[ad_1]

designer491/iStock via Getty Images

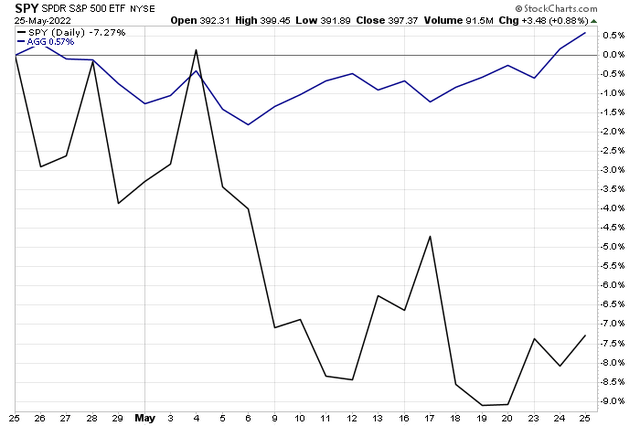

2022 has been downright awful for bond investors. At least it had been. Fixed income has actually provided some ballast to a balanced portfolio over the last two months. Consider that since late April, the iShares Aggregate Bond market ETF (AGG) sported a positive total return while the SPDR S&P 500 ETF (SPY) is down more than 7%. Bond yields might have put in a short-term top for now.

Near-Term Bond Market Returns Are Positive As The Stock Market Dropped Big

Stockcharts.com

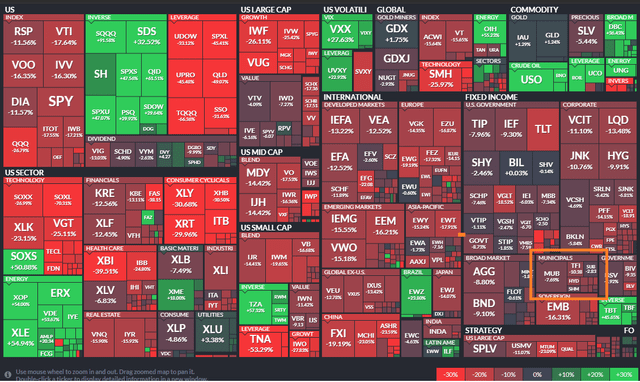

Year-To-Date ETF Performances: Lower Bond Prices Mean Better Yields-To-Maturity Today

Finviz

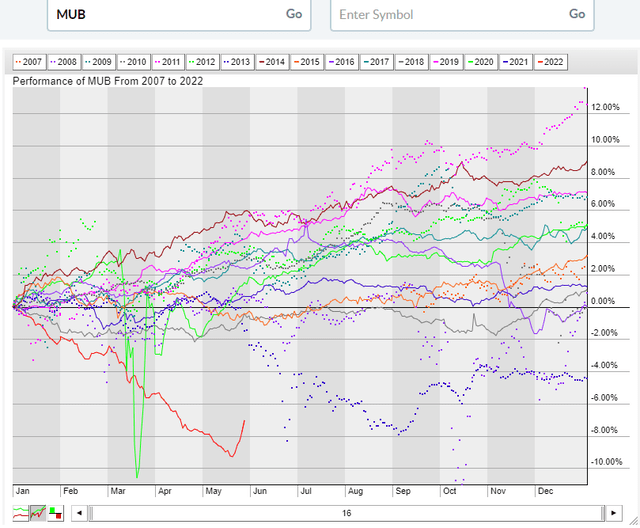

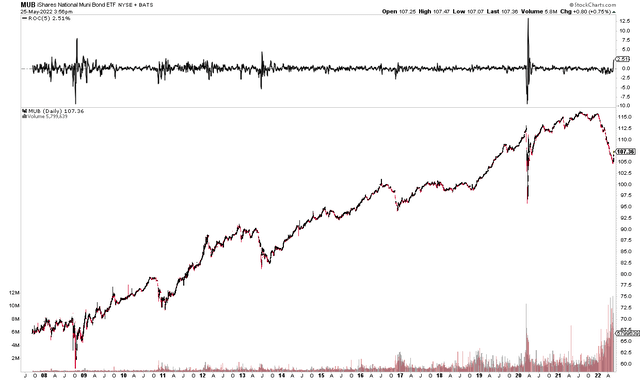

A MUB Drubbing To Start 2022

I see particularly interesting price action in the iShares National Muni Bond ETF (NYSEARCA:MUB). After enduring the worst start to a year through April since its 2007 inception, the muni bond market has come back in a big way off its May nadir. Still, there’s a long way to go before an investor can make up principal losses from the big interest rate climb to kick-off 2022.

Stockcharts.com

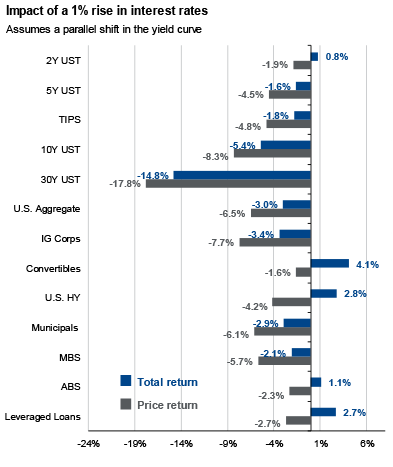

Here’s The Rub On MUB

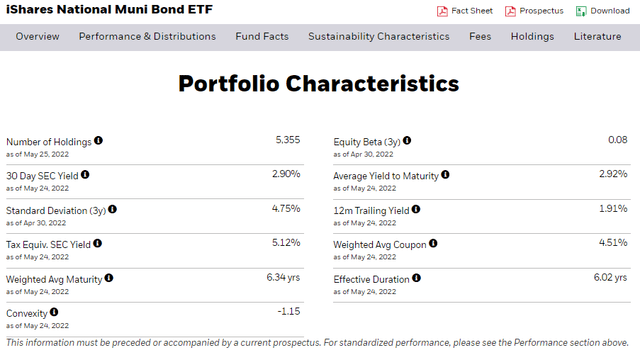

So, what exactly is the MUB ETF, you might ask. It is a low-cost index fund that tracks the investment results of an index composed of investment-grade U.S. municipal bonds. That means only high-quality muni bonds are included in MUB, so credit risk is quite small. Investors should be more concerned about interest-rate sensitivity. According to iShares, the ETF features an effective duration of 6.02 years – that means for an instant 1% rise in interest rates, the fund would lose 6% in value. Of course, its NAV would rise by that amount if rates fell.

A 1% Rate Rise Over One Year Would Result In A 2.9% Total Return Drop For U.S. Munis

J.P. Morgan Asset Management

MUB: A (Legal) Tax Haven!

What makes muni bonds attractive, though, is that they are tax-free. For an investor in the 37% top marginal tax bracket, a 2.92% average yield to maturity on MUB is a tax-equivalent yield of 4.63%. That’s a far cry from paltry yields seen just six months ago.

MUB Characteristics: Strong Tax-Equivalent Yield

iShares

Much Better Yields For Tax-Sensitive Fixed-Income Investors

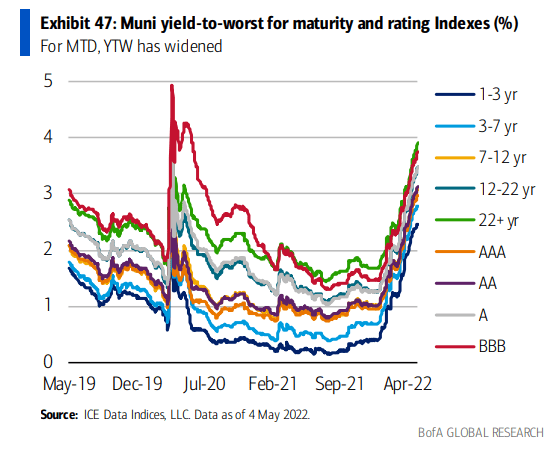

According to Bank of America Global Research, municipal bond yields are back to solid levels – the highest since the brief bond market sell-off seen during Covid in March 2020. While long-term muni fixed-income securities have a yield-to-worst near 4%, much less rate-sensitive issues can be owned with a still-strong 3% YTW.

BofA Global Research

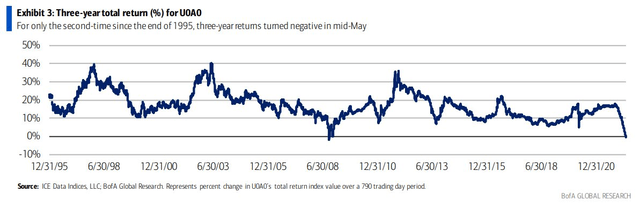

A Contrarian Indicator: Three-Year Rolling Returns Turned Negative

BofA has more insights – for only the second time since the end of 1995, three-year returns turned negative in mid-May for muni bonds. Sure enough, that’s right when buyers stepped in, driving up prices and pushing yields lower.

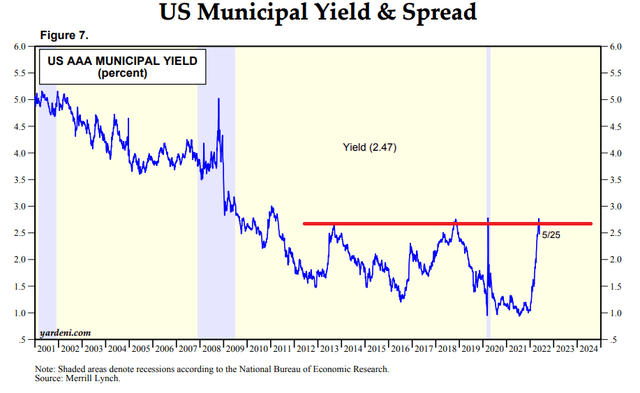

Moreover, the U.S. AAA Municipal Yield Index has found resistance near the 2.6% level over the last decade – this could be a good time to dip into MUB based on that technical tendency.

BofA Global Research

AAA Muni Yields Tend To Peak Near 2.6%

Yardeni.com

A Big Five-Day Bounce

In just the last few days, MUB has seen a rash of buying. The fund is up a massive 2.5% over just five days. That might not sound like much, but it’s a massive muni move, as seen in the “Rate of Change” chart above the price chart below. There has also been a flood of volume in MUB shares this month – a sign of a possible trend inflection.

MUB: Big 2022 Decline, But A Recent Rebound On Big Volume

Stockcharts.com

The Bottom Line

Muni bonds now yield close to 3% while they feature a tax-equivalent yield upwards of 4.6% for those in the highest marginal income tax brackets. Investors should do their own tax research to see if owning this fund makes sense, but MUB can be a decent place to park short-term money for high-income taxpayers seeking a good income. I like the bullish turn we have seen in MUB, and even if rates rise from here, the YTM is strong enough to offset some of those possible principal losses.

[ad_2]

Source links Google News