[ad_1]

webguzs

The NASDAQ 100 ETF (NASDAQ:QQQ) has seen an explosive short-covering rally over the past several weeks as funds de-risk their portfolios. It has pushed the QQQ ETF up nearly 23% since the June 16 lows. These types of rallies within secular bear markets are not all that uncommon; rallies of similar size or more significance have occurred during the 2000 and 2008 cycles.

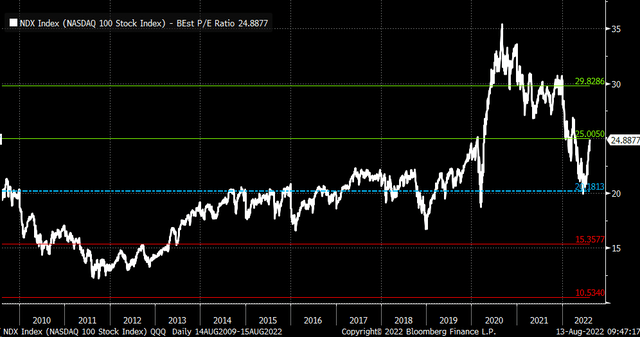

To make matters worse, the PE ratio of the NASDAQ 100 has soared back to levels that put this index back into expensive territory on a historical basis. That ratio is back to 24.9 times 2022 earnings estimates, pushing the ratio back to one standard deviation above its historical average since the middle of 2009 and the average of 20.2.

Bloomberg

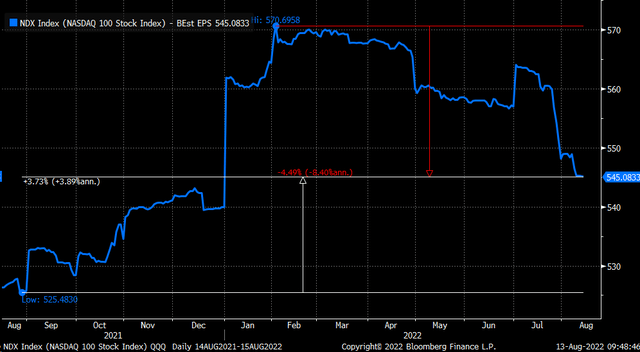

On top of that, earnings estimates for the NASDAQ 100 are on the decline, falling roughly 4.5% from their peak of $570.70 to around $545.08 per share. Meanwhile, the same estimates have risen just 3.8% from this point in time a year ago. It means that paying almost 25 times earnings estimates is no bargain.

Bloomberg

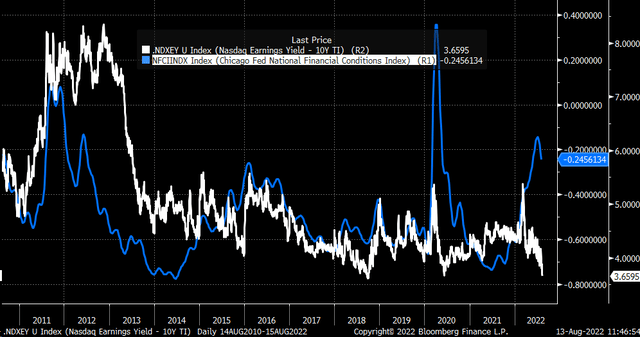

Real yields have soared, making the NASDAQ 100 even more expensive compared to bonds. The 10-Yr TIP now trades around 35 bps, up from a -1.1% in August 2021. Meanwhile, the earnings yield for the NASDAQ has risen to around 4%, which means that the spread between real yields and the NASDAQ 100 earnings yield has narrowed to just 3.65%. That spread between the NASDAQ 100 and the real yield has narrowed to its lowest point since the fall of 2018.

Bloomberg

Financial Conditions Have Eased

The reason the spread is contracting is that financial conditions are easing. As financial conditions ease, it appears to cause the spread between equities and real yields to narrow; when financial conditions tighten, it causes the spread to widen.

Bloomberg

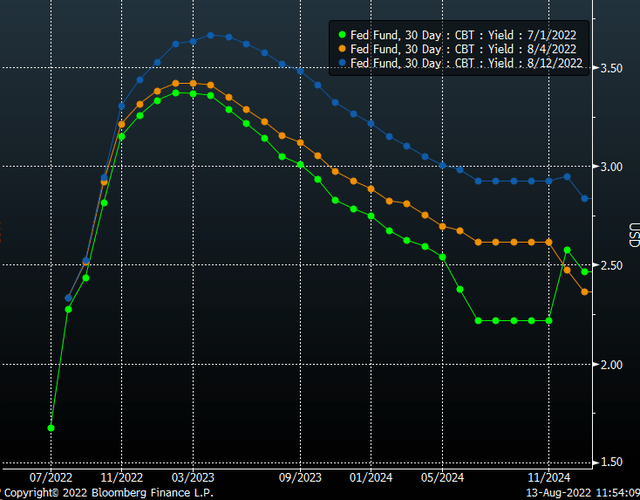

If financial conditions ease further, there can be further multiple expansion. However, the Fed wants inflation rates to come down and is working hard to reshape the yield curve, and that work has started to show in the Fed Fund futures, which are removing the dovish pivot. Rates have risen dramatically, especially in months and years beyond 2022.

Bloomberg

But more importantly, for this monetary policy to effectively ripple through the economy, the Fed needs financial conditions to tighten and be a restrictive force, which means the Chicago Fed national financial conditions index needs to move above zero. As financial conditions begin to tighten, it should result in the spread widening again, leading to further multiple compression for the value of the NASDAQ 100 and causing the QQQ to decline. This could result in the PE ratio of the NASDAQ 100 falling back to around 20. With earnings this year estimated at $570.70, the value of the NASDAQ 100 would be 11,414, a nearly 16% decline, sending the QQQ back to a range of $275 to $280.

Not Unusual Activity

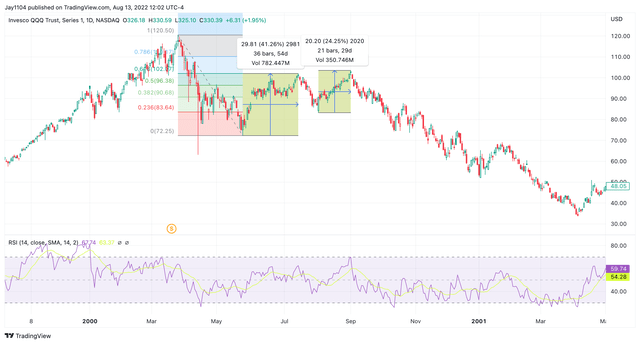

Additionally, what we see in the market is nothing new or unusual. It occurred during the two most recent bear markets. The QQQ rose by 41% from its intraday lows on May 24, 2000, until July 17, 2000. Then just a couple of weeks later, it did it again, rising by 24.25% from its intraday lows on August 3, 2000, until September 1, 2000. What followed was a very steep selloff.

TradingView

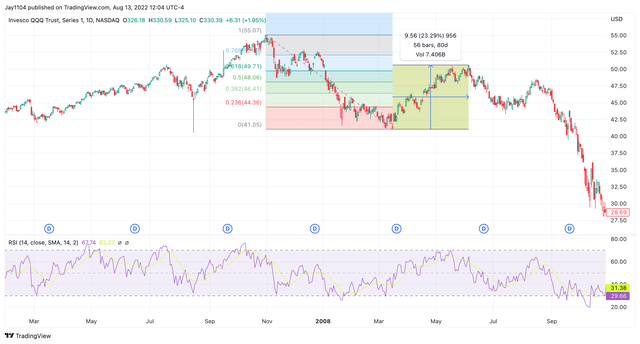

The same thing happened from March 17, 2008, until June 5, 2008, with the index rising by 23.3%. The point is that these sudden and sharp rallies are not unusual.

Trading View

This rally has taken the index and the ETF back into an overvalued stance and retraced some of the more recent declines. It also put the focus back on financial conditions, which will need to tighten further to begin to have the desired effect of slowing the economy and reducing the inflation rate.

The rally, although nice, isn’t likely to last as Fed monetary policy will need to be more restrictive to effectively bring the inflation rate back to the Fed’s 2% target, and that will mean wide spreads, lower multiples, and slower growth. All bad news for stocks.

[ad_2]

Source links Google News