[ad_1]

kovop58/iStock via Getty Images

Overview

The iShares MSCI Qatar ETF provides exposure to the Qatari stock market.

As of 25th November 2022, the fund was invested in approximately 32 different stocks which include popular names such as the Qatar National Bank – the largest bank in the Gulf region by assets.

The fund is heavily weighted towards Financials which represents more than 50% of its holdings.

iShares is the only provider to offer an exchange-traded fund with 100% exposure to Qatari stocks.

QAT has an expense ratio of 0.57% per annum which is justified given that it is the only ETF with such an offering.

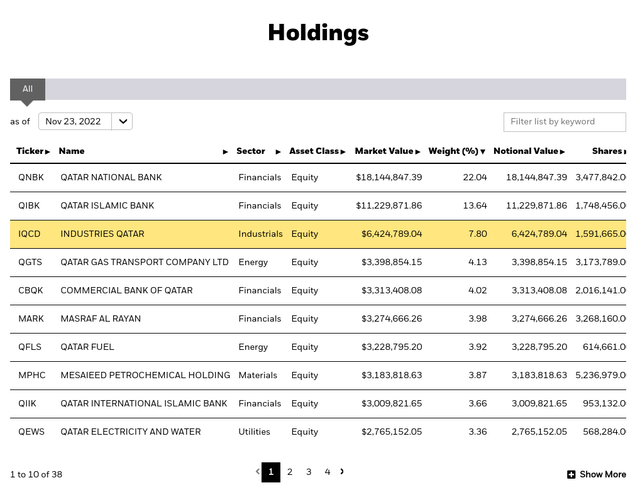

The fund’s top 10 holdings include:

iShares

The fund is managed by BlackRock, which is one of the largest asset managers in the world.

BlackRock is known for providing better liquidity than other asset managers due to higher assets under management and therefore higher trading volumes in its ETFs.

Liquidity is an important factor to consider when investing in an overseas fund.

During stress, it might be difficult to cash out at a good price, but I believe that the chances are higher with BlackRock compared with other ETF providers.

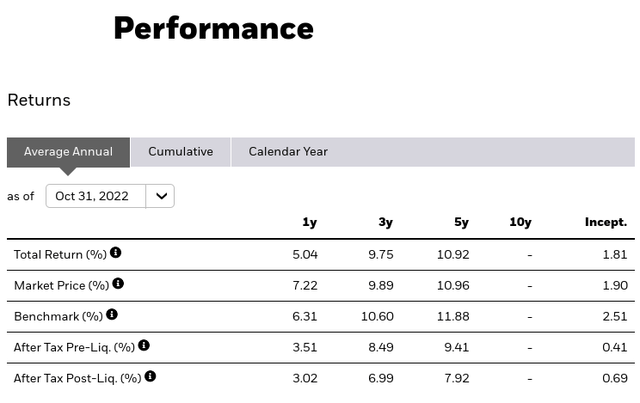

Fund performance

QAT has returned 1.81% per annum since its inception in 2014. The fund has not been able to track its benchmark closely. A hypothetical investment of $10,000 at inception would be worth approximately $11,500 today.

In my opinion, the risk/reward ratio for an investment in the QAT fund has been quite poor.

iShares

Portfolio

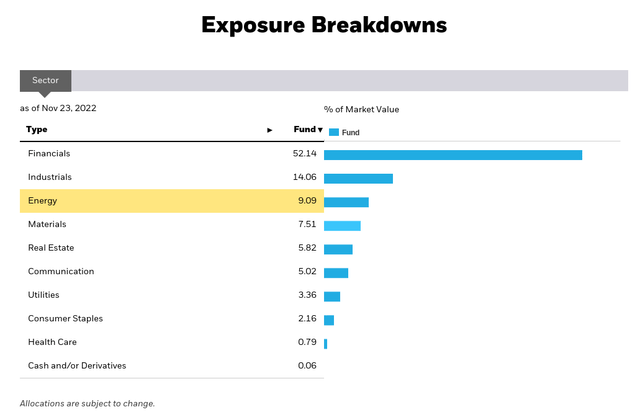

As previously noted, the fund is heavily weighted towards the Financials sector and therefore does not have a diversified exposure to a broad range of Qatari companies.

Notably, the fund has 0% exposure to the fast-growing Information Technology sector which is also reflective of Qatar’s economic dependence on the Energy sector.

Here’s the portfolio exposure breakdowns:

iShares

Qatar had a GDP per capita income of $92,080 in 2021 making it one of the richest countries in the world. Petroleum and natural gas are the key cornerstones of its economy, with Qatar home to one of the largest reserves of natural gas in the world.

As Qatar hosts the 2022 FIFA World Cup, we will analyze in the next section whether it will be beneficial for the economy and the QAT fund.

Impact of the World Cup controversies on Qatar

Hosting a World cup can boost a country’s economy by attracting tourists and via higher infrastructure spending. It is also an opportunity for the country to showcase themselves in front of the world as a good place to invest and do business.

It is estimated that Qatar invested $229 billion to host the World Cup which is more than 4 times the combined budget of the 8 previous World cups.

The high cost is because Qatar did not have the right infrastructure to host a World Cup.

For instance, Qatar had to build 8 new stadiums and was not able to leverage any of its existing facilities as they did not meet FIFA requirements.

Although the construction of these new stadiums will add to the country’s GDP initially, it will not provide sustainable growth. Most of these stadiums will have to be dismantled or re-purposed which will require additional investment.

Sporting infrastructure is expensive to build and maintain as it is often difficult to use the facility with enough frequency to cover costs. It also does not necessarily improve the economic well-being of a median worker.

Brazil who hosted the 2014 FIFA World Cup uses the most expensive stadium built as a bus parking lot today.

The 2022 FIFA World Cup has also been one of the most controversial World Cups in history.

The hosting of the World Cup in Qatar has been plagued by accusations of bribery, deaths of migrant workers, the exclusion of the LGBT community and the last-minute ban on alcohol drinking in the stadiums.

All these news stories have portrayed Qatar in a very negative light.

Although the country might benefit from the initial tourism boost from Western countries attending the World Cup, however I do not believe that the increase will be sustainable.

The controversies have affected Qatar’s appearance as a good place to visit, invest or do business which will have a negative impact on the economy, and eventually the QAT fund itself.

Conclusion

The 2022 FIFA World Cup will provide an initial boost to Qatar’s GDP; however, it will be difficult for the country to recover the $229 billion investment.

I believe it did not make much economic sense to host the World Cup in Qatar simply due to the lack of infrastructure to begin with.

Qatar’s reputation has also been bruised on the global stage by multiple controversies. It will take time for Qatar to rebuild its reputation on the global stage.

As Warren Buffett once said:

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

[ad_2]

Source links Google News