[ad_1]

AsiaVision/E+ via Getty Images

iShares MSCI China ETF (NASDAQ:MCHI) is an exchange-traded fund offering exposure to large and mid-sized Chinese companies, targeted access to the Chinese equity market. The ETF seeks to replicate the performance of its chosen benchmark index, the MSCI China Index. The expense ratio is 0.57%, which is not cheap, but in line with similar macro-oriented ETFs with country-specific strategies.

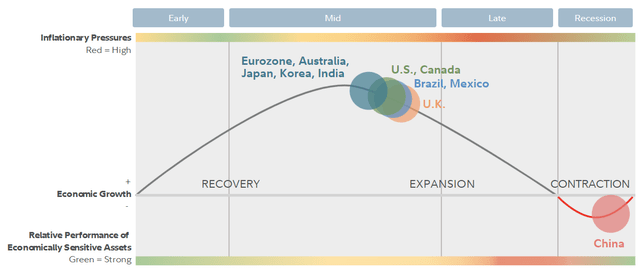

The fund had 630 holdings as of May 20, 2022, while iShares reported a price/book ratio of 1.47x (not particularly high), and a 30-day SEC yield of 1.44% (also not particularly high). The price/earnings ratio was a relatively low 10.04x, but valuations are generally lower in China due to important factors such as political uncertainty and possibly more recently due to the fact that China is in recessionary territory economically. See for example analysis from Fidelity as of Q2 2022.

Fidelity.com

However, one could argue China is now best positioned for an upswing given that its business cycle appears well ahead of the United States and other major economies. If China is contracting, perhaps things can only get better from here. Picking a bottom in the market is not easy, but it is possible we might see Chinese equities out-perform cyclically.

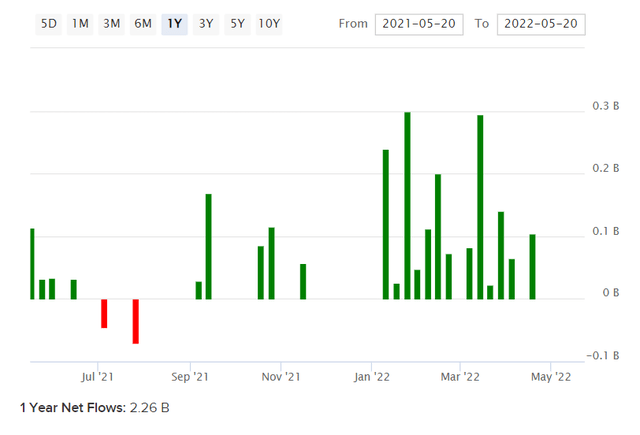

MCHI had assets under management of about $6 billion as of May 20, 2022, which would evidence a fairly high level of popularity. As depicted below, fund flows have been positive to the tune of circa $2.3 billion over the past year.

ETFDB.com

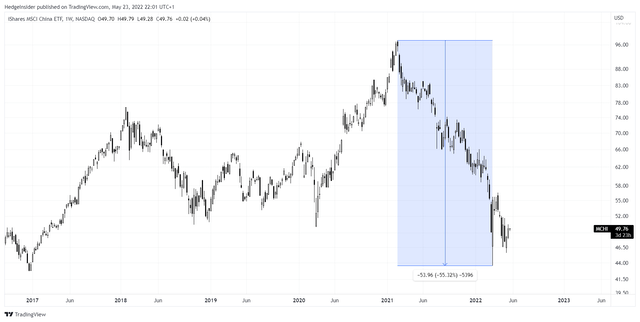

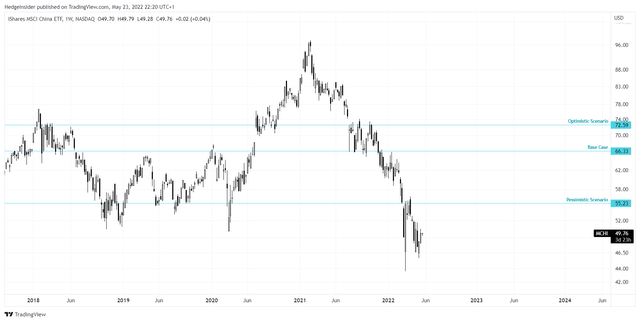

Perhaps you could take the opposite view as a contrarian and argue that maybe investor sentiment is implicitly optimistic. Nevertheless, MCHI is an ETF marketed predominantly to U.S. investors, and U.S. investors are not the only source of equity capital in China. Most equities are off their all-time highs recently, and MCHI is not exception. The chart below illustrates a recent drawdown of about -55%.

TradingView.com

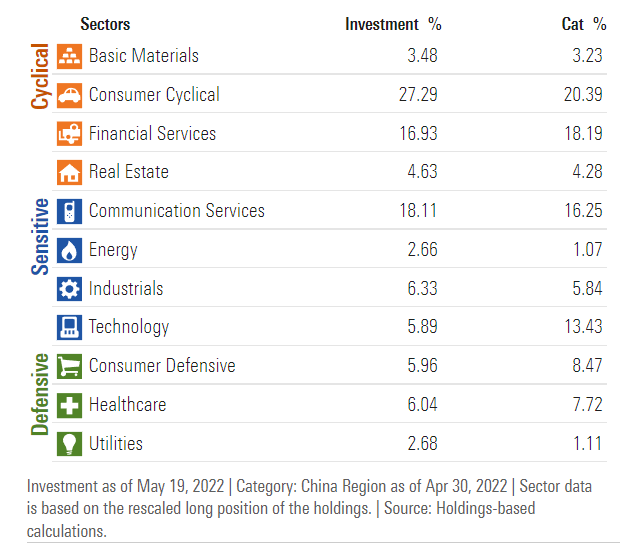

The MCHI fund is predominantly exposed to so-called Cyclical and Sensitive sectors (see classifications of MCHI’s sector exposures from Morningstar below). If Fidelity is correct to be viewing China in an economic contraction, the recent drawdown in the price of MCHI makes sense.

Morningstar.com

This also makes MCHI potentially interesting if we are to expect an economic rebound in China/Asia-Pacific.

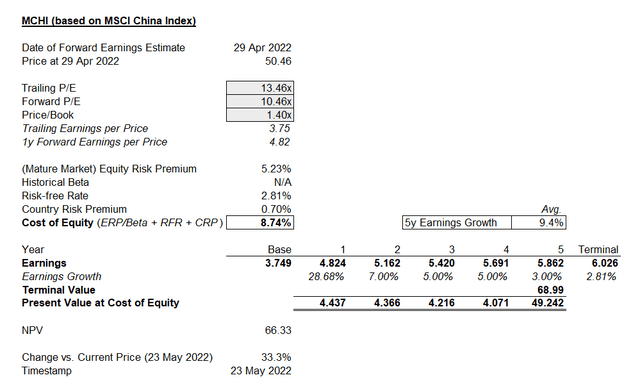

In terms of valuation, I would refer to the MSCI China Index as a source of clean, unbiased data (which does not adjust earnings for costs such as interest and taxes like for example Morningstar’s data might). Nevertheless, Morningstar does report a consensus analyst estimate of three- to five-year earnings growth of 7.69%, which is possibly directionally useful. I assume slightly better growth on the basis that MSCI’s index implies forward one-year earnings growth of 28.68%; afterwards, I assume 7% in year two, then 5% until year 5 in which I assume only 3% growth, and then the terminal year I go back to the risk-free rate (currently 2.81% on the Chinese 10-year).

For the discount rate, I assume 5.23% in accordance with Professor Damodaran’s estimate for May 2022 of the ‘mature market’ equity risk premium. I also use Damodaran’s suggested equity risk premium for China of circa 0.70%, and add in the Chinese 10-year yield of 2.81%. The sum is 8.74%, the level of return we should probably demand by investing in Chinese equities. Based on the above assumptions, MCHI is undervalued.

Author’s Calculations

Let’s assume forward one-year earnings estimates are correct, but instead, to be more conservative, let’s assume zero earnings growth through to the terminal year. On this basis, MCHI would still be undervalued with 11.0% upside potential. In the base scenario illustrated in my table above, the implied cost of equity would be not 8.74% but 11.53%. In my pessimistic scenario, the implied cost of equity would be 9.69%. So, I would guess that forward (total) returns are likely to be 9.69-11.53% per annum over the next few years for MCHI.

Of course, you could also argue that MCHI is fundamentally undervalued, that the implied cost of equity is unfairly elevated. If we see an upswing in the Chinese economy and Chinese equities, we could even see a compression of the embedded equity risk premium to, say, 4.50% (excluding the country risk premium). If we hold other assumptions constant, upside potential would come to 45.9%. From the current market price, that means our more rosy scenarios would take us to anywhere from $66.33 per share (albeit in total return terms) to $72.59 (illustrated below).

TradingView.com

On this basis, I view MCHI as fundamentally undervalued in basically every case. The only situation in which MCHI is likely to continue to fall is if either investors sell off Chinese equities indiscriminately (probably in accord with broader risk sentiment globally), or China makes some catastrophic political moves that are “anti-markets”. I think the latter is the most prominent concern, but these moves are difficult to predict. An example would be Russian equities recently, crashing and/or de-listing following the country’s escalation of the Russo-Ukrainian War.

Nevertheless, rather than declaring Chinese equities uninvestable for political reasons, I will assume that one invests in China as part of a diversified strategy (not as a significant portion of one’s portfolio). On this basis, I think Chinese equities look like they offer a pretty attractive risk/reward profile. I would probably suggest that one should invest no more than 5% of one’s portfolio in Chinese equities due to political risks, and yet I would hold a generally bullish view on MCHI in light of its current price vs. fair value.

[ad_2]

Source links Google News