[ad_1]

Moyo Studio/E+ via Getty Images

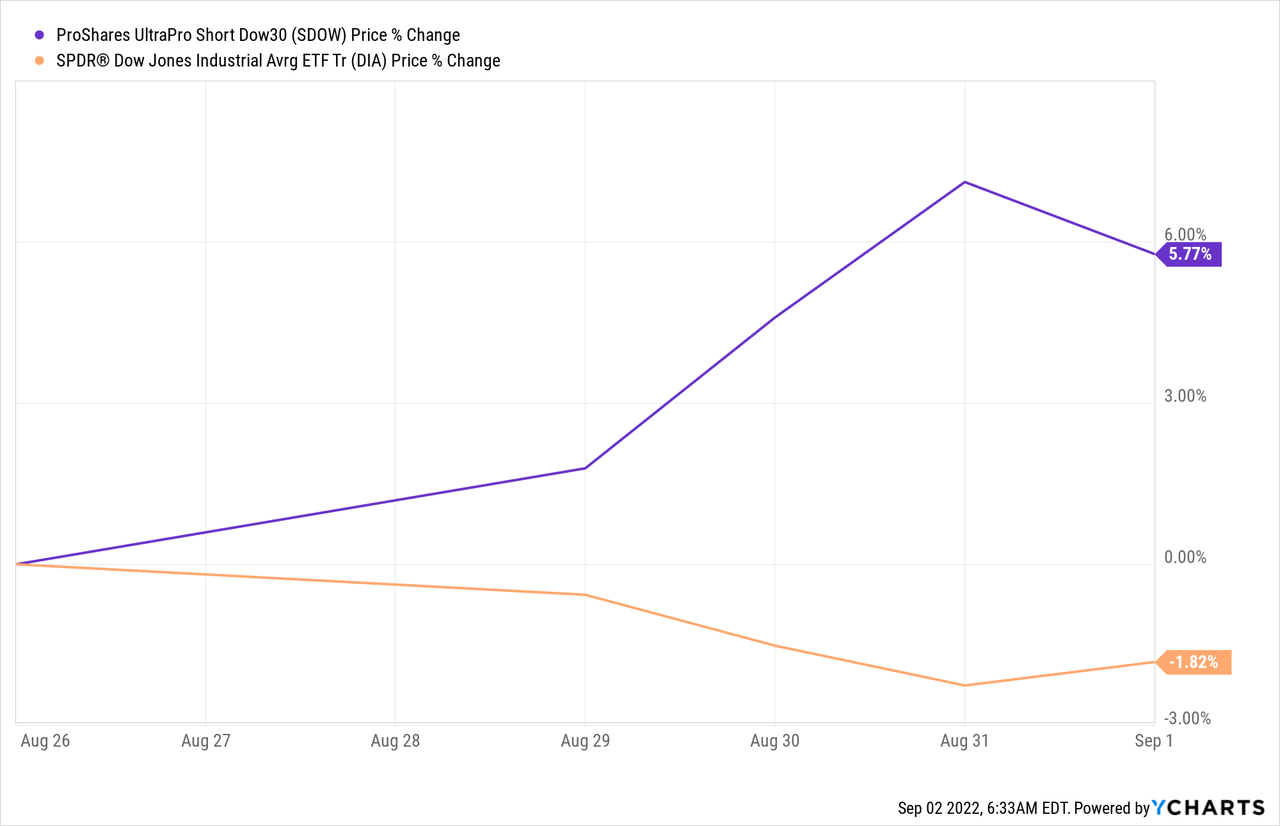

Just like dancing can be a liberating moment in enabling people to express feelings, market volatility also reflects the mood of investors as they trimmed down their positions after heightened market volatility following the Jackson Hole symposium. That hawkish tone by Fed Chairman on August 26 caused the SPDR Dow Jones Industrial Average ETF (NYSEARCA:DIA) to drop by over 1.8% since, as shown in the blue chart below.

Conversely, the ProShares UltraPro Short Dow 30 ETF (NYSEARCA:SDOW) which inversely tracks the Dow Jones Industrial Average Index by three times (or -3x), delivered a gain of 5.77%.

This outperformance of over three times (3x) is explained by the fact that DIA tracks the Dow Jones Industrial Average Index.

The aim of this thesis is to assess how to take advantage of the moves of SDOW and DIA by making use of Bump Dance. Taking advantage, in this case, means either profiting or, equally important, not losing money.

Analogy Between Volatility and Bump Dancing

Volatility has been impacting the markets since September 2021 when it became evident that the U.S. central bank would have to tighten monetary conditions in order to have some control over inflation. Now with rising rates comes the fear of the ripple effect. This is when rising borrowing costs induced by higher interest rates can affect the very growth of the economy.

In addition, corporate earnings are increasingly under scrutiny as a stronger dollar can impact profitability, while not forgetting high wage inflation and supply chain issues due to COVID-19 still lingering in China. These have all been compounded by the war in Eastern Europe in turn leading to higher commodity prices and fueling the uptrend seen in consumer price indices of countries throughout the world.

As a result, DIA and SDOW have been moving according to the tunes of a bump dance. Going into details, for those who are familiar with rock and roll, swing or slow, bump dance is different with the two partners momentarily bumping (or touching) their hips against each other before parting away. This action is repeated continuously according to a rhythm with the dance introduced in the U.S. during the 1970s. The following YouTube video illustrates my point.

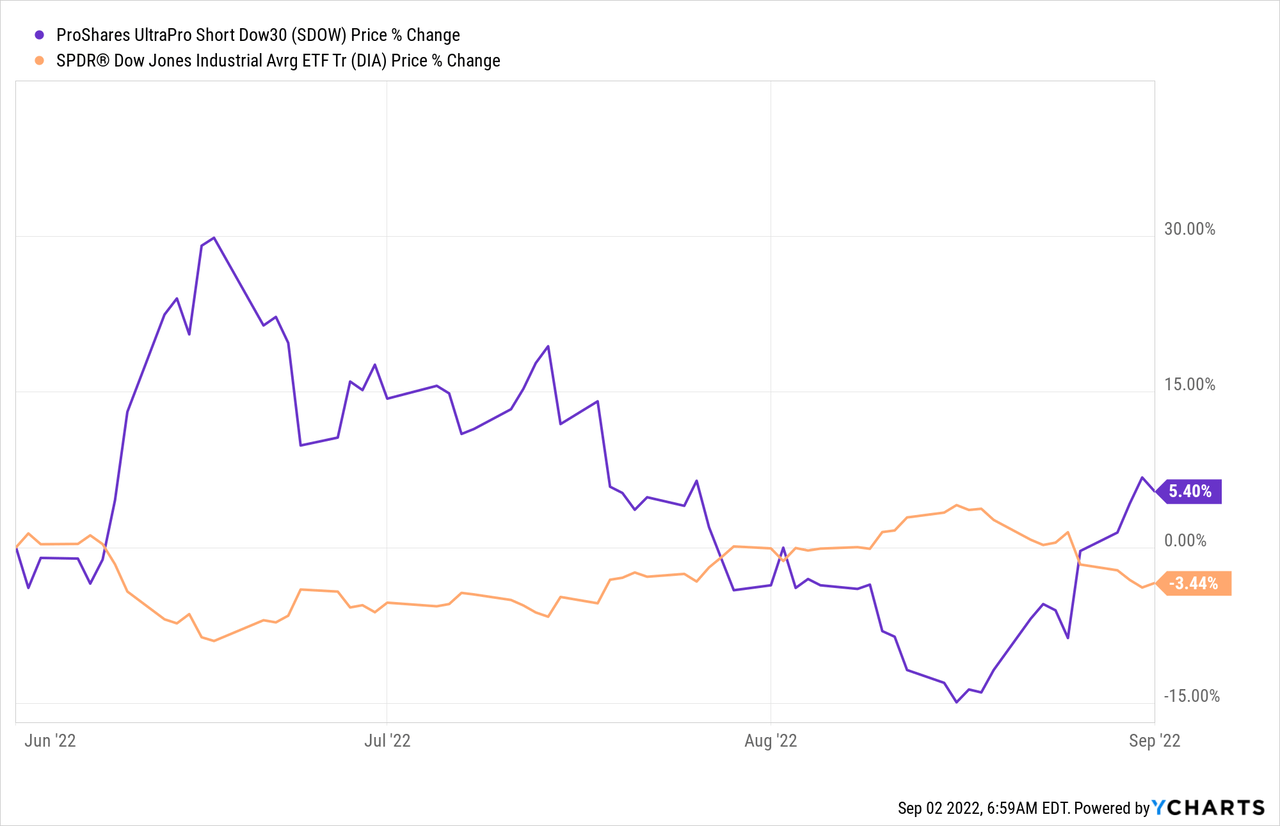

This is what SDOW and DOW have been doing for the last three months as seen in the charts below, with the blue chart bumping (touching or intersecting) with the orange one from time to time. This is completely different from a slow (dance) when the two partners move together.

Furthermore, investors will note that the somewhat low-rhythm bump dance in the June-July period has accelerated to a more frantic pace from August. This in turn raises the probability of SDOW and DIA coming closer (or bumping) within days compared to weeks in September.

Using Macroeconomic Factors

For this to happen, SDOW should fall and, at the opposite end of the spectrum, DIA should retrench from some of its recent losses, or there should be an upside in the ETF. To support my optimism about DIA, I list the following macroeconomic factors:

First, despite some headwinds and the economy shrinking in the first half of 2022 with some high-profile tech companies like Microsoft (NASDAQ:MSFT) announcing a freeze on hiring, job numbers have been remarkably consistent in July and August. Ironically, it is these high job numbers that are prompting the Fed to be more aggressive. The rationale is that more people being employed augments the wage inflation rate. Now, by raising interest rates, borrowing costs also increase thereby cooling entrepreneurs’ appetite to spend money. Normally, this is supposed to reduce economic growth and put a break on inflation’s rise. At the same time, with consumer sentiment having been revised higher in August, to 58.2, the Fed has some room to maneuver.

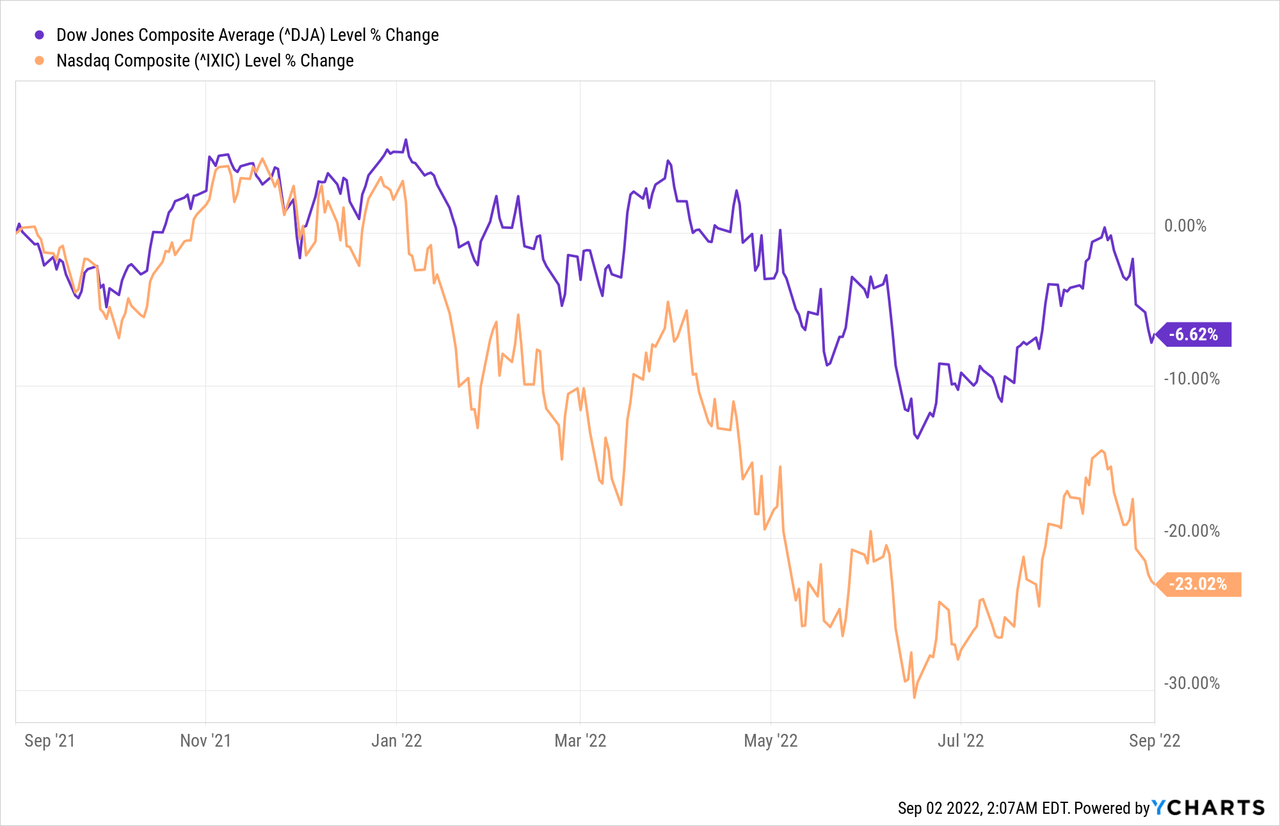

Second, as shown in the chart below, it is the tech sector as represented here by the Nasdaq Composite which is suffering more. For this purpose, technology stocks are most highly valued as they trade at above 23 times earnings while it is less than 17 for DIA. Now, with a tightening of monetary conditions, it is likely for the value strategy to prevail and tech stocks to suffer more.

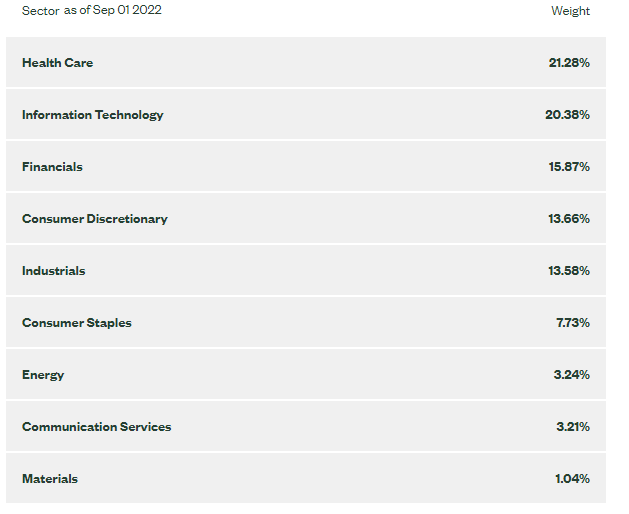

Third, the industrial names which constitute 13.58% of DIA’s holdings could as shown in the table below benefit from a reduction in energy prices as lockdowns in China and recession concerns in Europe dampen demand while a potential agreement with Iran could help the U.S. and its European Allies to have more bargaining power against OPEC. Two other positives for DIA are its exposure to healthcare which is viewed as a good defensive sector to own and financials, as banks normally benefit from rising interest rates.

Sector Breakdown for DIA (www.ssga.com)

Therefore, taking into consideration the above three points, there can be a rebound in the Dow Jones and, by ricochet, the DIA. For this matter, just like pullbacks occur during good years, a rebound can also occur during more uncertain periods, which is more appropriately termed a bear market rally.

Profiting from the Volatility – DIA

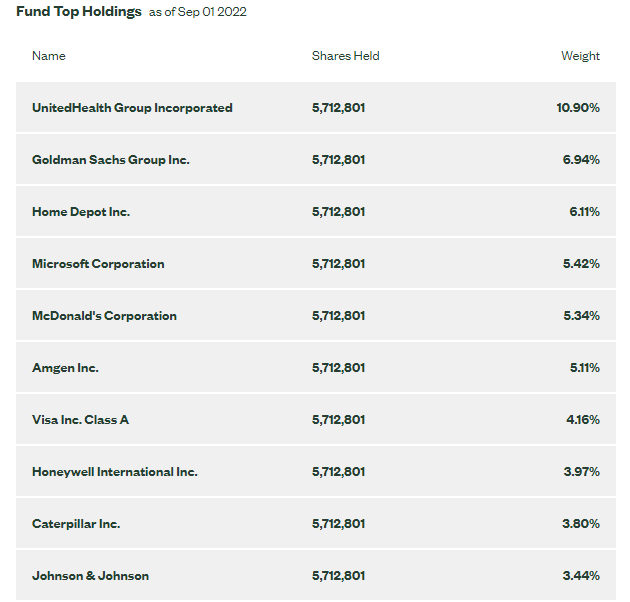

With such an upside, DIA could again flirt with the $339 level, which is 7% above its current share price of about $317. My bullish stance is also supported by its RSI of below 38. Moreover, looking at holdings, the ETF is well-diversified with thirty blue chip holdings with the top ten constituting roughly 55% of the overall portfolio. These are the types of stocks that you want to hold in the event of a recession instead of seeing your bank account depreciating rapidly as the inflation rate exceeds the savings interest. DIA pays dividend yields of 1.94% too.

Top Ten Holdings Breakdown For SIA (www.ssga.com)

Moreover, with the mid-term elections around the corner and the Presidential ballot in 2024, it is likely for the authorities to find a deal with Iran. Here, additional supply will contribute to easing off the high oil prices, which is a major contributor to inflation in the world.

SDOW – Not the Right Timing

This is a highly optimistic forecast and things may move in the opposite direction in case there are further cuts by OPEC or political instability in Iraq or Libya disrupting the oil supply. In these circumstances, high oil prices tend to be harmful to the economy and fledging economic indicators will likely lead to a fall in DIA.

However, this is not the case currently.

Thus, after a slowdown in job growth for August, which may be caused by more companies pausing recruitment exercises, the Federal Reserve could finally be achieving some success in engineering a slowdown and taming inflation. Now, bearing in mind that too much of a slowdown can engender recession, this may lead to a less hawkish tone by the Fed in the future.

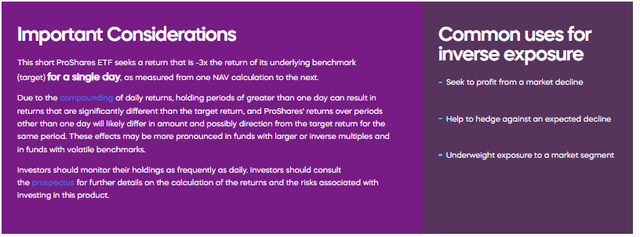

Viewed from this angle, this augurs well for the markets, but not for SDOW which enables investors to profit from market woes. Also, remember, that, unlike DIA, the Proshares leveraged ETF is not something you buy and hold. On the contrary, this is intended for trading purposes for a very short period of time, namely a single day due to compounding effects that can diminish your gains. It comes with a fee of 0.96%.

Important considerations when trading SDOW (www.proshares.com)

Hence, I have a bearish position on SDOW which also seems to have reached a peak as per the bump dancing chart above. This implies that there is more probability of losing money here, and, it is not a good idea to short the thirty blue chips held by DIA.

Conclusion

When you dance, especially in a closed discotheque, there is a lot of noise together with the music playing in the background. In these conditions, you cannot communicate easily with the one close to you. In the same way, as seen by the abrupt moves of SDOW, financial markets themselves cannot decipher good from bad news, resulting in extreme volatility which can be painful for the average investor.

In these conditions, at $33, SDOW seems to have reached a peak which is confirmed by its RSI of above 60. Therefore, in line with my earlier instance, the timing is not right to short the market.

On the other hand, for DIA, more than timing the market, it is rather about synchronizing the period of time you want to be positioned on blue chip stocks that come from such diverse sectors of the economy. In this case, in addition to macroeconomic factors, my bullish case for DIA is reinforced by the bump dance with SDOW, which shows that while history does not necessarily repeat itself, it surely rhymes.

[ad_2]

Source links Google News