[ad_1]

ra2studio/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Private equity investment firms exchange more risk for the potential to earn higher returns than they might by investing in public companies. According to McKinsey & Company’s 2022 PE Annual report, AUM was $9.8t by July’21.

Successful Private Equity firms should generate superior returns in line with the higher risks investments. That might be true, but the performance funds like Invesco Global Listed Private Equity Portfolio ETF (NYSEARCA:PSP) reflect how the stocks performed, not the returns of the actual private equity investments. Based on PSP returns, I would rate it a Sell.

Understanding Private Equity

For seasoned investors, you probably can skip this educational section directed at investors, like me, only somewhat familiar with this investment option. Since private equity might be new to some investors, a little background would be helpful. My last employer put together Private Equity funds they then marketed to other pension investors via a vehicle known as fund-of-funds. Compared to other asset classes, they were doing well.

While private equity has expanded to Asia as deals became available, 80% of the money has been flowing into buyout, growth, and other types of private equity in both the United States and Europe. Most private equity money comes from institutional investors, such as pension funds, sovereign wealth funds, endowments, and insurance companies.

What is Private Equity?

Private equity is ownership or interest in an entity that is not publicly listed or traded. A source of investment capital, private equity comes from high-net-worth individuals and firms that purchase stakes in private companies or acquire control of public companies with plans to take them private and delist them from stock exchanges.

The private equity industry is comprised of institutional investors such as pension funds, and large private equity firms funded by accredited investors. Because private equity entails direct investment—often to gain influence or control over a company’s operations—a significant capital outlay is required, which is why funds with deep pockets dominate the industry.

Source: investopedia.com

Two common private equity investments are:

Buyouts: A buyout is when a private equity firm buys a company where they believe they can make improvements to its operations or management. Most times, the ultimate goal is to take the company public again at a substantial profit. Private equity firms use their own capital as well as borrowed money to complete the deal, making the transaction one known as a leveraged buyout.

Venture Capital: This involves identifying startups needing to raise cash to expand their operation. Instead of a loan, they get equity in the company. Watchers of the program Shark Tank see this activity every week where they offer funds for a stake in the company. The hope is the company will go public, and they can sell out at a profit.

Risks of private equity

Private Equity investments are very illiquid since there is no public market. Another risk is getting a clear picture of what the private equity firm is buying into. Also, the investment might not work, as recently major write-downs were taken on the perceived value of some investments. While investing in a Private Equity ETF like PSP, eliminates the liquidity risk, investors are still relying on the managers to eliminate the other risks.

Is Private Equity Overrated?

Not being an expert on Private Equity, I searched for other, hopefully expert unbiased views on this topic.

Starting in 2004, massive amounts of money went into private equity. What happens then is that the S&P 500, starting in 2009, starts doing extremely well. In fact, it starts doing what it had always done, producing a 12 per cent return a year.

What happened with private equity? Again, it delivered 11 or 12 per cent returns, which is not bad. But now they are simply matching the S&P500. Maybe returns have been one per cent more for private equity than the S&P500. But that’s all we’re talking about. The margin is not significant.

Source: Ludovic Phalippou, Professor of Financial Economics at the University of Oxford’s Saïd Business School

He also expressed concerns about the lack of transparency in these transactions and the potential for conflict of interest between the PE investors’ desires and what is best, long-term, for the company.

As of September 2020, private equity funds had produced a 14.2 percent median annualized return, net of fees, over the previous 10 years, compared with 13.7 percent for the S&P 500, according to an analysis of indexes by the American Investment Council, a lobbying group for the industry, using the latest numbers offered. Public pension funds invested in private equity actually had worse returns than from the S&P 500 — 12.8 percent, net of fees. Private equity firms have long engaged in contentious practices, including loading companies with debt and laying off workers.

Source: Michelle Celarier of the NY Times

Besides returns close to buying a large-cap index fund, she has concerns about the ethics some private equity firms have shown in the past.

Largest Private Equity firms

- Blackstone

- KKR & Co. Inc.

- CVC Capital Partners

- The Carlyle Group Inc.

- Thoma Bravo

- EQT

- Vista Equity Partners

- TPG Capital

- Warburg Pincus LLC

- Neuberger Berman Group LLC

Exploring the Invesco Global Listed Private Equity Portfolio ETF

Seeking Alpha describes this ETF as:

Invesco Global Listed Private Equity ETF invests in stocks of companies operating across diversified sectors. The fund invests in growth and value stocks of companies across diversified market capitalization. It seeks to track the performance of the Red Rocks Global Listed Private Equity Index. PSP started in 2006.

Source: seekingalpha.com PSP

PSP has $185m in assets with a 144bps fee structure. The ETF shows a 14.7% yield but quarterly payouts vary greatly. The ETF invests based on the Red Rocks Global Listed Private Equity Index, which the provider describes as:

The Index is designed to track the performance of private equity firms which are publicly traded on any nationally recognized exchange worldwide. These companies invest in, lend capital to, or provide services to privately held businesses. The Index is comprised of 40 to 75 public companies representing a means of diversified exposure to private equity firms. The securities of the Index are selected and rebalanced quarterly per modified market capitalization weights. Red Rocks Capital, LLC, a wholly owned subsidiary of ALPS, is an asset management firm specializing in listed private equity.

Source: secure.alpsinc.com

secure.alpsinc.com

secure.alpsinc.com

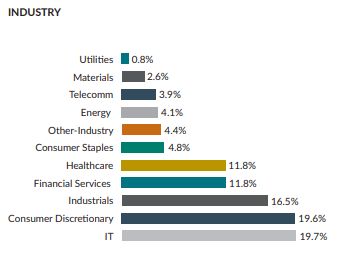

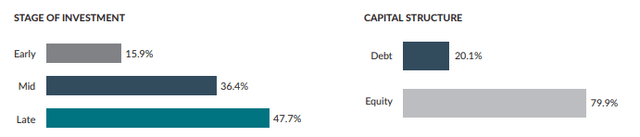

Readers will notice that the Index provider and Fidelity’s data source label industries differently. Based on the second set of charts, I suspect the Red Rocks has access to more details than others might. With almost an 80% equity exposure, the potential for outsized gains (and loses) is there compared to how Business Development Corporations invest, which is mostly debt. The Stage of Development chart indicates either a preference for late-stage investing or long-term relationships with companies that now have them close to IPO stage.

PSP Holdings review

Fidelity.com

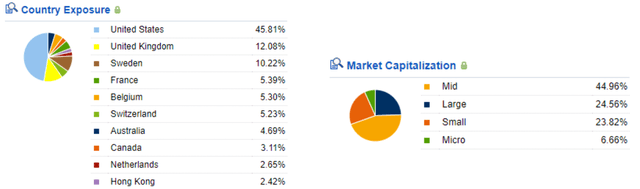

I was a little bit surprised that the US was 46% of the portfolio, barely above Europe’s 42%; Asia is the rest. The size distribution shows the focus is to be below Large-Cap companies, which would add diversification for investors with a large exposure to those stocks.

Fidelity.com

As stated above, it appears these allocation designations are more related to the stocks owned by PSP, not the investments made by the stocks owned.

Top Holdings

Fidelity.com; compiled by Author

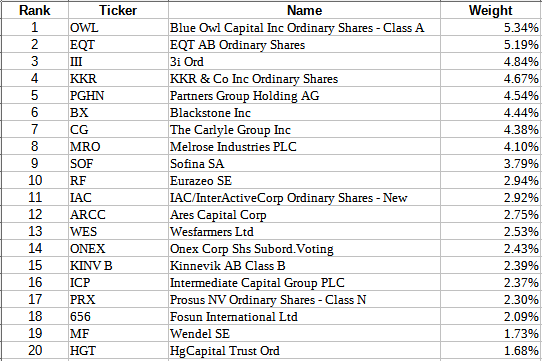

PSP holds about 80 positions, with the Top 10 having a 44% weight and the Top 20 67%. Here is a brief description of the Top 5, taken from their websites.

Blue Owl (OWL): “Through experience, scale, and the pursuit of excellence in everything we do, Blue Owl is a leading provider of capital solutions to the private market ecosystem. Our flexible, consultative approach helps position us as the partner of choice for businesses seeking capital and liquidity solutions to support their sustained growth.”

EQT AB (OTCPK:EQBBF): “A purpose-driven global investment organization, EQT has a track record of almost three decades of delivering consistent and attractive returns across multiple geographies, sectors and strategies.”

3i (OTCPK:TGOPF): “As an international investor and manager, we focus on opportunities where our sector and investment expertise, combined with our international presence and strong capital position, can create material value for our stakeholders.”

KKR & Co (KKR): “KKR is a leading global investment firm that offers alternative asset management as well as capital markets and insurance solutions. As investors with an industrialist vision, we aim to generate attractive investment returns by following a patient and disciplined approach.”

Partners Group (OTCPK:PGPHF): “Partners Group is a leading global private markets firm. Since 1996, we have invested over USD 170 billion in private equity, private debt, private real estate, and private infrastructure on behalf of our clients globally. We seek to generate strong returns through capitalizing on thematic growth trends and transforming attractive businesses and assets into market leaders.”

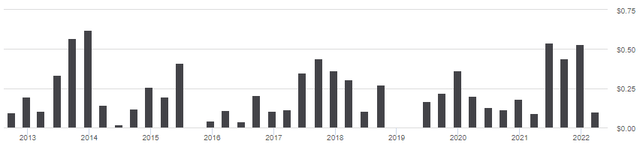

PSP Distribution Review

seekingalpha.com PSP DVDs

For investors looking for steady income, PSP is not your ETF. All distributions appear to be qualified dividends, no capital gains or ROC required.

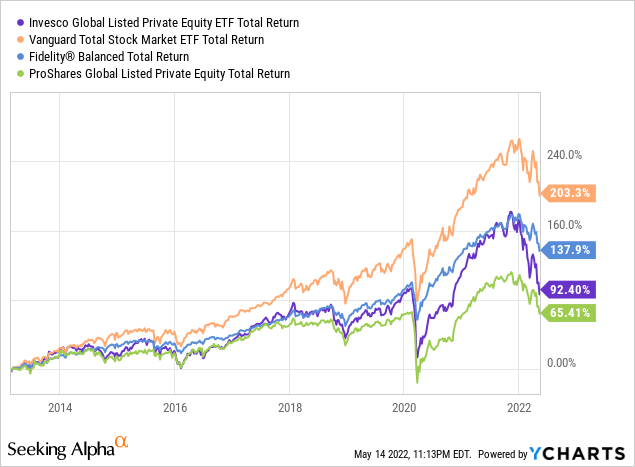

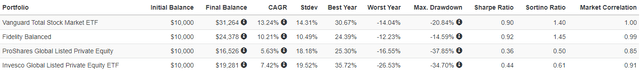

PSP Performance Review

I compared PSP’s Total Return with two funds investors might be currently using: the Vanguard Total Stock Market ETF (VTI) for 100% equity ones, and the Fidelity® Balanced Fund (FBALX) for a typical 60/40 investor. Both greatly outperform PSP. I also included the only other ETF investing in private equity I found, the ProShares Trust – ProShares Global Listed Private Equity ETF (PEX). For investors wanting a private equity ETF, then PSP would be the choice.

I also run all four thru PortfolioVisualizer.com to get risk and correlation data.

PortfolioVisualizer.com

So not only do PSP and PEX have the lowest returns, they managed to achieve that by having the highest StdDev and Drawdowns of the four funds. With high correlation factors, an investor would gain little by adding either fund to their asset mix.

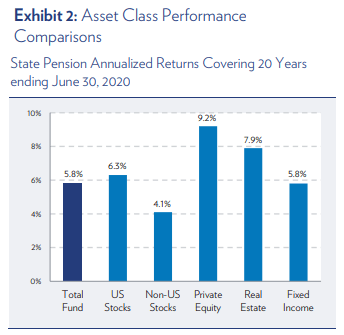

Portfolio Strategy

The next chart shows why Private Equity has gained popularity with large pension funds. How available those PE investment are to the general public wasn’t discussed. Also, this study only included state pension plans. Other results I saw, the difference between PE and US stocks was much closer.

cliffwater.com/Research

Wanting to be sure all views were considered, an article by Crystal Capital Partners lists seven reasons to own private equity. The firm offers such funds to institutional clients.

- Private equity investments have grown over the last few decades. The primary reason for increased investor interest in private equity investments is the return enhancement potential.

- PitchBook looked at historical data to examine how buyout funds specifically reacted during previous crises, including the Tech Bubble, 9/11, and the Global Financial Crisis and concluded that private equity performance tends to follow recessionary periods.

- Risk management: During recessions, two-fifths of publicly listed equities have experienced “catastrophic loss,” defined as a 70% or greater drop from their peak values. Yet less than 3 out of 100 private equity funds have suffered a similar loss.

- One of the benefits of private equity investments is they are less affected by immediate economic and market-based trends. The value of private equity investments is tied to company metrics and performance.

- Income generation: Laddered consistently and periodically (vintage diversification), a systematically designed private capital portfolio should produce a staggered series of consistent cash flows and liquidity events for an investor. Cash flows can be accelerated with the inclusion of private credit and real assets.

Source: crystalfunds.com/insights

I left off the last two as they seem to only pertain to the actual investor, not a fund that owned the investments. In the vain of showing multiple viewpoints, BOOX Research gave PSP a Buy rating in a recent article: Invesco Global Listed Private Equity Portfolio ETF: Don’t Count The PE Guys Out. That’s the value of Seeking Alpha; the ability to get multiple views on most investments. While I like to private equity concept, I do not feel PSP is passing those benefits onto its investors, thus my Sell rating.

Final Thought

With extra due diligence, an investor can pick which firms to invest in directly. Here are some recent article links to some of the largest players:

- Blackstone (High Yield Investor)

- KKR (BOOX Research)

- Carlyle Group (Wolf Research)

- Blue Owl Capital (Brad Thomas)

[ad_2]

Source links Google News