[ad_1]

DNY59/E+ via Getty Images

Close to a year ago I wrote about the Simplify Interest Rate Hedge ETF (NYSEARCA:PFIX), which provides investors with an incredibly effective way to profit from higher interest rates. Interest rates have significantly increased since, so I thought an update was in order.

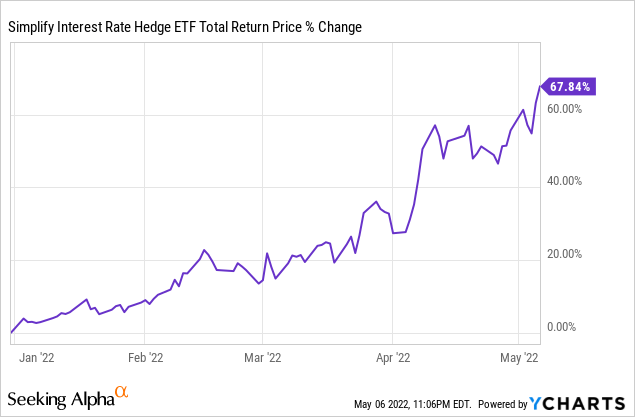

PFIX is meant to significantly outperform as interest rates, specifically the 20-year Treasury rate, increase. The fund has performed as expected, posting gains of more than 55% on a 1.5% increase in its reference rate. Results were outstanding, with the fund significantly outperforming most relevant asset classes, interest rate hedges, and inflation hedges. Expect significant gains if interest rates continue to increase, a distinct possibility as long as inflation remains elevated.

PFIX is an appropriate investment for aggressive investors and traders looking to profit from higher interest rates. The fund’s complicated, leveraged holdings make it an inappropriate investment for more conservative investors.

Interest Rate Hedge Security/Options Analysis

I’ll start with a high-level overview of the fund’s holdings and strategy. These have not materially changed since I last covered the fund, so feel free to skip this section if you’ve read my previous article on the subject.

PFIX’s strategy is quite simple.

The fund invests 50% of its assets in 5-year Treasuries. These are simple holdings, and mostly provide the fund with a little bit of income.

The fund invests the other 50% of its assets in 7-year OTC payer swaption on the 20-year Treasury rate. These are not so simple holdings, but I have some experience with these and similar derivatives, so hopefully I can explain how they work in simple terms.

Let’s say you are a bank, and you invest $100 million in 20-year Treasuries yielding 3.0%.

You are concerned that yields will rise, as inflation is at multi-decades highs, as indicated by Federal Reserve officials, and as has been occurring for months.

Treasuries, however, have fixed interest rates. Doesn’t matter what the Fed or the market does, you are stuck with that 3.0% yield for 20 long years. Good luck selling an old, low-yield Treasury if rates rise too.

Not an ideal situation, but one with an easy solution.

Go to another bank, and ask them to swap the fixed 3.0% Treasury yield for a variable yield. Let’s say 2.4% plus the Federal Funds rate, adding up to 2.9% as of today.

Higher Federal Funds rates would immediately result in higher yields, courtesy of your counterparty.

Lower Federal Funds rates would immediately result in lower yields, courtesy of the same.

Intuitively, net profits are dependent on higher yields.

Less intuitively, net profits are likely to be negative, as there are costs to these swaps. Costs generally take the form of spreads. In the example above, we swapped a fixed 3.0% rate for a variable 2.9% rate, with the bank’s counterparty pocketing the 0.1% spread.

Banks and other large financial institutions use swaps like this to hedge their interest rate exposure.

Importantly, the swaps can also be used for speculation: just buy the swaps without the Treasuries. This way, you potentially profit from rising rates, and don’t have to invest in low-yielding Treasuries.

PFIX invests in similar assets to the ones above. Let’s have a look.

PFIX – Overview and Expected Performance

PFIX invests 50% of its assets in 7-year OTC payer swaption on the 20-year Treasury rate, with the remainder being invested in Treasuries. Said swaptions are quite similar to the derivatives described above, with the caveat that the swaps only kick in when 20-year Treasury rates rise to 4.0%.

PFIX’s swaps are the key to the fund’s strategy and expected performance. As derivatives, their characteristics are explicit and well-known, and their performance directly dependent on the performance of specific variables.

PFIX’s swaps are cheap, as they don’t kick in until rates have risen by a lot. Insurance against improbable events is quite cheap, because the insurance company knows reimbursements are unlikely. Same principle here. As an aside, costs are currently somewhat higher than average, as interest rates have risen by a lot, boosting the price of these swaps. Still, costs remain low.

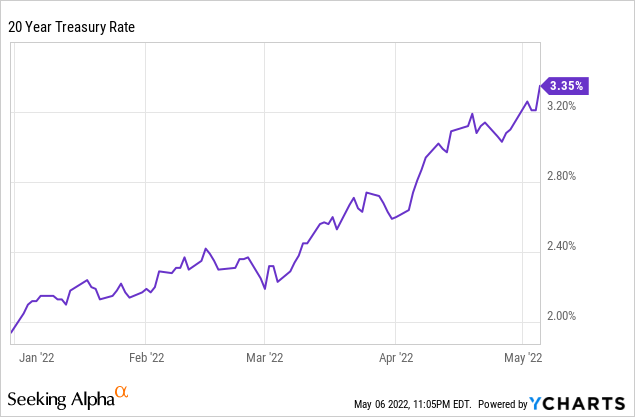

Because the swaps are cheap, the fund can buy a lot of these, and so the fund is (implicitly) extremely leveraged. Expect significant gains from relatively small interest rate movements. As an example, 20-year Treasury rates have increased by about 1.35% YTD, from 2.0% to 3.35%.

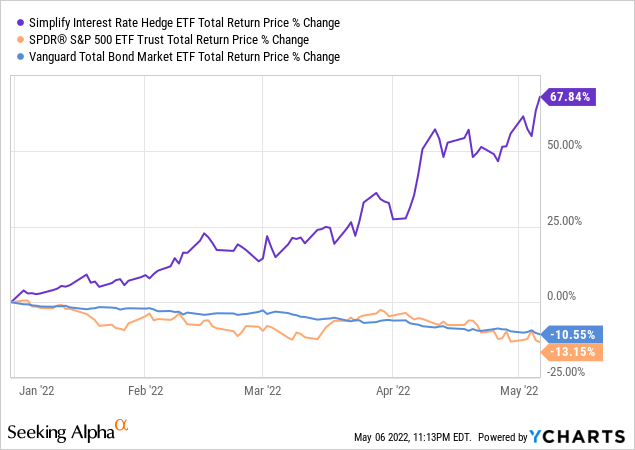

PFIX itself is up by more than 67%, or fifty times the movement in the underlying reference rate. Massive gains, and broadly reflective of the significant implicit leverage in the fund’s swaps.

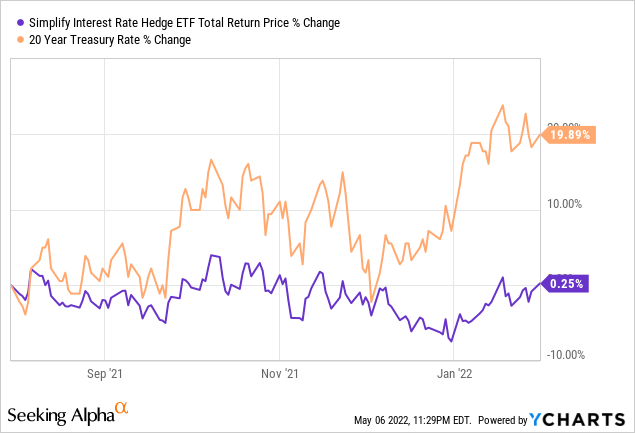

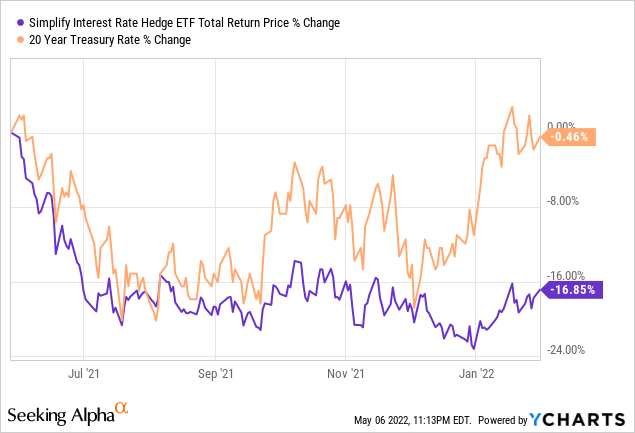

Because the swaps don’t kick in until rates rise to at least 4.0%, gains start to massively ramp up the closer you get to 4.0%, and are comparatively weak when rates are farther away from 4.0%. As an example, from July 2021 to January 2022, Treasury rates rose from 1.8% to 2.2%, but PFIX was flat. Gains only picked up once rates rose above 2.5%, and were quite strong once rates reached 3.0%.

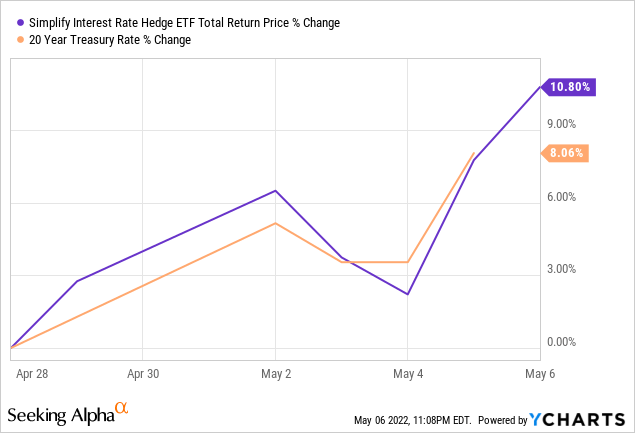

Once rates are closer to 4.0%, the fund starts to see significant gains from even minor interest rate movements. As an example, in the past week 20-year Treasury rates have risen 0.35%, from 3.0% to 3.35%, while PFIX is up by more than 10%. Small interest rate movements had no impact when rates were around 2.0%, but are having massive effects now that rates are hovering between 3.0% and 4.0%.

A corollary to the above is that gains would be much higher if rates rose above 4.0%. Reference rates currently stand at 3.35%, having risen by 1.365% YTD, so we are not too far off from this scenario. In my opinion, rates are close enough to 4.0% that any further interest rate increase should have outsized effects on the fund’s share price and performance.

Because the swaps have costs, expect significant losses if interest rates trend sideways (no profits minus costs equals net losses) for a sustained period of time. As an example, interest rates were flat since the fund’s inception to January 2022, during which the fund suffered losses of about 17%.

As PFIX’s swaps have costs, and as profits are only realized if interest rates significantly increase, long-term returns will likely be negative. Positive long-term returns would require continuous significant increases in long-term rates, which are possible, but do not seem terribly likely.

Due to the above, PFIX is more appropriate as a short-term trading vehicle than as a long-term investment. Consider trading PFIX for short periods of time, and consider locking-in gains. As an aside, it seems that PFIX itself does this. From what I’ve seen, they sold several older swaps with lower strike prices as interest rate rose, effectively locking-in some gains. As we don’t have detailed information regarding the specific trades made I can’t really analyze the trading in any real depth, but it does seem like the fund tries to take advantage of gains and changing market conditions.

For investors that know about options, PFIX’s swaps have some of the same characteristics as long-dated OTM put options on 20-year treasuries. Interest rate delta and gamma are both positive.

Due to PFIX’s highly leveraged holdings and options, a small allocation should be sufficient for the vast majority of investors. Extremely few reasons to go above 10%, and even that is quite high. At a 10% allocation, expect a significant portion of portfolio gains, losses, and exposure to be directly related to long-term Treasury rates. A 10% allocation would have hedged about 50% of the losses experienced by an equity / bond portfolio YTD, a reasonably strong amount. Diversifying into commodities, energy, value stocks, and similar, would have hedged the rest. I strongly believe that investors should err on the side of caution when dealing with complicated, leveraged funds, and that includes PFIX.

Let’s summarize.

PFIX invests in cheap, leveraged, interest rate swaps. Expect double-digit gains from small interest rate increases, triple-digit gains from larger movements, losses otherwise.

As an aside, all the scenarios and characteristics mentioned above were included in my first article on PFIX, when the fund was quite new, and didn’t have a long performance track-record. Point being, the above are / were forward-looking predictions of how the fund should perform under different scenarios based on my knowledge and understanding of the fund’s strategy and holdings. It has performed as expected under all relevant scenarios, which I think is important information to investors to consider.

PFIX – Investment Thesis

PFIX’s investment thesis is remarkably simple.

The fund would profit from higher Treasury rates, which will likely continue to increase as long as inflation remains elevated. As such, the fund is an appropriate investment opportunity for investors concerned about rising interest, inflation, or both. Expect significant market-beating returns if rates rise, as has been the case YTD.

Due to the PFIX’s complex, leveraged holdings, the fund is only appropriate for aggressive traders and speculators. Only invest in PFIX if you are comfortable with leverage, options, and (potential) double-digit losses. PFIX sees double-digit gains on 0.35% interest rate increases, it would see similar losses for similar-sized interest rate decreases. Losses would be significant if inflation and rates normalize, and investors need to be prepared for said eventuality.

Due to the PFIX’s complex, leveraged holdings, the fund is inappropriate for more conservative investors looking for interest rate hedges.

Conclusion – Effective Interest Rate Hedge

PFIX provides investors with an effective way to profit from increased interest rates.

[ad_2]

Source links Google News