[ad_1]

Martin Wahlborg/E+ via Getty Images

iShares MSCI Sweden Capped ETF (NYSEARCA:EWD) is an around $543 million portfolio of mostly asset-heavy Swedish companies from the upper- and mid-cap equity echelons.

Its equity basket features 44 stocks, with the top ten accounting for close to 48% of the net assets. Its 54 bps expense ratio seems adequate for an international equity ETF.

EWD might seem alluring as a long-term holding providing passive exposure to a resilient advanced Nordic economy with a comparatively low political risk which bodes well for consistent capital appreciation and income growth over the decades to come.

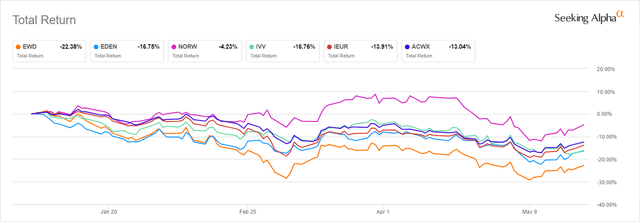

However, this year, EWD has hit a rough patch, in sharp contrast to its stellar 2021 when it outperformed the Nordic peers, the iShares MSCI Denmark Capped ETF (EDEN) and Global X MSCI Norway ETF (NORW), delivering a close to 23% total return vs. 14.8% and 13.1%, respectively, though finishing a bit behind the iShares Core S&P 500 ETF (IVV) that sported a ~28.8% return.

Seeking Alpha

As illustrated by the chart above, though the Scandinavian peers have all been in the red this year, EWD has underperformed both as well as IVV, the iShares Core MSCI Europe ETF (IEUR), and the iShares MSCI ACWI ex-U.S. ETF (ACWX).

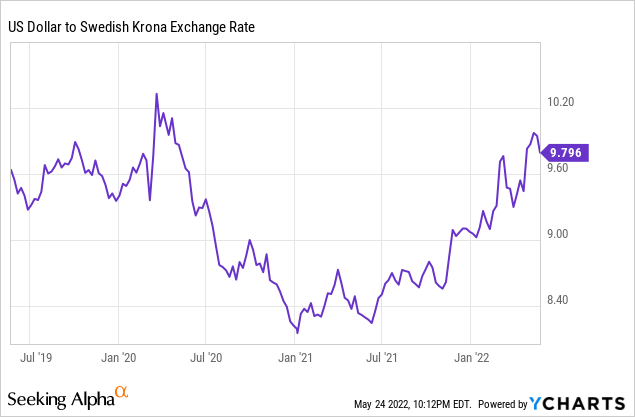

The essential culprit for its dreadful returns in 2022 so far has been the sinking krona, which, in turn, has been impacted by the dovish stance of the Riksbank since the inflation problem in the nation was less of an issue compared to other corners of the developed world. In February, the regulator had no plans to turn hawkish until at least the end of 2024. Thus the surging U.S. dollar buoyed by the inflation-fighting Fed resulted in EWD’s NAV declining. For better context, the EWD holdings dataset from iShares as of May 23 shows a USD/SEK rate of 9.83, while the same file from December 31, 2021, features a rate of 9.05, an increase of over 8.6%.

Of course, the FX headwinds were not the only reason for the NAV cratering as most of the SEK-denominated shares of its holdings have been under pressure amid global bearishness. For example, the essential holding with a 6.3% weight as of May 23 Investor AB (OTCPK:IVSXF), an investment company overseeing a portfolio of publicly-traded and privately-held names, has lost close to 24% in Stockholm since the beginning of the year. Nordea Bank’s (OTCPK:NRDBY) share price has been less afflicted, down by ~11%, likely being propped up by the monetary tailwinds discussed below. At the same time, Atlas Copco (OTCPK:ATLKY), a manufacturer of industrial tools and equipment and EWD’s third largest investment (~5.6%), has been hit much harder, with the share price slipping by a staggering ~34%.

However, the central bank’s dovishness was an issue only in the first months of the year. The regulator reversed course in April with a 25 bps increase of the repo rate, acknowledging that climbing consumer prices surprised to the upside, thus demanding swift and decisive action. Moreover, with the April inflation data released on May 12, it seems the SEK’s decline has finally ended as the USD/SEK has only briefly remained in the over-10 territory for the first time since 2020 and then retreated, with traders pricing in further tightening of credit conditions in the country.

Does that make EWD an apt investment to play that unexpected reversal? I doubt that. With inflation hitting 6.4% in April 2022 (compared to 6.1% in March), being grossly above the 2% target, there is no doubt the Riksbank will proceed with the balance sheet reduction and the repo rate increases in line or even quicker compared to the assumptions shared in the April monetary policy decision press release, but these steps will likely have side-effects. For example, the central bank has already lowered its 2022 GDP forecast to 2.8% from 3.6% to account for the higher CPIF (Consumer Price Index with a Fixed interest rate) and higher financing costs.

Besides, inflation has already been taking its toll on consumer confidence, with the CC index tumbling sharply to 95.23 as of April from the zenith of 103.47 reached in June 2021. For better context, the ratio for the U.S. was slightly above 97 in April. A value below 100 is indicative of pessimism. Business confidence has also been already impacted, though to a lower extent, with the BCI still pointing to optimism (104.1 as of April; the U.S. had 100.5) despite a retreat from a 104.9 level reported in December 2021. Needless to say, with inflation remaining elevated and capital becoming scarcer, this metric might also easily inch lower.

Discussing the portfolio in greater detail

As of the prospectus, the fund’s investment mandate is to track the MSCI Sweden 25/50 Index. At the moment, there are 44 stocks in its portfolio (62 total holdings, including cash and futures), with the top allocation being the industrial sector encompassing 16 companies with a combined weight of ~35.8%. Financials come second, accounting for ~28.3% of the portfolio, with the above-mentioned Investor AB being the key name from the sector. Information technology is the last in the top trio, represented by just three companies, Hexagon (OTCPK:HXGBF), Ericsson (ERIC), and Sinch (OTC:CLCMF), having a ~9.5% combined weight.

Meanwhile, the fund is radically underweight in energy, featuring just one oil & gas exploration & production name, Lundin Energy (OTCPK:LNEGY), previously known as Lundin Petroleum, with a 1.7% weight.

The microscopic footprint in the oil & gas industry immunized the EWD investors against the two calamitous oil price crises of the previous decade, with the latter triggered by the pandemic being especially horrible, with the Brent price dropping to single digits at some point in spring 2020. However, this has also hindered the Sweden ETF from reaping the benefits of the wild oil price rally this year undergirded by the supply/demand imbalances, resulting in Lundin’s share price surging by over 33% to an all-time high. Due to liquidity and FX issues, LNEGY has gained just ~17%.

So, on a side note, investors seeking energy-heavy Nordic portfolios should look at NORW, an ETF with a quarter of the net assets deployed to the sector which I discussed in the November note.

Final thoughts: FX tailwinds, if materialized, are unlikely to bolster returns meaningfully

After a rather robust 2021 with a total return well exceeding its Nordic peers EDEN and NORW, the rough few months of the tumultuous 2022 have sent the ETF’s price straight to the levels it previously tested in 2020, which begs a question of whether this is a textbook example of a buy-the-dip opportunity.

I am of the opinion that even though the risk-reward profile might look appealing, the macro issues pose a serious threat to the fund’s performance.

Surprisingly, high inflation in Sweden is a double-edged sword. While helping the krona to regain lost ground to the U.S. dollar somewhat, it will inevitably dent the fundamentals of the EWD holdings, thus leading to capital depreciation.

Bulls can make their point by touting the fund’s P/E of just ~10.1x, an astounding level that the IVV investors can only dream about. But I should warn against making decisions only on the basis of this seemingly comfortable ratio. The issue is that inflation coupled with higher interest rates can easily catalyze earnings compression, thus the EWD holdings most exposed to higher costs of goods sold, operating expenses and more dependent on fresh capital (thus being rates-sensitive) would suffer most, reporting lower profits, consequently suffering from investor dissatisfaction and declining share prices, while their P/Es could remain the same as the nominator and the denominator would both decrease.

Summing up, with the forecast inflation up and the 2022 GDP growth rate down, the Sweden ETF has a rather risky equity mix at the moment. Hence, though not outright bearish on the fund, I assign it only a Hold rating for now.

[ad_2]

Source links Google News