[ad_1]

Adrian Vidal/iStock via Getty Images

Introduction

I give the Schwab Strategic Trust – Schwab U.S. Dividend Equity ETF (SCHD) a buy rating. I like the low expense ratio of the ETF and think it provides a reasonable return. While dividend investments are not for everyone, if an investor is looking for an easy dividend investment, then I believe this is one they should consider.

SCHD is an ETF run by Schwab that attempts to track the return of the Dow Jones U.S. Dividend 100. The ETF boasts a favorable 0.06% expense ratio and a solid dividend of 2.86%. As written in another article, to be included in the Dow Jones U.S. Dividend 100:

Stocks must meet a basic set of liquidity, trading, size, and capitalization criteria for inclusion into the index. Importantly, only stocks with 10 consecutive years of dividend payments are included in the index.

Stocks meeting said criteria are ranked according to their yield, dividend growth, return on equity, and cash flow to total debt. The top 100-ranked stocks are included in the index, weights are based on market capitalization, but capped at 4.0%.

A holding of SCHD may have a higher than 4.0% allocation during the quarter but will be reweighted at the end of the quarter back down to only 4.0%. Additionally, capping the top companies to a 4.0% weighting helps the ETF be more evenly weighted between companies than most ETFs who base their weighting only on the market cap of companies. Finally, the ETF makes sure only to retain companies who have a solid history of dividends, leaving an investor not having to worry about the positions in the ETF.

Investing in SCHD allows an investor to buy into a basket of good dividend stocks and not worry about checking the stocks in the list or reweighting their holdings. An investor can buy into SCHD and let it sit. For an investor who does not want to spend too much time looking at their investments, the small fee charged by SCHD is more than worth the convenience.

Historical Returns

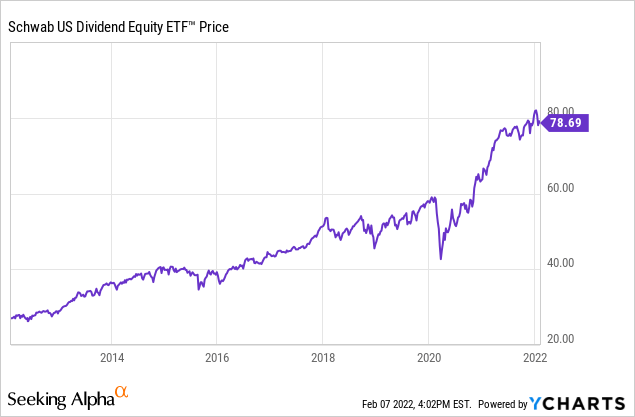

Over the past ten years, the stock has returned 190%, 19% per year. In comparison, the S&P 500 returns shown through (VOO) are 235%, 23.5% per year. One important note is that SCHD returns a much higher dividend, currently, it is 1.5% higher.

The stocks ten-year chart is below:

Top Holdings

The top holdings are all name brand companies that have solid dividend histories.

| 1. | Merck & Co., Inc. (MRK) | 4.24% |

| 2. | The Home Depot, Inc. (HD) | 4.19% |

| 3. | Texas Instruments Inc. (TXN) | 4.16% |

| 4. | Broadcom Inc. (AVGO) | 4.15% |

| 5. | Amgen Inc. (AMGN) | 4.11% |

| 6. | PepsiCo, Inc. (PEP) | 4.09% |

| 7. | BlackRock, Inc. (BLK) | 4.05% |

| 8. | Pfizer Inc. (PFE) | 3.97% |

| 9. | Cisco Systems, Inc. (CSCO) | 3.96% |

| 10. | Verizon Communications Inc. (VZ) | 3.96% |

Sector Allocation

The ETF tends to favor sectors with more value companies compared to growth. As a result, there is a much smaller allocation to Technology than other ETFs.

| Financials | 21.95% |

| Industrials | 17.41% |

| Consumer Goods | 16.71% |

| Technology | 15.41% |

| Health Care | 12.67% |

| Consumer Services | 5.30% |

| Telecommunications | 4.17% |

| Basic Materials | 3.76% |

| Oil & Gas | 2.03% |

| Non-Classified Equity | 0.37% |

Dividend Investing

Dividend investing has many fans. Some of the biggest reasons to invest in dividend-paying companies are the income dividends provide, reinvestments can increase growth, and dividends are usually a sign of a strong balance book for the company.

Another important thing about investing in dividend companies is that they are usually more stable. Stability is a favorable characteristic when the market is volatile, such as today when trillion-dollar companies are losing and gaining hundreds of billions of dollars in a single day.

If an investor is buying into a dividend-paying company and does not need the dividend payment as a source of income, they should look into a dividend reinvestment plan (DRIP). DRIP will automatically take your dividend payment each time it is made, whether quarterly, monthly, or yearly, and invest it back into shares of the company. While increasing your principal, DRIP will also increase the number of shares an investor has, which, as a result, will increase the investor’s next dividend payment. This effect can snowball, resulting in very high growth for an investor’s initial investment, even if the original investment does not grow that much. DRIP can be done automatically by most brokerages.

Risks

Because this ETF is in so many different sectors, any broad market event will affect it. For example, a bear market will lower its returns, and a bull market will increase its returns. Additionally, higher inflation levels will lead investors to rotate more into value companies, such as the ones in the ETF, rather than growth companies. On the other hand, lower inflation will lead investors to rotate out of value plays and into higher growth plays. Inflation is important to consider since the United States is in a high inflation environment.

This ETF’s holdings are more heavily weighted to value companies. For this reason, it will perform worse than growth companies in bull markets. On the contrary, it will hold its price much better in bear markets than those same growth companies.

Conclusion

SCHD is a good investment for someone looking to invest in a higher dividend stock but who does not want to pick individual companies. The low expense ratio of this ETF is very favorable for any investor, and the historical great asset appreciation of the stocks inside makes this an ETF about more than just the dividend.

[ad_2]

Source links Google News