[ad_1]

There is a single problem that is beginning to plague financial markets today: not enough cash. As global central banks have pushed interest rates far below equilibrium levels, would-be money market savers have been forced to put their money in longer-duration and higher-risk investments. Now that rates have hit new lows and excess liquidity is gone, the U.S. repo market is starting to break down as banks no longer have the cash on hand to invest in short-term money markets.

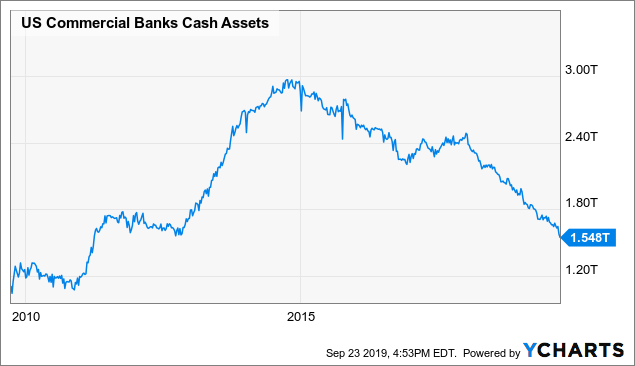

Put simply, this has created a house of cards in the global financial system where asset values are rising but cash levels are falling. Amazingly, very few people are aware of how extreme this trend has been. Just take a look at bank cash assets:

Data by YCharts

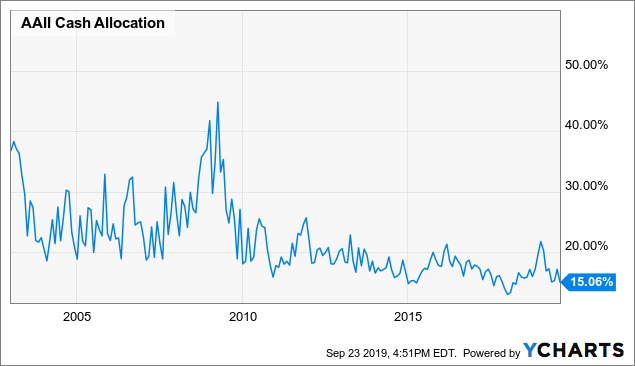

Data by YChartsBanks have collectively cut their cash reserves in half over the past four and a half years. Even investors have cut their cash allocation dramatically over the past two decades of excessively low rates:

Data by YCharts

Data by YChartsRemember, asset values in the U.S. have been climbing across the board while cash ratios have been plummeting. Owning cash is starting to look very attractive if one can gain from repo market blips. While interest rates are low, financial stability is even lower and those companies and governments without cash will eventually be burned by a lack of liquidity.

One particular subset of the market that has particularly bad cash management is companies that perform excessive share buybacks. The worst are those that borrow money to buy back shares, increasing leverage and decreasing liquidity for a short-term share price boost. Even those companies that opt for buybacks in lieu of a rare practice, real capital investment/R&D, have put themselves in jeopardy. Put simply, companies (and investors/governments) that lack dry powder will be hurt as liquidity continues to evaporate.

Short selling or de-allocating toward companies that perform excessive buybacks may be a very smart decision today. Luckily, there is a buyback focused ETF by Invesco called Invesco BuyBack Achievers ETF (PKW) that gives us a nice “buyback basket” that we can analyze. Let’s look at the companies in the fund and see if they are truly ill-prepared for the coming “buyback fire.”

Introduction to the Invesco Buyback Achievers Fund

Before we get into the weeds, let’s talk about the ETF’s basic characteristics. The fund invests in a basket of U.S. large-caps that have had a net share reduction of at least 5% over the trailing twelve months. The ETF has a nice history and has been trading since 2006 and has outperformed the S&P 500 by a nice margin in its initial years but has been underperforming recently.

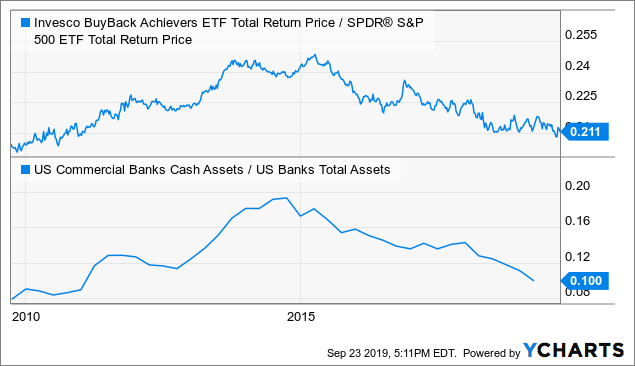

Take a look at the fund’s total return divided by that of SPY. This lets us see the precise net out/underperformance of the fund. I also included bank cash to assets to illustrate the cornerstone of my thesis:

Data by YCharts

Data by YChartsFrankly, I found this absolutely startling. Buyback companies outperform the S&P 500 when bank excess liquidity is rising. They underperform when it is falling. In other words, when there is too much cash, those who use it on share buybacks are rewarded, but when the financial system is out of money (today), those who waste it on buybacks are penalized.

Today, we are in a no/low-cash environment and companies without that dry powder are looking increasingly risky.

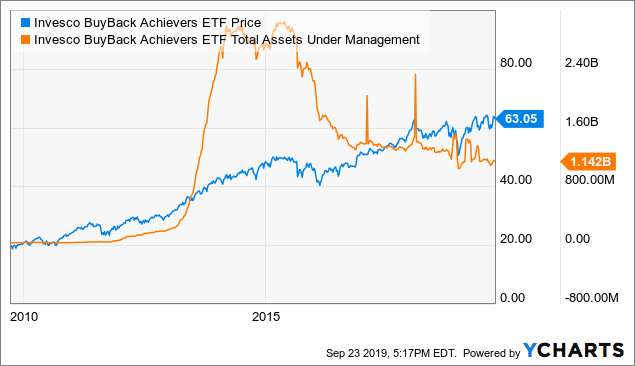

Luckily, investors have been deallocating toward the fund as that outperformance trend has faded. Take a look at its AUM vs. the price of the fund:

Data by YCharts

Data by YChartsI always find it interesting that investors pour their money into a strategy right before it stops working. You can see that it jumped the most in 2013-2014 right before the strategy stopped outperforming. For what it’s worth, there is still over $1B in the fund so it is very liquid and has low closure risk, but a lot more potential deallocation.

For being a general large-cap U.S. equity fund that has been consistently underperforming, it has a high expense ratio at 62 basis points. I have seen much higher, but the strategy does not have a very high turnover/complexity, so it is a bit high.

Let’s look at the fund’s holdings at a closer level.

Low Valuations Don’t Compensate for Balance Sheet

On the surface, the fund looks cheap. The fund’s weighted average “P/E” ratio is only 14X which is about a third less than that of the S&P 500. That said, these valuations are rationally low. The companies have bad balance sheets (not a lot of cash) and very low revenue growth.

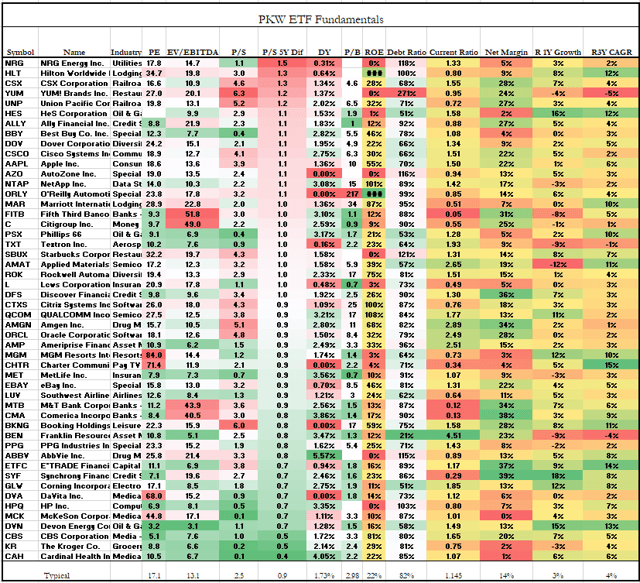

To see this, here is a table of the top 50 companies in the fund. While this leaves out about 130 other holdings, these top 50 make up well over half of the fund’s total holdings:

(Data Source – Unclestock)

The problem with buybacks is they confuse financial statements and often times mislead some investors. When a company uses its cash to purchase its own shares, its “retained earnings” is reduced and the company’s debt ratio is increased. This is why most of these firms have excessively high debt ratios and return on equity.

Current ratios are one of my favorite financial figures today. They let us know how much cash the firms have to make short-term debt obligations. In general, companies that perform buybacks will have low current ratios due to their (in my opinion) misuse of cash. As you can see, the typical company in the ETF barely has enough money to meet obligations and many have far less (as seen by the count of companies with current ratios below one).

Remember, there is not a lot of free cash in the system today, so many of these firms are likely to be faced with higher interest rates when they refinance. This could easily become a vicious cycle that causes some of these stocks to go the way of Thomas Cook.

The Core Problem With Buybacks

Another important fact about these “buybackers” is their inability to grow. When repurchasing shares, the company’s management is effectively saying “We have no way to organically grow our business but we also think we’re the best investment on the market today.” To me, that does not make much sense as a truly good long-term investment is one with high organic growth potential.

Companies that do excessive dividend payments are in a similar boat where they are often depleting cash reserves too much. However, I like them much more because they are being honest with their investors about their lack of organic growth potential. A high dividend payer’s management is effectively saying “We have no way to organically grow our business, so we’d like to return our cash profits to you to find a better investment growth opportunity or increase dry powder.“

Don’t get me wrong, buybacks do make sense if a company honestly believes it is undervalued. Management (usually) knows the workings of their company better than investors, so they may know if it’s undervalued. The problem today is that almost nothing in the large-cap space is undervalued.

The Bottom Line

Overall, I believe PKW and most of the companies in it will continue to underperform the market until a recession is over. Once it is over, cash balances will likely be higher in relation to asset values and many companies will be undervalued. When these conditions are met, I expect PKW to return to outperformance. Until then, I expect underperformance to accelerate downward as global liquidity continues to dry up.

For me, PKW is a clear “sell.” Of course, this begs the question “Who has the cash and will they generate alpha?” This is a surprisingly tough question to answer, but it will be in one of my next articles so feel free to “follow” if you’d like to stay up to date with this market theme.

Interested In Closely Following Global Events?

“The Country Club” is a dedicated service that focuses on single-country and regional ETFs with the goal of helping our subscribers diversify globally and get a better grasp on how world events will affect their portfolio. We will certainly be providing subscribers further updates on this idea.

Subscribers receive exclusive ideas, model portfolios, and a wide range of tools including our exclusive “Country Club Dashboard” which allows them to visualize global financial and economic data. If you haven’t already, please consider our 2-week free trial and get your passport to global markets today!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News