[ad_1]

da-kuk/E+ via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on March 21th, 2022.

About one month ago, I wrote about the Invesco DB Commodity Index Tracking ETF (NYSEARCA:DBC), a fund offering investors diversified exposure to commodity prices through futures contracts. DBC outperforms when inflation is high, as has been the case YTD, and is a fantastic choice for commodity bulls.

Invesco has another similar fund, the Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (NASDAQ:PDBC). As such, and considering reader interest, I thought to do a quick article summarizing the similarities and differences between these two funds.

Both DBC and PDBC offer investors diversified exposure to commodity prices through futures contracts. Their characteristics and expected performance are quite similar, with two key differences. PDBC is the slightly cheaper fund, with a 0.62% expense ratio, versus 0.85% for DBC. DBC’s investors must also file a K-1 tax form come tax reporting season, while PDBC’s investors do not. Although both funds are incredibly similar choices, PDBC seems like the slightly stronger, cheaper, simpler choice.

PDBC Versus DBC – Similarities

Index and Performance

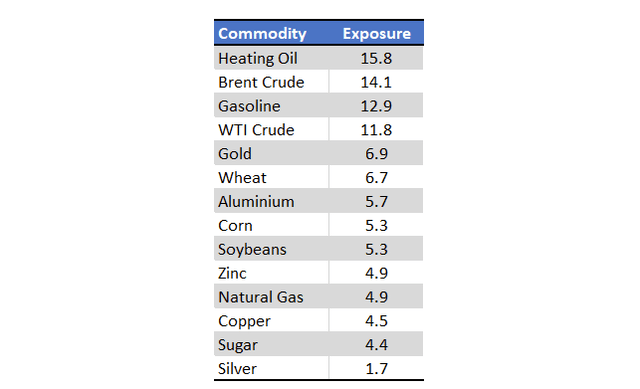

Both PDBC and DBC are diversified commodity index ETFs, tracking the DBIQ Optimum Yield Diversified Commodity Index Excess Return. It is a relatively simple index, which includes exposure to the following commodities:

DBIQ Index Provider

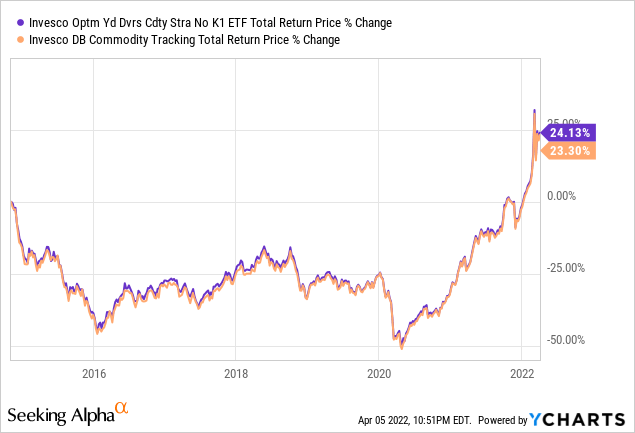

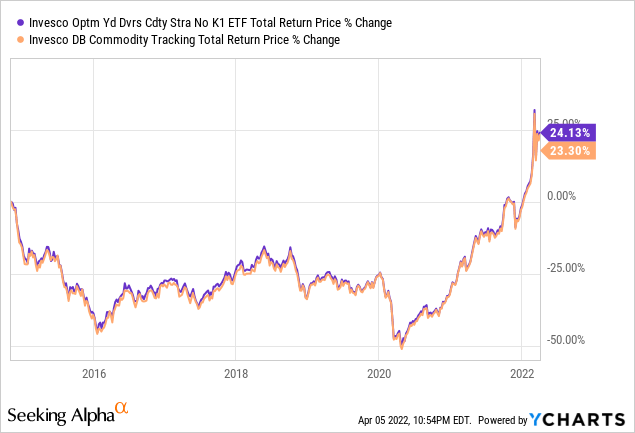

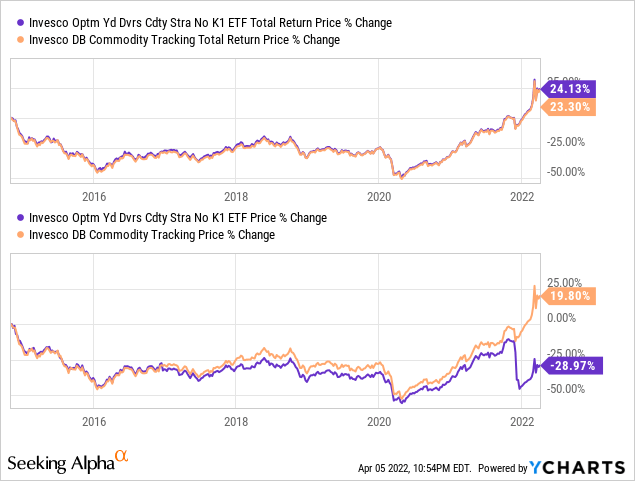

As both DBC and PDBC track the same index, their performance should be the same. Total returns for both funds have been functionally identical since inception, as expected.

Due to the above, PDBC and DBC are extremely similar funds, with similar characteristics, investment thesis, performance, etc. There are differences, but these are minor, all things considered.

Pure Commodities Exposure

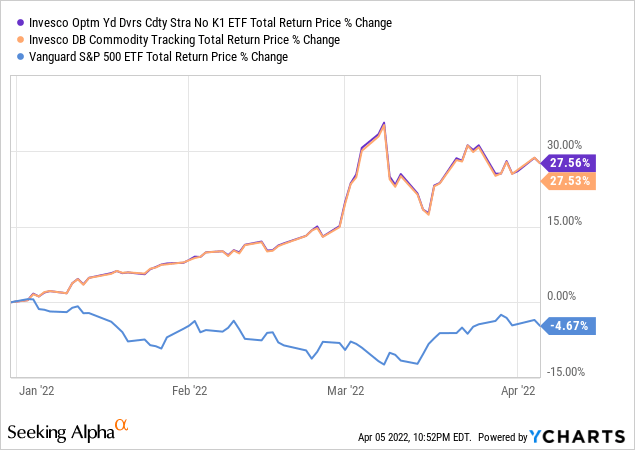

PDBC and DBC gain their commodities exposure through futures contracts. These are financial derivatives whose profits are almost entirely dependent on commodity prices: prices go up, profits go up, and vice versa. The relationship is direct, strong, and consistent, all important benefits for the funds and their shareholders. Both funds should outperform when commodity prices are higher and rising, as has been the case YTD.

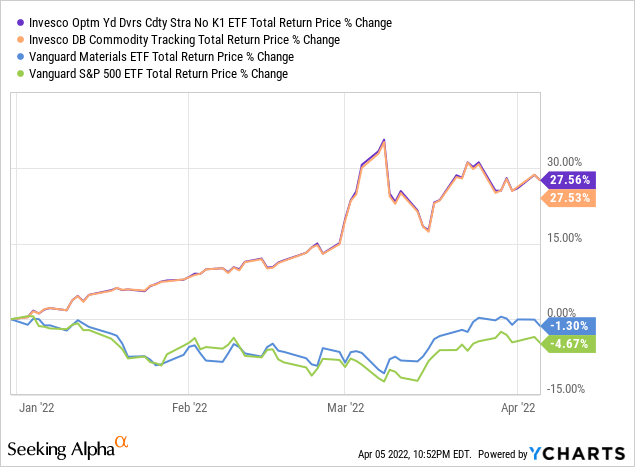

Importantly, the above is not necessarily true for other commodity funds, especially those focusing on commodity equities. Companies which produce commodities, including oil and basic materials, see higher revenues, earnings, and cash-flows when commodity prices increase. Stronger financial performance tends to lead to higher share prices and strong shareholder returns, but this is not necessarily true. Other factors matter too, including valuations, investor sentiment, and the like. It is possible for commodity equity funds to perform quite badly even when commodity prices are elevated, as has been the case for some U.S. commodity equity funds YTD, including the Vanguard Materials ETF (VAW).

VAW’s losses were almost entirely due to frothy U.S. equity valuations, and bearish market sentiment. Although the fund’s underlying holdings benefit from rising commodity prices, investors are selling U.S. equities due to other concerns, and so share prices have gone down.

PDBC and DBC gain their commodity exposure through futures contracts, and so the above issues are irrelevant. PDBC and DBC see strong returns when commodity prices increase, regardless of valuations, investor sentiment, and other similar factors. This is a significant benefit for both funds, and particularly important for commodity bulls.

Diversified Commodities Exposure

PDBC and DBC both offer investors diversified commodities exposure, with investments in oil, natural gas, gold, wheat, and most significant commodities. Diversification helps ensure strong returns during all relevant inflationary environments, something which is not necessarily true for other commodity funds.

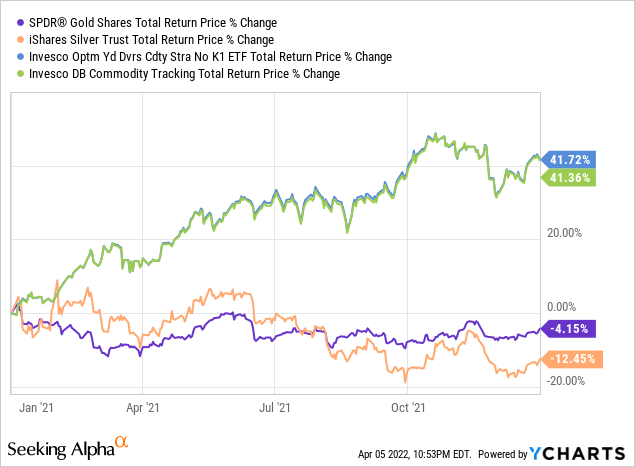

As an example, gold and silver, two of the most popular inflation hedges in the market, have not performed all that well since inflation picked up in 2021. Lots of reasons for this, including waning investor interest in these metals from younger investors. PDBC and DBC, with their diversified commodity exposure, performed much better, as the other commodities picked up the slack.

Diversification is key, and PDBC and DBC both provide it.

Risks and Negatives

Finally, both PDBC and DBC share the same risks and drawbacks. Three stand out.

First, both funds invest in futures contracts, which are costly investments. These costs reduce shareholder returns, a negative for both funds and their shareholders. On the other hand, both funds take steps to reduce these costs, by selecting comparatively cheap contracts, so costs are generally within reason.

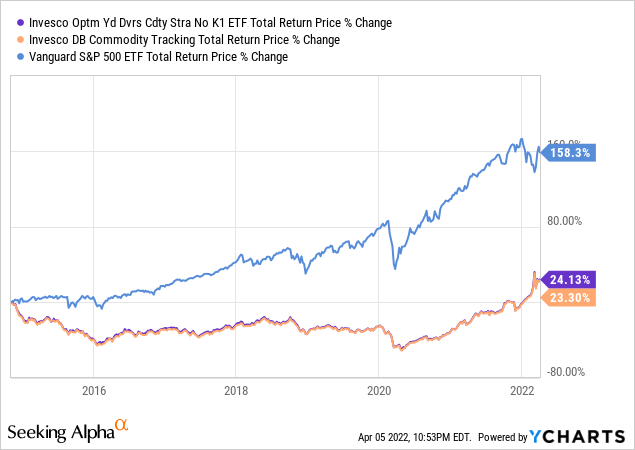

Second, both funds have extremely low long-term expected returns. This is because the underlying securities of both funds have no underlying cash-flows, earnings, or dividends. Stocks have dividends and buybacks, bonds have coupon payments, while futures contracts have, well, nothing of the sort. Prices can go up, but that is also true for bonds and equities. As such, both funds should underperform most asset classes in the long-term, as has been the case since inception.

Finally, both funds have counterparty risk. Both funds should see strong returns when commodity prices increase, assuming their counterparties have the necessary cash to fulfill the obligations set forth in the bought futures contracts. This is almost always the case, but there are exceptions. As an example, a few days ago the London Metal Exchange cancelled several nickel trades, as nickel prices skyrocketed, preventing a counterparty from fulfilling their contractual obligations. Contracts were cancelled, and profits were zeroed out. Although these situations are quite rare, they are not unprecedented, and are a constant risk.

Although PDBC and DBC are broadly similar funds, they do have two differences. Let’s have a look.

PDBC Versus DBC – Differences

Expenses

PDBC is slightly cheaper than DBC, with a 0.62% expense ratio for the former, versus a 0.85% expense ratio for the latter. PDBC is cheaper as it is a younger fund, and expense ratios have drifted down for decades due to strong competition in the industry.

PDBC’s lower expense ratio is a benefit for the fund and its shareholders, and should lead the fund to slightly outperform relative to DBC. This has been the case since inception, as expected.

In my opinion, considering the significant similarities between the two funds, PDBC’s lower expense ratio makes it the clear winner. I see no reason to overpay for simple index funds, so would pick PDBC over DBC.

Tax Reporting

Due to financial regulations, most commodity funds, including DBC, are structured as commodity pools, which means investors must file a K-1 form come tax season. These forms are something of a hassle, and a deal-breaker for many investors.

PDBC avoids these issues by investing in commodities through a subsidiary. As per financial regulations, doing so allows the fund to be structured as an open-ended fund, which does not require filing a K-1 form. PDBC’s simpler tax reporting requirements are a benefit for the fund and its shareholders, especially so for investors wishing to avoid the hassle of filing K-1 forms.

As an aside, PDBC’s structure also means that returns are distributed to shareholders as distributions, while DBC retains most of its earnings. This has no bearing on total returns, but does mean that PDBC’s distribution yield is higher than that of DBC, but that DBC’s capital gains are higher than those of PDBC. The discrepancy is quite large, with PDBC distributing 40% in income to shareholders in 2021. As mentioned previously, this did not have any impact on total returns, with DBC’s greater capital gains roughly equaling PDBC’s greater distributions.

Conclusion – PDBC is the Clear Winner

PDBC and DBC are two strong diversified commodity index ETFs. PDBC’s lower expense ratio and simpler tax reporting requirements make it the superior choice, although both share more similarities than differences.

[ad_2]

Source links Google News