[ad_1]

Anne Czichos

Introduction

As a dividend growth investor, I constantly seek income-producing assets that can supplement my passive income. Sometimes I add to my existing positions, and on other occasions, I buy new positions to diversify my holdings further. The current bear market can benefit long-term investors seeking passive income for lower prices.

My dividend growth portfolio comprises tens of positions in single stocks that increase their FCF over the long term and pay increasing dividends. ETFs are sometimes overlooked by dividend growth investors, as investors have less control over their portfolios. However, on some occasions, they can be a good solution for different investors.

In the past, I was not too fond of using ETFs as a substitute for single stocks. Yet, I understand that smaller portfolios may find it beneficial to gain diversification from the beginning. My favorite ETF and the one I will look at is the one offered by Charles Schwab (SCHW): Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD), as I have followed it since 2020, and it has been a reliable fund.

Seeking Alpha’s company overview shows that:

Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF is an ETF launched and managed by Charles Schwab Investment Management, Inc. It invests in public equity markets of the United States. It invests in stocks of companies operating across energy, materials, industrials, consumer discretionary, consumer staples, health care, financials, information technology, communication services, utilities sectors. It invests in growth and value stocks of companies across diversified market capitalization. It invests in dividend paying stocks of companies. It seeks to track the performance of the Dow Jones U.S. Dividend 100 Index, by using full replication technique.

Fundamentals

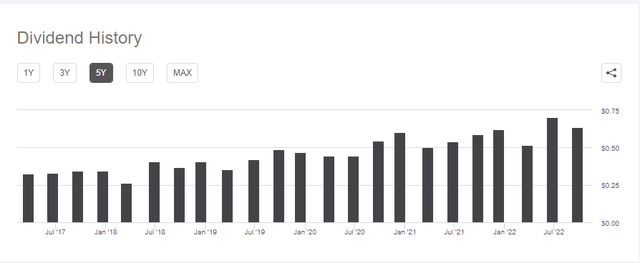

The Schwab U.S. Dividend Equity ETF is an excellent investment. It was founded in 2011. Thus it has a significant track record. It holds 103 stocks in different sectors, which means investors gain important diversification from day one. The fund offers a dividend yield of 3.25% based on the distributions of the last twelve months, which has grown at a CAGR of ~10% annually in the past 11 years.

This long track record is one of the essential metrics for dividend growth investors. The ETF is not a “dividend aristocrat,” as it only started trading slightly over a decade ago. However, during that time, the strategy has been very efficient for dividend growth investors. The yield is adequate, and so is the dividend growth. Therefore, there is reason to believe that if the ETF managed to perform even during the Pandemic downturn, it would perform well in other challenging environments, as we see now.

An essential aspect of the ETF during these times is its income beats inflation. The last payment was 8.5% higher than a year ago. The total 2021 payments were 11% higher than the full amount investors gained in 2020. Therefore, this ETF may be extremely useful during periods of high inflation like the one we are experiencing now.

The ETF follows the Dow Jones U.S. Dividend 100 Index and invests in roughly 100 stocks diversified across different sectors. The largest sectors are the financial sector (20% of the assets), consumer staples (14% of the assets), and healthcare (13% of the assets). Therefore, some significant diversification allows investors to gain exposure to various industries.

Pros

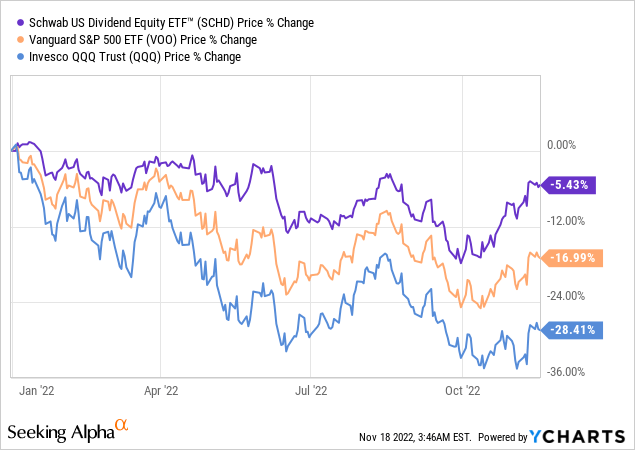

The ETF is suitable for volatile times. The defensive nature of the ETF has helped it outperform the market in 2022 and even before that. Since I wrote about the ETF precisely two years ago, the ETF returned 25 compared to the S&P 500 (VOO) 11% and the Nasdaq (QQQ) -2.5%. Year to date, the graph below shows how well the ETF performed during the current bear market, as it returned -5.43%, and including the dividend paid, it almost didn’t lose any money.

Psychological effect during a downturn is also an advantage of investing in an ETF compared to single stocks. One of the most challenging tasks for investors is to keep investing even during downturns and keep executing the plan. You doubt yourself when you see stocks in your portfolio that are down 20% and even 30% or 40%. The ETF offers less volatility as it “hides” the internal returns of the assets it invests at. It makes adding more capital to the investment easier from a psychological perspective.

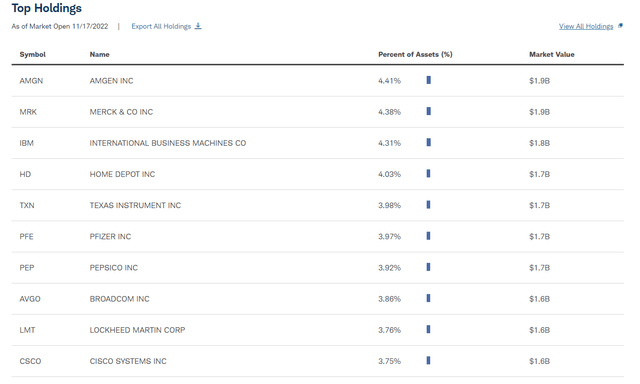

In addition, the ETF invests only in high-quality holdings. The table below shows the largest holding according to the fund’s website. These are household names and well-known brands that most investors are aware of. These are high-quality companies with a long track record of outstanding performance, and therefore, investors rest assured that while the ETF invests in 100+ stocks, there is no need to follow them as they are blue chips thoroughly.

Charles Schwab

Cons

The fees are a minor con as they lower some of those total returns. However, this is a little setback as the current expense ratio is only 0.06% of the assets. However, while the fees are low now, they may be increased in the future if the market environment changes, for example, and there is less competition in the ETFs market. In this case, investors may have to sell their investments and pay significant capital gains tax as they shift to another ETF.

Another disadvantage is the lack of control investors have over their investments. Investors in the ETF cannot decide to sell a stock, and they blindly follow the index. For example, the index doesn’t consider the real estate sector. Therefore, there are no REITs in the ETF. Investors may also feel uncomfortable with some investments the fund makes, and again there is nothing they can do but accept it as a package.

Another minor setback for investors is that the dividend may not be as reliable. So far, the dividend has grown annually, but unlike a company with a dividend policy, the ETF relies entirely on its components. If several components cut the dividend, the income may decrease. In addition, the dividend is paid quarterly, and while it grows over the long term, as the graph below shows, the ride may be a little bumpy. Some investors may prefer higher predictability.

Seeking Alpha

Conclusions

I prefer individual stocks as I created my diversified fund, and managing them is not time-consuming. It allows me to have better flexibility, add to sectors that have suffered more than others, and decide if I want to focus on dividend growth or dividend yield. However, I do believe that, at the moment, investing in this ETF can be an excellent investment for dividend growth investors.

The ETF allows you to have a low-maintenance dividend growth portfolio. It suits investors with different amounts of capital as you can gain exposure to 103 companies with less than $100. During volatile times the psychological effect is even more critical. Therefore, investors should consider adding Schwab U.S. Dividend Equity ETF to their portfolio and some REITs and foreign companies to diversify further.

[ad_2]

Source links Google News