China Growth Headwinds And Policy Response

Today’s price action shows that the market continues to question major central banks’ policy responses. The implied probability of a 75bps rate hike in the U.S. started to grind higher again, and in Europe, the July liftoff is now firmly priced in. Policy calibration does not always means more hawkish. In China’s case, the market is clamoring for more policy support. The latest headlines, however, looked inconsistent. On the one hand, the central bank is talking about more policy coordination and structural monetary policy tools to prop up the economy. On the other hand, the Politburo asked to “resolutely” stick to the dynamic zero-COVID policy, despite the disastrous activity gauges for services. The consensus sees only tiny cuts (5bps or so) in the medium-term lending facility rate and the loan prime rate – thinking that the bulk of the support will come from the fiscal side. The upcoming credit aggregates should give us more color on the fiscal side’s engagement.

Polish Central Bank Falling Behind The Curve?

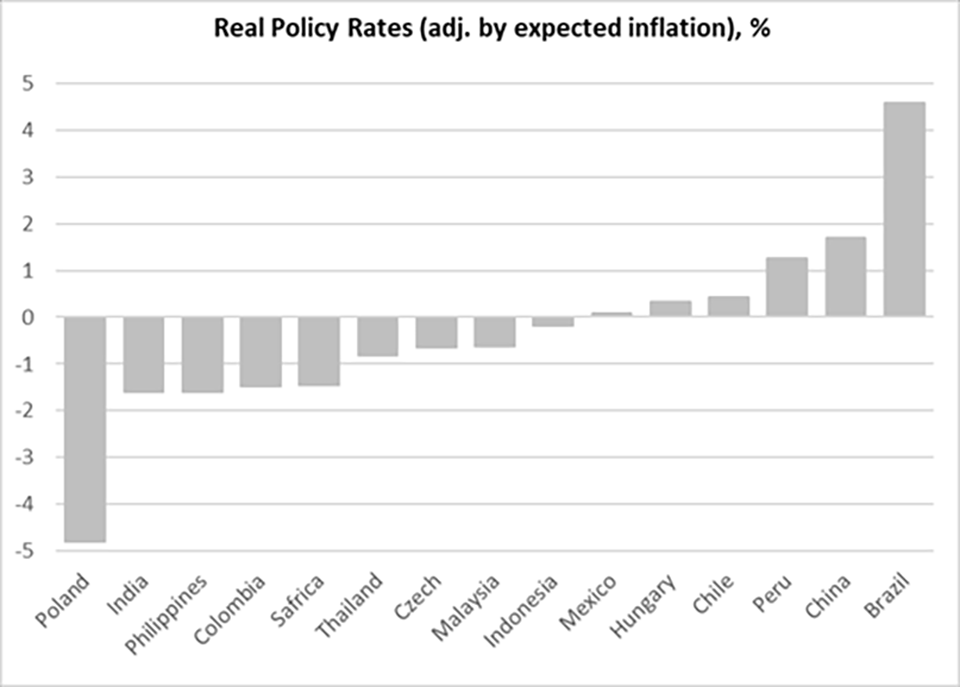

Policy calibration concerns are also heard loud and clear in Poland (a major constituent of the J.P. Morgan’s EM local bond index, GBI-EM). The central bank’s minutes sounded more hawkish than yesterday’s below-consensus 75bps rate hike, but it is hard to tell whether this will translate into a faster pace of policy tightening. Poland’s real policy rate adjusted by expected inflation is among the most negative in emerging markets (EM) (see chart below), and if the central bank continues to do more of the same, local bonds’ performance will continue to suffer.

LATAM Policy Frontloading

The latest monetary policy decisions in LATAM seem to be more aligned with reality. Chile hiked by more than expected on Thursday (125bps), and today’s above-consensus inflation print (10.5% year-on-year) vindicated the move. Colombia maintained the pace of tightening in April (+100bps), and the latest inflation number (9.23% year-on-year – a big upside surprise) shows that the central bank is moving in the right direction. Brazil might be extending its tightening cycle until June (and maybe August) in response to persistent inflation pressures. Will Mexico’s central bank resist the pressure to tighten less? Stay tuned!

Chart at a Glance: EM Real Policy Rates – Wide Range of Expected Outcomes

Source: VanEck Research; Bloomberg LP