[ad_1]

PercyAlban/iStock Unreleased via Getty Images

iShares Russell Mid-Cap Growth ETF (NYSEARCA:IWP) is a fund overseeing a portfolio of medium-size U.S. equities exhibiting robust growth characteristics.

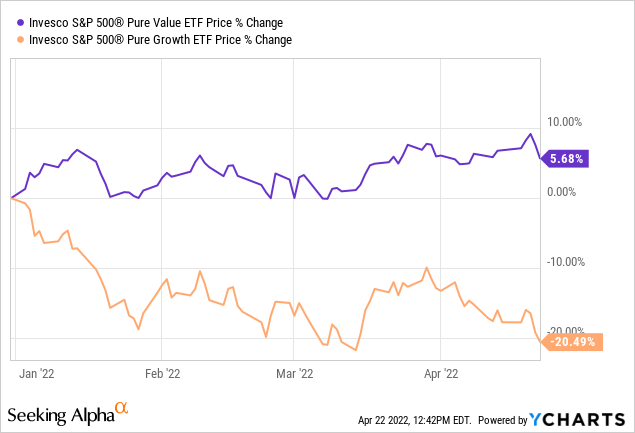

For quite some time, approximately since the end of 2021, I have been a growth-style skeptic, consistently arguing against a too-large allocation to richly priced equities with great expectations factored in. And as we have already seen this year, investor exodus has disproportionately affected high-multiple stocks, mostly from the broad tech sector, while value players, especially those from the large-cap echelon, have been chugging along. So my skepticism was justified. The difference between the returns of the Invesco S&P 500 Pure Growth (RPG) and the Invesco S&P 500 Pure Value ETFs (RPV) offers a perfect illustration.

But have the thesis already become irrelevant? Should I change my mind now? The decline cannot continue ad infinitum, and periods of prolonged softness might offer generous discounts, and, hence, rare buying opportunities and superior returns. But I would not say so. There are still a few reasons for skepticism, which I would like to explain below in the article.

Before we delve into the strategy and holdings, my primary conclusion is that investors who ignore the price tag, paying attention only to growth stories (that have been already materializing for some time or are only about to be delivered) would likely find IWP alluring, especially if they want an ex-Tesla (TSLA) and the like portfolio. And hence, if they are expecting growth (or speculative, if you please) equities to stage a massive rebound despite a few (probably, rather aggressive string) potential rate hikes in the U.S., this ETF should appeal to them, especially considering its adequate cost structure. However, those who prefer a more balanced value/quality/dividend mix would be disappointed.

The investment strategy and the portfolio

According to the prospectus, IWP tracks the Russell MidCap Growth Index. Constituents are selected from the Russell MidCap Index, which, in turn, is based on another benchmark – the Russell 1000, which is at times used as a bit broader substitution for the S&P 500.

To qualify for IWP’s underlying index, a company must have a relatively higher Price/Book (reflecting a growth premium) and stronger growth prospects manifested in higher 2-year I/B/E/S forecast growth and higher 5-year sales per share historical growth. So at least in theory, IWP’s holdings should have both solid forward profit and past revenue growth; we will check that below in the article.

The benchmark is rebuilt completely once a year to ensure the portfolio does not lose relevance, and players delivering on growth targets constitute the bulk of it. More details on the index construction can be found in the factsheet downloadable from the FTSE Russell website.

Since the portfolio is composed of the selected Russell 1000 constituents (not Russell 2000, which encompasses small-size names), the possibility of it being overweight in companies with less than $10 billion in market values is tilted towards zero. More specifically, as of April 18, approximately 82% of IWP’s net assets were allocated to companies with market capitalizations above that level. Those who amassed at least $20 billion had ~57%, like Palo Alto Networks (PANW), the largest holding with a 1.75% weight.

Hence, amongst the growth funds I covered in the past, its closest peer is VOT which tracks the CRSP US Mid Cap Growth Index. As I discussed in the note, VOT has exactly the same issue: it has a large-cap equity mix, with all value and quality characteristics typical for this echelon.

| iShares Russell 2000 Growth ETF (IWO) | October 2021 article |

| iShares Russell 1000 Growth ETF (IWF) | November 2021 article |

| Vanguard Mid-Cap Growth ETF (VOT) | January 2022 article |

| Invesco S&P 500 Pure Growth ETF (RPG) | January 2022 article |

IWP has a bit larger allocation to the tech sector, ~34% now vs. VOT’s ~28.4% as of end-March, but it is possible the figure has changed since then.

IWP’s second-largest sector is healthcare, with DexCom (DXCM), a company sporting an A- Quant Growth grade being the key position from this sector.

Examining value, growth, and quality characteristics

As I said above, IWP’s key issue is valuation. It would be rather strange to expect large-cap growth equities to trade at a discount. And 82% of the fund’s holdings having a D+ or worse Valuation grade is not a surprise. But is that safe when aggressive interest rate hikes are in the cards? Readers should answer by themselves.

IWP’s growth credentials also do deserve a deeper inspection. First, the fund has around 41% allocation to stocks with Growth grades of at least B-. This is fairly impressive. Most funds I have analyzed to date typically had below 30%.

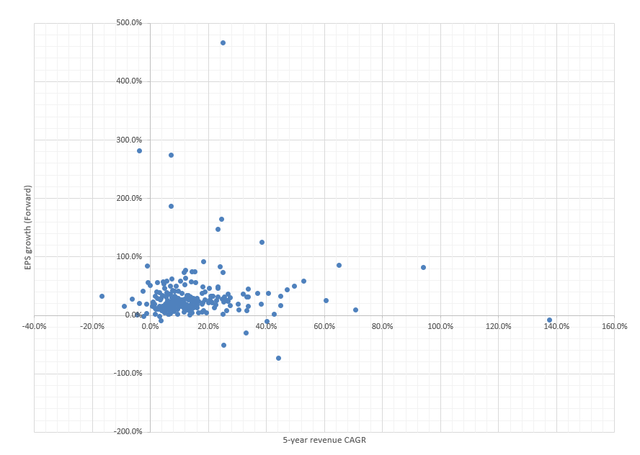

To bring a bit more color, as promised, I assessed the past sales and future earnings growth rates. The following chart summarizes 5-year revenue CAGRs and forward EPS growth rates:

Created by the author using data from Seeking Alpha and the fund

Please, take notice that the chart covers ~77% of the holdings as those with missing revenue or/and earnings growth data and those without a Quant rating (~1.3%) were excluded.

What does the chart tell us? Certainly, IWP has a portfolio of companies capable of delivering outstanding growth rates. For example, ~23% boast an over 20% 5-year revenue CAGR, a phenomenal result. But laggards can also be spotted. More specifically, Howmet Aerospace (HWM) has a 5-year sales CAGR of (16.7)%; still, as it is forecast to deliver a 32% EPS growth, I believe its presence in the growth equity mix is justified.

Speaking of quality which in the case of companies expanding rapidly is typically soft, IWP has close to 82% of the net assets allocated to stocks with a B- Profitability rating and better. This is more than enough to say the quality is barely a concern. IWO, for instance, had only ~50% as of the end of October 2021.

Returns: a brief view

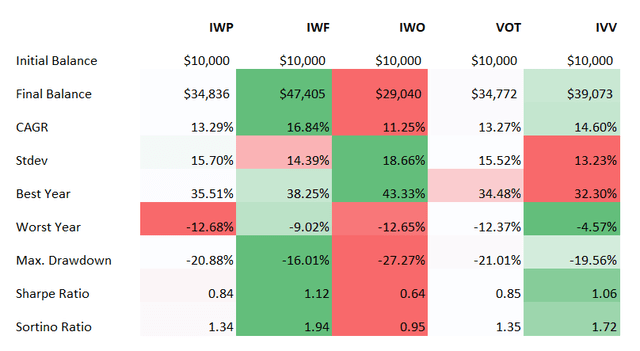

What returns the strategy was capable of delivering in the past? For example, during the previous decade? The table below offers a succinct answer.

Created by the author using data from Portfolio Visualizer

Heavyweights from IWF beat all the selected peers easily, with a 16.8% CAGR delivered between March 2012 and March 2022, while also offering stronger Sortino and Sharpe ratios (more reward for more risk). Partly, this result was bolstered by an outstanding 2020, one of the most successful years for the growth style thanks to the pandemic-related tailwinds. IWO, a truly mid/small-cap mix, is the weakest in the cohort, partly owning to terrible 2021 performance and sluggish 2022 to date.

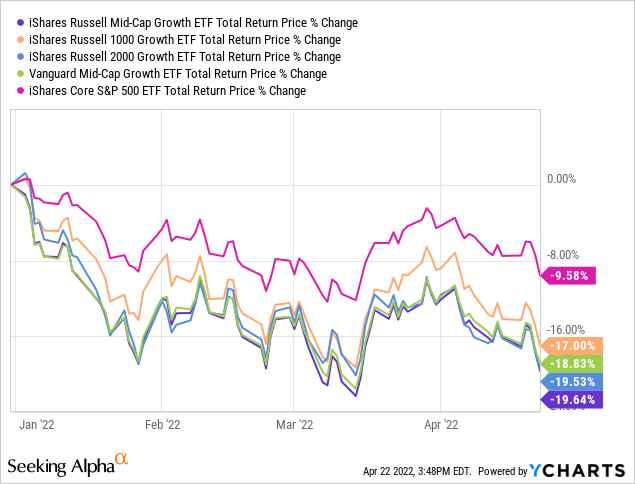

This year, all the selected ETFs including IVV which I use as a market barometer have been suffering from the reduction of the growth premia. The total returns speak for themselves:

Final thoughts

The following conclusions can be drawn:

- IWP is mostly a large-size ex-mega-cap fund, with limited, or better to say, diminutive exposure to the medium/small-size echelon. Investors should incorporate this fact into their ETF selection process and decide if they can tolerate it or not. This is a story similar to VOT.

- IWP’s permanent issue is overvaluation. During the hawkish 2022, amid persistent inflation that can become even worse in case energy prices continue creeping higher, too-large exposure to extremely overpriced stocks is a precarious proposition.

- Thanks to the size factor, IWP easily beats its counterparts like IWO in terms of profitability characteristics, though it should be noted it does not guarantee superior returns.

- Its expense ratio of 23 bps is below the sector median. At the same time, it has a diminutive dividend yield of 42 bps, which is consistent with its strategy revolving around the growth factor. Anyway, for dividend-focused investors, IWP is a fund to ignore.

Considering all of the above, IWP earns a Hold rating.

[ad_2]

Source links Google News