[ad_1]

The ALPS Alerian MLP ETF (AMLP) is widely known as the leading fund for gaining exposure to the biggest master limited partnerships and their high yields but I believe the Global X MLP ETF (MLPA) looks even better. The Global X MLP ETF offers a higher yield and lower expense ratio than its rival while still giving investors exposure to the MLP sector whose future outlook is looking positive. The MLPA has delivered a solid performance this year and will likely continue doing well in the future.

Image courtesy of Pixabay

The ALPS Alerian MLP ETF, which has $8.55 billion of assets under management, is not only the biggest fund in the MLP space but also one of the largest in the entire energy sector. In fact, it is the second-largest fund behind the energy industry’s largest ETF, the SPDR Energy Select Sector (XLE) which has $13.78 billion of assets under management. The Global X MLP ETF, on the other hand, is a much smaller fund with $901.5 million of assets under management and it doesn’t get as much coverage in the financial media as the Alerian MLP ETF which is considered as the MLP industry’s benchmark fund. But in my opinion, the Global X MLP ETF, or MLPA, is an excellent alternative to the Alerian MLP ETF.

Image: Author

First, let’s talk about the future outlook for midstream MLPs. The oil price environment has been far from stable, with the price of the US benchmark WTI crude falling from $66 a barrel in late-April to $50 at the start of this month to $57 at the time of this writing. The broader equity markets have also fluctuated in this period. The volatility has been driven in large part by the US-China trade war jitters and other geopolitical factors. A number of major US companies have significant exposure to China which is either an integral part of their supply chain network or a key market which underpins their future growth.

On the other hand, the midstream master limited partnerships, in general, have little to no exposure to China. The MLPs typically generate nearly all of their revenues from the United States and their exposure to international markets is limited mainly to Canada. As such, the midstream firms are largely immune from the trade war pressures that have dragged oil prices and the equity markets lower.

Meanwhile, the US Federal Reserve has turned dovish this year and now seems prepared to cut interest rates by up to half a percentage point in the near term. The 10-year bond yields have already fallen by 65 basis points this year. That’s increased the appeal of dividend-paying sectors like MLPs who offer high yields of an average of more than 8%.

At the same time, the US oil and gas production continues to rise which means that there will be significant opportunities for midstream firms whose oil and gas gathering, transportation, storage, processing, and fractionation assets will be used shale drillers. The US oil production from the Permian Basin, which is the most prolific shale oil play in the US, will climb to 4.23 million bpd in July, up from 3.45 million bpd in the same period last year, as per data from the US Energy Information Administration. At the same time, the natural gas production from the Appalachia region, which is the largest gas producing region in the US, will increase to 32.4 billion cf per day from 27.98 billion cf per day a year earlier. In this environment, there will be tons of oil and gas flowing through pipelines and other assets of MLPs.

The MLPA gives investors exposure to 20 of the largest and most liquid midstream MLPs. It tracks the performance of the Solactive MLP Infrastructure Index which follows those MLPs that own and operate assets used in energy logistics such as pipelines, storage facilities, and natural gas gathering and processing plants. MLPA is a top-heavy fund in which the largest holding, which is usually the biggest MLP in terms of market cap, gets the highest rank in the portfolio and the greatest percentage of net assets.

The smaller MLPs sit at the bottom of the holdings table and get a small share of the fund’s assets. MLPA’s top-3 holdings are all large-cap, well-established MLPs – Enterprise Products Partners (EPD), Energy Transfer (ET), and Magellan Midstream Partners (MMP). Together, the three firms account for more than a quarter (27.3%) of MLPA’s assets. Not surprisingly, MLPA is heavily tilted towards large-cap, with a weighted average market cap of $17.85 billion.

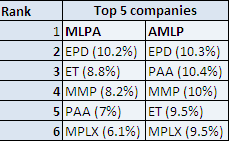

AMLP, whose underlying index is the Alerian MLP Infrastructure Index, also has a similar portfolio. AMLP tracks four more firms than MLPA. However, both MLPA and AMLP have Enterprise Products, Energy Transfer, Magellan Midstream, Plains All American (PAA), and MPLX LP (MPLX) in their top 5 holdings with slight changes in their positions. AMLP is more tilted towards the top-10 companies than MLPA. The ALPS Alerian MLP ETF’s top-10 holdings account for 73% of the fund’s assets while Global X MLP ETF’s ten largest holdings represent around 65% of the fund. This difference of around eight percentage points, however, isn’t significant.

Image: Author

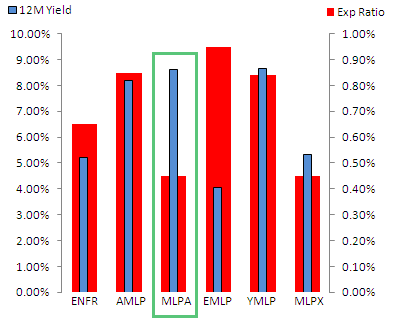

However, the two key things which make MLPA a better ETF than its bigger rival is that it offers a higher dividend yield and charges a lower annual fee. MLPA’s 12-month yield clocks in at 8.61% which exceeds 8.19% offered by the Alerian ETF. The Global X ETF comes with a low expense ratio of just 0.45% which means that the fund charges just $45 each year on every $10,000 of investment. AMLP, on the other hand, has a much higher expense ratio of 0.85%.

In fact, MLPA offers one of the most attractive combinations of high yield and low expense ratio in the entire MLP ETF universe. The other leading MLP funds such as the ALPS Alerian Energy Infrastructure ETF (ENFR), First Trust North American Energy Infrastructure ETF (EMLP), and Global X MLP & Energy Infrastructure ETF (MLPX) offer lower dividend yields of 5.22%, 4.04%, and 5.33% respectively. The VanEck Vectors High Income MLP ETF (YMLP) comes with a dividend yield of 8.63% which is marginally higher than what investors get with MLPA but YMLP also has a much higher expense ratio of 0.84%.

Image: Author. Data: Morningstar, Seeking Alpha Essential.

MLPA looks well positioned to deliver a good performance in the future on the back of the strength of its underlying MLPs, particularly its top holdings which are positioning to capitalize on the growing levels of oil, gas, and NGL production.

As indicated earlier, Enterprise Products is MLPA’s top holding. It is an NGL powerhouse with exposure to crude oil, natural gas, and petrochemicals as well while its asset footprint is spread across all the major shale oil and gas-producing regions in the US. Enterprise Products also owns export facilities which allow it to tap into the growing demand of US fuels from international markets, particularly from Asia. It has a rock-solid financial health, which is evident from the fact that it has the best credit rating in the midstream energy sector and a healthy leverage ratio of 3.4x EBITDA.

Enterprise Products also has a solid track record of consistently growing distributions for two decades at a CAGR of 8%. The MLP is currently working on a number of growth projects, including roughly 700 miles of pipelines, a petrochemical facility, and ethylene export terminal, which will drive its earnings and distributable cash flow growth in the near future. That will make it easier for Enterprise Products to continue growing distributions.

For these reasons, I believe MLPA is a great ETF for those investors who are looking to gain exposure to the midstream space. It has performed well this year, rising by 14.2% and outperforming AMLP which has posted gains of 11.7% in the same period. MLPA’s shares are priced at a reasonable 19.4x earnings. With an attractive dividend yield and low expense ratio, the MLP has generated solid returns for its shareholders and could continue doing well in the future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News