[ad_1]

Introduction

Welcome to Orchid’s Platinum Weekly report, in which we discuss platinum prices through the lenses of the GraniteShares Platinum Trust (PLTM).

Although PLTM has sold off pretty sharply over the past week, we remain of the view that the sell-off will prove transient.

In fact, we believe that the consolidation in PLTM was a natural bout of profit-taking after the speculative community lifted too significantly their net long exposure to the precious metal.

But dips will become increasingly bought by the investor community, considering that 1) platinum remains very cheap compared to its peers and 2) supply tensions in the world’s largest platinum-producing country, South Africa, prevail.

In this context, we see PLTM trading in a range of $8.85-10.00 per share in the course of September.

Source: Trading View, Orchid Research

About PLTM

PLTM, which was created in January 2018, is directly impacted by the fluctuations of platinum spot prices because the fund physically holds platinum bars in a London vault and custodied by ICBC Standard Bank.

The investment objective of the GraniteShares Platinum Trust is to replicate the performance of the price of platinum, less trust expenses (0.50%), according to the official GraniteShares’ website.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the platinum market, contrary to ETFs using futures contracts.

Also, the structure of a grantor trust protects investors since trustees cannot lend the platinum bars.

PLTM is the lowest-cost ETF on the market, with an expense ratio of 0.50%. PLTM competes with Aberdeen Standard Physical Platinum Shares ETF (PPLT), which was created in October 2010, which is however more expensive, considering that its expense ratio is at 0.60%.

Taking into account the total cost, however, PLTM is more costly than PPLT due to the higher spread (0.10% for PPLT vs 1.08% for PLTM over the past 60 days).

That said, we expect the total cost for PLTM to eventually move below than for PPLT as more liquidity flows into PLTM.

Speculative positioning

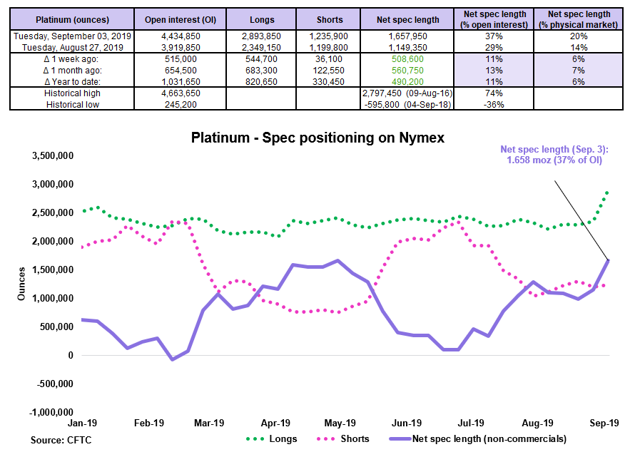

Source: CFTC, Orchid Research

Speculators lifted remarkably their net long exposure to Nymex platinum in the week to September 3, for a second week in a row.

Over August 27-September 3, speculators lifted their net long positions in Nymex platinum by the equivalent of 508,600 oz or 11% of the open interest. This represents around 6% of the global physical market, in one single week!

The net spec length moved from 29% of open interest on August 27 to 37% of open interest on September 3. Although this is a significant increase, the net spec length is still far below its historical high of 74% of open interest.

This therefore suggests to us that platinum’s spec positioning is not stretched on the long side, and there is plenty of room for additional speculative buying in the form of either fresh buying or short-covering.

Implications for PLTM: The positive swing in speculative sentiment in favor of platinum should drive further speculative buying in Nymex platinum in the near term, which in turn should push platinum spot prices higher, thereby boosting the performance of PLTM.

Investment positioning

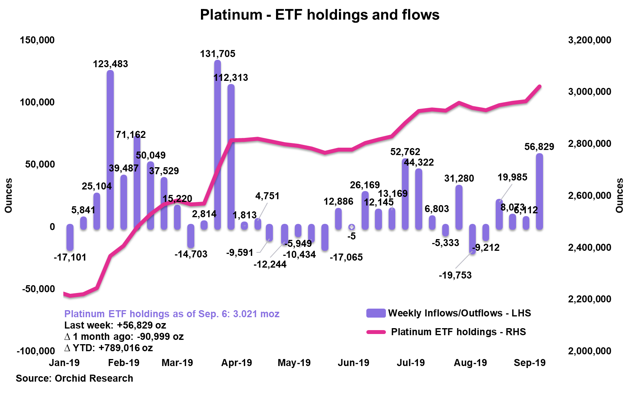

Source: Orchid Research

ETF investors bought platinum at an aggressive rate in the week to September 6, marking a 4th straight week of net inflows.

This was the largest weekly net inflow since late June.

In the year to date, ETF investors have accumulated nearly 800,000 oz of platinum, marking a massive 35% increase in platinum ETF holdings, equivalent to 10% of the global physical market.

Two main factors have driven the surge in investor appetite for platinum, in our view, namely 1) a cheap valuation (platinum has traded at a significant discount to palladium, a rare and unusual feature in the historical behavior of PGMs prices) and 2) increased supply tensions in South Africa (73% of global platinum output) where a strike seems more likely than not.

Implications for PLTM: The refined platinum market has tightened meaningfully in recent months due to the marked increase in investor demand for the precious metal. As the platinum price remains relatively cheap to the palladium price, we believe that inflows into platinum ETFs will continue in the near term. This should therefore boost platinum spot prices, which bodes well for PLTM.

Closing thoughts

While we believe that the marked sell-off in PLTM over the past week has been exacerbated by technical profit-taking after speculators boosted too aggressively their bullish bets, platinum’s positioning among the speculative community is far from being stretched. This therefore leads us to believe that the sell-off will prove transient as dips will be eagerly bought by the investor community. But further downward pressure cannot be ruled out before the uptrend resumes.

For September, we envisage a trading range of $8.95-10.00 per share for PLTM, suggesting that the PLTM is presently in the middle of our trading range forecast.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

[ad_2]

Source link Google News