[ad_1]

lindsay_imagery/E+ via Getty Images

Investment Thesis

In my last article on the Invesco Water Resources Portfolio ETF (NASDAQ:PHO), I discussed how it is important to pay attention to valuations, especially when a fund trades at lofty multiples. Since then, PHO lost ~22% vs a loss of ~16% for the S&P 500 and has clearly underperformed the market. Despite the recent pullback, PHO still trades at over 20x earnings which is expensive in a rising rates environment. As investors are increasingly searching for alternative sources of income to protect their portfolios against inflation, they are turning to dividend-paying stocks and US Treasuries (now yielding above 3%), to the detriment of ESG funds such as PHO. I believe this trend is likely to continue over the next months. Therefore I expect PHO to underperform the market.

What Has Happened Since My Last Article

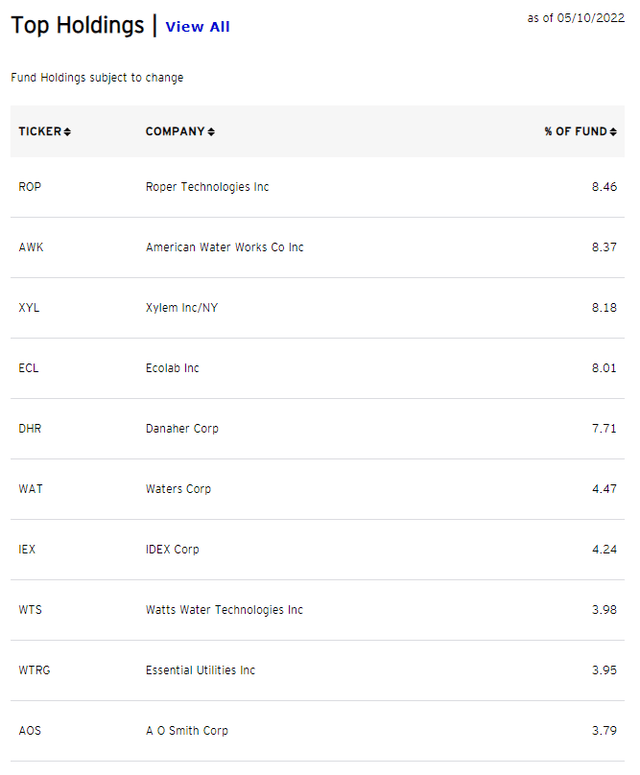

As a reminder, PHO tracks the performance of the NASDAQ OMX US Water Index, which is composed of companies that create products designed to conserve and purify water for homes, businesses, and industries. You will find below a recent breakdown of the top 10 holdings and you can read more about the strategy in my previous article.

Invesco

I have compared below PHO’s price performance against the SPDR S&P 500 Trust ETF (SPY) over the last 5 months to assess which one was a better investment. Since my previous article, PHO underperformed the S&P 500 by a ~5.7 percentage points margin.

Refinitiv Eikon

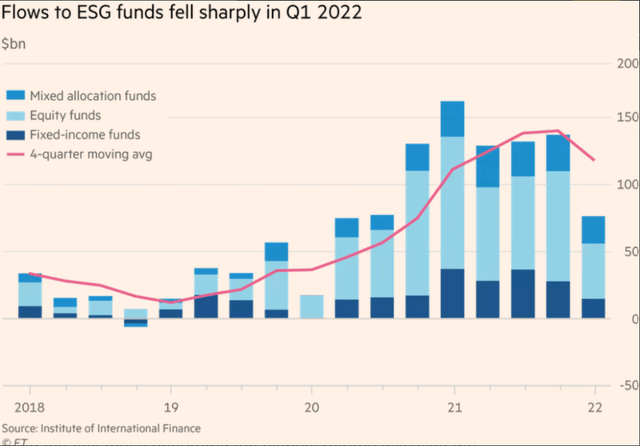

The fund was a favorite of the ESG crowd a few months ago and its performance has followed the inflows coming from the ESG investment wave in the past. Q1 2022 represented the first quarter when flows to ESG funds saw a significant drop since 2020.

FT

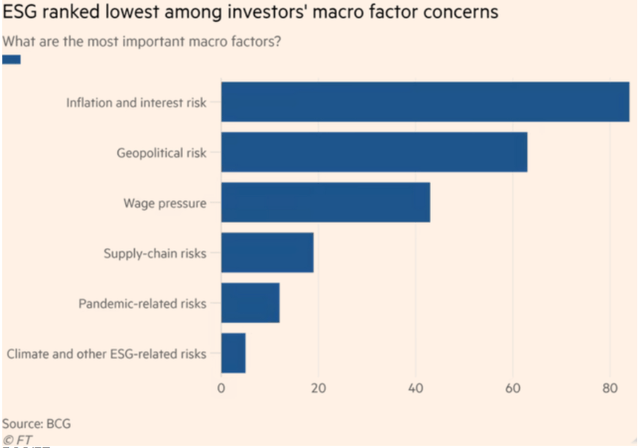

I think this has massive implications that can lead to a paradigm shift where the economy and inflation become the most important issues for investors rather than ESG. This is reflected in recent data published in the FT. As a result, the funds that benefited in the past from an abundance of capital such as PHO are now facing a bleak outlook over the next couple of months as investors’ interest in the topic is abruptly declining.

FT/BCG

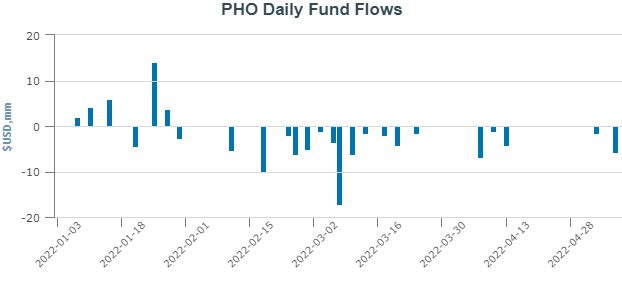

PHO has noticed firsthand the effects of capital outflows. Investors pulled nearly $63 million YTD and there wasn’t any major inflow over the last 3 months. The market is ultimately driven by supply and demand and I am concerned by the lack of demand for this product. I think the fact that it has performed poorly compared to the market since my previous article reinforces some of the trends we are seeing.

ETF.com

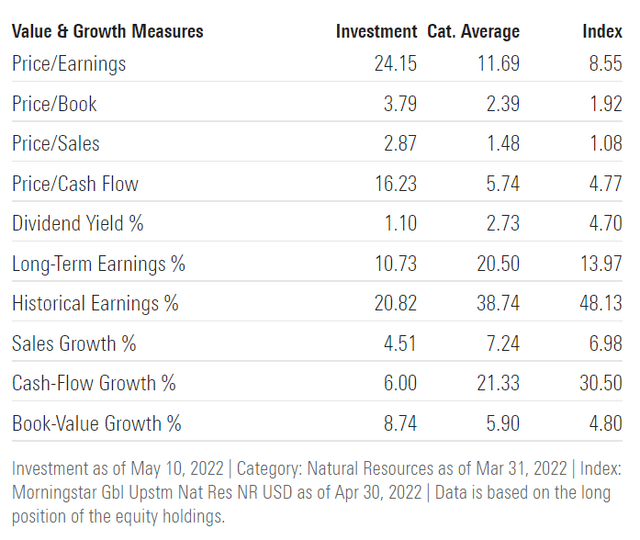

Valuations Are Still High

In my previous article on PHO, I talked about the fact that valuations were stretched across the portfolio. Back then, it was trading at an average TTM price-to-earnings ratio of ~28. Unfortunately, valuations are still high despite the recent pullback. The fund now trades at ~24x earnings and has a price to book ratio of nearly 3.8. These multiples are much higher than what you would be paying for a plain-vanilla S&P 500 ETF today, which makes PHO look overvalued from a relative perspective.

Morningstar

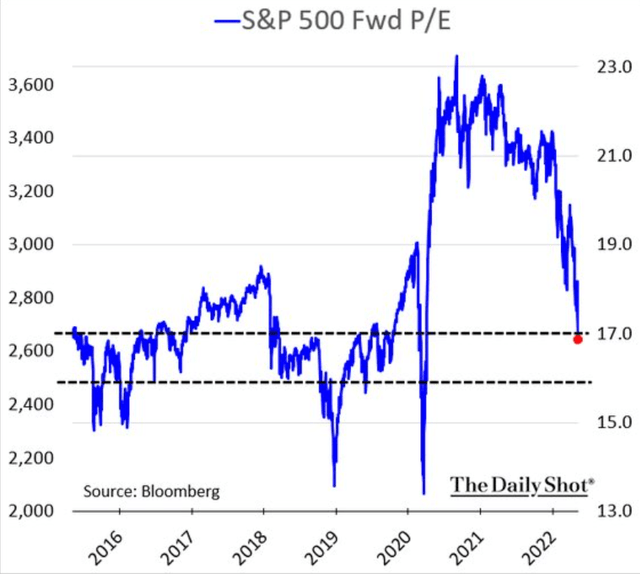

At the same time, inflation is now higher than in December 2021 and probably more entrenched. This doesn’t bode well with high PE stocks as previously mentioned in my articles. From a historical perspective, you should expect lower valuations than we have at the moment when the CPI is high. As a result of high inflation, market participants are increasingly reluctant to pay higher multiples and Wall Street starts to be skeptical about consensus earnings estimates.

Bloomberg/The Daily Shot

Stocks are not a good inflation hedge, especially when they have a low dividend yield. PHO’s yield is much lower than what the market offers and more importantly, it is lower than what investors can get on 10-year Treasuries. That has profound consequences for long-duration assets such as stocks since investors will now pay a lower multiple in order to get a higher yield.

Refinitiv Eikon

All in all, I believe there is more downside risk for PHO and the probability of a 20% pullback from the current level is pretty high. If we have a recession on top of that over the next 12 months, I think a 30 to 40% drawdown is something that could realistically happen. Given the abovementioned reasons, I think PHO will be an underperformer in the near future.

Key Takeaways

Since my previous article, PHO has clearly underperformed the market. Investors’ sentiment is shifting from the ESG trade to stocks that can shield them from geopolitical and inflation risk. As a result, the fund experienced negative net flows YTD as demand for this product is declining. This comes at a terrible moment since the fund is still trading at a lofty valuation, and the selling might reinforce some of the negative trends that we are already noticing. Despite the recent pullback, PHO is trading at over 20x earnings which makes it overvalued given how high the CPI is at the moment and how fast rates are rising in the US.

[ad_2]

Source links Google News