[ad_1]

Sezeryadigar/E+ via Getty Images

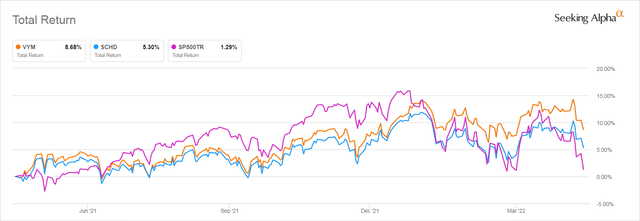

It’s been a little over a year since I wrote about the Vanguard High Dividend Yield ETF (NYSEARCA:VYM) and concluded that income investors would do far better investing in the Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD). As it turns out, after many years of under-performing SCHD and the S&P 500, VYM managed to outperform both this past year.

VYM’s 1 Yr Total Return Compared to that of SCHD and The S&P 500

Seeking Alpha

I can take comfort that I am not alone among investment writers in making investment forecasts that don’t turn out to be true. I do, however, take responsibility for my bad calls and try to figure out why they turned out to be bad calls.

So let’s take another look at VYM and SCHD to see if we can find any clues as to why VYM is currently outperforming and whether that outperformance is likely to continue.

SCHD’s Has Sustained Its Longer Term Performance for A Good Five Years

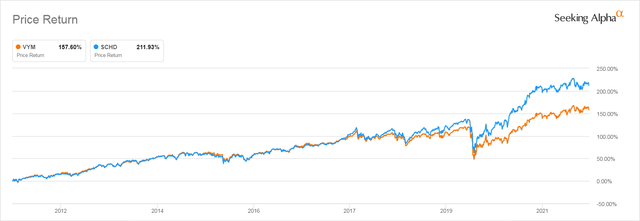

Below you can see a chart comparing the price performance of VYM and SCHD since 10/18/2011 which is the week when SCHD started to trade. I look at their price history first because that tells investors who spend their dividends how safe their investment has been. If an ETF’s share price declines and the dividend for some reason is no longer compelling, the investor who bought it at a higher price ends up with less money with which to buy a replacement dividend.

VYM and SCHD Price Return Since SCHD’s Inception 10/18/2011

Seeking Alpha

As you can see, their price performance was very similar until the end of September, 2017, when it began to diverge sharply. Over the longer time frame, even with this year’s outperformance, VYM’s price return has been inferior to that of SCHD, though it has been positive. Buyers of VYM could have made more, but they still did okay.

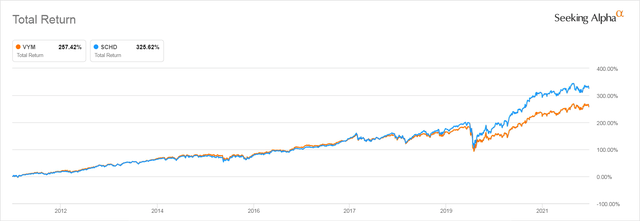

If we look at Total Return, which includes the dividends these ETFs paid, does VYM, which calls itself a “High Dividend” ETF, unlike SCHD, look like a better investment?

Obviously not.

VYM and SCHD Total Return Since SCHD’s Inception 10/18/2011

Seeking Alpha

As with its price return, starting in October of 2017 SCHD’s total return increased dramatically while VYM, which began lagging in 2017 had a much harder time recovering from the 2020 COVID-19 swoon.

Now let’s look at what makes these ETFs tick and, naturally, what might explain the sharp divergence in their performance over the past five years.

VYM and SCHD’s Indexes Use Very Different Methodologies to Pick Their Dividend Stocks

Both of these ETFs are passive ETFs that track indexes. Though as is more and more the case with ETFs nowadays, they use custom indexes that use different techniques to do clumsy stock picking in the hopes of getting an advantage over competitors.

VYM’s Methodology is Something of a Mystery

When I wrote about it a year ago, I felt VYM was a poor choice for income investors due to its misleading name. Its dividend was anything but high as many of its holdings had dividends under 1%. This seemed to be a side effect of what must be a clumsy method its index uses to select stocks.

However, I was unable to find the specific document that spells out the methodology used to construct VYM’s index. All Vanguard tells us about the strategy its $57.4 Billion ETF follows is that it:

Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields.

The FTSE High Dividend Yield Index doesn’t come up on a search of the FTSE Russell Index website. It refers searchers to the FTSE All World High Dividend Index, so I assume VYM’s index is the US subset of this index. As described in an article I wrote a VYM: The Dividend Paying Total Stock Market ETF, the methodology used to pick VYM’s stocks appears to be this:

Take all the stocks in a broad market index, eliminate REITs, eliminate those paying dividends under 1% and then, relying on analysts’ estimates, line up all these dividend-paying stocks by their forecasted future dividends and eliminate some bottom fraction of them for some reason. The actual fraction is not discussed. But whatever it is, VYM has ended up holding 445 stocks.

VYM is Market Cap Weighted, Undoing Any True Benefit of Broad Market Diversification

They are held in market cap weights. As is the case with almost all market cap weighted indexes right now, the top 10 stocks make up a big proportion of its total value: 22.30% as of March 31, 2022.

Its top 100 stocks make up a whopping 80.66% of its total value. A full 283 other, smaller stocks in VYM each contribute only one tenth of a percent or less of the total value of the ETF. Of those 283 smaller stocks, 83 stocks make up less than one hundredth of a percent of VYM’s total value. So though VYM appears highly diversified as investors own shares of 445 different stocks, most of those stocks are held in amounts so tiny as to make no difference to the entire ETF’s performance.

Only if you were to see a massive rise or, more likely, a massive decline in the share prices of small and medium cap stocks occurring all at the same time, would it have an effect on the price of VYM. That did seem to happen in March of 2022 and could, of course, happen in another crash.

VYM’s Actual Holdings Look Like a Total Stock Market Fund Stripped of Its Growth Stocks

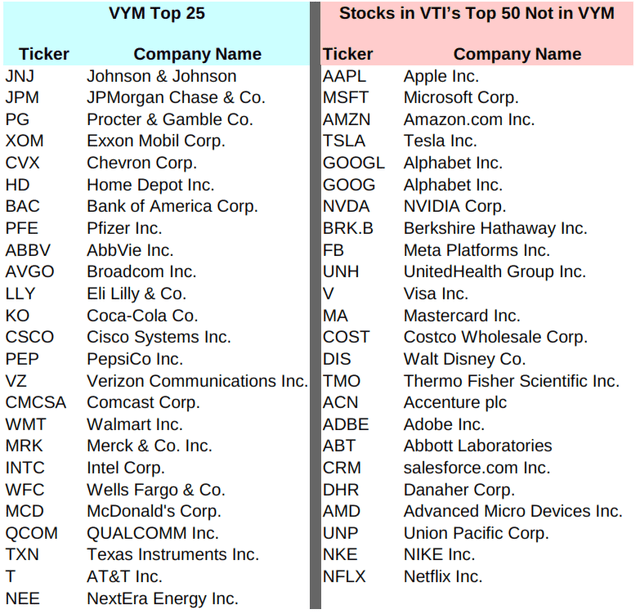

Last year, when I compared the top 25 stocks in VYM, which was at the end of February, at the time made up 45% of its total value with the top 25 holdings of the Vanguard Total Stock Market ETF (VTI) it became clear that whatever its methodology, in practice, VYM was a total Stock Market ETF without its growth stocks.

The picture remains the same today. VYM’s holdings are almost identical to those of the Vanguard Total Stock Market ETF with its growth stocks removed.

Below I have listed the Top 25 Stocks ranked by weight in VYM, every single one of which is found in the top 50 holdings of VTI. Beside them you will see listed the 24 stocks in VTI’s top 50 holdings that are not found in VYM. As you can see, almost half of VTI’s top 50 are missing from VYM. Most of them, with the exception of a few stocks like Berkshire Hathaway (BRK.B) and Disney (DIS), which don’t pay dividends, would be considered growth stocks.

Top 25 Stocks in VYM With VTI Stocks Omitted of 3/31/2022

advisors.vanguard.com

SCHD’s Index Is Explained In Far More Detail

The specific index SCHD follows is a custom index it alone uses, the Dow Jones Dividend 100 Index. I went into great detail as to how the Schwab U.S. Dividend Equity ETF’s index chooses stocks in a recent article, Is SCHD Still A Good Choice for Dividend Investors. I will briefly summarize what I found after carefully reading its methodology document.

SCHD Demands a Consistent Dividend Paying History But Is Not A Pure Dividend Growth ETF

SCHD’s methodology document explains that it picks the stocks for SCHD starting with a broad market index. Like VYM, it excludes REITs. Then it looks for stocks that have a history of a “Minimum 10 consecutive years of dividend payments.” Note, this does not say “growing dividend payments.” SCHD is not a pure dividend growth ETF.

SCHD’s index does consider dividend growth history, but dividend growth is only one of four other factors that are each ranked separately, before the rankings are added together and the top ranking 100 stocks selected for SCHD.

And SCHD’s index does not require that a stock have raised its dividend every year. It only requires that the stock’s dividend has grown over the previous five years. It will forgive a year or two of dividend stagnation if the average dividend growth over several of the last five years has been high. As a result SCHD does hold some stocks that have frozen or even cut their dividend at some time during the past five years but seen these dividends recover.

SCHD also applies a screen for expected forward yield, as does VYM, though SCHD’s index’s methodology document gives no detail on how this works. But then, we don’t have information about how VYM’s forecasted yield screen works either.

SCHD’s Index Applies Simplistic Value Screens

SCHD has a reputation for screening for quality. However, close reading of its index’s methodology document reveals that it only applies the two following crude screens for value: Free cash flow to total debt and Return on Equity. The first metric gives us a vague sense as to how well the company can cover their dividend, the second as to how well the companies behind its stocks produce income.

No Price-Related Screens Are Applied

Neither of these screens address the issue of how reasonably SCHD’s stock holdings might be priced. There is no consideration of Price/Earnings ratio, Price/Sales ratio, or price to anything else ratios. Most importantly, SCHD’s index does not apply any screening for the rate at which a stock is growing its earnings. It takes into account neither a stock’s historical earnings growth or forecasted future growth. As a result, when we look at SCHD’s holdings, we see quite a few stocks that are growing their earnings very slowly or, as in the case of IBM (IBM) not at all.

SCHD Holds Stocks in Market Cap Weight Ignoring the Complicated Ranking System It Uses to Select Stocks

Though SCHD’s index ranks stocks separately on the four factors cited above, then adds up the four rankings and only takes the stocks whose total ranking falls in the top 100, those quality rankings have no impact on how much of a given stock SCHD owns.

More importantly, if a stock’s ranking drops below the top 100 at the annual reconstitution, it can stay in SCHD. It only drops out and gets replaced by a better stock if its total ranking on the index’s screens places it below the 200th ranked stock. So poorer quality stocks that once were better quality can persist in SCHD for quite a while, which is why IBM still remains its fifth largest holding.

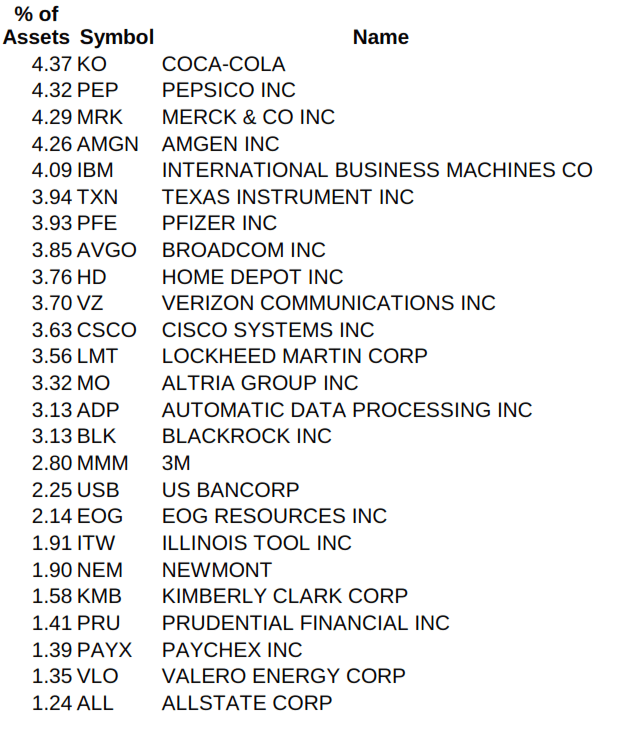

SCHD’s Current Holdings

Below is the list of the top 25 stocks in SCHD ranked by weight. The Top 25 stocks ranked by weight in SCHD make up a full 75.25% of its total value. Twenty-one of its stocks with smaller market caps each only make up less than one tenth of one percent of the ETF’s total value. Nevertheless, as SCHD holds far fewer stocks than VYM’s 445, the smallest holding in SCHD still makes up 0.02% of the value of the whole, which is larger than the weight of the smallest holdings of VYM.

Top 25 Holdings in SCHD Ranked by Weight – As Of 4/26/2022

Schwab Asset Management

This list looks quite different from the top 25 stocks in VYM which we saw listed above. This intrigued me and I did some further comparisons to see what might explain it.

What is the Overlap Between These Two ETFs?

All the stocks in SCHD are held in VYM. However, their relative rankings in the two ETFs are a different because SCHD requires that 10-year history of consistent dividend payment, dividend growth over the five years, and does that rudimentary value screening which VYM does not. This excludes quite a few dividend paying stocks that make it into VYM.

To better understand the overlap between the holdings of the two ETFs, I checked the top 25 stocks in SCHD, which together make up 75% of the ETF’s value against the top 80 stocks in VYM, which make up 75% of its value. The following five stocks in SCHD’s Top 25 listed were not found in VYM’s Top 80: Kimberly-Clark (KMB), Prudential (PRU), Paychex (PAYX), Valero (VLO) and Allstate (ALL).

This does suggest to me that SCHD’s index methodology has been superior for the decade during which it has been trading, as it does give more weight to companies with more consistent dividends, some dividend growth, cash flow to support ongoing dividends, all of which do point to better quality for long-term investors.

A Closer Look at VYM and SCHD’s Dividends

Though you’d expect a High Dividend ETF (VYM) to be paying a higher dividend than a mere US Dividend Equity ETF (SCHD), you’d be wrong.

Many of VYM’s “High Dividend” Stocks’ Yields are Barely Over 1%

The Top 100 stocks in VYM ranked by weight make up 80.66% of the ETF’s total value. When I sorted those hundred stocks based on their dividend yields, those with the smallest yields were yielding just over 1%. Sixteen of the Top 100 stocks ranked by weight had dividend yields less than 2%. Only 13 of the Top 100 had dividend yields higher than 4%.

That would explain why Vanguard tells us that the trailing 12-month dividend yield of VYM as of March 31, 2022 was only 2.75%. That’s a respectable yield, but a lot more like the median yield of dividend paying stocks than a high yield. VYM’s SEC yield as of March 31, 2022, the latest date for which Vanguard provides any information was even lower at 2.66%.

SCHD’s Holdings’ Dividend Yields Are Higher

Only three stocks in SCHD yield less than 2% and those are all yielding more than 1.82%. A full quarter of the stocks in SCHD, yield more than 4%. SCHD’s distribution Yield (TTM) as of 03/31/2022 is 2.87%. Its SEC Yield as of 04/22/2022 was 3.11%. (Note however that Vanguard gives us a SEC yield dated back three weeks and a lot has happened to dividend stocks during those three weeks.)

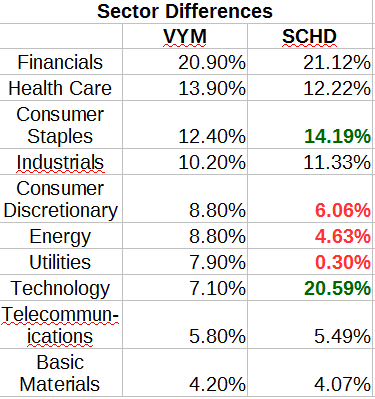

Sector Allocation Differences Help Explain Recent Performance Differences

How do the sector holdings differ between SCHD and VYM? The table below compared the data that Vanguard and Schwab Asset Management give us about the sector weightings in their ETFs. The table makes it clear that they differ a lot. Probably because of the screens that SCHD applies ends up creating a sector tilt that eliminates what have been in the recent years poorly performing sectors.

I have highlighted the sectors where SCHD’s sector allocation is significantly different from VYM’s. Those in red are lower. Those in green, higher.

Sector Allocations

Vanguard, Schwab Asset Management

As you can see, SCHD has far more invested in dividend-paying Technology sector stocks than VYM. That alone should be enough to explain why after years of outperforming VYM it has lagged this year as Technology stocks after years of superb performance have been seeing their inflated prices collapsing.

VYM also allocates almost twice as much of its value to Energy sector stocks than does SCHD. This is easily explained given the lackluster performance of so many Energy stocks over the past five years. Now that oil prices are skyrocketing, the recovery in oil stocks has been boosting VYM’s price.

It is also significant that VYM holds far more Utilities than does SCHD. Utilities are a sector that has recently surged as investors seek “safer” investments in a rising rate environment because regulated Utilities are able to raise their rates when their costs rise.

SCHD also carries a bit more of its weight in Consumer Staples and less in the Consumer Discretionary sector. Readers familiar with my previous rants about the arbitrary and often senseless way that the two Consumer Sectors are defined by GICS won’t be surprised to find that I don’t consider this difference to be material. If you add up the percentages allocated to both Consumer sectors for each ETF, the total allocation to Consumer stocks in each is almost identical.

Valuations Matter But Valuation Data Is Scanty for Both ETFs

Below I compare the very few valuation metrics Vanguard and Schwab Asset Management provide for VYM and SCHD. As is always the case with ETFs, each company provides different metrics and it isn’t clear how they arrive at them.

| Metric | VYM | SCHD |

| P/E Ratio | 15.4 | 15.74 |

| Average 5 yr Earnings Growth Rate | 10.90% | Not Given |

| Price to Cash Flow | Not Given | 11.45 |

| Return On Equity (ROE) | 15.20% | 35.19% |

| Price/Book Ratio | 2.6 | 3.44 |

| Turnover Rate | 7.7% | 14.51% |

Source: Vanguard and Schwab Asset Management

The more than double Return on Equity of SCHD’s holdings stands out here, a very positive metric. It is balanced, to some extent, by SCHD’s higher Price/Book. However, Price/Book has become a less useful metric in modern business than it was in the mid-20th century. The 5-year earnings growth rate for VYM looks decent, except that it is averaging in the huge growth numbers that a lot of stocks achieved in 2021 as they recovered from 2020’s lock downs. You’d really like to see that growth rate with the outlier removed to know how useful it is.

The difference in turnover rate is, however, significant. SCHD does add and subtract stocks while VYM, more like a Total Stock Market index, does so less frequently, not mildly chasing recent performance the way SCHD does.

Seeking Alpha’s Quant Scores Slightly Favor SCHD

Seeking Alpha’s Quant Scores for both ETFs are very good, but slightly better for SCHD. The Quant system ranks SCHD at 25 in its Large Cap asset class of 470 ETFs. That’s considerably better than the ranking it gives VYM, which is 53.

But unlike the ratings for individual stocks which are rich in detail about the stocks’ financials, the Quant Scores provided for ETFs don’t examine the financials of the ETFs’ holdings, so the score is based on some pretty weak parameters: Momentum, Expenses, Dividends, Risk not measured by any valuation metrics and Flows. I find these less than useful.

The Quant ratings do show that SCHD is experiencing stronger asset flows than VYM, though overall VYM has more assets under management, $39.89 Billion compared to SCHD’s $33.88 Billion.

The major difference between these two ETFS that isn’t captured by any of these metrics is that VYM holds a lot of very tiny positions in hundreds of very small stocks. Smaller stocks have historically been far more vulnerable to market downturns. We can see that when we look at the chart above showing how SCHD, with its mostly large cap holdings performed in March 2020 vs. VYM.

Looking Towards the Future Does Either Stand Out?

That summarizes what we know right now about these two ETFs. They have both been decent investments over their relatively short lives, though SCHD has been more profitable over the past five years. But that’s the past. How should investors be thinking about the factors affecting their future performance?

Higher Fixed Income Rates Will Challenge Both ETFs

A year ago, when the longer Treasury notes were paying less than 1.75% and 5-year CDs were paying near 1%, the yields on both of these ETFs looked pretty good. They were, after all keeping up with inflation, which despite the Fed’s best efforts was still being reported as being below 2% a year.

What a difference a year makes! Last week, briefly, it was possible to buy a 5-year Treasury Note paying 3.0%. Today I bought a noncallable 3-year CD paying 3.00% as insurance in case the Fed plays Chicken with rates again when the market drops and stops raising them.

But if the Fed does what it has been loudly signaling it is going to do and does raise the Federal fund rate to 2.75% by the end of this year, we should be seeing lots of 3% and 4% Treasury and CD yields coming up. Possibly 5%. The latter fixed income rates will make the yields of these dividend ETFs far less attractive to investors seeking income.

Nor is the promise of dividend growth likely to save you. VYM doesn’t pay attention to dividend growth. As you can see from the chart below, its yield has very rarely exceeded 3%.

VYM’s 10 Year Dividend Yield History

Seeking Alpha

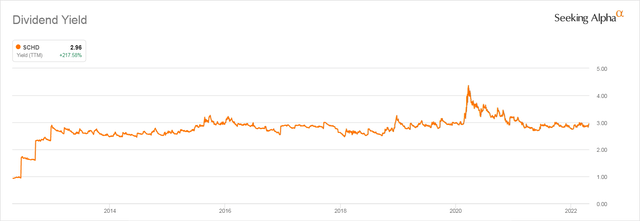

Even though SCHD screens for growing dividends, the history of its actual dividend yield shows that its dividend has not shown any hint of growing consistently.

SCHD’s 10 Year Dividend Yield History

Seeking Alpha

It should become immediately obvious to you that the only time that the dividend yield goes up for either of these ETFs is when their price tanks. If investors have the choice of a nice safe fixed income 4% or 5% the prices of these ETFs will have to decline to push up their yields up to that level so that they remain competitive.

Over time, in past inflationary eras, stocks have eventually seen their share prices rise to counter inflation, but there is a lag between the onset of inflation and the rise of stock earnings that can last for years. So investors buying into these ETFs now should expect, that if inflation continues to be significant, they will have to settle in for a long and patient wait before the share prices of either of these two ETFs resume rising.

Will the Taxation Difference Between Stocks and Fixed Income Be Enough to Keep Dividend ETFs Attractive?

There is a tax advantage when yield comes in the form of a stock dividend rather than CD or bond interest. But that advantage doesn’t apply to investors investing in tax advantaged accounts like IRAs. It also doesn’t matter to retirees whose taxable income is relatively low and whose Standard Deduction is greater than the dividends they receive.

But even if you are in a medium tax bracket, a 5% taxable CD yield will net out to more take home cash than will a dividend of 2.75% or even 3%. For residents of states with high state income taxes, the exemption of Treasuries from state tax also gives them a favorable tax profile. And most importantly, when you are getting your income from a CD or Treasury you sleep like a baby, no matter what some psychopath’s latest act of megalomania does to the price of stocks.

If the current much higher rate of inflation persists, dividend stocks are not where you want to be. You would do better being invested in some kind of rolling, short-term fixed income position, like a money market fund or a short-term Treasury ladder. That’s what we old folks did way back in the early 1980s when interest rates were looking like they would soon hit 20%. My early 1980s money market fund kept up with inflation just fine back then. Even back in 2018 the last time the Fed attempted to raise rates, my money market fund was paying a competitive yield.

Bottom Line: VYM and SCHD Have Had A Decent Run but We May Soon Find Out If Dividend Investing In Retrospect Was a Fad

Both VYM and SCHD have only traded during a period of rate suppression. This is not coincidental. ETF providers invented dividend ETFs when they saw dividend investing take off when the Feds made it impossible for retirees to get safer income from the CDs and bonds retirees had traditionally relied on.

Over the years of rate suppression, investors in both these ETFs have gotten used to seeing their share prices rise. In the case of SCHD, almost as much as did the broad market indexes.

You may believe this will continue, especially if you believe that the Fed will continue to keep rates near zero. Many readers do. But there is a nonzero chance that rates will, at a minimum, revert to what was considered a reasonable, and actually pretty low, level up until the Financial Crisis of 2008 when buyers expected to get mortgage rates near 6% and retirees could find safe fixed income paying 5-7% yields.

If Rates Do Revert, The Dividend ETF You Want to Own is One Holding Stocks More Likely to See Price Appreciation

Since the dividends alone are no longer going to attract hordes of new investors to either VYM or SCHD, you have to consider which ETF is most likely to see the prices of its holdings rise over time.

VYM has the advantage of being closer to a broad market index fund minus the growth stocks. Investors are getting burnt by the growth stocks they have adored until now, perhaps badly enough that growth stocks will be out of favor for a decade or more.

Another possible advantage for VYM is that it holds many more stocks than SCHD and doesn’t change its holdings as much as SCHD. Nor does VYM pay attention to a stocks past history. So some of VYM’s currently unfashionable holdings might become more popular in future years, as have the neglected Energy and Utility stocks that have driven VYM’s recent outperformance this year.

On the other hand, the overall higher quality of SCHD’s holdings, as reflected in its overall Return on Equity and its use of cash flow metrics in selecting stocks, might make it a better investment for the long-term as it has been over this past decade. And don’t forget that as we have seen this past decade, too, SCHD’s higher portfolio turnover rate works in its favor when the economy picks up.

So a case could be made for either ETF, for those who still want to produce income from dividends, even in an inflationary environment.

There is, however, one last factor to keep in mind. The nature of the holdings in both ETFs could change a lot if the economy goes into a prolonged recession and companies stop paying dividends. They could also change if more companies started using their excess cash for stock buybacks rather than dividends. Buybacks, which were once illegal, have become increasingly popular with academically-influenced investors who, possibly erroneously, but very vocally, believe they are a more tax efficient way to reward shareholders than dividends.

So that’s that. I’m out of the prediction business so I won’t tell you which ETF to buy. I tax loss harvested my most recent SCHD lots into VYM, but if the Vanguard S&P 500 ETF (VOO) ever hits my valuation-based price targets I will tax loss harvest both back into VOO and get back to buying Treasuries and rungs of my CD ladder to provide income. For now, though I’m still holding both and will until I get another significant tax loss harvest opportunity.

[ad_2]

Source links Google News