“A 60:40 allocation to passive long-only equities and bonds has been a great proposition for the last 35 years… We are profoundly worried that this could be a risky allocation over the next 10.” – Sanford C. Bernstein & Company Analysts (January 2017)

“Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria” – Sir John Templeton

“Life and investing are long ballgames.” – Julian Robertson

Introduction

I have written a series of public articles on the bond market, starting in 2016, ultimately correctly, at least thus far, calling the secular top in sovereign bond prices (low in bond yields).

Since then, I have generally remained bearish on bonds, with a focus on the iShares 20+Year Treasury ETF (TLT), leaning against the prevailing market sentiment that lower for longer is here forever, or more recently, the narrative that a recession is around the corner, which evidence is starting to debunk.

An overview of my public writing on bonds reflects this view, highlighting the good and bad calls, and the consistency of my longer-term message.

TLT – Nowhere To Go But Lower (Long-Term Bond Yields Higher) – June 12th, 2019

Too Much Worry About Bonds – March 29th, 2019

Bond Bear Market Still Intact – March 15th, 2019

Lower For Longer Is No Longer Certain – October 8th, 2018

The Bond Bubble Is Bursting – Published On October 7th, 2016

Are We At The Point Of Maximum Financial Risk For Bonds? – Published On August 26th, 2016

The Bond Bubble Is About To Burst – Published On August 9th, 2016

The Irrational Fear Of Deflation – Published On June 17th, 2016

Inflation Is Coming, Are You Prepared? – Published On March 11th, 2016

Despite the peak in sovereign bonds in 2016, with the notable exception of German longer-term bond yields, which have made new lows recently (highs in terms of price), investor sentiment towards bonds has remained robust, with a record disparity between stock and bond flows, specifically money flowing out of equities, and into bonds.

With investors embracing the bond market at the tail-end of a nearly four-decade bull market, anticipating a series of dis-inflationary/deflationary outcomes, what if something different happens?

Investment Thesis

After a nearly 40-year bull market, U.S. bond prices are poised for a generational bear market, meaning higher bond yields.

TLT Keeps Rising With Equities

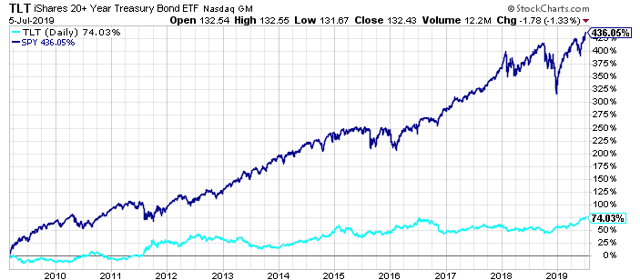

With the S&P 500 Index, as measured by the SPDR S&P 500 ETF (SPY), up 20.5% in 2019, the iShares 20+ Year Treasury ETF, has risen a healthy 10.4%.

(Source: Author, StockCharts.com)

This has continued a trend that has been ongoing for much of the current bull market in U.S. equities, which dates to March 9th, 2009.

(Source: Author, StockCharts)

(Source: Author, StockCharts)

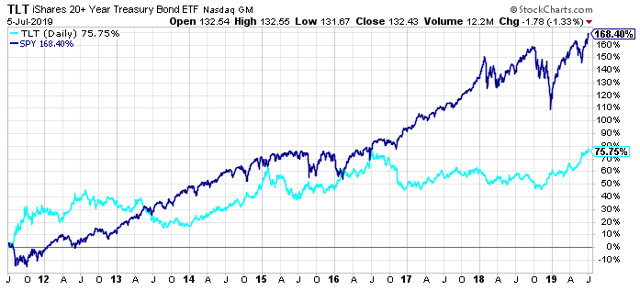

Looking at the chart above, since the middle of 2011, TLT has risen with equities, as U.S. stocks and bonds both became a safe-haven repository for global capital flows when global growth came in below expectations.

Thus, if you look at performance gap between SPY and TLT from June 30th, of 2011 through today, it is not nearly as big as the gap from March 9th, 2009 through today.

(Source: Author, StockCharts)

(Source: Author, StockCharts)

Ultimately, coming out of 2007-2009, there were genuine concerns about building inflationary pressures.

These concerns were vaporized with price action from 2011-2016, echoes of which remain today, as U.S. stocks and bonds have continued to rise in tandem, notably in 2019.

A Budding Reversal

Strictly looking at price charts, TLT appears to be losing its momentum on a daily basis, gapping lower with Friday’s better than expected Employment Report.

(Source: Author, StockCharts)

(Source: Author, StockCharts)

A bigger picture weekly chart shows how bullish the recent price action has been in TLT, with prices rising 26 of the past 35 weeks.

(Source: Author, StockCharts)

(Source: Author, StockCharts)

While bond bulls have been in charge, three of the past 4 weeks have been modest negative declines for TLT, potentially signalling that momentum is waning.

Bigger picture, on an unadjusted basis, meaning removing the impact of dividends and focusing on price action only, TLT is below its 2016 highs.

(Source: Author, StockCharts)

(Source: Author, StockCharts)

Undoubtedly, there has been a terrific rise in TLT since its late December 2018 lows.

The only question, now, in my opinion is where this rally peters out, and then, do we ultimately go lower than the late 2018 lows.

Bond Bulls Are Acting Euphoric

The famous Templeton quote applies here, specifically:

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.

– Sir John Templeton

Building on this narrative, there is certainly euphoria in the bond markets, indicated by record bond ETF inflows in the United States.

(Source: Bloomberg, State Street Global Advisors)

(Source: Bloomberg, State Street Global Advisors)

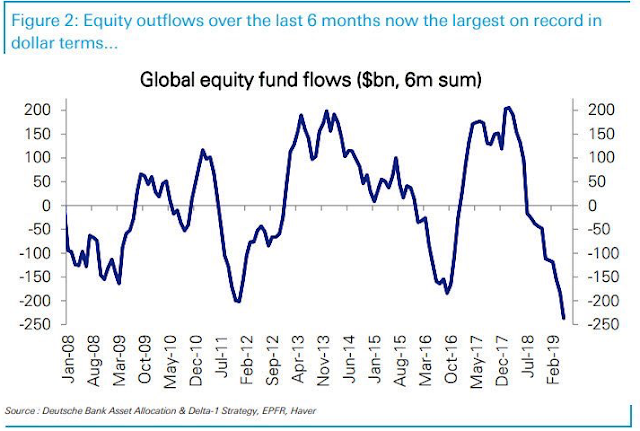

Prior to the record inflows into bond ETFs in June of 2019, State Street (STT) reported record withdrawals from equity ETFs in May of 2019.

This has continued a trend, with Deutsche Bank (DB) reporting record global equity fund outflows.

(Source: Deutsche Bank, EPFR, Haver)

With investors in record numbers retreating from equities, even with the S&P 500 index up 20% in 2019, and embracing the perceived safety of bonds, perhaps dis-inflationary/deflationary fears have finally peaked?

Closing Thoughts – Expect The Unexpected

Almost all investors are positioned for the lower for longer narrative, with most investors anticipating a near-term recession. This is reflected in sovereign bond prices, with a broad retrenchment in sovereign bond yields, despite a surging U.S. stock market. This has resulted in an interesting contrast, with investors exiting equities, and embracing bonds, as indicated by fund flows.

Concurrently, yield-oriented favorites, including REITs, as measured by the iShares U.S. Real Estate ETF (IYR) and the Vanguard Real Estate ETF (VNQ) have thrived, rising 21.5% and 22.2% respectively year-to-date in 2019, outperforming the S&P 500 Index. This out-performance has been prevalent for much of the current bull market, with a notable turn higher since 2011, as yield-oriented investments have become market leaders.

As someone who invested in REITs near their 2009 lows, including a substantial stake in First Industrial Real Estate (FR), Vornado (VNO), and General Growth Properties, all contrarian, deep value investments at that juncture, I never imagined the thirst for yield would reach the levels it has today, but that is what markets do, they go to farther extremes than almost anyone imagines.

Unfortunately, that is where we stand with the bond market today, in my opinion, specifically at an unsustainable extreme, because almost all investors have bought into, and adopted, the prevailing narrative. which is lower for longer, or a near-term recession.

Wrapping up, we are experiencing euphoria in real-time in the bond market, which ironically already made a secular top in 2016, in my opinion.

Bigger picture, commodities are historically undervalued compared to equities and bonds; bonds are at a dangerous precipice even compared to the building mania for passive investments. Fundamentals still do matter, fundamentals were always the wrong scapegoat, and I still believe 2019 is going to be a banner year for value equities, similar to 2000, as price discovery, after more than a decade of growth outperforming value, is poised to return with a vengeance.

To close, even though it has been a very difficult, more than decade-long stretch for value-oriented investors, with pockets of significant out-performance, including 2016, I think we are about to enter a golden age for active value investors who do the fundamental work, who can find the future free cash flow-leading companies in the most out-of-favor sectors, and the most out-of-favor equities, including this public write-up, will be at the forefront of this opportunity.

There is historic opportunity in the investment markets today. I have spent thousands of hours analyzing the markets, looking for the best opportunities, looking to replicate what I have been able to accomplish in the past. From my perspective, the opportunities in targeted out-of-favor equities today are every bit as big as the best opportunities in early 2016, and late 2008/early 2009. For further perspective on these opportunities, consider a membership to The Contrarian, sign up here to join.

Disclosure: I am/we are long SHORT TLT VIA PUT OPTIONS AND SHORT SPY IN A LONG/SHORT PORTFOLIO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Every investor’s situation is different. Positions can change at any time without warning. Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author’s opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies’ SEC filings. Any opinions or estimates constitute the author’s best judgment as of the date of publication, and are subject to change without notice.