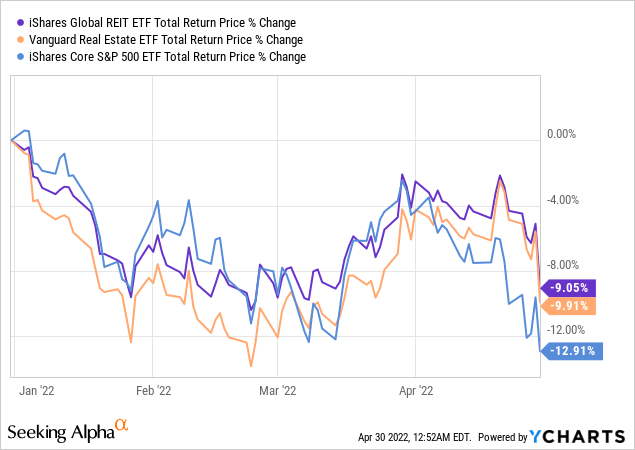

Finally, investor sentiment is currently broadly bullish about value and international stocks, with the fund slightly outperforming relative to its peers YTD. As with the above, the difference in performance between the fund and its indexes is quite small, but the difference is still there, and broadly beneficial for the fund and its shareholders.

In my opinion, REET’s strong fundamentals, inflation exposure, cheap valuation, and comparatively high dividend yield, should lead to strong, market-beating returns moving forward. This has been the case YTD, and the trend is set to continue, in my opinion at least.

REET – Performance Track-Record

REET’s performance track-record since inception is below-average, with the fund underperforming relative to most relevant U.S. indexes since inception. Performance has significantly improved in the past year, but the overall track-record remains middling, at best.

Seeking Alpha – Chart by author

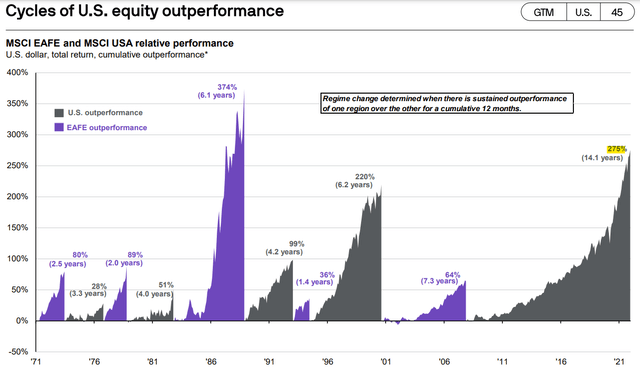

REET’s subpar performance is almost fully explained by U.S. securities outperforming comparable international securities for more than a decade. Outstanding U.S. returns have caused most global and international funds, including REET, to lag behind their U.S. peers. Global markets have performed quite a bit better in the recent past, so the trend seems to be reversing itself.

J.P. Morgan Guide to the Markets

As mentioned previously, I believe that REET’s future performance will be quite strong, but the fund’s performance track-record is subpar, at best. I’m willing to overlook past underperformance, although I’m sure this will be a deal-breaker for many investors.

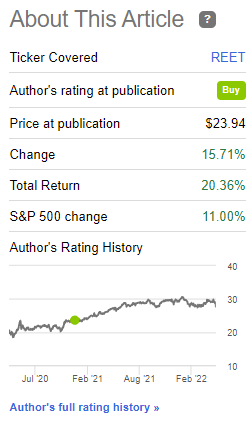

As an aside, I made a similar forward-looking analysis for REET more than a year ago. At the time, fund fundamentals seemed even stronger, but the performance track-record was even weaker. I argued that strong fundamentals outweighed past performance, and was (mostly) proven right, with the fund quite well since.

REET Seeking Alpha Article

Past performance meant little then, and I think it will mean little moving forward.

Conclusion

REET is a global REIT index ETF. REET’s diversified holdings make the fund a buy, and one which is mostly appropriate for investors looking to diversify their real estate investments into international markets.

[ad_2]

Source links Google News