[ad_1]

z1b/iStock via Getty Images

Thesis: Recovery For Apartments, Hotels, Self-Storage Not Over Yet

The Nuveen Short-Term REIT ETF (BATS:NURE) is a specialized ETF that holds only real estate investment trusts (“REITs”) that own real estate with short-term leases, such as apartments, hotels, and self-storage facilities.

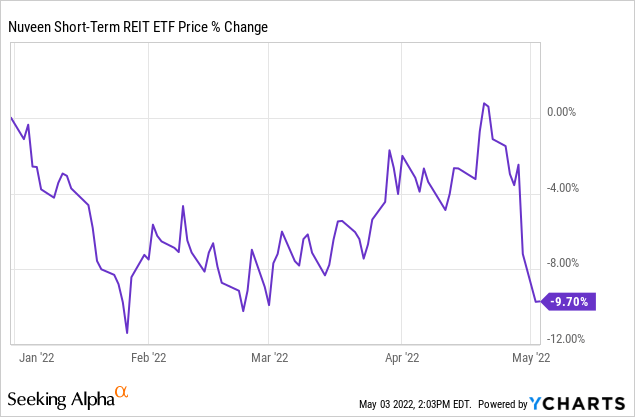

After enjoying an incredibly strong run in 2021 (up 51%), NURE has struggled this year, falling nearly 10%.

I would attribute this drop primarily to valuation concerns as well as the perceived end of the post-pandemic rebound.

However, NURE’s underlying holdings are still firing on all cylinders and likely to continue doing so over the course of 2022. NURE’s inflation-hedging REITs should continue to see strong fundamental performance, due to their ability to raise rents faster than the average REIT, for as long as high inflation lasts. And the ETF offers this specialized exposure for a relatively low expense ratio of 0.35%.

As such, this dip represents a good buying opportunity for ETF investors.

(Personally, I prefer to pick the individual REITs I want and weight them in my portfolio as I desire, but for those looking for an easy one-stop-shop for exposure to short-term lease REITs, NURE presents a great option.)

Update On NURE

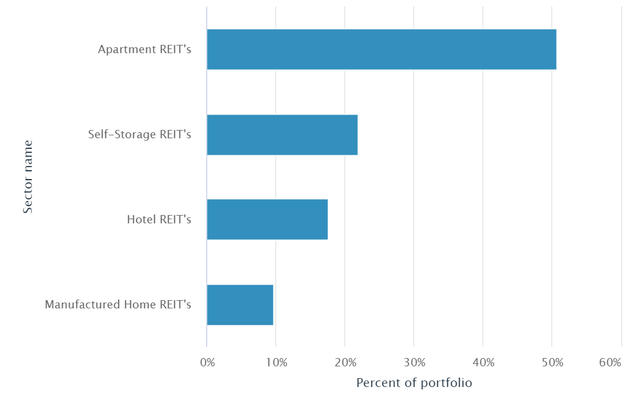

The sectoral weightings within NURE do not change much over time, although the individual REITs do move around depending on their own performance.

Apartment REITs always account for roughly 50% of NURE, while self-storage REITs have the second-most exposure at about 22%, followed by hotel REITs at 18% and finally manufactured home REITs at just shy of 10%.

Nuveen

As you can see, then, residential REITs of some form or another make up about 60% of NURE. And by the way, single-family rental REITs Invitation Homes (INVH) and American Homes 4 Rent (AMH) are included in the “apartment REITs” segment, even though they own single-family homes.

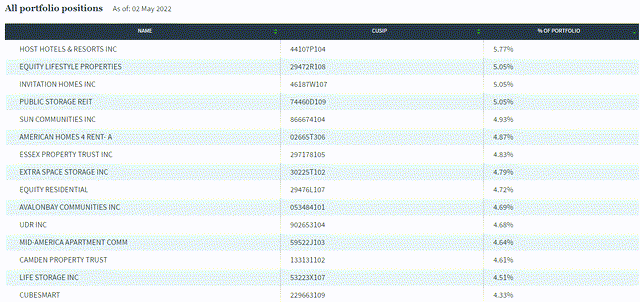

Interestingly, there are currently no apartment REITs in the top five holdings and only 3 apartment REITs in the top 10.

Nuveen

As we examine the actual performance of these top 15 holdings shown above, we find that they are almost uniformly delivering better-than-expected results. And that is based off of fairly optimistic expectations for this post-pandemic recovery year.

Here are the basic Q1 2022 results for NURE’s top holdings that have so far reported:

- Equity LifeStyle Properties (ELS): FFO per share up 14.3% on 18.6% revenue growth; boosted FFO/sh guidance

- Invitation Homes (INVH): AFFO per share up 12% on blended rent growth of 11%

- Sun Communities (SUI): Core FFO per share up 6.3% on a 24% increase in total revenue; boosted core FFO/sh guidance

- Essex Property Trust (ESS): Core FFO per share increased 9.8% and dividend raised 5.3%; boosted core FFO/sh guidance

- Equity Residential (EQR): Slight FFO miss despite 7.8% YoY rent growth

- AvalonBay Communities (AVB): FFO per share in line on 8.5% rental revenue growth

- UDR, Inc. (UDR): Slight FFO per share beat on 18.5% total revenue growth

- Mid-America Apartment Communities (MAA): FFO per share beat on 12% total revenue growth; boosted FFO/sh guidance

- Camden Property Trust (CPT): AFFO per share growth of 22% on revenue growth of 16.5%; boosted FFO/sh guidance

- CubeSmart (CUBE): FFO per share in line on same-store NOI growth of 21.4%; boosted FFO/sh guidance

Six of the ten REITs among NURE’s top 15 holdings that have reported Q1 2022 results so far have boosted their 2022 earnings guidance.

In other words, with the recent dip, NURE’s fundamental performance is moving in the opposite direction (upward) as its stock price (downward).

Bottom Line

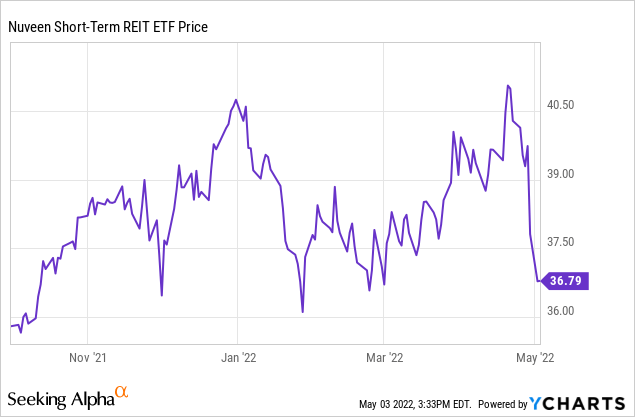

Make no mistake, many of NURE’s underlying holdings are still richly valued even after their recent drop in price. But for those who missed out on NURE’s strong run in 2021, the current dip represents a good buying opportunity.

As you can see above, NURE’s price is near the point where it has rebounded off its lows each time in the last six months. Unless a broader stock market selloff occurs, investors likely won’t get a much lower price for NURE in the short term.

[ad_2]

Source links Google News