[ad_1]

Main Thesis

The purpose of this article is to evaluate the Schwab Large-Cap Value ETF (SCHV) as an investment option at its current market price. With the major indices struggling of late, investors are likely looking to shift some of their assets to more defensive positions. SCHV helps fit this bill because while the top sectors are not defensive in nature, the fund is made up of companies that trade at below-average valuations, helping to limit potential downside. Furthermore, the more reasonable valuation helps keep the dividend yield high when it might otherwise not be.

While value-focused funds are always on my radar, I continue to find SCHV attractive now for a few more specific reasons. One, dividend growth remains strong, with the Q1 distribution up handsomely year-over-year. Two, while I do not expect the Financials sector to outperform this year, the top holdings within SCHV are Bank of America (BAC) and JPMorgan Chase (JPM). These are two companies whose shares have been performing well, are seeing record profits, and are aggressively hiking their dividends. Three, while the Health Care sector has been underperforming so far in 2019, this is a sector I continue to add to for long-term exposure and view its recent underperformance as a chance to add to positions at fair prices.

Background

First, a little about SCHV. The fund’s stated objective is to “track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Large-Cap Value Total Stock Market Index”. The fund attempts to hold the same proportions of its stocks as its weightings in the index and is managed by Schwab. SCHV is currently trading at $54.60/share and yields 2.83% annually, based on the last four distributions. I continued to recommend SCHV at the start of the year when I reviewed the fund in January. Since then, SCHV has performed well, generating a total return around 9%.

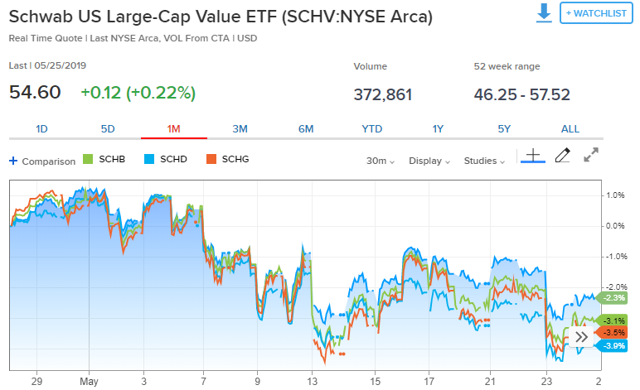

While this return is pretty good, SCHV has not been immune to the recent market pullback. In fact, the fund is down this past month by over 2%. However, this drop actually outperforms Schwab’s broad market, dividend, and growth funds, as measured by the Schwab’s U.S. Broad Market ETF (SCHB), Schwab U.S. Large-Cap Growth ETF (SCHG), and the Schwab U.S. Dividend Equity ETF (SCHD), whose returns are illustrated below:

Source: CNBC

With this in mind, I felt now was an opportune time to reassess SCHV to see if it makes sense to continue to add to positions at these levels. In the following paragraphs, I will explain some positive attributes that I believe justify adding exposure at these levels.

Dividend Growth Continues

When I reviewed SCHV in January, I noted how the fund had experienced strong dividend growth in 2018, and I saw that as a positive catalyst going forward. Fortunately, this trend has continued in Q1 this year, with SCHV experiencing similar dividend growth, as illustrated below:

| 2017 Distributions | 2018 Distributions | YOY Growth |

| $1.30/share | $1.50/share | 15.8% |

| Q1 2018 Distribution | Q1 2019 Distribution | YOY Growth |

| $.3316/share | $.3833 | 15.6% |

Source: Charles Schwab (with calculations made by Author)

As you can see, the dividend has been growing at a double digit pace consistently in the short term. Given that 2019 has seen more of the same, this metric encourages me to hold the fund going forward. While the yield is not “high”, this growth will help keep it higher than the broader market’s yield, even if the share price increases. Furthermore, with interest rates unlikely to move higher from here for the remainder of the year, a 3% yield remains attractive for equity investors. Therefore, the dividend story for SCHV appears quite positive, in my mind.

Top Financial Stocks Performing Well

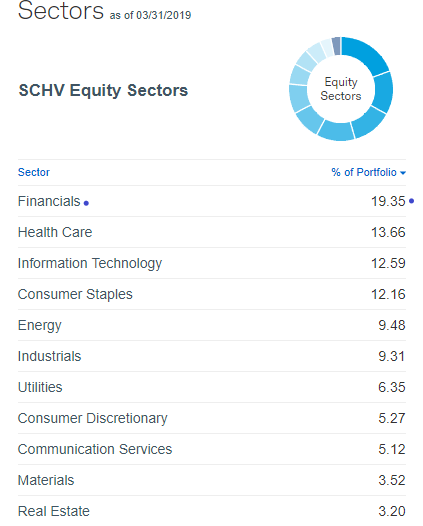

A second point regarding SCHV concerns the Financials sector. This sector makes up over 19% of the total assets in the fund and is actually the largest sector by weighting, as illustrated below:

Source: Charles Schwab

While this allocation is actually down from just over 20% in January, the performance of this sector clearly will have an out-sized impact on SCHV as a whole.

I will start by saying I recently noted I was neutral on the Financials sector for the rest of the 2019, after being bullish on it for quite some time. With interest rate hikes on hold and mortgage activity subdued, I don’t see the sector as a whole outperforming the market in the near term. However, I do believe there is value to be had within the sector and expect the below-average valuations to help buffer against too large of a downside move.

With that in mind, while I am not overly optimistic on Financials overall, I do believe there is selective value within the space, especially among the largest U.S. banks, which have seen strong performance over the past few years especially. SCHV has benefited from this, and two of the five top holdings within the fund are BAC and JPM, two banks that have handily beaten the broader Financial sector index over the last few years. In fact, over a 5-year time period, the outperformance is quite substantial compared against the Financial Select Sector SPDR ETF (XLF), illustrated in the graphs below:

Source: Google Finance

My point here is that even though I would not recommend going all-in on Financials right now, I would certainly recommend the best-in-class banks, of which I would include the BACs and JPMs of the world.

Aside from the past history of the share price gains, both BAC and JPM started 2019 off with solid earnings results for Q1. To illustrate, I have compiled some key metrics from their quarterly filings, listed in the chart below:

| Company | Revenue (millions) | YOY Gain | Net Income (millions) | YOY Gain | Recent Dividend Increase |

| JPM | $29,123 | 4.4% | $9,179 | 5.4% | 43% |

| BAC | $23,004 | Flat | $7,311 | 5.7% | 25% |

Source: Seeking Alpha Financial Disclosures

As you can see, the results are pretty good, especially considering 2018 earnings were quite strong as well. On the backdrop of corporate tax reform, large banks had a very good year (in terms of earnings), so to see continued growth really speaks to how well the companies are navigating our current economic environment. What is also striking is that both banks have seen their net income figures rise quicker than revenue, which means they are squeezing out more profit per dollar of revenue, which is a metric most investors should find comforting. Therefore, my takeaway here is that having these two companies as top holdings in SCHV’s portfolio is a win for investors.

Health Care Gains Have Slowed – That Is A Buy Signal

My final point on why I continue to favor SCHV has to do with its second largest sector by weighting – Health Care. As my readers are aware, this is a sector I have been recommending for quite some time, as I see both short-term and, especially, long-term potential for this corner of the market. This play was quite profitable in 2018, as it ended last year as one of the best performing sectors, and it handled the Q4 market volatility much better than the broader market.

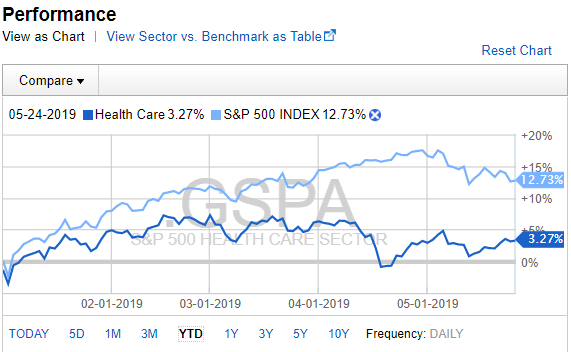

On this backdrop, the gains so far this year have been less impressive, with the Health Care sector vastly underperforming the S&P 500, as the graph below illustrates:

Source: Fidelity

Source: Fidelity

Clearly, the sector has lagged so far in 2019, but I believe this is a short-term setback, given how strongly the sector performed last year. Those results were bound to even out to some degree, and other sectors are catching up for now. However, I continue to see Health Care as a generational play, and I view this current weakness as temporary, and an opportunity to add to positions.

My primary reason for this belief is that health care spending in the United States continues to rise, and it is already at very high levels. In fact, according to a study done by the John Hopkins Bloomberg School of Public Health, the United States has the highest amount of health care spending among all developed countries. While this statistic has been the case for some time and is widely known, what is perhaps more striking is that this spending gap is accelerating. The study found that health care spending in the United States has been growing at a rate of 2.8% annually, which is higher than the developed country average of an annual 2.6% increase. Similarly, spending on pharmaceuticals also increased more quickly in the United States, at a rate more than three times faster.

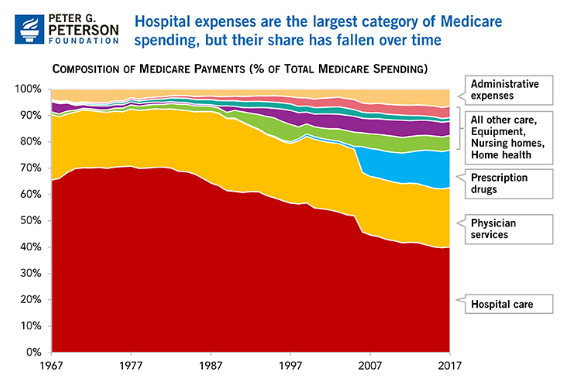

So what does this mean for SCHV? Well, it means that health care spending continues to make up a larger percentage of overall spending in the United States, and that could directly help some of the top companies in SCHV’s underlying portfolio. Medicare continues to be one of the government’s top expense categories, and that will only continue to get bigger as costs rise and our population ages. Furthermore, the share of spending on prescription drugs has been growing at a much faster rate, compared to other categories, such as hospital care, medical equipment, or home health. In fact, according to a report by the Peter G. Peterson Foundation, based on data from the Centers of Medicare and Medicaid Services, government spending on prescription drugs has taken off since 2006, and is eating a much larger share of the overall Medicare budget, as illustrated in the graph below:

Source: Peter G. Peterson Foundation

Source: Peter G. Peterson Foundation

My point here is that not only is health care spending on the rise, but the specific areas where the spending is increasing is good for some of SCHV’s top holdings. Specifically, Johnson & Johnson (JNJ) and Pfizer Inc. (PFE) are both in SCHV’s top ten holdings, and collectively make up over 5% of the fund. These are two leading companies in the pharmaceutical space, and they will directly benefit from the increase in spending I noted above. Therefore, their inclusion should provide long-term benefits for the shareholders of SCHV.

Bottom-line

SCHV is one of my core, long-term holdings, and I see no reason for that to change. In fact, due to the recent market volatility, I am adding to this fund at the expense of some of my individual and cyclical holdings. While the fund is up nicely since the year began, I continue to see reasons to buy. As a value-oriented fund, its P/E ratio just over 16 is markedly cheaper than the current P/E of just under 21 for the S&P 500. Furthermore, the fund’s dividend growth continues to impress, and its income stream of almost 3% remains attractive in our low rate environment. Finally, the Health Care sector has been struggling lately, but that provides investors with a buying opportunity, in my view. Given that SCHV is heavily exposed to that space, now seems like a perfect time to pick up some shares. Therefore, I remain long SCHV and continue to recommend positions at this time.

Disclosure: I am/we are long SCHV, SCHD, JPM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News