[ad_1]

Mlenny/E+ via Getty Images

Overview

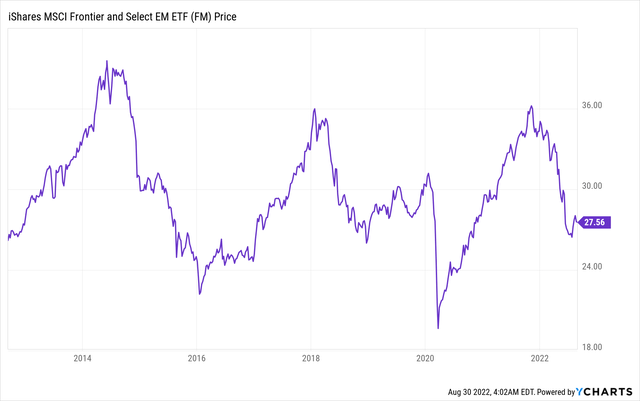

Frontier and select smaller emerging markets are intriguing long-term investment opportunities, tracked by ETFs like the iShares MSCI Frontier and Select EM ETF (NYSEARCA:FM). I am worried about various macroeconomic and political risks present this year, which will unlikely be resolved in the short term. However, I am still beginning to monitor select frontier and emerging markets. These markets have significantly underperformed the S&P during the past decade and trade at attractive levels. While the current price levels are certainly not at an absolute bottom, now is a solid time to hold or look for value in certain countries.

Ycharts

I am comfortable monitoring frontier/emerging markets stocks trading at the levels seen in 2010-2013. However, I think that frontier markets are facing multiple headwinds and that this ETF will most likely decline to the 2020 lows.

ETF Overview

Many frontier and emerging market ETFs ignore select key markets and fail to invest in listed equities directly in this market. In a previous article, I mentioned how the top holdings of a lot of emerging market funds were very similar and how some of these ETF products did not provide meaningful exposure to smaller, but significant markets. However, other ETFs invest a large % of the fund into equities listed directly in these markets. This is very difficult for retail investors to replicate on their own, which makes these products a worthwhile investment. On the other hand, a retail investor could easily invest in some of the top holdings of other larger emerging market funds.

The iShares MSCI Frontier and Select EM ETF is one vehicle to consider if you prefer a fund that invests directly in listed equities in smaller markets. Although it primarily focuses on frontier markets, it also focuses on smaller emerging markets with frontier characteristics. Some of these smaller emerging markets become overlooked by EM funds because they sometimes only make up less than 0.2% of the index. Frontier and emerging market ratings often change over time. It is not uncommon for markets to be upgraded to emerging market status, then downgraded to frontier market status later (i.e. Pakistan) or to the stand alone index (Argentina).

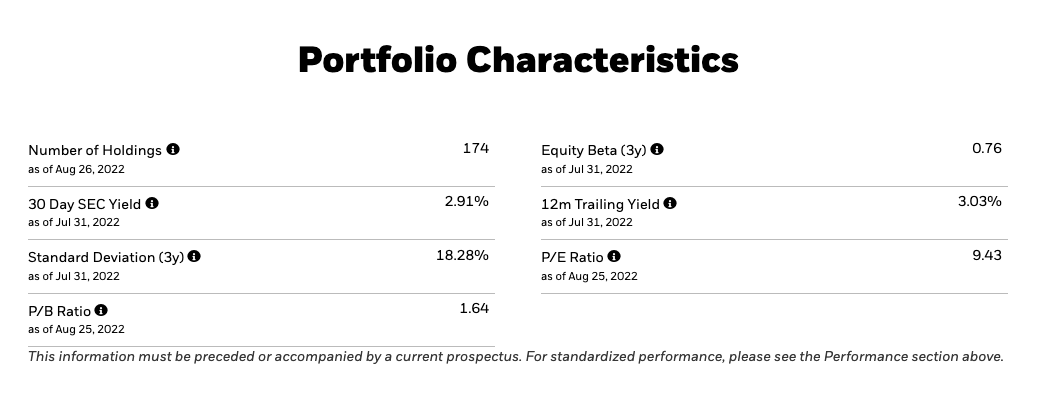

iShares

The iShares MSCI Frontier and Select EM ETF charge a 0.79% fee and currently have an approximate 3% dividend yield. This fund trades at a slightly lower valuation than the MSCI frontier markets Index, which trades at around 10.9x PE. The lower valuation is somewhat attractive but also reflects the relatively higher macro and political risks in many of these markets.

Country Bets

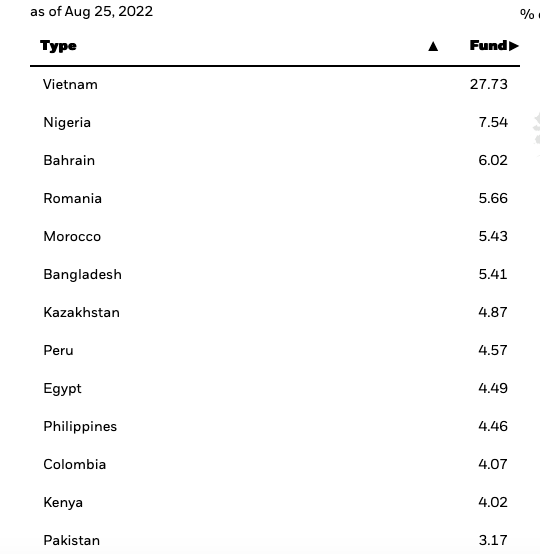

The ETF makes several modifications relative to the MSCI frontier market index, which makes it worth considering. It also invests in several emerging markets, including Peru, the Philippines, Egypt, and Colombia.

IShares

The MSCI frontier market index has a similar country weighting for several markets (Vietnam/Bahrain), although there are many differences between this index and the iShares MSCI Frontier and Select EM ETF.

MSCI

Key Differences

Stronger Bet on Nigeria: This ETF makes a larger and somewhat unpopular bet on Nigeria, as Nigeria is the second largest country in this ETF. Nigeria accounts for around 7.5% of this ETF, while Nigeria is currently not even a top 5 country in MSCI Frontier markets. Nigeria has substantially underperformed frontier markets and global equities, even with oil rallying this year.

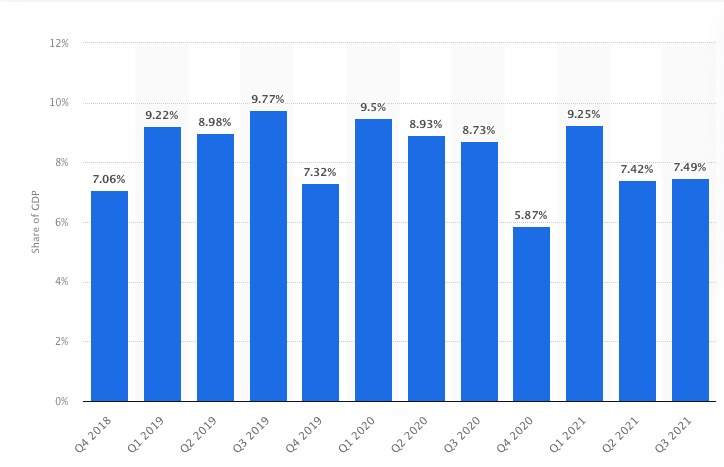

Oil’s Contribution to GDP

Trading Economics

The oil sector accounts for 7-10% of Nigeria’s GDP. Nigeria’s stock market has still not rebounded, despite the rapid increase in oil prices this year, largely due to the political and currency risks.

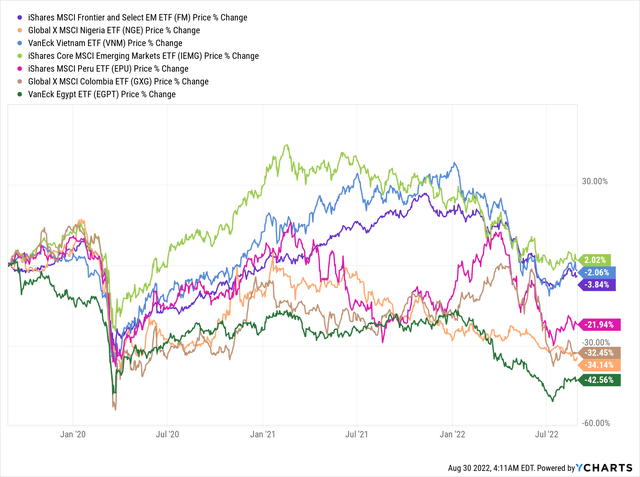

3-Year Relative Performance

Ycharts

Nigeria has also substantially underperformed ( -34%) other frontier markets and emerging markets during the past three years. Nigeria underperformed both the MSCI frontier and emerging markets, and almost all of the ETF’s top 10 countries.

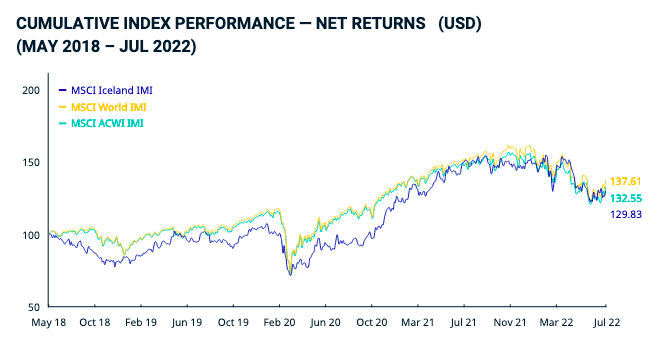

Not Including Iceland: This ETF does not invest in Iceland, even though Iceland is one of the top 5 countries in the MSCI Frontier Markets Index. Iceland has more or less performed in line with global equities, while many frontier markets have underperformed and overperformed during certain time periods. Overall, it makes sense to exclude Iceland if you are aiming for uncorrelated returns.

MSCI

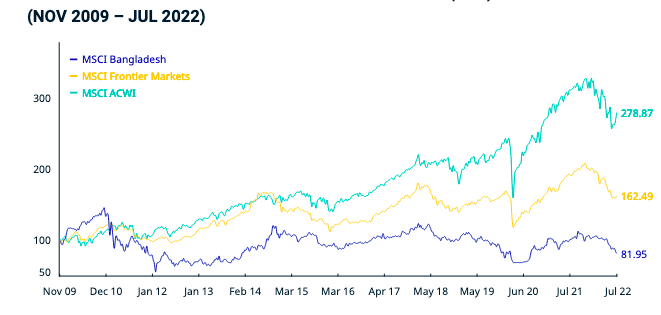

Heavy Bangladesh and Kazakhstan Weighting: This ETF also invests heavily in Bangladesh and Kazakhstan, which are both trading at between 8-11x PE. The valuation for these indexes is based on 3-6 companies since they are smaller equity markets.

MSCI

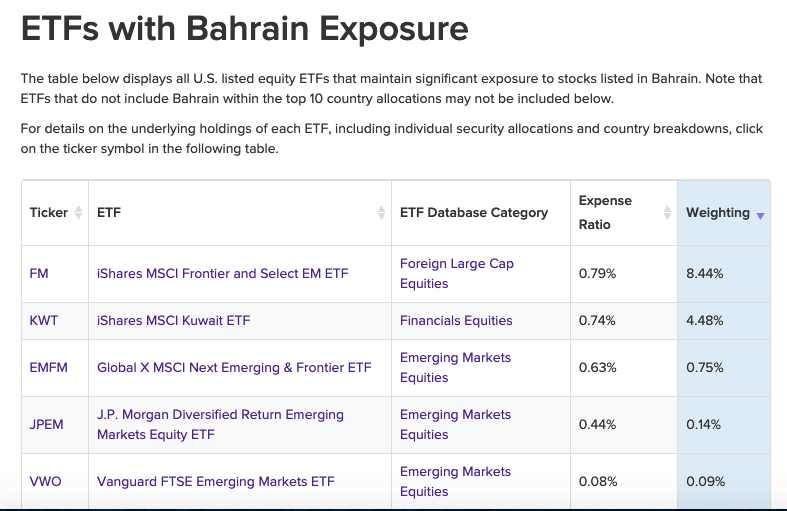

Bahrain Exposure: This ETF also has very strong exposure to Bahrain, while other frontier and emerging market funds typically invest less than 1% of their assets in this country. Markets like this have the potential to significantly rally if they are later upgraded to emerging market status, or if larger constituents (like Vietnam) are upgraded. In some cases, being the 2nd or 3rd largest market in MSCI frontier markets is better than being upgraded to emerging market status.

ETFDB

Valuation for Select Markets is Intriguing

Multiple frontier and smaller emerging markets in this ETF are trading at very attractive valuations at the moment. Below are additional markets that the ETF invests in that trade at a single digital PE ratio.

|

Country |

P/E |

P/B |

Dividend Yield |

|

Egypt |

5.46 |

1.17 |

4.73% |

|

Pakistan |

3.72 |

0.62 |

8.15% |

|

Romania |

7.48 |

1.26 |

7.09% |

|

Nigeria |

7.76 |

1.54 |

7.69% |

|

Kenya |

9.63 |

3.20 |

4.79% |

Source: MSCI

This is not to mention other previously discussed countries, including Kazakhstan and Bangladesh, which also trade at a compelling valuation. It is easy to build a portfolio of cheap frontier market stocks by investing in this ETF ( circa 9.4x earnings), as well as some of the other country-specific ETFs. Overall, this ETF has decent exposure to frontier and emerging markets that are in a bottoming out phase and have a very attractive valuation.

Investors can invest directly in three of these five markets by investing in country-specific ETFs. These ETFs include the VanEck Egypt Index ETF (EGPT), Global X MSCI Nigeria ETF (NGE), and the Global X MSCI Pakistan ETF (PAK).

Latin America Gap

This ETF does not offer strong exposure to Latin American markets, but that is mainly because most of the prominent markets in this region are classified as emerging markets or stand-alone markets. This fact is not necessarily a flaw of the ETF. Peru and Colombia are the only two in the region that meet the “smaller emerging market” status. However, this only leaves total regional exposure at around 9%. This is a simple fix as there are a variety of Latam emerging markets that are easily accessible on US exchanges:

-

Brazil: Brazil has multiple ETF options including the iShares MSCI Brazil ETF (EWZ) and the iShares MSCI Brazil Small Cap Index (EWZS). I have also covered Banco Bradesco (BBD) and Telefonica Brasil (VIV) in previous articles.

-

Chile: Investors can consider the iShares MSCI Chile ETF (ECH), or banks in Chile, such as Banco de Chile (BCH).

Investing in this ETF and a basket of larger emerging market ETFs and ADRs could be the best way to have balanced frontier and emerging market exposure.

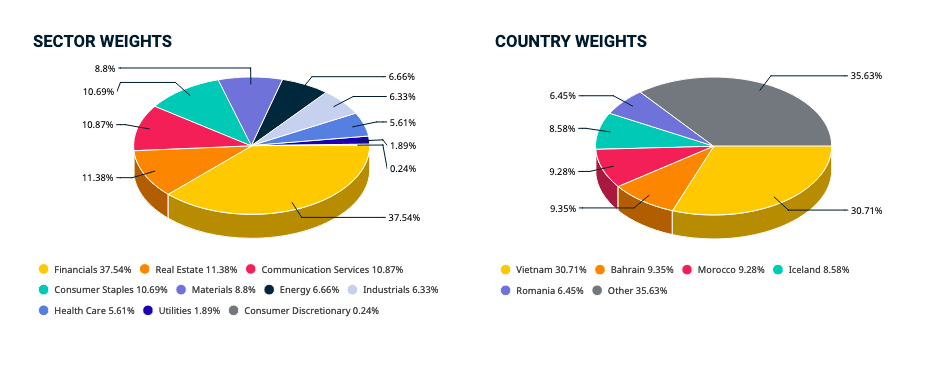

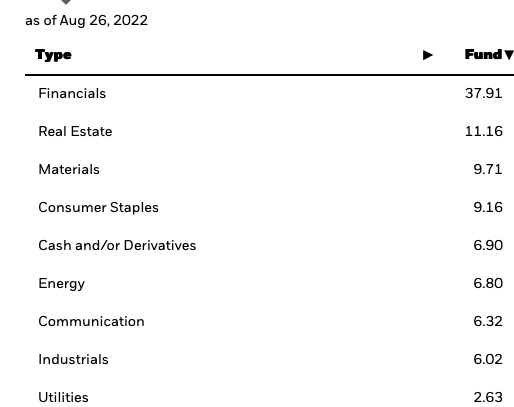

Industry Breakdown

Another reason that I am interested in adding other ADRS/ETFs is that this ETF has very heavy exposure to real estate and financials ( circa 50% of assets). There are only a very few markets where I feel comfortable enough investing in banks.

iShares

Banks may seem appealing at first glance because of rising interest rates, but the higher level of currency risk and NPL risk makes it best to only do selective shopping in specific countries. This is not to mention that these higher levels of inflation are also paired with slower/negative growth in many of these economies, so interest income will likely decline in many cases because of higher NPLs/currency depreciation. Furthermore, banks with a high % of consumer loans on their books are also vulnerable to higher NPLs, especially in markets with higher household debt.

Heightened Macro and Political Risks

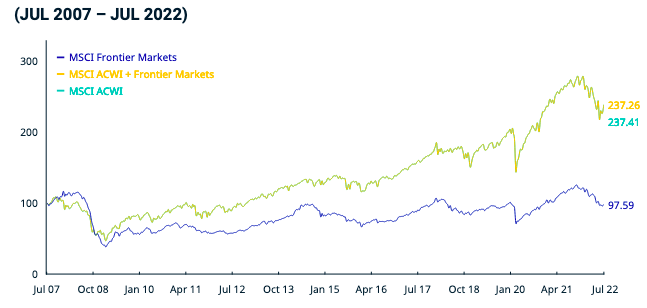

Frontier and emerging markets always carry a strong level of macro and political risks, which justifies their discount to other equity markets. However, these negative trends will likely accelerate in the next 12-24 months, and certain markets such as Sri Lanka, Turkey, and Pakistan have already faced serious issues. It is interesting to note how frontier markets have still drastically unperformed other markets since 2007. MSCI frontier markets also trade at an approximate 38% discount to MSCI ACWI.

MSCI

Reuters recently noted that the number of emerging economies with a budget and current account deficits above 4% will reach a record this year. Vietnam and Bahrain, the ETF’s #1 and #3 largest countries, had a current account surplus. The average debt to GDP in frontier markets was above 100% in 2021, and this remains a significant risk for many countries, as the government has to spend a large % of revenue on interest payments. This is not to mention rising inflation levels, which do not fully reflect the strain on consumer spending, as food and energy are a small % of CPI in many countries. The larger risk associated with food/energy/transportation inflation is an increase in political risks, as seen in Chile, Turkey, and Sri Lanka. The potential for broader sovereign debt defaults is another potential risk. At the very least, it is clear that a debt to GDP above 100% is not healthy, and could be a particular issue for countries with high levels of external debt. This is another key reason to wait and to do selective shopping for countries with lower debt-to-GDP levels.

Final Thoughts

I think this ETF is a decent way to gain exposure to frontier and emerging markets, but it would be a waste only to invest in this ETF. I also plan to buy ADRs and ETFs in other countries such as Brazil, Chile, Egypt, and other markets. However, frontier markets are facing a plethora of challenges that will not likely be resolved in the short term. I am willing to wait for a lower entry point overall but may make a few exceptions for select countries. I think Egypt is the best market in terms of risk-reward potential.

[ad_2]

Source links Google News