[ad_1]

Introduction

Welcome to Orchid’s Palladium Weekly report, in which we discuss palladium prices through the lenses of the Aberdeen Standard Physical Palladium Shares ETF (PALL).

PALL continues to make all-time highs, having rallied a little bit more than 4% since our last update, in line with our very bullish view.

PALL benefits from positive tailwinds from a positive macro backdrop for the overall precious metals space, in addition to a tight physical market and momentum-based buying by the CTA community.

Although we acknowledge the strong performance of PALL so far this year (+33% YTD), we believe that upward pressure could continue further due to the structure tightness of the palladium market – proxied by the backwardation in forward spreads.

In this regard, we maintain our September high forecast of $166/share, representing a ~5% upside from its current level.

Source: Trading View, Orchid Research

About PALL

For investors seeking exposure to the fluctuations of palladium prices, PALL is an interesting investment vehicle because it seeks to track spot palladium prices by physically holding palladium bars, which are located in JPM vaults in London and Zurich. The vaults are inspected twice a year, including once randomly.

The Fund summary is as follows:

PALL seeks to reflect the performance of the price of physical palladium, less the Trust’s expenses.

Its expense ratio is 0.60%. In other words, a long position in PALL of $10,000 held over 12 months would cost the investor $60.

Liquidity conditions are poorer than that for platinum. PALL shows an average daily volume of $3 million and an average spread (over the past two months) of 0.33%.

Speculative positioning

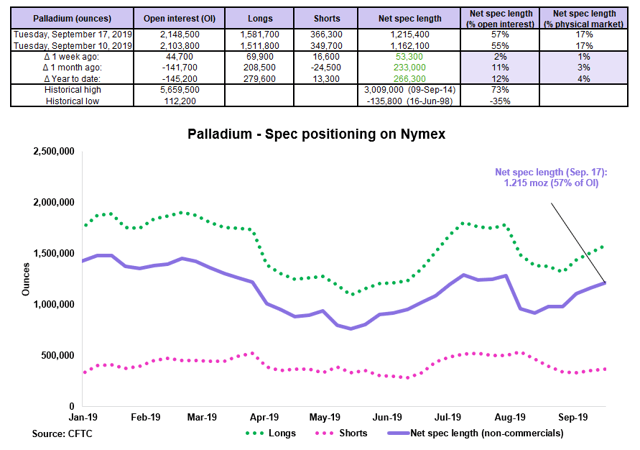

Source: CFTC, Orchid Research

Speculators lifted their net long exposure to Nymex palladium in the week to September 17, for a third straight week.

Over the latest reporting period of September 10-17, the net spec length rose by the equivalent of 53,300 oz, representing 2% of open interest.

The net spec length is now up 266,300 oz (~12% of open interest) since the start of the year.

However, at 57% of open interest, the present net speculative length in Nymex palladium is still far below its historical high was 73% of open interest.

Implications for PALL: Given the large room for additional speculative buying in Nymex palladium in the near term, we hold the view that palladium spot prices could move higher from here, which is positive for the performance of PALL.

Investment positioning

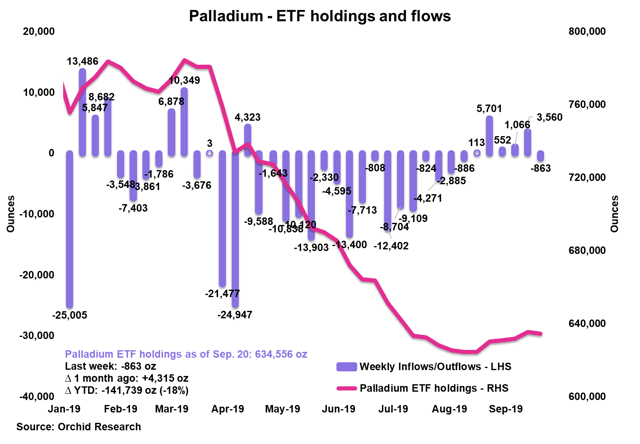

Source: Orchid Research

ETF investors left their palladium holdings little changed in the week to September 20, according to our estimates.

ETF investors have been quiet since August. This comes after an intense wave of selling of 148,000 oz in the first seven months of the year.

Interestingly, the marked appreciation in palladium spot prices since the start of the month (+8% MTD) has failed to stimulate palladium supply by inducing ETF investors to liquidate their holdings.

If current palladium ETF holdings prove “sticky” due to the large presence of long-term holders, the tightness of the palladium market could become even deeper.

Implications for PALL: The lack of outflows from palladium ETF holdings prevents the tightness in the market from easing. This should therefore result in even tighter forward spreads and much higher palladium spot prices, which is positive for PALL.

Auto trends

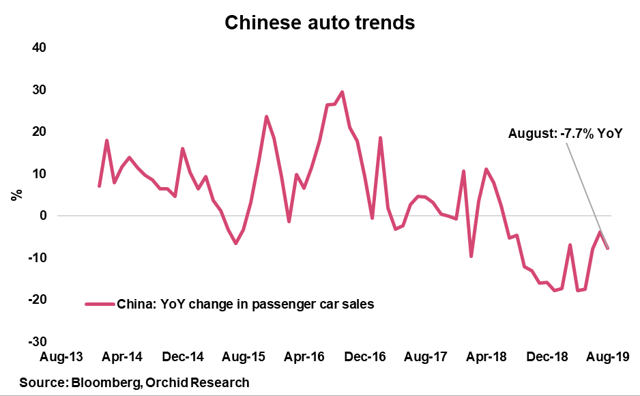

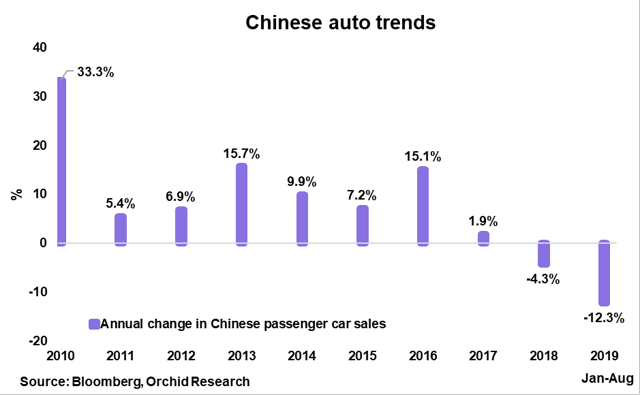

In China (24% of automotive demand), auto sales continued to disappoint last month.

Passenger car sales dropped 7.7% YoY in July, marking a 14thmonth of uninterrupted decline, according to the CAAM. In January-August, sales contracted by 12.3% YoY, after a fall of 4.3% YoY in the whole of 2018.

Source: CAAM, Orchid Research

Source: CAAM, Orchid Research

However, Chinese authorities have considered a removal of restrictions on auto purchase.

The China’s Guizhou province, Guiyang, is the third city to end restrictions to new vehicle sales. According to SFA:

Licence plates for vehicles permitted to drive in downtown Guiyang were previously capped at 24,000 units annually in a bid to ease congestion. Guangzhou and Shenzhen agreed in June to allow an additional 100,000 and 80,000 new vehicles to be sold, respectively.

This could result in a recovery in car sales growth in the coming months, which could in turn boost autocatalyst demand for palladium.

This is consistent with the CAAM’s projections, namely – a decline of 5% YoY for passenger car sales in the whole of 2019, implying a noticeable recovery in final quarter of the year.

Implications for PALL: Since we expect the growth in Chinese auto sales to recover in the final months of the year, driven by the recent easing of restrictions and the easing measures implemented by domestic fiscal and monetary authorities, we think that autocatalyst demand for palladium could get a boost in Q4 2019, which should be positive for PALL.

Closing thoughts

We expect PALL to move further higher toward our imminent target of $166 per share, implying a 5% upside from here.

Upward pressure in PALL will be driven by 1) positive macro tailwinds benefiting the broad-based precious metals space, 2) a lack of ETF outflows exacerbating the physical tightness, 3) expectations for a recovery in growth in Chinese auto sales boosting autocatalyst demand, and 4) momentum-based buying by the CTA community.

Did you like this?

Click the “Follow” button at the top of the article to receive notifications.

![]()

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our research has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. Therefore, this material cannot be considered as investment research, a research recommendation, nor a personal recommendation or advice, for regulatory purposes.

[ad_2]

Source link Google News