[ad_1]

Gold is something that you can use to diversify your stocks/bonds portfolio and can work as a market or inflation hedge. The Perth Mint Physical Gold ETF (AAAU) allows you to buy gold like any other physical gold ETF (like GLD or IAU), except it allows not only Authorized Participants but any investor to redeem their shares for physical gold and is backed by the Government of Western Australia.

Photo Source: Perth Mint Bullion

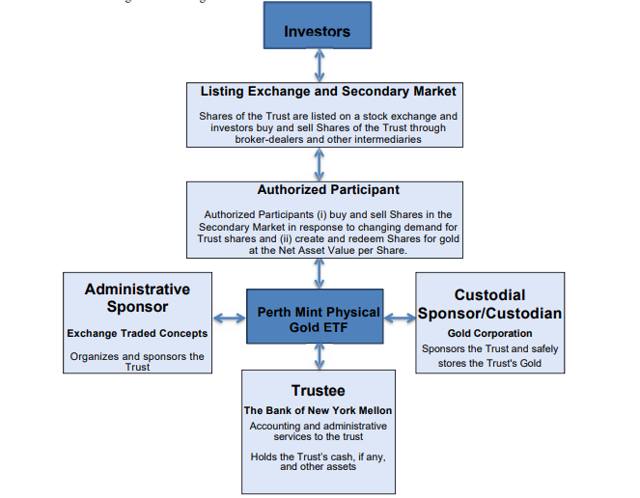

Legal Structure

AAAU is structured as a Trust, established under a Depository Trust Agreement in the State of New York. Each share represents units of a fractional undivided beneficial ownership in the trust. The custodial sponsor is Goldcorp (NYSE:GG) (the State-owned company which operates/does business as the Perth Mint) and the administrative sponsor is Exchange Traded Concepts, LLC. The Trustee is The Bank of New York Mellon.

Management fee is 0.18%, and net assets are $107M.

Storage

All gold (at least 99.5% purity) is currently held by the Perth Mint, and all deposits are certified at least twice/year by Deloitte. The fund’s Administrative Sponsor, Exchange Traded Concepts, is also entitled to appoint additional auditors/inspectors who can visit Perth Mint premises and examine AAAU’s gold holdings and related records.

Perth Mint has been established since 1899 and refines US$14B worth of precious metals annually. It has clients in 130 countries ranging from pension funds, central banks, and corporate/private clients. They process 92% of Australia’s gold output, making it a prime location to store gold.

Other ETFs may hold their deposits with banks which may be associated with some counterparty risk (whereas AAAU is government-backed). Perth Mint is located in the State of Western Australia, which is a geopolitically stable region and would have relatively little external security threats due to Perth’s relative geographical isolation. AAAU’s trustee is Bank of New York Mellon which is responsible for ensuring the fund operates according to its prospectus.

Government-Backed

Western Australia’s Gold Corporation Act (1987) contains an explicit guarantee backed by the Treasury in the name/on behalf of the Crown in right of the State of Western Australia (Crown is equivalent to the Government for you Americans), covering the cash equivalent of gold due, payable and deliverable by the Mint/Goldcorp and any obligations. This guarantee would be limited by the financial ability of the State. However, it’s backed by physical gold, and Perth Mint is audited at least twice annually with additional auditing by the fund’s sponsor. So, this should not be an issue. Western Australia has a credit rating of AA+ from S&P and was upgraded from negative to stable in October 2018. Losses may also be sustained due to “nuclear accidents, terrorism, riots, acts of God, insurrections, strikes and similar causes beyond the control of the Custodian”, if you’re concerned about this and really want to cover your bases, you might consider obtaining physical gold. The Parliament of Western Australia may also decide to amend the act to remove/change the guarantee, which the custodian will warn the trustee should it learn of any proposals to do so.

Physical Gold vs Futures-Based Gold Funds

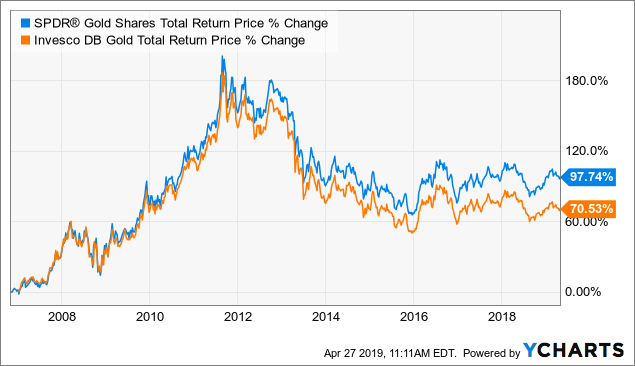

There are also futures based gold funds, but these can suffer from contango (when the spot price is lower than the future contracts) when futures contracts are rolled over. Futures-based gold ETFs may benefit when gold futures go into backwardation (when futures contracts trade lower than spot price), although this is rare for gold, meaning that futures-based funds tend to lag physical gold funds long term, which you can see in the chart below comparing Invesco DB Gold (DGL), a futures-based fund, and SPDR Gold Shares (GLD), which is a physical gold fund.

Data by YCharts

Data by YCharts

The trust holds London bars and other gold products with a purity of at least 99.5%.

Redemption

So, all ETFs have some sort of creation/redemption procedure, in order to keep the market price as close to NAV as possible. However, this is typically limited to institutions/broker-dealers only. AAAU allows small-time investors to redeem their shares for gold following a standard procedure and rather reasonable freight costs.

You can use the calculator in order to estimate how much gold your shares would be worth. Ex: 1000 shares is worth 9.9873 ounces of physical gold (not including shipping costs/insurance costs).

The shares may be redeemable for physical gold, but how is that done specifically?

- Contact the Perth Mint to discuss delivery options including location, insurance, dates and methods.

- The Perth Mint will then provide you with a quote detailing the type and quantity of gold, the delivery fee, the amount of shares to be surrendered. The quote will be valid for 3 days.

- Submit the filled in quote application form, along with proof of ownership of AAAU shares, along with a copy of photo ID and proof of residence. The Perth Mint will review the form and then give you a customer account number and delivery ID.

- Instruct your broker to transfer your AAAU shares to the Perth Mint’s account on the share submission date (which was a part of the quote).

- Receive your gold by providing photo ID when it is delivered using the agreed upon delivery method. Alternatively, you’d also be able to pick it up yourself at the Perth Mint if that was agreed upon in the quote.

How much will it cost to have the gold delivered?

For US addresses, there will be a fixed freight cost of $30 if the total amount of gold is worth less than US$25,000. If the order is worth more than US$25,000, an armoured delivery may be required, with rates being set based on location and value of gold. Insurance may be purchased at a cost of 1% of the delivery value, irrespective of the order value.

Fine Print

Here’s some fine print involving redemptions. The likely hood that redemption is suspended on a US trading day would be rather low, I’d assume. I’m thinking it might be used in cases where it would be technically infeasible to deliver (natural disaster, spike in shipping costs, military conflict, etc). Selling shares on the market and purchasing gold locally is another alternative to the redemption process.

“The request for the exchange of shares for gold is subject to a number of risks including but not limited to the potential for the price of gold to decline during the time between the submission of the request and delivery. Delivery may take a considerable amount of time depending on your location. The Trust may suspend redemptions of baskets by authorized participants and Gold Corporation may suspend or reject the exchange of shares for physical gold, which could affect the market price of the shares. The withdrawal of an authorized participant and substantial redemptions by authorized participants may affect the liquidity of the shares.”

– Redemption Process FAQs

The delivery or registration of transfers of shares may, and on the direction of a Sponsor, shall be suspended generally, or refused with respect to a particular purchase order by the Trustee, (I) when the Trustee’s transfer books are closed, (II) if the Custodian has informed the Trustee and the Administrative Sponsor that it is unable to allocate gold to the Trust Allocated Metal Account either in connection with a particular purchase order or generally or (III) if such action is deemed necessary or advisable by the Custodial Sponsor, for any reason in its sole discretion at any time or from time to time, but only after consulting with the Administrative Sponsor. Redemptions by Authorized Participants may and, on the direction of a Sponsor, shall, be generally suspended or particularly rejected by the Trustee (1) during any period in which regular trading on NYSE Arca is suspended or restricted, or the Exchange is closed, (2) during an emergency as a result of which delivery, disposal or evaluation of gold is not reasonably practicable, or (3) for such other period as the Sponsors determine to be necessary for protection of registered owners of shares. See “Creation and Redemption of Shares by Authorized Participants – Creation Procedures – Authorized Participants – Rejection of purchase orders” and “Creation and Redemption of Shares by Authorized Participants ¬Redemption Procedures – Authorized Participants – Suspension or rejection of redemption orders.”

– Prospectus

Why Gold?

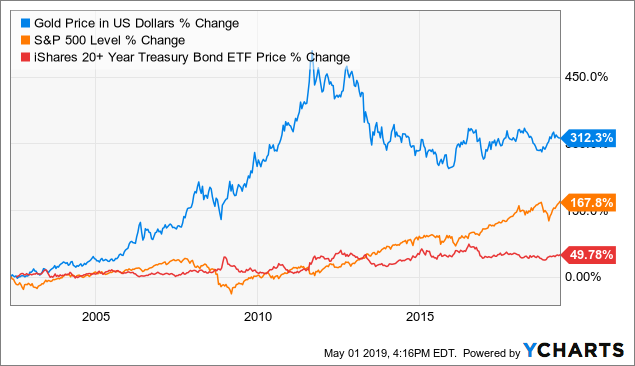

Data by YCharts

Data by YCharts

While I generally agree with Milton Friedman’s thoughts on not having gold standard for central banks, it can still have value for investors by providing diversification for portfolios and help hedge inflation and other uncertainty-based risk factors.

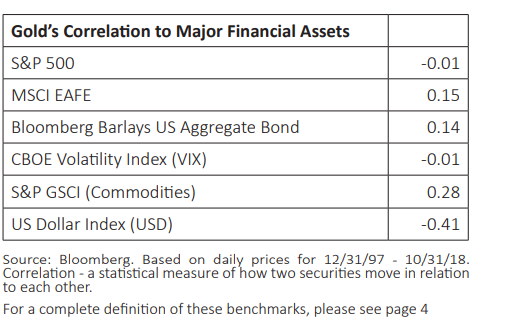

As you can see in the chart below (sourced from AAAU’s investors documents), gold has a low correlation to equities, bonds, and the US dollar. Having at least small portion of your portfolio in gold can help lower your overall portfolio volatility through its low correlation and may help increasing your risk-adjusted returns long term. Hedge Fund Manager Ray Dalio suggests having 5-10% of your portfolio in gold as part of a diversified portfolio. Gold typically outperforms the stock market and bonds during periods of high inflation. While there can be some concern involving gold as it does not produce any income, but if it helps smooth drawdowns, that may make up for it. If you currently own gold via GLD or IAU, then you may consider selling and buying this fund in order to take advantage of its redeemability and government-backed structure. If you’re looking to generate income with gold, you might consider selling covered calls, or if you have access to the Canadian markets, you might consider Horizon’s Gold Yield ETF (TSX:HGY) which does exactly this (holding physical gold ETFs while selling covered calls). As always, when making any major changes to your portfolio, you should seek the advice of a qualified financial professional.

Risks

Since this is a physical gold ETF, all the risk factors involved with investing in gold would affect this fund. If central banks and other major holders of gold decide to sell on mass, that could lower its price. Higher interests rates may also mean that investors may decide to switch from gold to bonds, again potentially affecting its price. There is also the (extremely low) risk of a nuclear accident, terrorism, or insurrection in Western Australia that may affect the holdings of the Perth Mint.

Royal Canadian Mint Exchange Traded Receipt

The Royal Canadian Mint also offers Gold Exchange Traded Receipts on the Toronto Stock Exchange listing under MNT. It allows you to redeem shares for cash, or at a minimum amount of 10,000 ETRs (~$130k) redeem for physical gold. This could be another option if you’re a Canadian investor looking for another government-backed redeemable gold exchange-traded product.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News