[ad_1]

Dimensions/E+ via Getty Images

Short-term market participants with an interest in the US housing market and the innate propensity and wherewithal to deal with leverage risks may consider looking at the Direxion Daily Homebuilders & Supplies Bull 3X Shares ETF (NAIL). The ETF follows a daily reset policy and seeks to deliver 3x the “daily” return of the Dow Jones US Select Home Construction Index (note, not 3x the return over a specific period); this index covers an entire gamut of sub-industries within home construction including home builders, suppliers of building materials, furnishing and fixtures, and home improvement retailers.

Housing market considerations

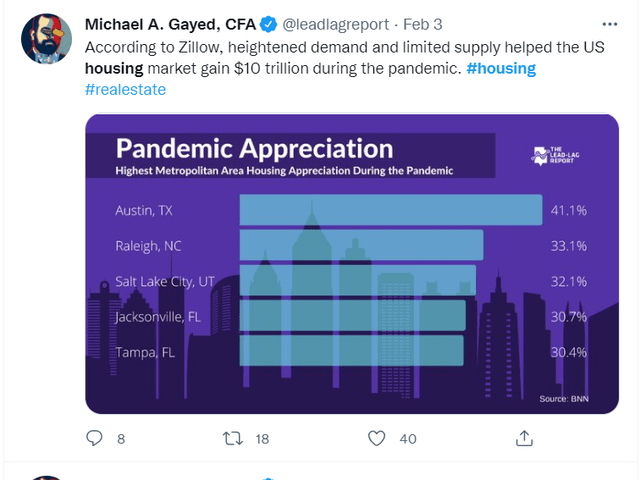

As mentioned recently in The Lead-Lag Report, within the broad US economy, the housing market has been one of the key beneficiaries of the pandemic, seeing its value expand by many trillions of dollars. With such monumental figures floating around, interest in this segment is understandably sky-high, but calling tops and bottoms in the housing market has proven to be a tricky business over the years, and many folks have gotten their fingers burnt in the act of doing so. I will not attempt to do the same, rather I will lay out some of the broad contours that one ought to be aware of before dabbling with this segment.

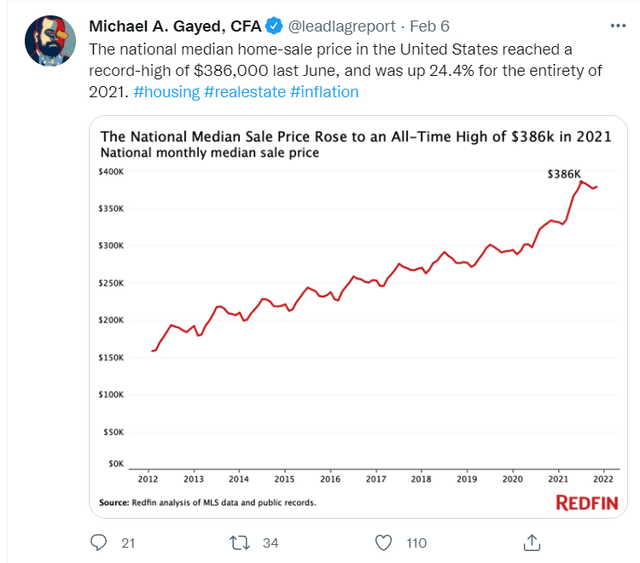

The housing market has been sturdy for a while now but at some point, one has to bring up the affordability quotient. As highlighted in The Lead-Lag Report, median home sale prices are inching closer to the 400k mark and were up nearly 25% for the whole of last year.

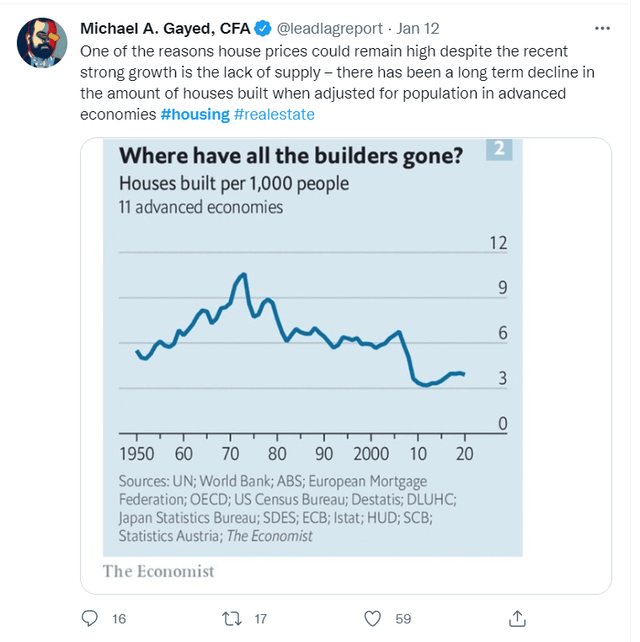

It’s difficult to see pricing coming down any time soon, and this is primarily on account of supply-side issues. Our research shows that the number of houses built per 1000 people has been trending lower for a while now, and mind you, this is something that is quite common across the advanced economies. One also has to consider if home builders will have the appetite to clear their backlog particularly at a time when lumber prices are up nearly 30% in February and residential construction materials are up by 19% since Dec 2020. Note that homebuilder confidence had dipped last month for the first time in four months.

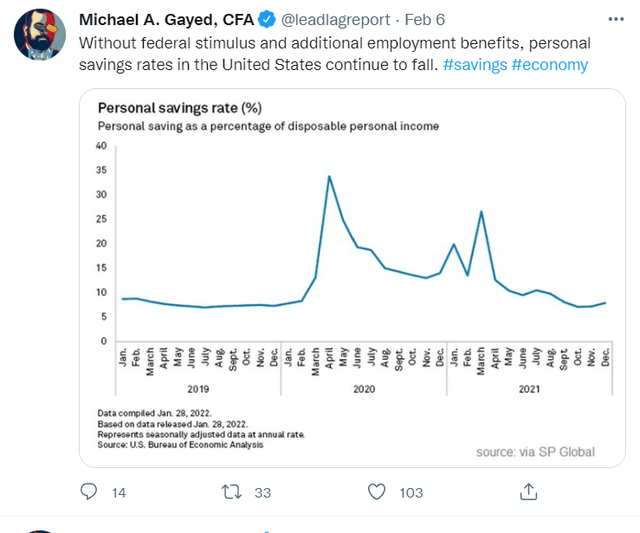

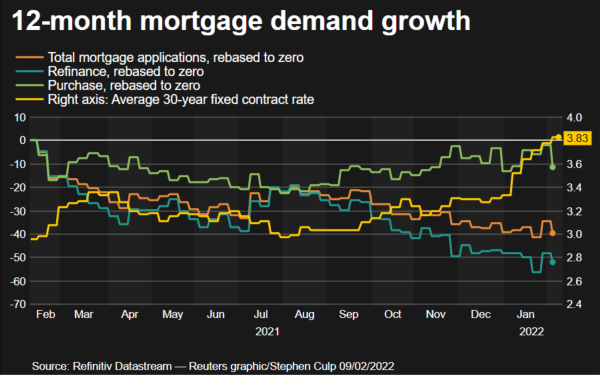

It’s hard enough getting access to homeownership under a prolonged environment of loose monetary conditions. With the Fed all set to pivot to a hawkish interest rate regime, you have to wonder if potential home buyers will now be priced out. Of course, the Fed Funds Rate and the 30-year mortgage rate aren’t directly correlated, but they tend to move in the same direction. The most recent 30-year mortgage rate is closer to 3.75% now vs 3% just a few months ago. A 75bps spike in mortgage rates on a $300k loan translates to a $200 monthly payment increase. Think about how that could burn a hole in the average American’s pocket particularly when you consider that various stimulus packages have been unwound and the personal savings rate is now well into normalized single-digit levels.

Data from the Mortgage Bankers Association suggests that momentum has been slowing for a while now with overall mortgage demand down by 40% vs a year ago.

Maybe these pricey financing conditions could help bring some normalcy to the supply-demand imbalance; as buyers choose to sit on the sidelines, this would put less pressure on the supply side to meet inventory requirements, consequently bringing down prices.

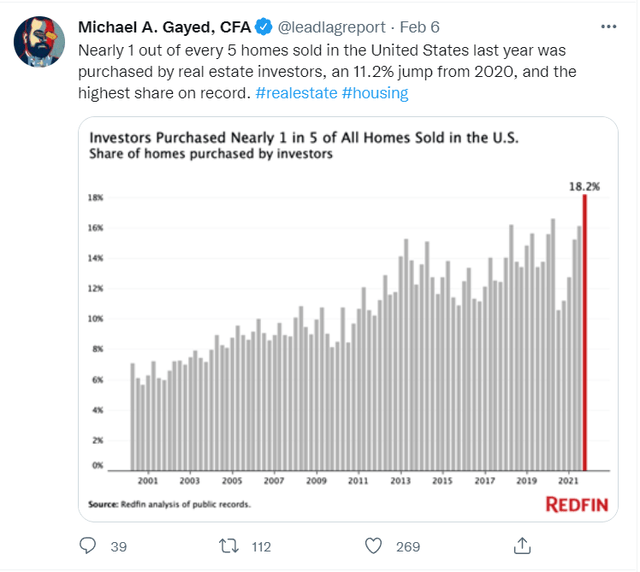

There’s another ever-increasing dimension that one ought to consider when viewing the housing market; it’s the growing influence of real estate investors here. As pointed out in The Lead-Lag Report, this cohort of buyers currently accounts for nearly 20% of all homes purchased. This is a segment of the market where sentiment tends to be quite finicky and in a flick of a moment funds can be pulled out adding to any brewing underlying pressure. In previous housing market booms, this was less of an issue, now it’s not something one can just cast aside.

Conclusion

With a product such as NAIL, the impact of volatility plays a very important role in what you eventually get; in other words, this is a product that suffers when volatility spikes, even if returns of the index are flat.

Even though we haven’t yet seen risk-off or high-volatility conditions, I think there’s a strong chance we see this come through in H2-21 when you have a wicked concoction of sharply rising Fed Funds rate, a slowing growth landscape, and diminishing inflation. For now, the markets continue to price in a higher likelihood of even more quarter-point hikes by The Fed, and I worry that the central bank may tighten things too fast, thus potentially igniting a deflationary volcano. This would serve as a perfect landscape for volatility to return, like a phoenix.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

[ad_2]

Source links Google News