[ad_1]

Publishing on Seeking Alpha you quickly get a sense of whom the community is meant for, above average investors who have a tendency to do it themselves and for whom the feeling of “I Did it!” generally means more than the eventual risk.

While that is true, there are also many investors who choose to take that approach with only a small percentage of their overall investment portfolio while leaving the majority of their retirement assets in managed money products such as ETFs, mutual funds or actively managed accounts.

The reality is, life gets in the way of due diligence and active self-directed investors simply cannot do this part time.

In that spirit, a few years ago I covered a series of ETFs which were meant for investors who believe in passive ETFs, yet wanted an easy way to apply a fairly proven strategy. Those funds are the PACER ETF Trendpilot series of funds.

If you have not done so already, do take a look at my complete article on the funds here, “Index Investing For The Lazy (Or Short On Time).”

The strategy is available for 3 domestic and 2 international series however today I wanted to focus on the Pacer Trendpilot US Large ETF (PTLC) and see how the fund performed during Q4 2018.

Investment Case

The investment case for the fund is fairly simple. You want to have exposure to the market but you want a one ticket solution to a simple yet effective investment strategy.

For a complete investment case, please take a look at my initial article, “Index Investing For The Lazy (Or Short On Time).”

Fund Basics

- Sponsor: PACER ETFs

- Index: Pacer Trendpilot US Large Cap Index

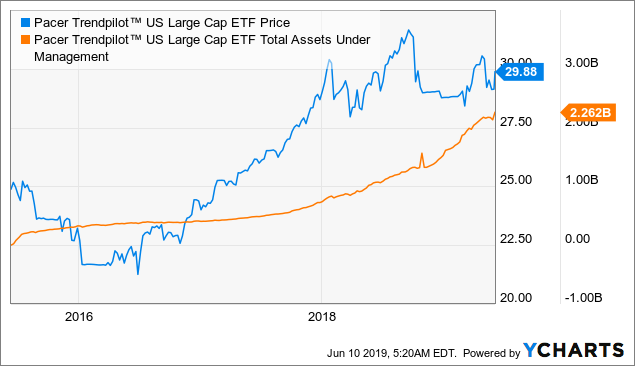

- AUM: Approximately $2.262 billion (6/7/2019)

- Historical Style: US Large Caps

- Investment Objectives: Seeks to track the total return performance, before fees and expenses, of the Pacer Trendpilot US Large Cap Index.

- Number of Holdings: 509 securities.

- Current Yield: 1.9% distribution yield

- Inception Date: 6/11/2015.

- Fees: .60%

Source: YCharts & PacerETFs

The Index and The Fund

I quite admire PACER ETFs and am quite happy they have been successful in raising equity for their smart-beta strategies.

The Pacer Trendpilot US Large Cap ETF follows the Pacer Trendpilot US Large Cap Index.

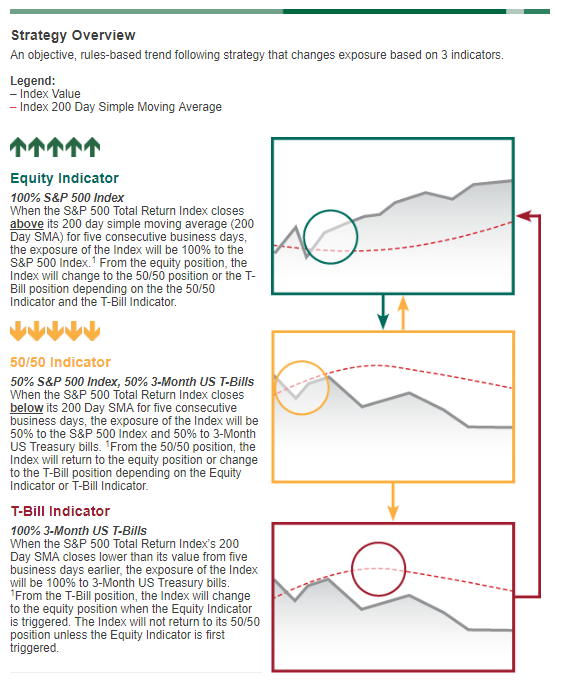

The index is designed to participate in the market when it is trending up, pare back exposure during short-term down trends and by going into T-Bills during long-term market down trends.

What’s a great teaching moment here is that it is critical to look at the underlying index, especially if it is a proprietary index that is designed to track another sub-index.

While PTLC has always followed the “Pacer Trendpilot US Large Cap Index,” the index itself switched from following the Wilshire US Large Cap Index, which are the 750 largest companies in the Wilshire 5000 Index, to now following the S&P 500.

As mentioned, the index has 3 investment stances, “full invested,” “partially invested” and “Cash,” which is determined by the underlying index value and the relatively 200 day, SMA, or simple moving average.

Source: Pacer ETFs

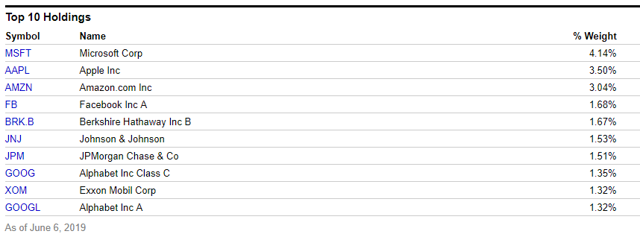

Turning to the fund, we can indeed find that it’s a typical S&P 500 ETF.

Looking at the top 10 holdings shows us a fund consistent with most “market cap weight” capitalization methodologies.

The top 10 holdings represent just over 21% of the fund with the top holdings being Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Facebook (FB) and Berkshire Hathaway B (BRK.B). Source: YCharts

Source: YCharts

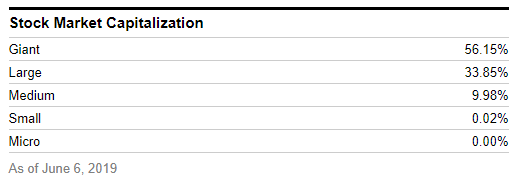

Consistent with a large cap fund, the vast majority of the holdings are either Large or Megacap stocks.

Moving on, as I remind investors in such niche ETFs,

One of the critical things to watch with new ETFs is their capital raise.

Running an ETF is not cheap and there are always questions as to how long a sponsor will keep the fund open if it does not raise sufficient capital in order to generate income for the sponsor to keep the fund going. Over the past few years, we have covered a number of funds which seemed like great ideas, yet were not successful in their capital raise and were forced to shut down.

Source: “Fidelity MSCI Real Estate Index ETF: Sometimes ‘Broader’ Is Better.”

The most recent example of that was Janus Henderson closing one of my favorite fixed income funds, the Janus Henderson Quality Income Fund (SGQI) which I wrote about previously.

What is important here is that PACER is not a huge ETF sponsor and has also had to close down exchange traded products in the past due to insufficient capital raises and acceptable trading volumes.

Fortunately, the fund has done a tremendous job raising equity and is now sitting at over $2.25 billion in assets under management.

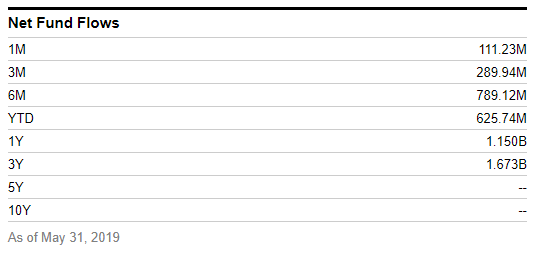

Data by YCharts

Data by YCharts

What is quite impressive is that most of this came from the capital raise rather than market performance. Most impressive is that the fund essentially doubled their assets under management in just the last 12 months!

So is the fund “less risky?”

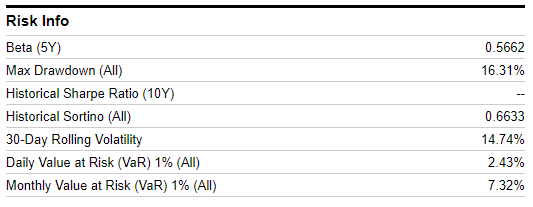

Looking at the risk statistics provided by YCharts, we can see how the fund compares against the S&P 500. What we find is that fund has a five-year beta of .5662 vs. the S&P 500 and had a maximum draw down of 14.74%.

What this tells us is that yes, the fund absolute cut it’s volatility!

Performance

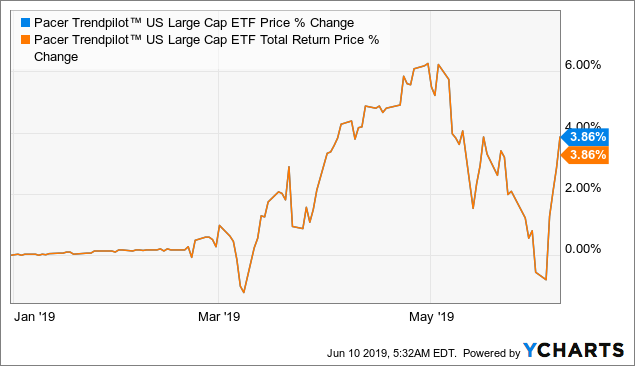

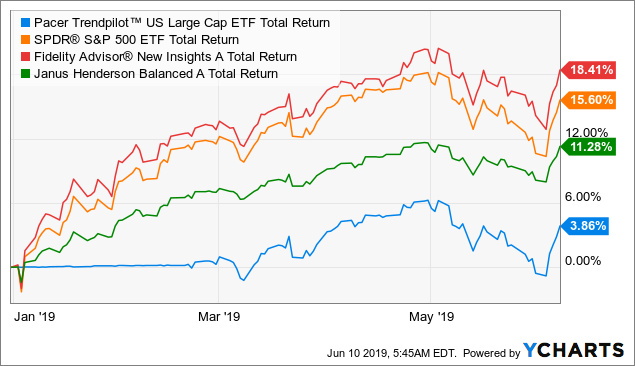

Year to date, the fund has done okay and achieved a 3.86% total return. This is the same as the underlying price per share as the fund had not yet paid out any dividends.

What’s important to note is that the fund was flat through March as it was not invested and was sitting on the sidelines in cash/t-bills.

Data by YCharts

Data by YCharts

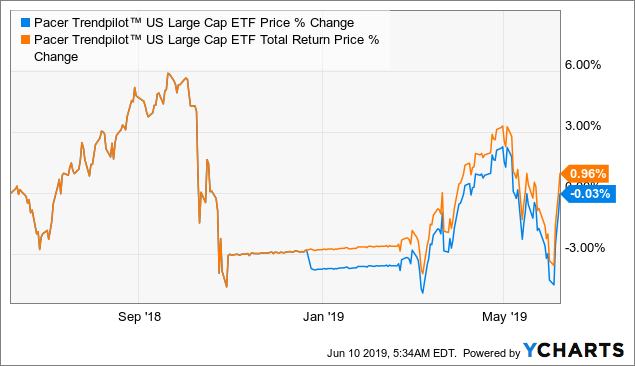

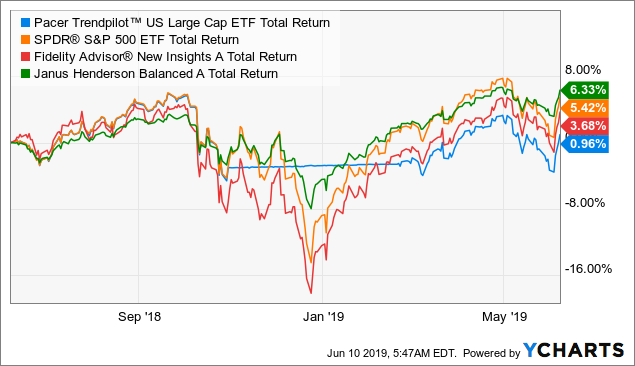

Over the previous 12 months the fund is essentially flat with a .03% drop in the price per share and a .96% total return. As we can clearly see, the fund cut it’s exposure around October and remained in cash through March.

Data by YCharts

Data by YCharts

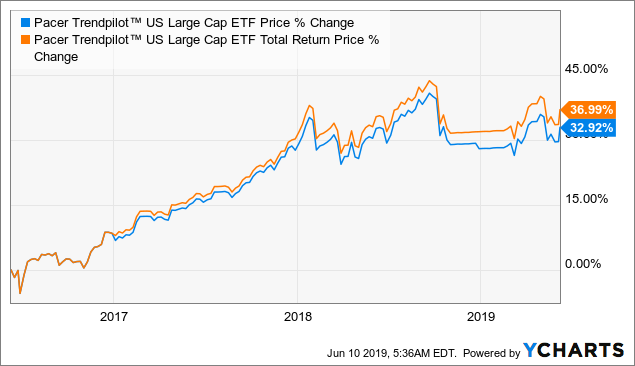

Looking back three years, we see the “on the sidelines” position of the fund.

During this time, the fund achieved a 36.99% total return while the underlying price per share increased 32.92%.

Data by YCharts

Data by YCharts

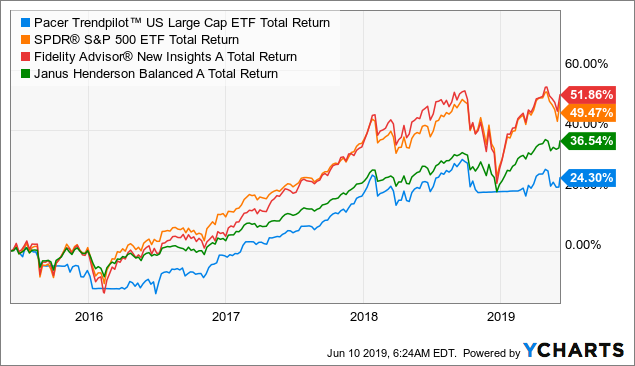

Since inception, the fund has achieved positive returns with a 24.3% total return and a 20.1% increase in the price per share.

We can further see 3 periods of time when the fund remained on the sidelines during sell offs.

Data by YCharts

Data by YCharts

So what about if you had just invested in the S&P 500 index through the (SPY)? What about an actively managed fund such as the popular Fidelity New Insights mutual fund (FNIAX)? Or perhaps a solid “go-anywhere” balanced fund such as the Janus Balanced Fund (JDBAX)?

As we can see, year to date, all of the funds achieved positive returns. The difference is, the Pacer ETF lagged far behind simply due to remaining in cash through March, during the time when the equity markets had the sharpest rebound.

Further of note, the actively managed Fidelity fund outperformed the S&P 500.

Data by YCharts

Data by YCharts

Over the previous 12 months, we once again see PTLC has lagged although the difference was not as big.

Further of note, the fund did lead during Q4 when it correctly went into cash.

Data by YCharts

Data by YCharts

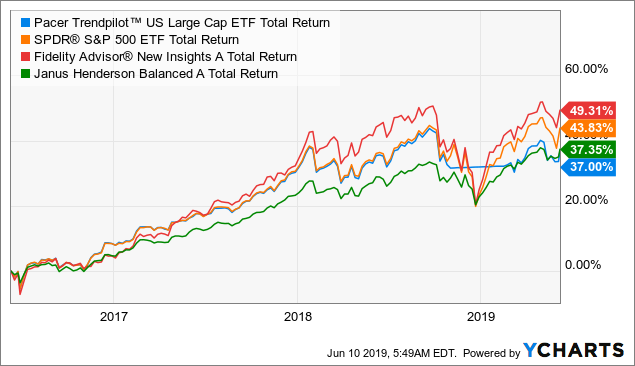

Looking back three years, we continue to see the trend play out, the Trendpilot ETF keeps up with the SPY during the time it is participating in the market, correctly cuts it losses however starts lagging when it continues to stay on the sidelines as the market recovers.

Data by YCharts

Data by YCharts

Looking further back through to inception we continue to see this trend play out.

Seemingly, investors would be better off by simply investing in a “balanced” type fund.

Data by YCharts

Data by YCharts

Bottom Line

It’s quite peculiar.

On one hand, the fund had meaningfully lagged it’s underlying benchmark, the S&P 500 and the actively managed equity funds since it’s inception.

On the other hand… you can’t hold it against the fund as it did precisely what it was supposed to!

The overall strategy is fundamentally sound and would identify and save investors money in a prolong market correction.

The reason why it is lagging is not that it incorrectly identified downturns but rather that the 200 day simple moving average is too long a time to wait to get back into the market. As we know, the majority of the gains come in the first part of the rebound.

So does this mean the fund is doomed to fail?

No, I don’t believe so. I believe if your goal is to avoid the long term losses that we would see in a major recession, this fund would correctly identify those markets. The few percentage points that the fund would give up waiting for the 200 day SMA to bounce back would likely be offset by the money saved correctly identifying a major downturn.

One thing for certain is that the fund has been successful in raising equity and I believe changing over from the Wilshire Large Cap 750 to the S&P 500 will continue to help attract capital from both retail and institutional investors who are benchmarked to the S&P 500.

So can an active investor replicate this strategy and perhaps modify it a bit better?

Yes, they can.

But the entire premise is that it relies on the investor staying on top of the strategy and that is precisely the point. Will they? Will you?

Let me know in the comments below.

We all know, it’s not about how much you make, but about how much you keep. My focus will be on the latter — making sure you preserve the income that you earn.

We all know, it’s not about how much you make, but about how much you keep. My focus will be on the latter — making sure you preserve the income that you earn.

With every new research article, Income Idea subscribers will be able to see a detailed analysis along with our take on the investment and the sponsor, along with actionable ideas and strategies of how to implement it into your portfolio if we feel it belongs there.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News