[ad_1]

tolgart/E+ via Getty Images

Investment Thesis

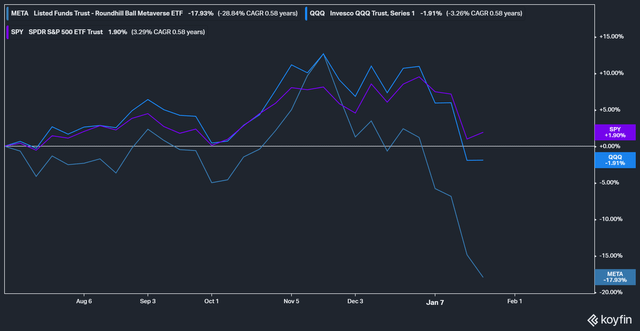

Roundhill Ball Metaverse ETF (NYSEARCA:META) has hit its all-time lows recently, as the market correction continued in January. However, in a late December article, we highlighted that investors keen on a diversified metaverse ETF can consider META. We also revised our rating from Neutral to Buy as it seemed sellers had digested the ETF’s momentum spike.

Nonetheless, the ETF surprised us as it raced to hit its all-time lows last week. Moreover, it was an incredible decline from its November momentum spike. Notably, we observed that the ETF underperformed most of its top six holdings since July.

Therefore, we think that while the ETF seems quite well-diversified, it still needs to prove its ability to outperform. As such, while we still rate META as a Buy, we believe it should only be used as a speculative opportunity to gain access to the metaverse.

Apple Joined the Top Six Holdings for January

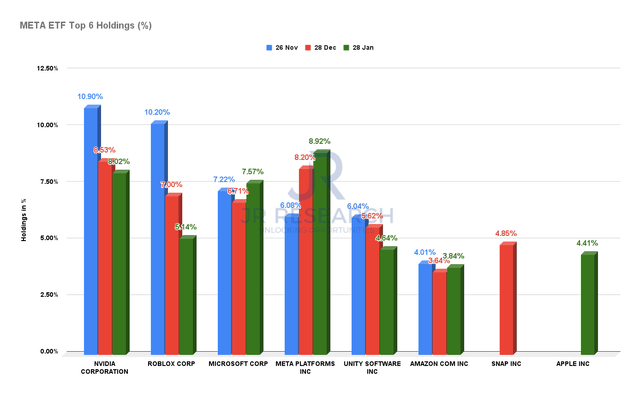

Changes in META top six holdings since 26 November’21

Roundhill Investments

Readers can glean that the most notable change to META ETF’s top six holdings as of 28 January is the addition of Apple (NASDAQ:AAPL) stock. The Cupertino company announced its FQ1’22 results recently, which it delivered with aplomb. We also discussed Apple’s results in a recent article. Given the strength of AAPL stock over the last couple of months, investors should not be surprised that it has made its way into the top six. Moreover, given the strength of the company’s robust performance and guidance, AAPL stock could continue its stay at the top.

Snap (NYSE:SNAP) stock left its top six after joining the fray in December. Its continued slide from its all-time highs in September has added more misery for its investors and META ETF. Despite losing more than 60% of its value since September, some investors still consider its valuation too expensive.

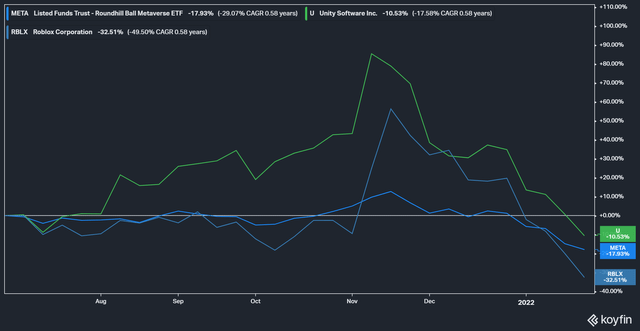

META ETF performance

koyfin

Furthermore, Roblox (NYSE:RBLX) and Unity (NYSE:U) stocks have also continued to slide after making their all-time highs in November. Their spikes in November were the key reasons why we were cautious on META’s positioning back then. As both stocks continued declining, their weightings in META have also fallen. Notably, we also observed that the manner of their recent slides bore similarity to META ETF’s price decline, as seen above. Both stocks are still among the top 6 holdings of the META ETF, so investors should continue to expect significant volatility.

NVIDIA (NASDAQ:NVDA) stock was its #1 holding in November and December. However, the stock has lost 34% of its value since its all-time highs in November. Consequently, it also markedly impacted the ETF’s performance.

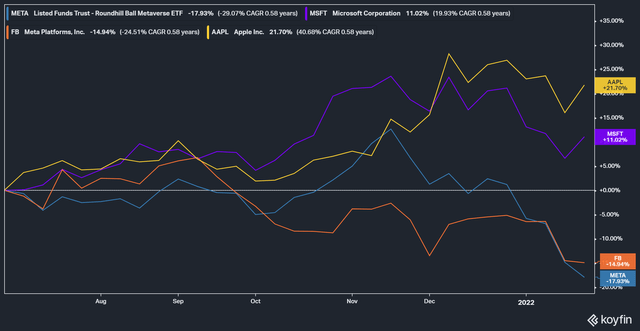

META ETF Performance

koyfin

Therefore, META had to count on what we consider as “predictable” stocks for their wide moats and strong competitive advantages recently; the trio of Microsoft (NASDAQ:MSFT), Meta Platforms (NASDAQ:FB), and Apple. Microsoft and Apple announced their earnings last week. Investors breathed a sigh of relief as both companies demonstrated their prowess with their robust earnings. Microsoft wowed investors with solid growth across its cloud computing segment and also issued impressive guidance moving ahead. We also discussed MSFT’s earnings in a recent article. In addition, Apple CEO Tim Cook & Team reported a record quarter and guided for a firm FQ2. Thus, we believe that AAPL and MSFT’s robust performances will continue to undergird META ETF’s performances moving ahead. Moreover, we can observe that both stocks have also significantly outperformed the ETF.

Meta Platforms will report its results in the coming week. It’s vital as FB stock is the #1 holding in META ETF’s holdings for January. In addition, investors can observe that the market has punished its stock since last July, as it had dealt with Apple’s IDFA changes. Therefore, we believe that the market will be looking towards Meta CEO Mark Zuckerberg and Co. to demonstrate that the company has made notable progress. While we think that the near-term volatility in FB’s stock looks to have been priced in, there could be further volatility if Zuckerberg disappoints.

Nevertheless, we also shared in a recent NVIDIA article that discussed Meta Platform’s ambitions to build the “fastest AI supercomputer in the world when it’s fully built out in mid-2022,” codenamed AI Research SuperCluster (RSC). Its development is critical for its metaverse ambitions. Thus, we have a high conviction that Meta’s strategy to build its transformative virtual world is well on track. Therefore, we encourage investors to ignore the near-term volatility over its stock if earnings disappoint next week as FB continues to adjust to life with Apple’s new AppTrackingTransparency framework.

We also explained that we remain confident of NVIDIA’s ability to deliver on its full-stack AI computing growth story over the next few years. NVDA bears have leaped to their defense recently, as they parsed its stock’s 34% drop from the top. But, should investors be surprised with the extent of its retracement?

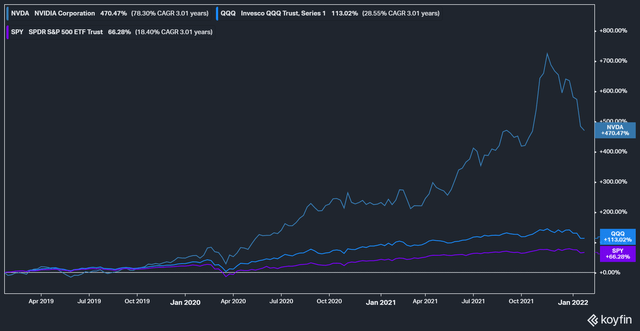

NVIDIA stock 3Y performance

koyfin

Given its substantial rise over the past three years, we believe that it’s only healthy for a deep correction to shake out the weak hands. Investors should not be taken aback at all. Given that it rose 470% over the last three years (3Y CAGR: 78.3%), the drop is merely a necessary and healthy blip in its growth story. We believe that the best is yet to come for NVIDIA, as it starts to monetize its multi-billion opportunities through its full-stack leadership. Its Omniverse engine will play a significant role in helping companies develop their metaverse strategy. Therefore, we can understand why NVDA stock is still the #2 holding in the META ETF. We are confident that the stock will continue to outperform over time.

Then, Why Buy META ETF Only for Speculation?

META ETF performance

koyfin

META ETF currently has 46 stocks. While it’s diversified, it’s less diversified than the Invesco QQQ ETF (NASDAQ:QQQ) and the SPDR S&P 500 ETF (NYSEARCA:SPY), for example. Therefore, it’s still a thematic ETF and should not be used to replace an Index ETF strategy. In addition, its top six holdings account for about 39% of its total fund exposure. Therefore, it’s imperative that its top holdings continue to outperform the market over time. Nonetheless, the rest of its holdings still account for more than 60% of its exposure. Thus, the fund selection (through the Ball Metaverse Index) over the rest of its holdings is also critical.

Nonetheless, given the ETF’s volatility against the market, we believe that it’s only suitable as a speculative opportunity for now. META needs to prove that it can deliver much better consistency before we are willing to consider it suitable for a general thematic investment strategy.

While we reiterate our Buy rating, we wish to caution that it’s suitable only as a speculative opportunity for now.

[ad_2]

Source links Google News