[ad_1]

5M_photos/iStock via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the ProShares Online Retail ETF (NYSEARCA:ONLN) as an investment at the current market price. This fund takes an approach to own retailers that principally sell online or through other non-store channels, rather than traditional brick-and-mortar retailers.

I cover ONLN regularly but have taken a cautious approach to the second in the second half of the year. This outlook was reiterated in July when I last wrote about it, and that caution was certainly rewarded:

Fund Performance (Seeking Alpha)

Looking ahead, I thought it was timely to do another review because the market has started to rebound sharply over the past few days. ONLN has been a part of this rally, so I wanted to assess whether an upgrade in the rating was warranted. After consideration, I still see too many headwinds to justify a “buy” rating on this fund, and I will explain why in detail below.

Online Retail Has Been A Dog In 2022

To begin, I want to take stock of how retail has fared recently. As the title of this review suggests, not having retail (online or otherwise) exposure this year would have prevented some pain for sure. While the market as a whole is down sharply, retail has fared even worse. Case in point – ONLN has lost over twice what the S&P 500 has since January 1:

YTD Performance (Google Finance)

This amplifies to me why one has to be especially careful before diving in right now. Retail has been a straightforward losing play in 2022. Can that change? Of course, and many could see such a large drawdown as an opportunity for a value or contrarian play. There is merit to that. But it also exemplifies why treading carefully also makes sense. This is a pretty steep loss and highlights that this sector has been out of favor consistently, which very well could continue.

Let’s Examine Reasons For The Decline

I now want to dig in to the why behind ONLN’s poor performance. Mentioning it is one thing – but we have to understand what is driving it. Once we have that understanding it will be easier to predict what Q4 has in store for this sector.

Unfortunately, there have been a few primary drivers of ONLN’s underperformance, all of which I believe will continue to pressure the fund.

The first is inflation. This has been the number one headwind for stocks in 2022, including retail. It would be easy to pin the blame on the Fed, because the rate hiking cycle is likely the reason behind the rotation out of riskier assets. But the underlying root cause for why the Fed is hiking rates is higher-than-expected inflation.

The challenge with inflation is it is dampening consumer spending and sentiment. Ultimately, if the same amount of cash buys fewer goods, that means consumer’s purchasing power declines as a result (all other things being equal). This has been the case all year, with pressures on the American and global consumer mounting consistently.

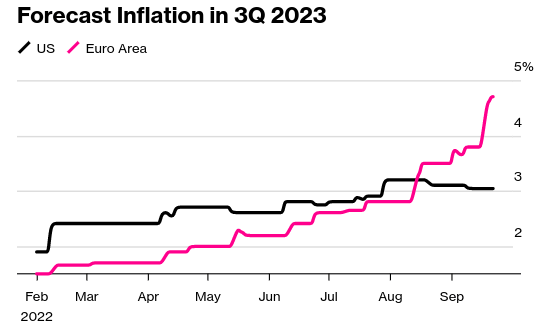

My concern going forward is that I do not believe consumers are prepared for inflation to remain high. Across the developed world, inflation expectations among economists have been rising for the forward year:

Inflation Forecasts (US and Europe) (Bloomberg)

Yet, consumers in America are under the impression that inflation is going to eventually go away. This is probably due, in part, to messaging from U.S. officials. At first, inflation was “transitory”. Then it was “transitory for longer”. Now it is just a “transition” until… we don’t know what. To me, it has become clear many policymakers do not have a clue when it comes to inflation forecasting.

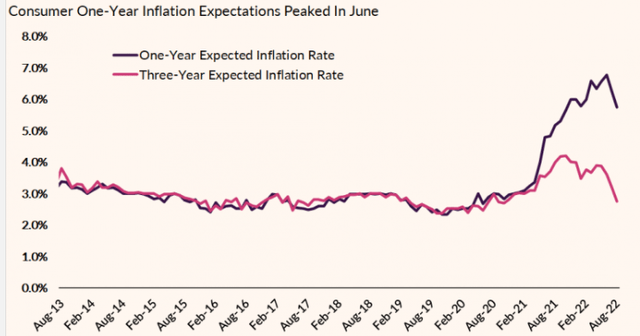

But the problem is many Americans trust what they have to say. As a result, Americans continue to believe inflation is a problem that will be going away. For support, consider a recent survey showing that Americans have begun to predict lower prices in both a year and three years from now:

Consumer Inflation Forecasts (Ally Bank)

This highlights a fundamental headwind for retail stocks in my opinion. One, continuous inflation is going to pressure the retail sector as fewer goods and services are ultimately purchased. Two, if consumers believe inflation is going to cool over the next year, they are likely going to pull back on purchases now. What I mean is, if households expect prices to decline in the future, they could delay big ticket (and higher margin) items in the near term in the hopes they can get those same products for a lower cost. This hurts the short-term outlook for retail going into the all-important holiday season. The distinction is, if consumers thought inflation would get worse, then would rush to buy now, setting up a nice tailwind for retail stocks. But at this moment the opposite is true.

Expanding on that thought, there seems to be a disconnect between U.S. consumer expectations and what economists are predicting. If economists are right, and their upgrades to inflation forecasts turn out to be accurate, consumers are going to be in for a nasty surprise. I don’t see a lot of upside in this scenario.

Sentiment Is Troubling

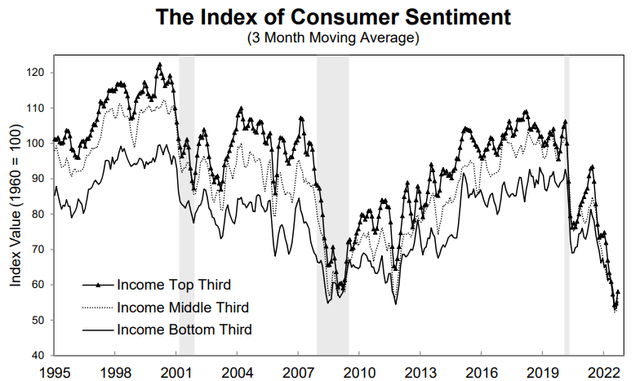

The next topic is an extension of the prior topic and relates to consumer sentiment. Simply, sentiment has deteriorated over the past year to the point where it has reached levels not seen in decades:

Consumer Sentiment (University of Michigan)

This is related to inflation because it is the biggest attribute for why this sentiment level is where it is. This again reiterates why I am neutral on retail and ONLN by extension. Consumers are worried about the present, and that is going to keep a lid on discretionary spend. For consumer staples, there aren’t much American households can do except maybe switch to lower-priced alternatives. But ONLN is a more discretionary play, focused on consumer-oriented spending on things people want, not need:

ONLN’s Top Holdings (ProShares)

This is why I am hesitant to upgrade my rating. With consumers worried about their financial footing, spending is likely to be more discerning.

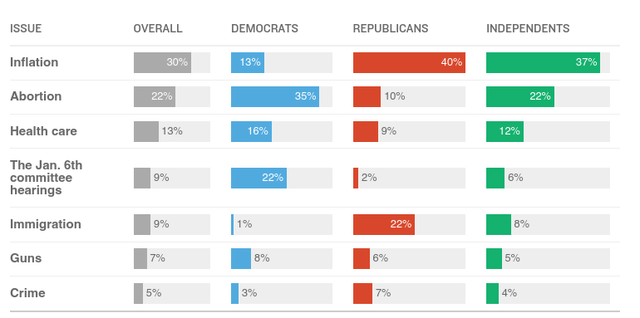

This probably rings true with a lot of readers of this article. I know in my own life inflation and the economy are primary concerns for my household. Going into the mid-term elections, we are able to see more clearly how other Americans are viewing critical topics like inflation. With polling done on an almost daily basis, the one constant theme is that inflation is the number one issue on the top of voter’s minds:

Top Concern (Registered Voters) (NPR)

This relates back to my broader concern for ONLN. Americans are worried about the economy and in particular rising prices. This impacts their mood/sentiment, their forward outlook, and, ultimately, how freely they are going to spend their money. If this sense of trepidation continues, the investment case for ONLN remains clouded.

Gas Prices Back On The Rise

The next item I want to tackle is gas prices. This has been a driver of both inflation and consumer sentiment, as Americans see higher prices at the pump and that impacts how they live their lives (and where they spend their money!).

Over the past few months, gas prices have receded from their highs, which has helped free up consumer cash for other items. The challenge going forward is that gas prices are starting to rise again. Geo-political pressures in Europe and Asia continue to support oil prices, and OPEC+ is likely to initiate some sort of production cut that is also going to keep prices from going much lower. As a result of these factors, retail pump prices have been rising in the last few weeks, as shown below:

Retail Gas Prices (Yahoo Finance)

This presents a challenge for ONLN and the retail sector more broadly. As oil prices rise, consumers delay or forgo other purchases.

It can also hurt online retailers more prominently, as they rely on shipping and car services to get their goods to end consumers. As fuel prices crimp margins, stock prices will have trouble reclaiming their former highs. This is relevant for many of ONLN’s top holdings, such as Chewy, Inc. (CHWY), eBay (EBAY), and DoorDash (DASH) (see the prior chart for the fund’s top holdings). This makes me less bullish on investing in online retail plays rather than other types of consumer discretionary funds.

The Story Isn’t All Bad

Through this review, I have suggested multiple reasons why I am not going to recommend ONLN. But the truth is I am not overwhelmingly bearish either. The U.S. economy continues to plug along, ONLN has already seen a wipe-out of 40% since the year began, and investors are starting to dip back into risk-on assets. All of these factors play in this ETF’s favor.

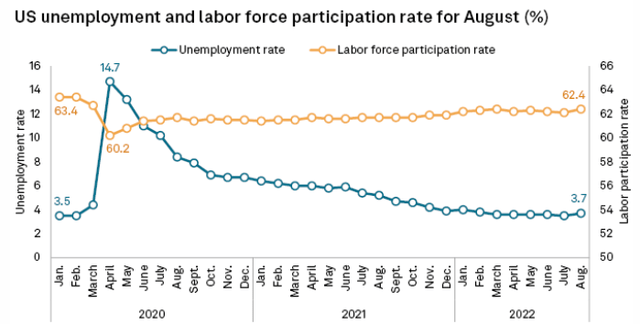

In addition, the consumer story is not completely bleak. Yes, I see challenges with sentiment, inflation, and fuel prices. But the labor market is an area that helps to counter-balance this. We have seen unemployment retreat back down to pre-Covid levels and labor force participation has been pushing higher also:

U.S. Labor Market (S&P Global)

The takeaway for me is that there are positive signs out there. Does this mean I am going to take the leap into ONLN right now? No, because I see a few too many headwinds at the moment. But I am not a total bear here either and do see a scenario where gains could occur. Americans are getting back to work – and that means more disposable income in the hands of the public. That is a positive force for retail stocks, although it is negated a bit by inflation and other factors. But the overall health of the labor market is a positive force that we do have that is helping us start Q4 on the right footing.

Bottom Line

ONLN has had a rough year, and I am reluctant to call this a value play at current levels. The fund has seen a nice rebound in the past few trading days, and that makes me think further upside will be limited. Sustained inflation, higher prices at the pump, and a worried American mindset all suggest retail plays are going to face continued hurdles going into 2023. Therefore, I believe a “hold” rating remains appropriate, and I suggest readers approach any new positions in this fund very selectively at this time.

[ad_2]

Source links Google News