[ad_1]

Investment Thesis

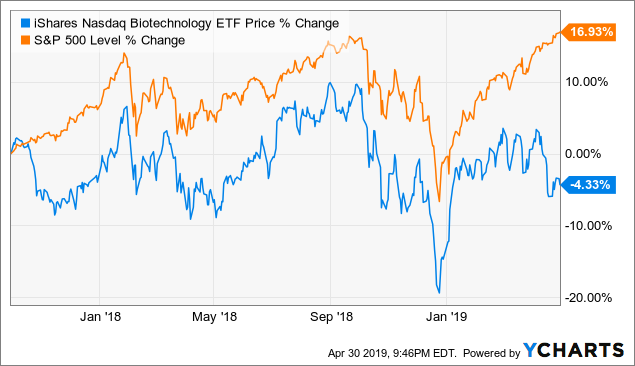

As shown above, the iShares Nasdaq Biotechnology ETF (ticker: IBB) has underperformed the market over the past 18 months. The primary culprit for such lagging investment returns stems from reduced valuations via multiple contraction. Not only have some companies seen its top- and bottom-line growth figures contract a bit recently, but intense discussions surrounding regulation of the biotech industry has led to substantial increases in the cost of equity. The focus of this investment thesis is on the later, as the cost of equity seems to have exaggeratedly increased beyond reasonable levels, providing an enticing opportunity for tactical investors. The risk/reward profile of the biotech subsector has not been this attractive in many years; hence the overweight recommendation.

Sector Overview

The biotech subsector is constantly in the news, as drug price regulation seems to be the popular topic among politicians. However, a divided Congress has resulted in little action. Though the potential to control drug prices would have substantial consequences for the biotech space, there is nothing concrete on the horizon that should cause inflated cost of equities for the underlying companies. As is the case with every investment, uncertainty is the only certainty.

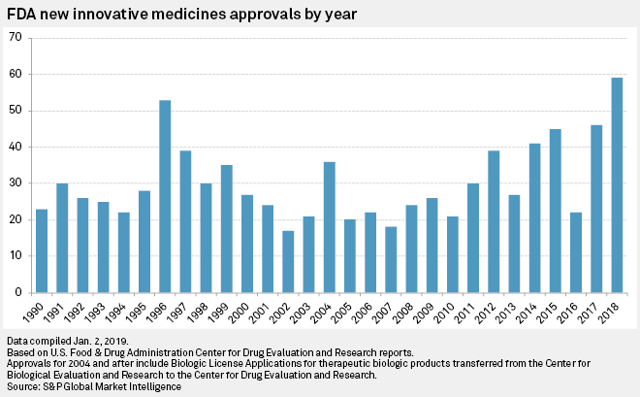

Aside from political influences, the biotechnology subsector (along with the entire healthcare industry) encompasses several long-term tailwinds that should allow companies to grow substantially. Drug manufacturing pipelines appear robust and the FDA continues to approve new medicine in record fashion:

In addition, an aging demographic in the U.S. helps keep demand high for new and existing drugs; a non-cyclical feature associated with the industry. Furthermore, societal benefits from medical innovation are an indefinite opportunity for healthcare companies (ie. cures for diseases, life-saving procedures, etc).

Valuation

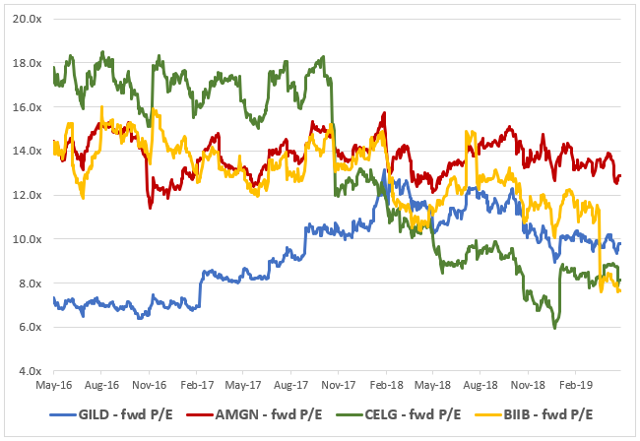

Throughout the biotech subsector, valuations of individual companies have contracted materially over the past couple of years. Though results of individual companies likely impacted the entire subsector somewhat, the general downtrend in valuation has coincided with increased fears of regulation. The chart below displays the forward P/E ratios for the top four holdings of IBB, which cumulatively account for over 30% of the portfolio:

[source: S&P Capital IQ]

As shown, trading multiples started compressing in the fall of 2017, the same point in time when IBB started underperforming the overall market.

The divergence between IBB and the stock market has created an intriguing opportunity for investors. The fund’s forward P/E ratio is ~20.0x (as of 4/30/19), compared to ~17.0x for the S&P 500. However, earnings growth within the biotechnology subsector is poised to materially outperform the S&P 500 over the intermediate term, as evident based on the top 10 holdings discussion below. Therefore, the market must be pricing in a much higher cost of equity for biotech stocks. Though this subsector is vulnerable to significant regulation risk, the added risk premium seems unreasonably high. It is difficult to generalize about all the stocks within the biotech space, especially as individual company results differ drastically and contributions to IBB dynamically evolve. However, it is quite clear based on IBB’s top 10 holdings that valuations seem disconnected based on past and expected results.

Top 10 Holdings – Company Highlights

Presented below is a brief discussion highlighting FY 2018 results for each of the top 10 holdings within IBB. The information barely scratches the surface in regard to the investment outlook of each stock. However, there are certain stock metrics that are consistent within the portfolio that emphasize the upside potential of this subsector, such as future growth, analyst ratings, and (generally) healthy balance sheets. For an in-depth analysis of each company, please visit the respective article page for detailed information discussing corresponding investment potential.

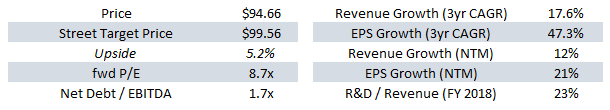

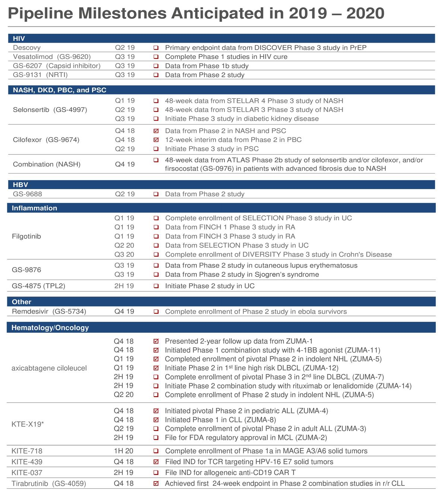

Celgene Corp (ticker: CELG)

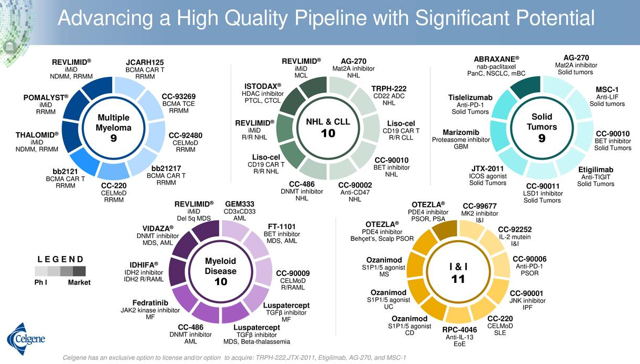

CELG sales from the REVLIMID, POMALYST/IMNOVID, and OTEXLA drugs grew nicely in FY 2018 (up 18%, 26%, and 25%, respectively). Total revenue growth is expected to be 12% in FY 2019 and 13% in FY 2020. It incurred R&D expenses of $3.5b in FY 2018 (23% of revenue); an increase of ~200bps Y-o-Y. There is $2.8b authorized in its share repurchase program; CELG purchased ~$6b of shares in FY 2018. Bristol-Myers (ticker: BMY) recently entered into a $74b acquisition agreement of CELG, which will likely close in 3Q19. CELG shareholders also receive one Contingent Value Right (CVR) of $9.00/share upon the FDA approval of ozanimod (by December 31, 2020), liso-cel (JCAR017) (by December 31, 2020) and bb2121 (by March 31, 2021). Below is an illustration of CELG’s current pipeline:

[source: IR Presentation]

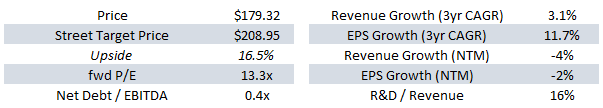

Gilead Sciences (ticker: GILD)

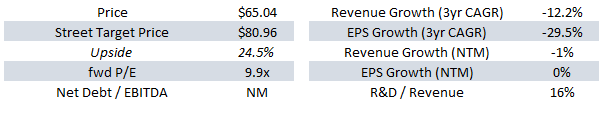

GILD’s HIV franchise grew 12% Y-o-Y in FY 2018; 77% of U.S. treatment volume comprised of its Descovy portfolio. HCV franchise detracted from results and will continue to do so indefinitely. It incurred R&D expenses of $3.5b in FY 2018 (16% of revenue); an increase of 300bps Y-o-Y, primarily due to support growth following acquisition of Kite. As of 12/31/18, $5.1b was authorized in its share repurchase program (~6% of market cap). Total revenue growth is expected to decline in FY 2019 and grow low-single-digits thereafter. GILD’s current pipeline:

[source: IR presentation]

Amgen (ticker: AMGN)

AMGN’s revenue growth has been disappointing recently, though international sales grew 10% in FY 2018, driven by 14% volume growth. Its Hematology/Oncology portfolio grew 14%. It incurred R&D expenses of $3.7b in FY 2018 (16% of product sales); flat Y-o-Y from FY 2017. Analysts expect future revenue growth to be at a low-single-digit clip for the next few years. In FY 2018, AMGN repurchased ~$18b of shares and paid $3.5b in dividends. As of 12/31/18, $5b remains authorized for further share repurchases. For more company highlights, please reference the recent IR presentation.

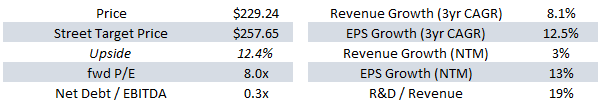

Biogen (ticker: BIIB)

BIIB has been active in acquisitions and divestures recently:

- Agreed to sell Hillerod facility to FUJIFILM for up to $890mm

- Agreed to acquire Nightstar Therapeutics

- Discontinued aducanumab

Revenues grew almost 10% in FY 2018, as its biosimilars business grew 28% Y-o-Y in 4Q18. It incurred R&D expenses of $2.5b in FY 2018 (19% of product sales); a 100bps increase from FY 2017. BIIB’s authorized share repurchase program totals $5b for FY 2019. Its current pipeline includes:

[source: IR presentation]

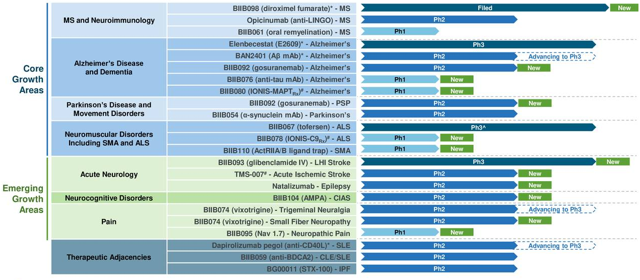

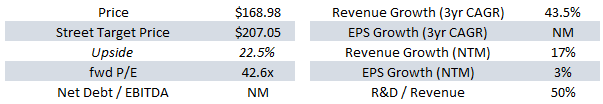

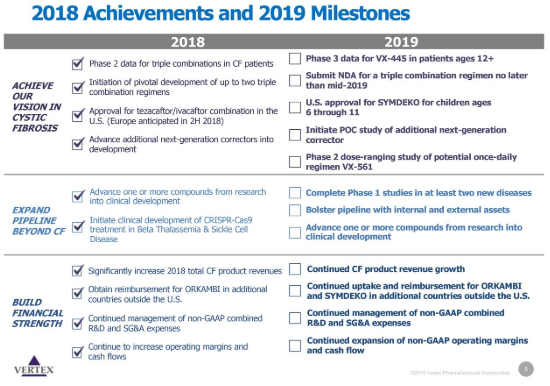

Vertex Pharmaceuticals (ticker: VRTX)

VRTX’s main focus is on treating cystic fibrosis and management is very encouraged by its triple combination regimens, as they have the potential to treat up to 90% of CF patients. Its success is highlighted by CF product revenue growth of 40% Y-o-Y in FY 2018. It incurred R&D expenses (combined with SG&A) of $1.5b in FY 2018 (50% of product sales); down from 61% of product sales in FY 2017. There is $500mm of share repurchases authorized by the board of directors. Its current pipeline includes:

[source: IR presentation]

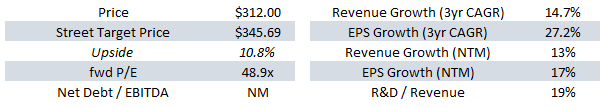

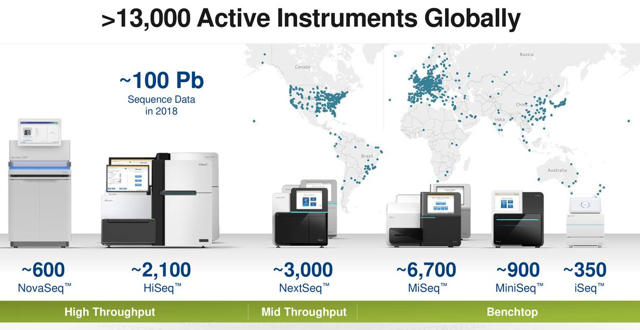

Illumina (ticker: ILMN)

ILMN reported successful results in FY 2018 as revenue grew 21% Y-o-Y and EBITDA grew 34% Y-o-Y. International sales account for 47% of total revenue (as of FY 2018) and grew 25% Y-o-Y. It entered into an agreement to acquire Pacific Biosciences of California, which is expected to close mid-2019. ILMN reported a backlog of $900mm+ as of FY 2018. It incurred R&D expenses of $623mm in FY 2018 (19% of total revenue) and $546mm in FY 2017 (20% of total revenue). Its board authorized a $500mm share repurchase plan as of 2/6/19 (% of market cap). Its current pipeline includes:

[source: IR Presentation]

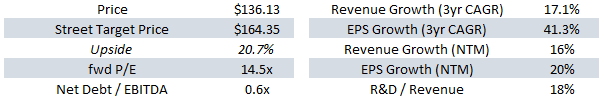

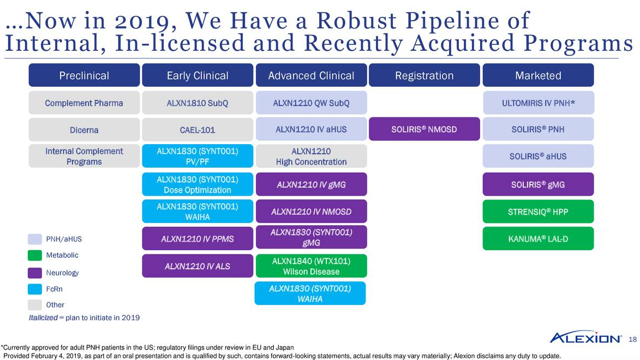

Alexion Pharmaceuticals (ticker: ALXN)

ALXN revenue grew 16% Y-o-Y in FY 2018, including 20% growth in volume. Its 2019 outlook is quite optimistic, as management expects continued strength in SOLIRIS/ULTOMIRIS. For example, U.S. gMG patients taking SOLIRIS increased from 43 (as of 12/31/17) to 788 (as of 12/31/18). In addition, its ULTOMIRIS conversion goal is 70%+ within first two years of launch. ALXN expects R&D to be 18% of total revenue in FY 2019 (relatively flat vs. FY 2018, though down 700bps from FY 2017). As of 4/23/19, there is $430mm remaining on the share repurchase program (% of market cap). Its current pipeline includes:

[source: IR presentation]

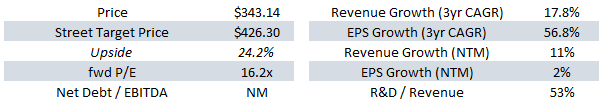

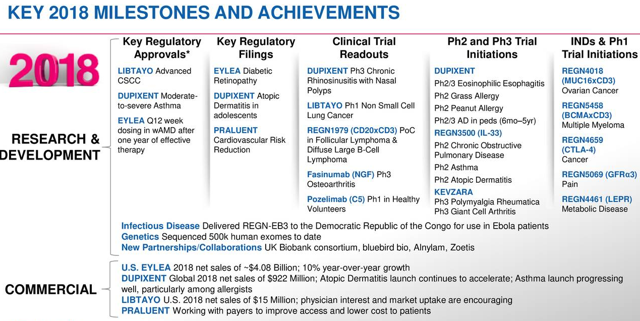

Regeneron Pharmaceuticals (ticker: REGN)

IN FY 2018, REGN grew revenue and EBITDA by 14%. Its R&D expenses were 53% of net product sales as of FY 2018; down 300bps from FY 2017. Its current pipeline includes:

[source: IR Presentation]

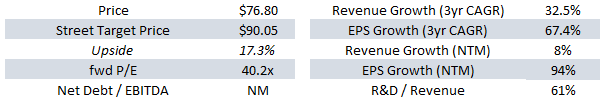

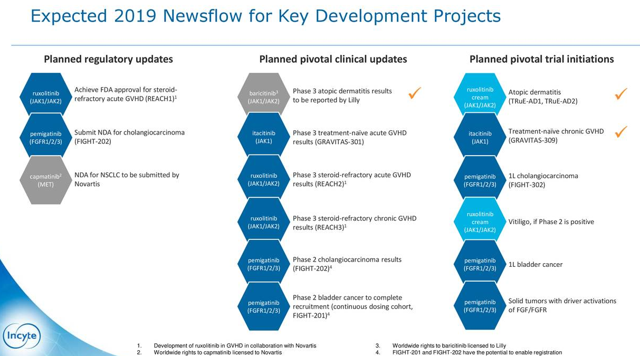

Incyte (ticker: INCY)

INCY reported 25% growth in product-related revenue in FY 2018. Management expects its Jakafi product revenue to exceed $2.5b in the long-term; reported $1.4b as of FY 2018. Its R&D expenses totaled 61% of revenue as of FY 2018; down 300bps from FY 2017. Its current pipeline includes:

[source: IR presentation]

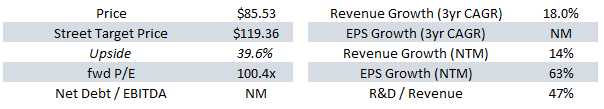

BioMarin Pharmaceutical (ticker: BMRN)

BMRN recently reported seven approved products that are expected to deliver $2b in revenue in FY 2020. It achieved 14% revenue growth in FY 2018. Its R&D expenses were 47% of net product sales in FY 2018; down 100bps from FY 2017. Its current pipeline includes:

[source: IR presentation]

Risks To Investment Thesis

The primary risk associated with an overweight thesis to the biotechnology subsector is regulation. Political motivations to regulate the prices of drugs (and other healthcare services) will cloud over this industry indefinitely. Unfortunately, this risk is difficult to quantify because of the uncertainty surrounding government intervention. However, if regulation does increase within the industry, IBB investors should expect further underperformance relative to the overall market. Furthermore, there are numerous company-specific risks that can affect the performance of this subsector in the short-term. However, industry tailwinds should smooth out the results over time.

Conclusion

The healthcare industry, and specifically the biotechnology subsector, have numerous tailwinds over the long-term. The recent divergence between IBB and the overall market likely stems from increased fears over increased regulation. However, the current cost of equity for the subsector seems to have priced in a good amount of that risk, leaving plentiful upside should regulatory actions continue to be tabled indefinitely. Therefore, overweighting IBB provides an attractive opportunity to generate alpha.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information presented is based upon sources and data believed to be accurate and reliable.

[ad_2]

Source link Google News