[ad_1]

RomoloTavani

(This article was co-produced with Hoya Capital Real Estate)

Introduction

With such an interesting name, the Newday Ocean Health ETF (AHOY) needed a look into. It sounded like a specialized Environmental, Social, Governance, or ESG, fund, which are raking in cash these days. The sub-advisor name, Newday Impact, itself seemed to support an ESG tag, and from their own description, I would say that is the case. Toroso Investments, LLC serves as the Fund’s investment adviser.

Understanding the sub-advisor firm

i0.wp.com/newdayimpact.com

UN Investment Principles

Newday Impact offers portfolios addressing the major ESG issues in the world, including climate action, fresh water, human rights, gender equality, animal welfare, and quality of governance. Newday Impact works with family offices, institutions, investment advisors, financial services platforms, and individual investors, who want both a return on investment and community impact. Newday Impact investment portfolios reflect the change you want to see as the world confronts its most pressing issues.

Newday Impact is much more than an impact investing company. We are a platform that empowers individuals and institutions to invest consistent with values. Newday Impact supports its partners by donating 5% of net revenue to nonprofits working on the frontline of these issues that are addressing society’s greatest environmental, societal, and governance challenges.

Newday Impact portfolios address major ethical issues and are designed and constructed around a combination of UN Sustainable Development Goals and ESG principles using a rigorous, repeatable process.

Insights from deep research into the behavior of the companies whose securities are in the portfolios helps Newday Impact deliver portfolios more aligned with the change responsible investors want in the world. Partnerships with leading organizations provide Newday Impact with access to guidance on achieving higher levels of impact.

Source: newdayimpact.com

Understanding the ETF

Newday provides this description of their ETF:

AHOY invests in industry-leading companies that contribute positively to Ocean Health. The Fund categorizes Ocean Health companies as those concerned with and attentive to CO2 emissions, end of lifecycle product waste, and discharge into bodies of water, as well as companies committed to environmental protectionism. AHOY is actively traded and seeks long-term capital appreciation through investments primarily in the U.S.

AHOY uses exclusionary screening, ESG research and fundamental analysis to identify securities and construct the portfolio with its highest conviction ideas. The ETF started June 6th of 2022.

Source: newdayimpact.com AHOY

Newday’s website lists three reasons to invest in their ETF:

- Invest in your values: Newday Impact believes it is important to invest in your values. The issues that are important to investors should be reflected in their investments.

- Invest to make a difference: Impact investing is defined as investing with the INTENTION to generate a positive environmental or social change. ESG managers just screen companies but do not necessarily affect change. Newday does both.

- Newday’s commitment: Newday Impact has aligned with some of the world’s leading environmental and social advocates to affect change and supports these advocates by donating 5% of our net revenue to these causes.

Of the 17 United Nations Sustainable Development Goals, AHOY focuses on these six:

newdayimpactetfs.com

Later, I provide a link to explore more about these goals.

Holdings review

Portfolio construction rules are:

- Between 40-60 selected from the S&P 500 Index

- Sector weights must be +/- 15% vs. the benchmark

- Stock allocation limits: Minimum of 50bps; maximum of 750bps

- Fully invest, holding only long-only equity positions

- Expected turnover range: 30-40%

While these are not the largest holdings, the AHOY website provides them as examples of how stocks are selected.

- Tetra Tech, Inc. (TTEK): Tetra Tech is applying cutting-edge approaches to improve the health of the world’s oceans and fisheries and is at the forefront of developing and implementing strategies to combat ocean plastic pollution.

- Austevoll Seafood ASA (OTCPK:ASTVF): A seafood company, engages in the salmon and trout, white fish, and open sea pelagic practices businesses in Norway, the European Union, the United Kingdom, Eastern Europe, Africa, Asia, North America, South America, and internationally.

- Clean Harbors (CLH): Directly aids in the helping of man-caused ocean contaminations as well as their underlying commitment to running an environmentally responsible company. Their refurbishment activities allow them to extend the life of their parts washers and avoid disposal of over 500 tons of metal and plastics annually.

- Jacobs Engineering (J): One of the top-ranked global environmental firms and a recipient of the World Environment Center’s Gold Medal Award for Sustainable Development. Jacobs’ Consolidated Safety Services provides coastal restoration and fisheries management services to the National Oceanic and Atmospheric Administration.

- Agilent Technologies Inc. (A): Agilent develops products that help measure and combat plastic pollution in oceans and water supplies across the globe. Agilent has also ranked in the top three of Barron’s Most Sustainable Companies for three years in a row.

- Garmin Ltd. (GRMN): Garmin offers a broad range of products and is a leading manufacturer of recreational marine electronics. In 2020, Garmin was able to recycle more than 183 metric tons of e-waste.

- Xylem Inc (XYL): Xylem is a leading provider of technology solutions to address the challenges concerning clean water and quality water resources. The company was able to prevent over 7 billion cubic meters of polluted water from flooding communities or entering local waterways.

For more details on AHOY’s and the UN goals, here are two useful links:

- AHOY Pitch PDF

- UN SD Goals

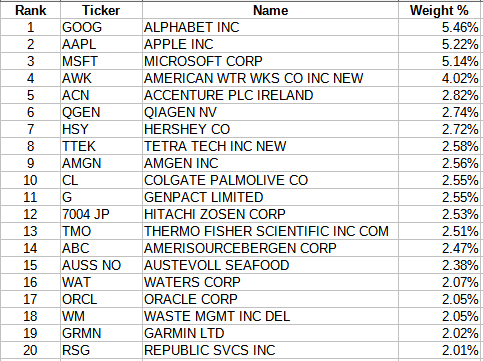

Top 20 holdings

newdayimpactetfs.com

As I will show later, Technology dominates the portfolio, including the biggest three holdings accounting for 16% of the assets. The Top 10 are 36%; with the Top 20 coming to 58% of the portfolio.

Distribution review

AHOY has yet to announce any payouts, but based on what the S&P 500 Index yields, a 1.5% yield could be expected.

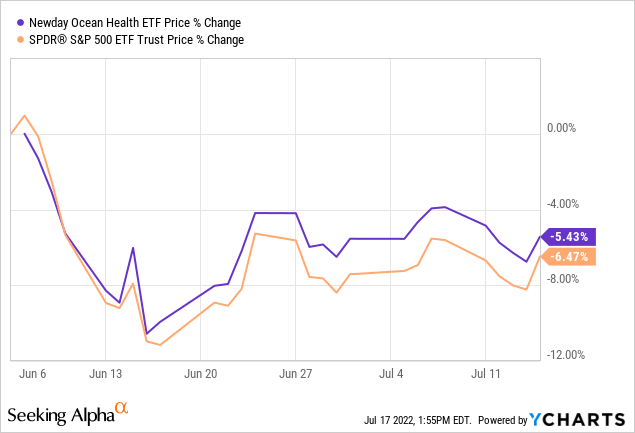

Performance so far

AHOY has only traded for five weeks, so limited knowledge can be gleaned from the next chart, where I compare the ETF to the SPDR S&P 500 ETF (SPY), since all AHOY stocks must be in that Index. I used price-only since AHOY has not made a payout yet.

AHOY so far is matching up well against SPY.

Portfolio strategy

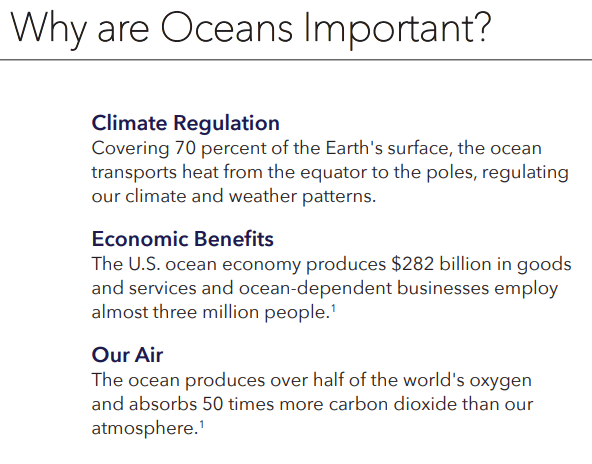

The Newday Ocean Health ETF focuses on companies they feel are helping fix the oceans. They list three reasons as to why this is critical to the planet:

newdayimpactetfs.com Pitch PDF

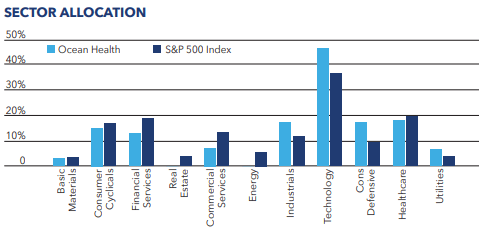

As an investor, it is important to keep in mind that AHOY is a subset of stocks from the S&P 500, so you already own them if you have a S&P 500 Index fund or other Large-Cap US equity fund. For that reason, here is how AHOY and the SPDR S&P 500 ETF compare at the sector level.

newdayimpactetfs.com

With the rules limiting AHOY’s ability to drift far from the S&P 500 Index sector weights (+/- 15%), the ETF is a condensed version of the S&P 500 Index and other ETFs like SPY. For investors, then the question becomes: Are you investing in AHOY because you like the theme or because you believe the theme will outperform an unrestricted ETF like SPY?

If for the first reason, then it seems one would then ask: Is technology the solution since over 40% of the portfolio is in that sector? In a sense, they are, but that applies to almost any problem in the computer/internet age we live in. The second question then is, “Do you agree with the six UN goals they invest on?”. At first, I wondered why the Hunger goal; but fish is a vital source of protein. I would like to see AHOY classify each holding as to which goal/goals they believe the company is addressing, not just the few on the website.

If for the second reason, one needs to believe both Energy and Real Estate stocks will underperform the Index going forward, as neither sector is owned by AHOY. For Energy, that hasn’t been the case in 2022; Real Estate is matching the Index.

The bottom line: I personally do not see, without a better understanding on how each holding was picked by the Newday Ocean Health ETF, a reason to include this new ETF in one’s equity allocation yet.

[ad_2]

Source links Google News