[ad_1]

ETF Overview

The Schwab U.S. Aggregate Bond ETF (SCHZ) focuses on investment grade bonds, which includes U.S. government bonds, corporate bonds, and mortgage-backed securities. The fund tracks the market value-weighted Bloomberg Barclays U.S. Aggregate Bond Index. SCHZ has very low credit risk, as all of the bonds in its portfolio are investment grade. However, the fund may underperform against other investment grade bond ETFs, as the company has significant exposure to mortgage-backed securities. SCHZ offers a 2.8%-yielding dividend. It is a good choice for conservative investors with a long-term investment horizon.

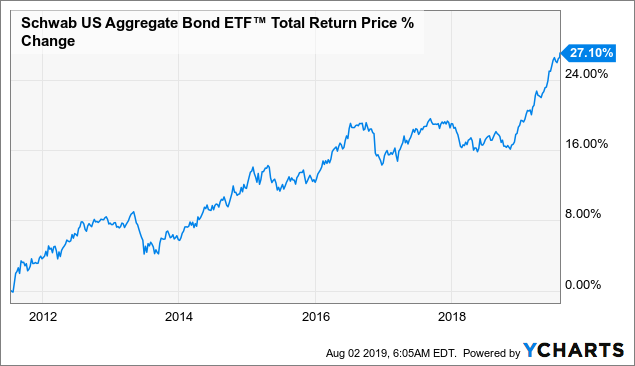

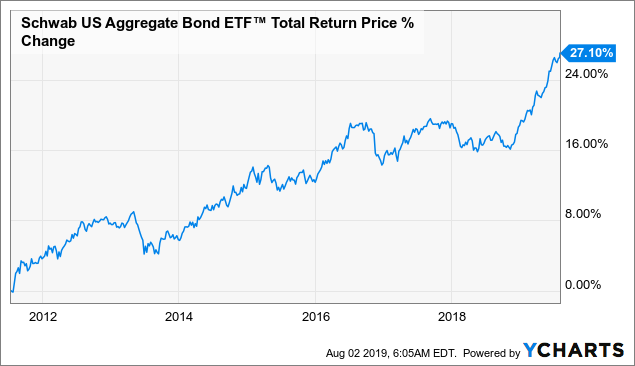

Data by YCharts

Fund Analysis

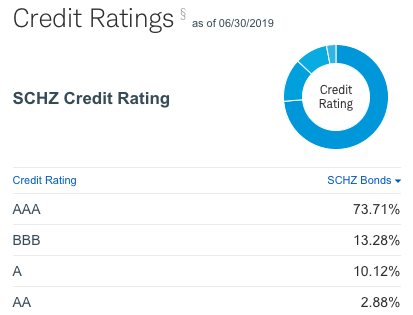

Low credit risk

As can be seen from the table below, about 73.7% of SCHZ’s portfolio consists of AAA-rated bonds. BBB-rated bonds only represent about 13.28% of the portfolio. We like its low exposure to BBB-rated bonds because BBB rated bonds are at the lower end of the investment grade credit spectrum. Hence, in an economic recession, some of these borderline issuer credit ratings may be downgraded. The low exposure to BBB-rated bonds means that SCHZ will have very little credit risk.

(Source: Schwab website)

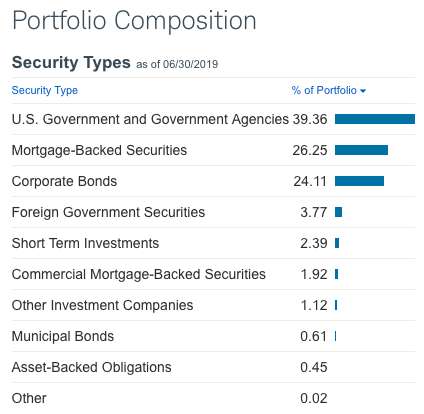

Value of mortgage-backed securities may decline in a market downturn

SCHZ’s investment grade bond portfolio include three primary types: U.S. government-backed bonds (39.36%), mortgage-backed securities (26.25%), and corporate bonds (24.11%). Since all of these types of investments are investment grade bonds/securities backed by the government, credit risk is low. However, there is downside risk in a market downturn due to SCHZ’s 26.3% exposure to MBS. While credit risk may be low, many investors still remember how mortgage-backed securities played a central role in the financial crisis that began in 2007. Therefore, we think in a serious economic downturn, the value of these securities will likely deflate somewhat due to negative market sentiment. Since MBS has the same credit rating as the U.S. Treasury and is backed by the government, we do not see this risk as high.

(Source: Schwab website)

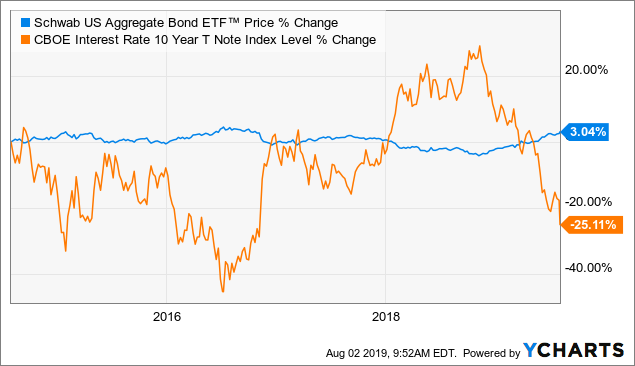

Modest interest rate risk

SCHZ’s portfolio of bonds has a weighted average maturity year of 7.8 years. This is shorter than many long-term bond ETFs (10-20 years) but longer than short-term bond ETFs (less than 5 years). Normally, if an investor holds on to a bond till it matures, he/she will receive the full value of the bond back. The longer the bond is before maturity, the more likely it is that changes in the interest rate will affect its bond price. However, as the bond approaches maturity, the impact of interest rate on the bond price will be much less, as eventually, investors will receive the full value of the bond once it matures.

The same is true for bond ETFs. Since SCHZ includes a portfolio of bonds, the longer the weighted average maturity year, the higher the fluctuation of its bond price to changes in the interest rate. Its intermediate maturity term means that the fund’s performance is slightly sensitive to changes in the treasury rate. As can be seen from the chart below, an increase in treasury rate by about 25% has the potential to reduce SCHZ’s fund price by about 3%.

Data by YCharts

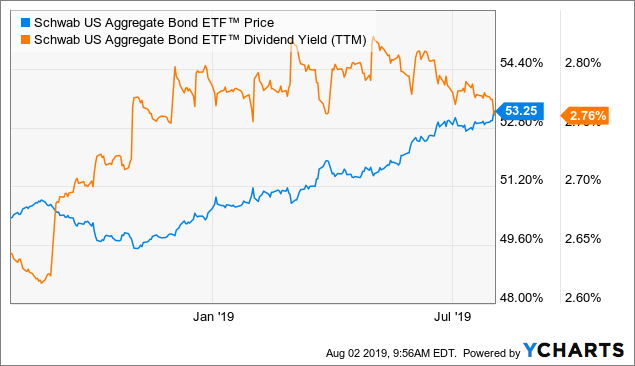

A 2.8%-yielding dividend

SCHZ investors will receive dividends with an annualized yield of about 2.8% on a trailing 12-month basis. This dividend should be safe, as these bonds are investment grade with a very low default rate.

Data by YCharts

As we discussed in the previous paragraph, a 25% increase in the 10-year treasury yield has only resulted in a decline of about 3% in SCHZ’s fund price. This is only slightly more than 2.8%-yielding dividend investors can receive. Therefore, there is little risk in owning this stock, as the majority of the loss in capital depreciation will be covered by the dividend, even if the treasury yield increased by 40%.

Macroeconomic Analysis: Is this the time to invest?

The current economic cycle has been well into its 10th year. Nevertheless, there are already many signs that we are in a late-cycle environment. For example, we are seeing signs of investors rotating from riskier assets (e.g., energy, industrial, etc.) towards defensive assets (e.g., telecom, utilities, some REITs, investment grade bonds, etc.). We believe investors are concerned that the escalation of the global trade tensions will lead the U.S. and global economy into a recession. Although the Fed has cut its interest rate by 25 basis points in late July, President Trump’s recent tweet on adding 10% tariff on the remaining $300 billion imports from China is making the economic outlook more uncertain. In this uncertain environment, high-quality investment grade bonds are an obvious place where investors will park their money. Therefore, we think it is okay for investors to continue to hold on to SCHZ.

Investor Takeaway

For conservative investors, SCHZ may not be a bad choice to own, especially if investors are already overweight on equity ETFs. The fund will not deliver strong returns, but the chances of losing money is low. In fact, SCHZ’s average annualized return is nearly 3% since its inception. Therefore, we think investors can continue to hold on to this fund.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News