[ad_1]

Dia Dipasupil/Getty Images Entertainment

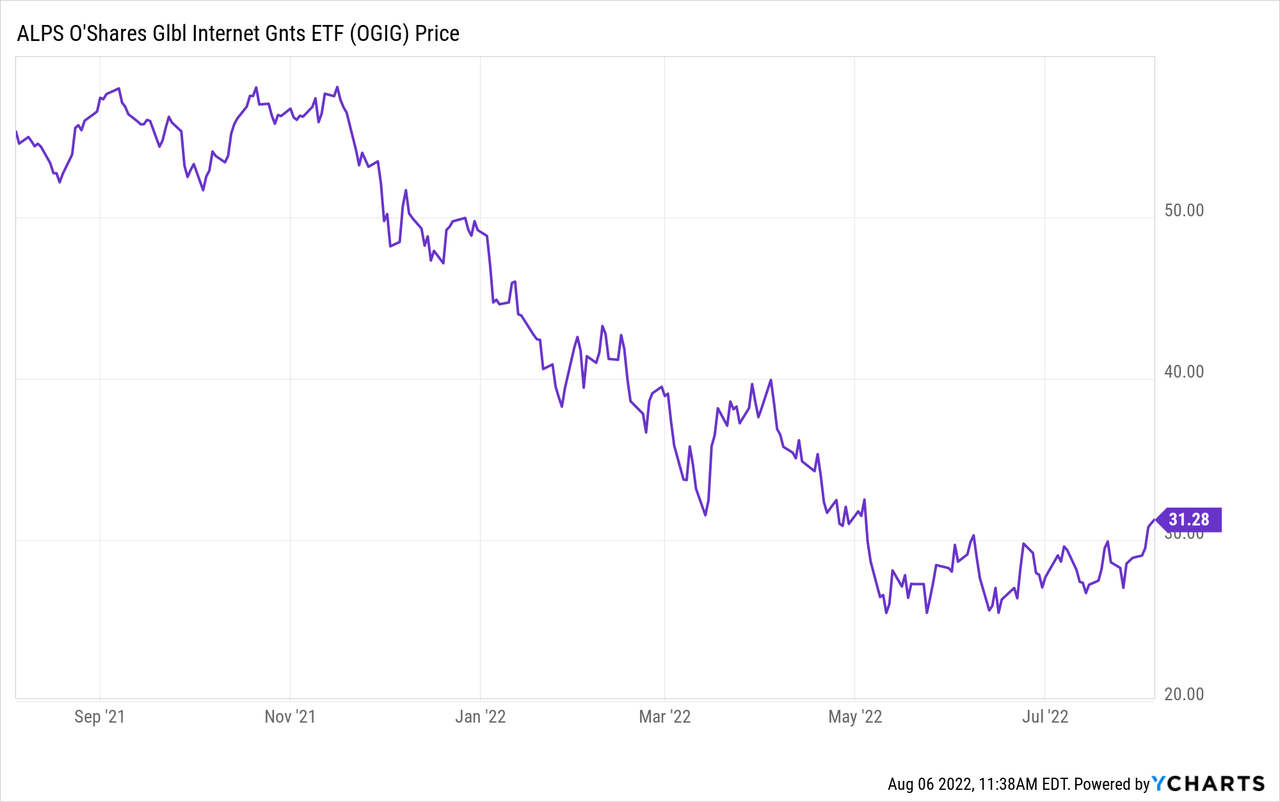

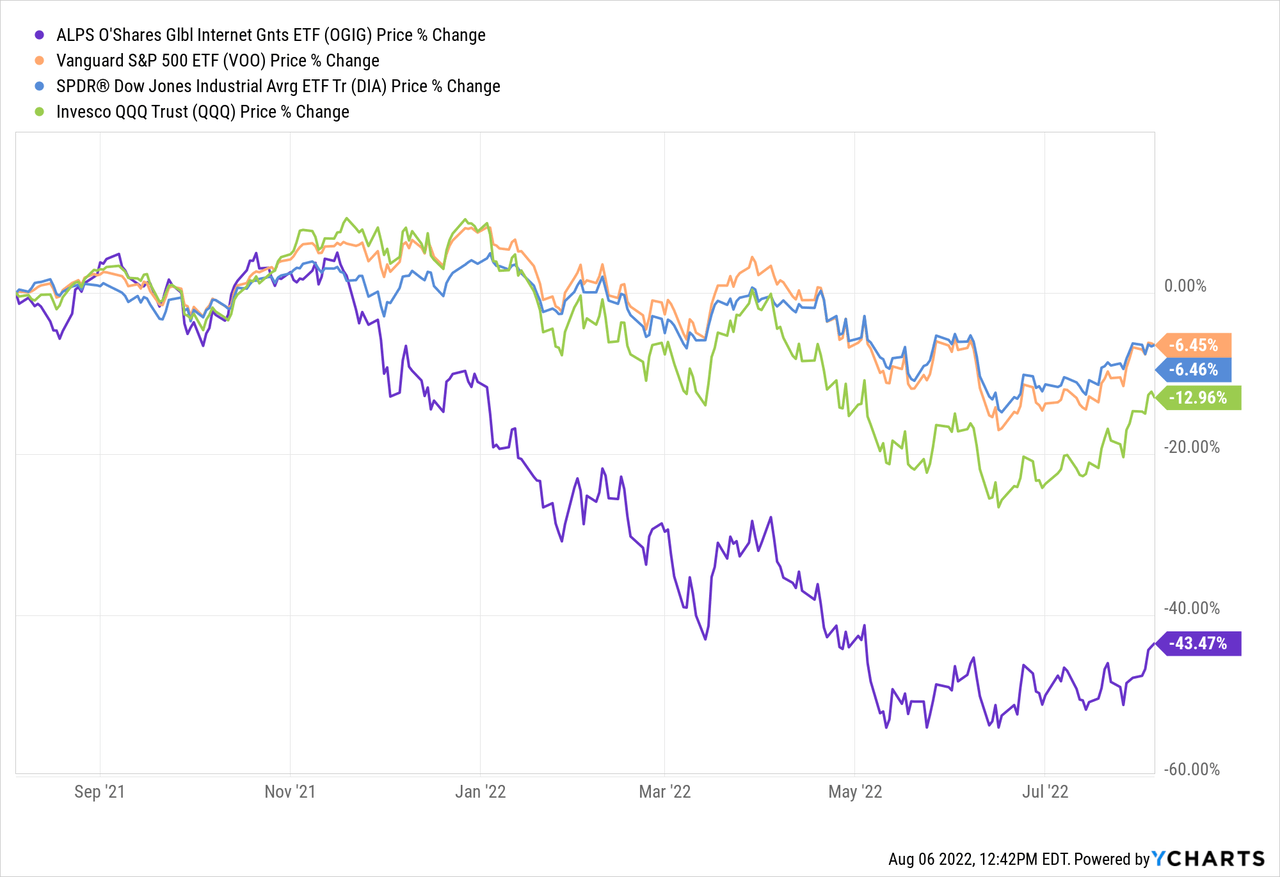

Back in July of 2021, I wrote a Seeking Alpha article suggesting investors sell the O’Shares Global Internet Giants ETF (BATS:OGIG) due to what I considered to be an unwise over-exposure to Chinese companies (see The OGIG Internet Giants ETF: Blunted By The China Tech Crackdown). The fund is down 43% since then (see graphic below). However, the fund appears to have bottomed and in January SS&C ALPS agreed to take over the OGIG ETF and three other funds from O’Shares, the company started by founder and Chairman Kevin O’Leary – better known as “Mr. Wonderful” from CNBC’s “Shark Tank”. While the correction in many technology stocks during the recent 2022 bear market has been brutal, the long-term potential of the “internet giants” appears quite constructive in my opinion. So, today I’ll take a fresh look at the OGIG ETF to see what it might offer investors going forward.

Investment Thesis

Many investors make the big mistake of equating the technology sector of today, and the bear market of 2022, with the dot.com bust of 2001. In my opinion, nothing could be more inappropriate. That is because the potential of the internet in 2001 simply didn’t have the technological infrastructure needed in order to bring that potential to fruition. Today, that infrastructure exists in the form of high-speed low-power semiconductors, high-speed networking, 5G smartphones & infrastructure, wireless mobility, cloud computing, the internet-of-thing (“IoT”), as well as artificial intelligence and machine language (AI/ML). That being the case, leading internet companies today have the technology to make the potential of the past a reality, have dominant positions in the market, and have continued to generate tons of free-cash-flow during the recent bear market.

That being the case, let’s take a closer look at the OGIG ETF to see how it has positioned investors for success moving forward.

Top-10 Holdings

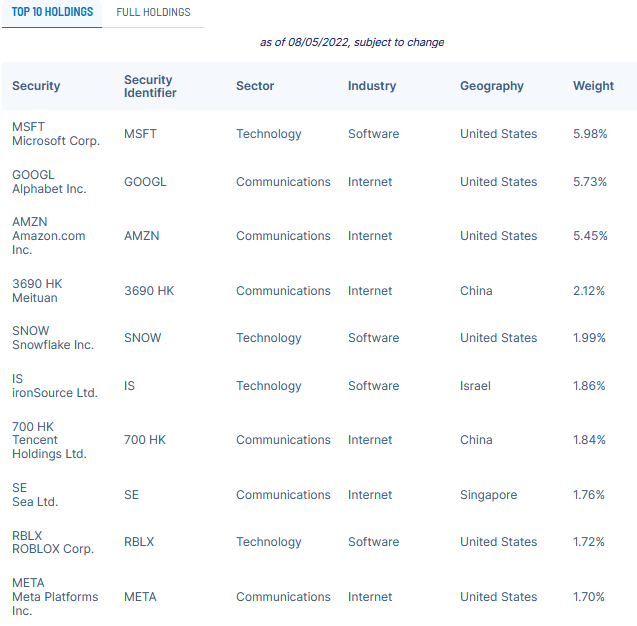

The top-10 holding in the OGIG Internet Giants ETF are shown below and equate to what I consider to be a moderately diversified 30% of the entire portfolio:

ALPS Advisors

Source: ALPS: OGIG Webpage

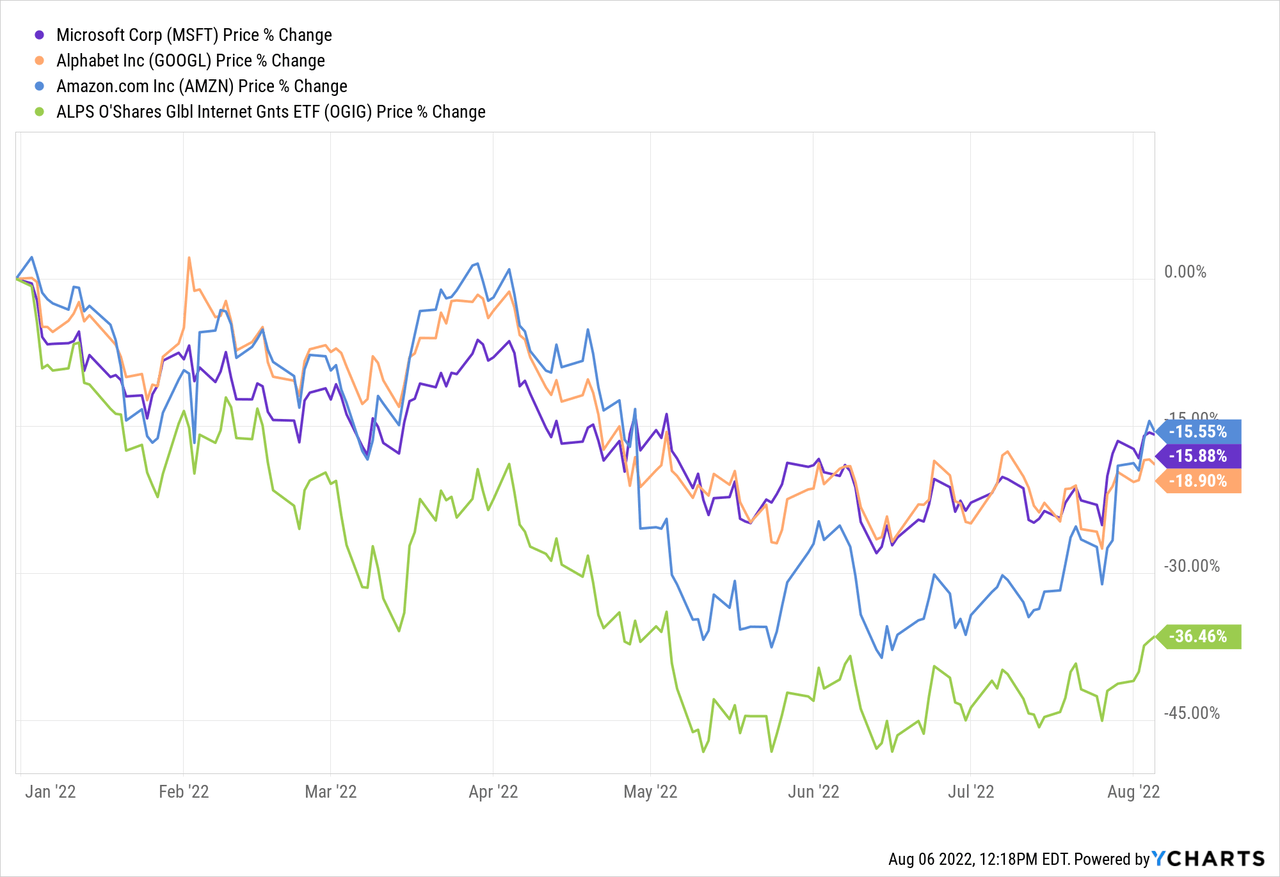

The #1 holding with a 6% weight is Microsoft (MSFT). Despite being down ~15% YTD, Microsoft has continued to perform very well this year. Microsoft released its Q4 FY22 EPS report in July. Highlights included:

- Revenue was $51.9 billion (+12% yoy, +16% in constant currency).

- Operating income of $20.5 billion (+8% yoy, +14% in constant currency).

- Net income was $16.7 billion (+2% yoy, +7% in constant currency).

- Azure and cloud services revenue grew 40%.

- Diluted EPS was $2.23 (+3% yoy, +8% in constant currency).

During the quarter, Microsoft returned a combined $12.4 billion to shareholders via share repurchases and dividends. That was an increase of 19% compared to Q4 of FY2021.

Google (GOOG) (GOOGL) is the #2 holding in the fund with a 5.7% weight. Google’s Q2 EPS report generally met expectations but was, in my opinion, quite strong given the backdrop of the current macro-environment combined with tough yoy comparisons. Highlights of the report included:

- Revenue of $69.7 billion was up 13% yoy (16% in constant currency).

- Operating income of $19.5 billion was relatively flat yoy.

- Diluted EPS of $1.21/share was down $0.15 yoy.

- Google Cloud revenue of $6.3 billion was up 36% yoy.

On July 15th, Google split the stock 20:1. The company ended the quarter with $125 billion in cash (an estimated $9.44/share) after buying back $15.2 billion in stock during the quarter. Google generated $12.6 billion of free-cash-flow in Q2 and remains my favorite mega-tech stock going forward.

With a 5.5% weight, Amazon (AMZN) is OGIG’s #3 holding. Amazon has caught a bid after a Q2 EPS report that generally beat consensus expectations for a rather lousy quarter. Amazon’s cloud business, AWS, generated $19.7 billion in revenue (+33% yoy) and $5.7 billion in operating income. Last week, Amazon announced plans to purchase iRobot (IRBT) for $1.7 billion. Analyst generally believe the acquisition is a strategic fit if AMZN can navigate regulatory challenges and actually close the deal. Similar to Google, Amazon has also split its stock 20:1 this year.

Despite their relatively strong financial performance this year, OGIG’s top-3 holdings are all down ~15% YTD while the OGIG ETF itself is down 36%:

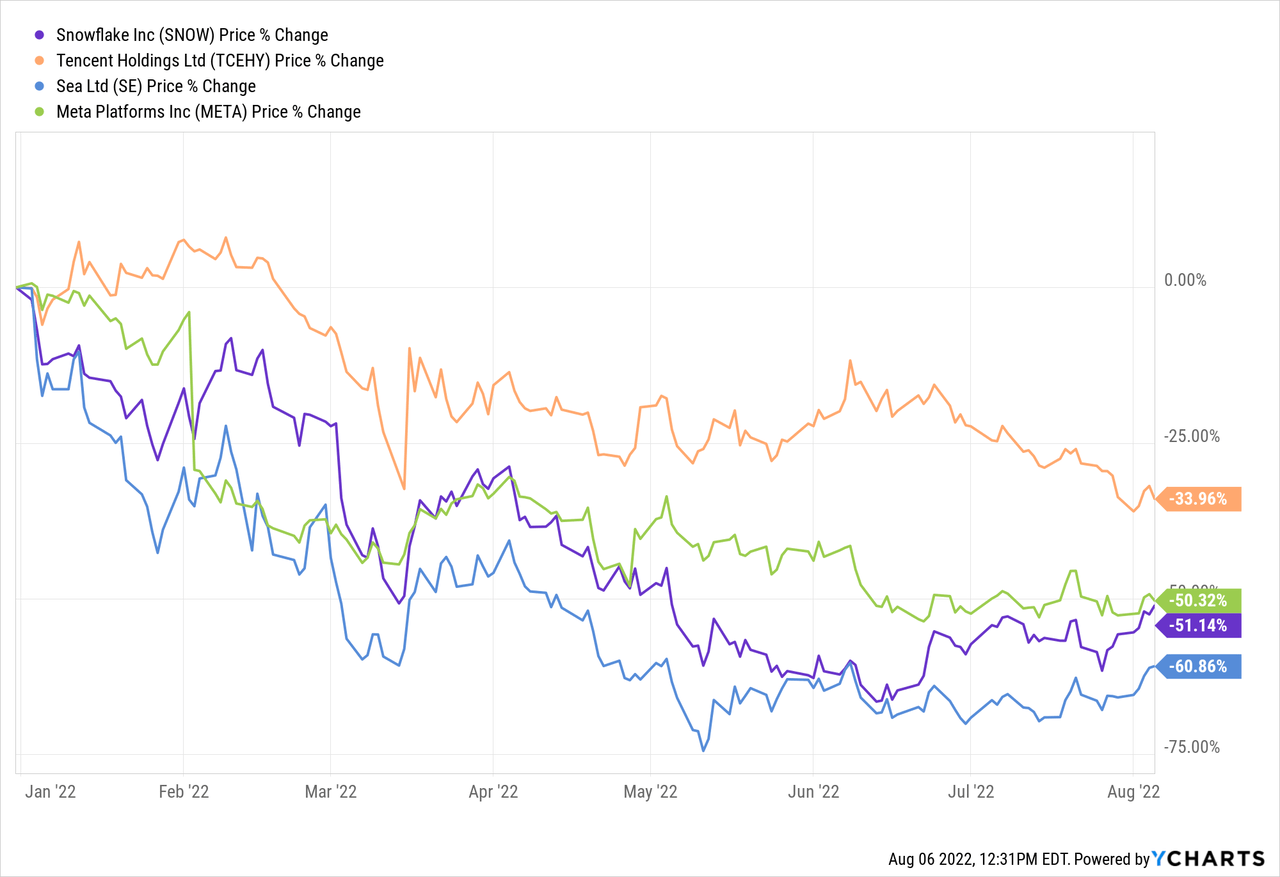

The fund has been pulled down by under-performing companies like #5 holding and cloud company Snowflake (SNOW), #7 holding and China-based Tencent (OTCPK:TCEHY), Asia-centered and #8 holding Sea Limited (SE), and #10 holding Facebook (META):

In aggregate, note that OGIG has ~4% of its top-10 holdings allocated to China-based e-Commerce company Meituan (OTCPK:MPNGY) and Tencent. Overall, OGIG has much reduced its exposure to China (to 10.9%) – or by about half since my last Seeking Alpha article on the fund (21%). However, that obviously came too late to keep investors from getting thrashed. Today, the fund still has only 71.5% allocated to U.S. based companies.

The expense ratio of OGIG is 0.48% (unchanged from when it was under O’Shares) and the fund pays no dividend. Notably, OGIG still tracks the O’Shares Global Internet Giants Index, which is still managed by O’Leary’s O’Shares company.

Performance

Over the past year, OGIG has drastically under-performed all broad market indexes – the S&P500, DJIA, and Nasdaq-100 – as represented by the (VOO), (DIA), and (QQQ) ETFs, respectively:

That being the case, I strongly suggest investors who want to invest in the biggest-n-best internet companies consider a fund like the Vanguard Russell 1000 Growth ETF (VONG). VONG’s top holdings include ~22% allocated to Apple (AAPL) and Microsoft, ~6% allocated to the two classes of Google stock, and 5.2% in Amazon. It is a 100% US equity-based fund and clearly has a superior portfolio as compared to OGIG. For more information on the VONG ETF, see my recent Seeking Alpha article (VONG: Vanguard’s Russell 1000 Growth ETF Outperforms). Note that VONG has outperformed the S&P500 over the past 3, 5, and 10-year time frames and has a very low expense fee of only 0.08% as compared to OGIG’s 0.48%.

Summary & Conclusion

While I am bullish on the long-term potential of the “internet giants” investment thesis, I am not a big fan of the OGIG ETF. Despite being taken over by ALPS Advisors, the fund itself is relatively unchanged from when it was under the O’Shares umbrella. At 0.48%, the expense fee is unchanged and still very high and the fund is still being managed to mirror the O’Shares Internet Giants ETF Index, which in my opinion still has too much exposure to China (and thus the whims of the CCP). Given the current escalation of tension by the CCP with respect to the US and Taiwan, exposure to Chinese equities is a risky endeavor. I maintain my SELL rating on OGIG and suggest investors wanting exposure to internet giants consider switching from OGIG to the VONG ETF instead.

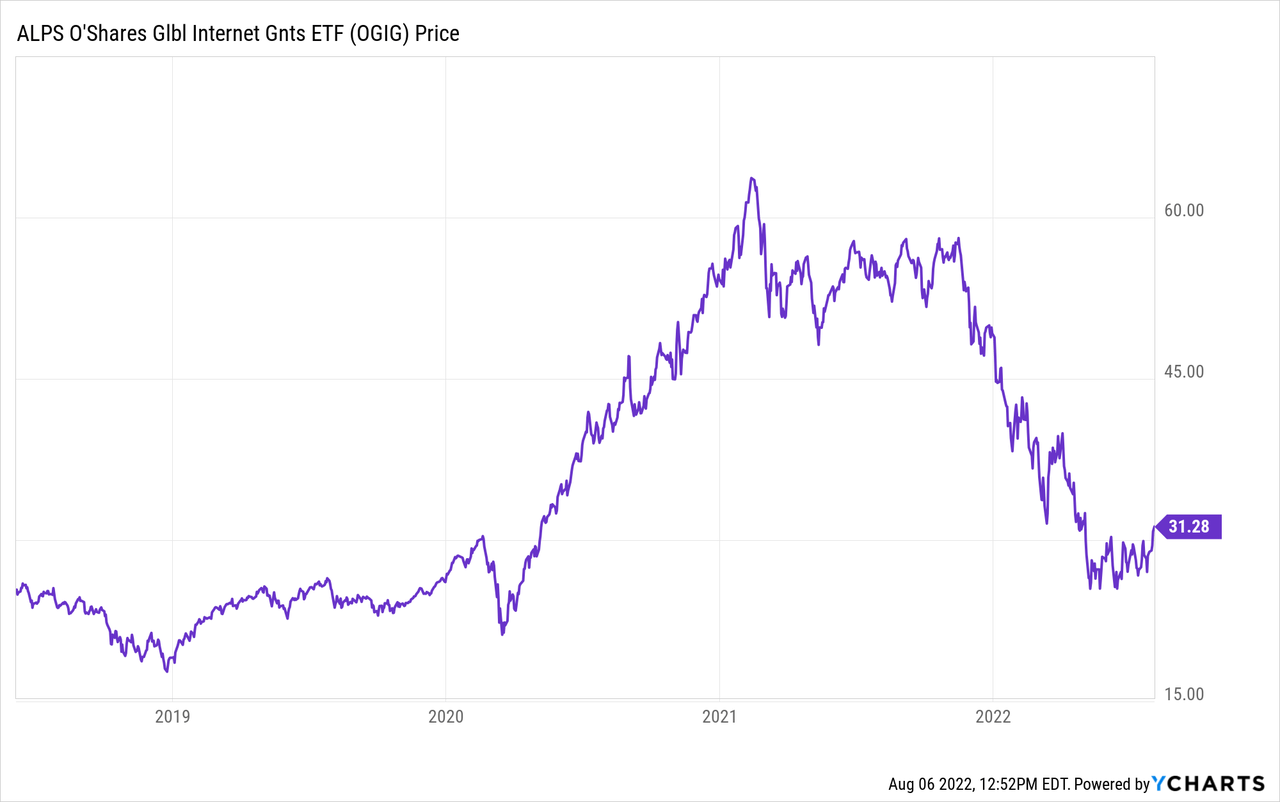

I’ll end with a 5-year price chart of OGIG and note that it has given back virtually all of the gains it generated since the covid-19 induced bull-market that started in 2020.

[ad_2]

Source links Google News