[ad_1]

Remains/iStock Editorial via Getty Images

As most all of you know, the recent rediscovery of “value” has led to a relatively swift and deep decline in the large technology companies that dominate the large-cap sector. As a result, the Schwab U.S. Large-Cap ETF (NYSEARCA:SCHX) is down ~9% YTD. However, note that is only ~1% worse than the S&P500, which speaks to how these large-cap tech companies dominate the major indexes of the broad market. Meantime, note the tech heavy Nasdaq-100 (QQQ) is down 14% YTD.

However, I think the current rotation out of large-cap tech stocks is an opportunity for investors who are looking for more exposure into the tech sector and to begin scaling into a well-diversified and low-cost fund. Today I will take a look at Schwab SCHX ETF, which is still dominated by tech stocks but also has significant diversification into the health-care, consumer discretionary, and financials sectors.

Investment Thesis

We all know why the large-cap tech sector benefited from the global pandemic and the resulting transition to work-from-anywhere: remote access via mobility. This led to massive spending on everything from PCs and development/application/cybersecurity software, to networking, cloud-based computing, and many niches in between. Recently there has been a rather broad-based sell-off in the sector, as though these trends will not remain vitally important going forward.

Newsflash: they will. Perhaps not at the growth-rate seen in 2020-2021, but, barring a global economic recession (which is certainly possible given Putin’s war-of-choice in Ukraine), many of these large companies will continue to thrive for many years to come. After all, most have strong global brands, the size & scale to compete very effectively, and are cash-rich and don’t need to borrow money at any interest rate. Not to mention that – as you can see by the graphic below – even if the 10-year U.S. Treasury yield was to rise to 3.5%, that is still a very low rate on an historical basis.

CNBC

Indeed, many of the companies in the SCHX ETF thrived during the 1990-2010 period when rates were significantly higher than they are today.

While weakness in the sector may continue for awhile longer, investors who want additional exposure should consider scaling into a well-diversified low-cost (0.03%) ETF like SCHX. I say that because the long-term secular growth trends in multiple tech sub-sector like high-speed networking, 5G smartphones & infrastructure, IoT (Internet of Things), and cloud-computing are still firmly intact in my opinion. Meantime, the SCHX is also a diversified ETF with significant allocations of capital outside the tech sector.

So let’s take a closer look at the SCHX ETF to see how it has positioned investors to benefit going forward.

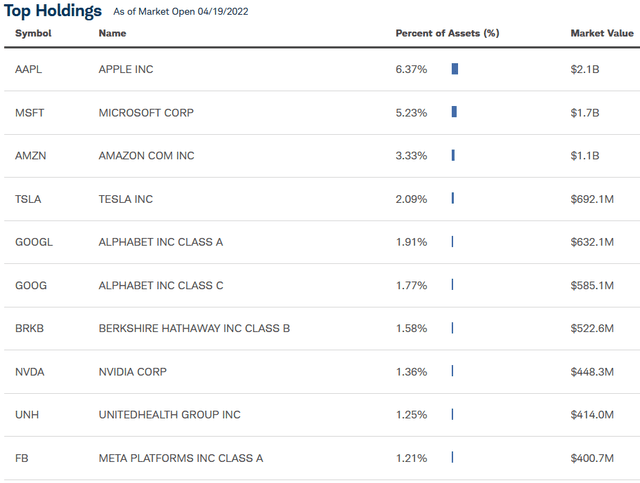

Top-10 Holdings

The top-10 holdings in the Schwab U.S. Large-Cap ETF are shown below and equate to what I consider to be a relatively well-diversified 26.1% of the entire 760 company portfolio.

Schwab

It should come as no surprise that Apple Inc. (AAPL), with a market cap of $2.7 trillion, is the #1 holding with a 6.4% weight. Apple is down 8.7% YTD despite a strong rally in March that saw it run from ~$150 to $180 in a matter of weeks. Apple continues to benefit from a strong 5G upgrade cycle and its high-margin services business, and note that Macs grew 25% in the December quarter. Apple ended the year with a whopping net-cash position of $80 billion and appears poised to generate ~$100 billion in free-cash-flow on an annual basis. That being the case, I fail to see how Apple will be negatively affected by even a rise to a 3.5% rate on the U.S. 10-year Treasury.

The #2 holding with a 5.2% weight is Microsoft (MSFT). In early January, Microsoft released a strong Q2 FY22 EPS report:

- Revenue of $51.7 billion was +20% YOY.

- Operating income was $22.2 billion (+24% YOY).

- Net income of $18.8 billion (+21% YOY) was $2.48 per diluted share.

- Microsoft Cloud (Azure) revenue was $22.1 billion, up 32% YOY.

Softie ended 2021 with $125.4 billion in cash after returning $10.9 billion to shareholders in the form of share repurchases and dividends during the quarter. That return of capital was up 9% as compared to the Q2 FY21.

If we count both classes of Google (GOOG) (GOOGL) stock, it is the #3 holding in the ETF with a 3.7% weight. Google is, and has been, my favorite big-tech stock for quite some time; it is a free-cash-flow generating machine of epic proportions. Some highlights from its latest Q4 EPS report:

- Revenue of $75.3 billion was up 32% YOY.

- Operating margin was 29%.

- Diluted EPS was $30.69/share.

- Free-cash-flow was $18.55 billion (that’s correct, in one quarter alone)

- Google Cloud (“GCP”) revenue of $5.5 billion was up 45% YOY.

- Google ended calendar year 2021 with $139.6 billion in cash.

Google, along with Amazon (AMZN) – the #4 holding with a 3.3% weight – have both announced 20:1 stock splits. As I explained in a previous article on Seeking Alpha, stocks that split tend to outperform the market on a go-forward basis (see Stock Splits A Tailwind For Large-Cap Growth ETF (SCHG)). Note that Tesla (TSLA), the #5 holding with a 2.1% weight, has also announced its intention to split the stock once again (likely 5:1).

But, of course, there are large-cap stocks outside of the tech sector. Conglomerate Berkshire Hathaway (BRK.B) (BRK.A) – with significant interest in rail, insurance, and utilities, among others – is the #7 holding with a 1.6% allocation. That said, note that Apple is currently the largest holding within the Berkshire Hathaway portfolio. That effectively increases Apple’s allocation within the SCHX portfolio.

Another non-tech company is diversified healthcare provider UnitedHeath Group (UNH), the #9 holding with a 1.3% weight. UNH is up 7% YTD and 38% over the past year.

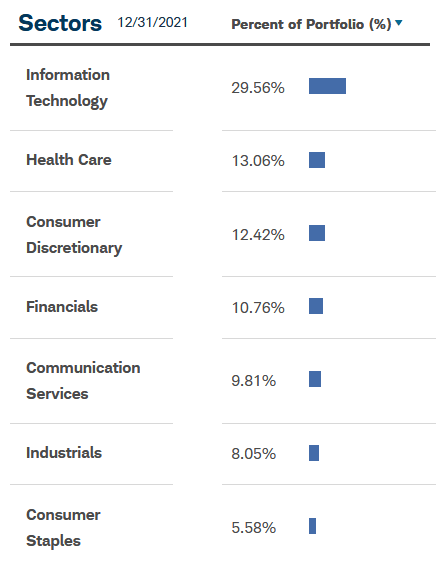

The SCHX ETF’s overall sector allocation is shown below.

Schwab

The IT sector is ~30% of the portfolio, while ~25% of the portfolio is relatively equally split between Heath Care and Consumer Discretionary. Financials, typically a good place to be during rising interest rate cycles, is 10.8% of the portfolio. Unfortunately, two sectors that have been on fire of late (Materials & Energy), in aggregate only equate to ~5% of the total portfolio.

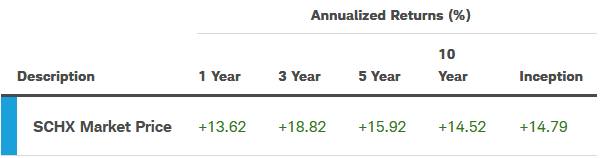

Performance

The SCHX ETF has a solid long-term performance track record.

Schwab

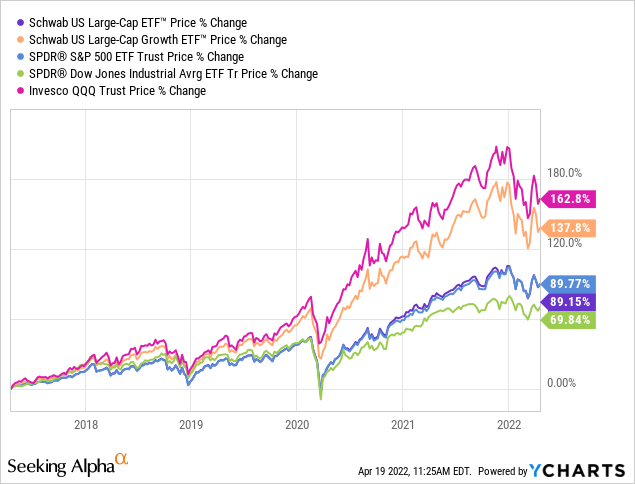

The following graphic compares the five-year price returns of the SCHX ETF with its sister fund, Schwab U.S. Large-Cap Growth ETF (SCHG), as well as the broad market averages (S&P500, DJIA, and Nasdaq-100) as represented by the (SPY), (DIA), and (QQQ) ETFs, respectively.

Despite the market’s recent pull-back in technology stocks, note the triple Q’s still lead the chosen group, with the Schwab Large-Cap Growth ETF coming in second, both of which led the rest of the pack by a significant margin.

Risks

All the normal risks apply given the current macro environment: global pandemic related shut-downs and supply-chain disruptions, high inflation, rising interest rates, and massive geopolitical uncertainty as a result of Putin’s horrific invasion of Ukraine and the resulting economic sanctions placed on Russia by the United States and the other free-democratic nations of NATO. Any of these factors have the potential of causing a serious global economic recession (or worse) that would put significant pressure on the market.

That being the case, I have been advising investors to take advantage of market volatility and to scale into any new investments over time.

Despite the recent pull-back in the market, the SCHX ETF still trades at a relatively rich valuation level (P/E=25x, price-to-book 4.6x).

On the flip-side, and as I pointed out above, many of the companies in the top-10 list of holdings have cash hoards that would protect them against down-cycles.

Summary & Conclusions

While the idea of increasing exposure to large-cap stocks (and tech particularly) is appealing to me at the present time, the SCHX ETF isn’t the best way to participate in that thesis (I rate it a HOLD). I prefer the SCHG ETF. Or, for those investors who prefer individual stocks, and who don’t like investing in a portfolio of 760 companies (like SCHX does), I suggest cobbling together a concentrated list of only the “best-of-the-best” companies – similar to what I did back in 2019 with the “A-List Technology Portfolio.” That 4-stock portfolio, which includes Apple, Amazon, Alphabet, and Broadcom (AVGO), has been the primary reason I have outperformed the market over the past few years.

Yet for those that are more comfortable with a more broadly diverse ETF, I’ll pass on SCHX and suggest investors consider the SCHG ETF instead. Its slightly higher expense fee (0.04%) is still relatively cheap and well worth the better performance it delivers.

[ad_2]

Source links Google News