[ad_1]

Olemedia/E+ via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on February 26th, 2022.

The Global X Lithium & Battery Tech ETF (LIT) is an equity index ETF focusing on lithium companies, a key beneficiary of the burgeoning EV industry. LIT offers investors a simple way to profit from increased EV industry growth, and is a buy.

LIT – Basics

- Investment Manager: Global X

- Underlying Index: Solactive Global Lithium Index

- Expense Ratio: 0.75%

- Dividend Yield: 0.43%

- Total Returns CAGR 10Y: 10.11%

LIT – Overview

LIT is an equity index ETF, investing in companies which focus on lithium mining and lithium battery production. The fund tracks the Solactive Global Lithium Index, an index of these same companies. It is a relatively simple index, including all relevant securities meeting a basic set of industry, liquidity, trading, and size criteria. Under normal conditions, the fund invests in 20 to 40 different holdings, depending on industry size and on the number of stocks meeting relevant inclusion criteria. It is a market-cap weighted index, with weight caps to ensure a modicum of diversification. LIT has an index methodology summary here, which explains the index in more detail, but I’ve summarized the most important points above.

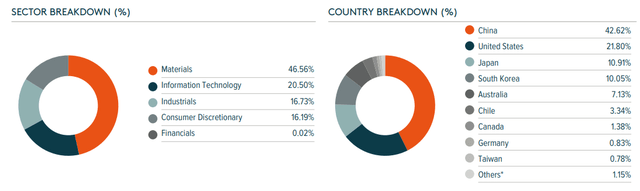

LIT’s largest holdings, industry and country exposure, are as follows.

LIT Corporate Website LIT Corporate Website

As can be seen above, LIT provides investors with some measure of industry, country, and issuer diversification. Nevertheless, LIT remains a relatively concentrated, niche fund, as it focuses on an extremely narrow set of stocks: those focused on lithium. As such, allocations to LIT should be kept relatively small, as a risk-reduction measure. Lower than 5% seems best, higher than 10% seems excessive, in my opinion at least.

LIT’s strategy and holdings cause the fund to (mostly) perform as a tech fund. This is because LIT’s holdings specialize in lithium mining and lithium battery production, the latter of which is a key component in electric vehicles (EVs), an industry which performs in-line with tech equity indexes. LIT focuses on lithium, lithium is an EV proxy, and EVs trade alongside tech indexes.

As an example of the above, we have Albemarle (ALB). ALB is the world’s largest lithium mining company, and it has seen strong demand for its products due to increased EV production. As such, there is a clear link between increased EV adoption and EV / tech / LIT performance.

ALB Investor Presentation

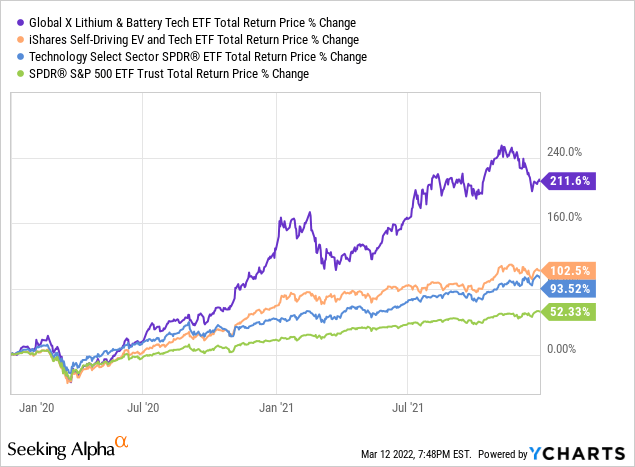

Due to the above, expect LIT to outperform when the EV industry and tech outperforms, as was the case between 2020 and 2022.

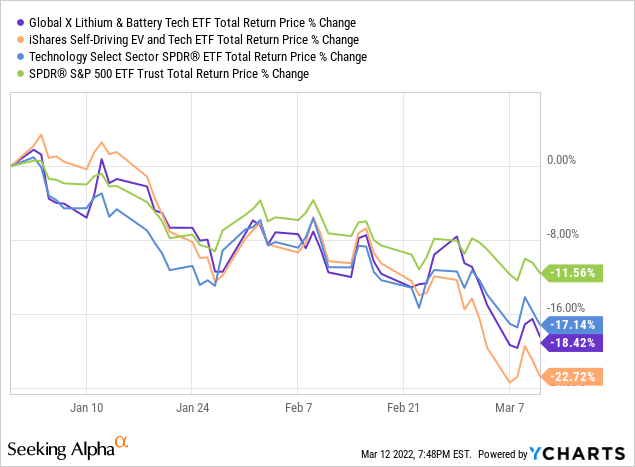

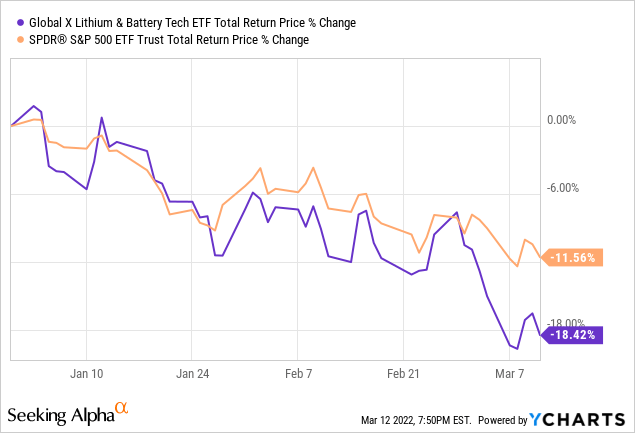

On the other hand, expect the fund to underperform when tech underperforms, as has been the case YTD.

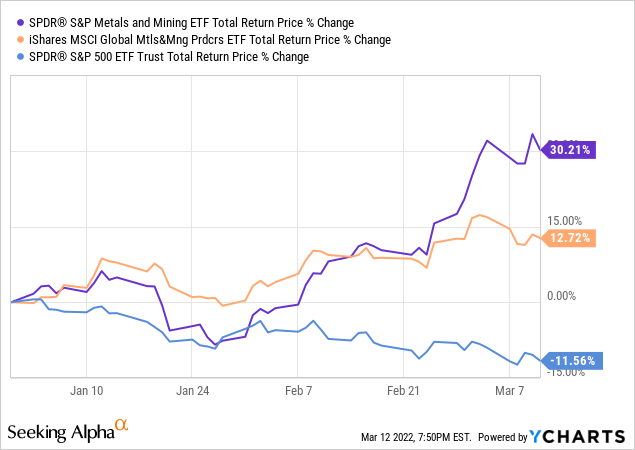

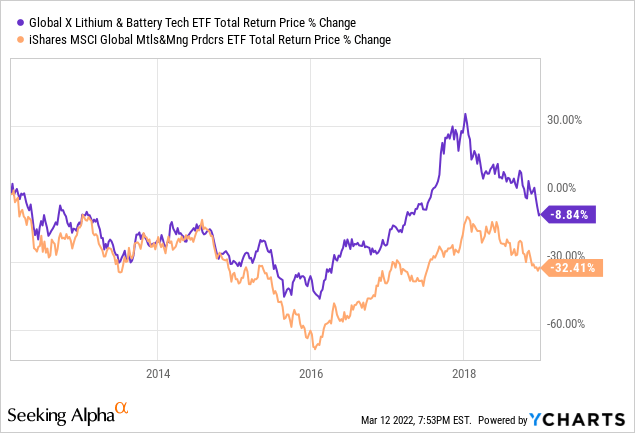

Although LIT is technically a mining fund, it does not currently behave or perform as one. This is mostly due to the fund’s aforementioned dependence on the EV industry. As such, investors should not expect the fund to perform in-line with other mining funds, or use the fund to express their views or opinions on the broader mining industry.

As an example, mining stocks tend to perform well when commodity prices are high and inflation is increasing. Both are currently true, which has caused most mining equity indexes to perform reasonably well YTD.

LIT, on the other hand, has underperformed YTD, even though it focuses on lithium mining stocks. As mentioned previously, this is because the fund tends to trade more like a tech fund than a mining fund, due to focusing on EV industry inputs.

All of the above is somewhat dependent on market sentiment, and I could see sentiment reversing, and for LIT to start performing like a more normal mining fund. I don’t see a catalyst for this, but it is still definitely a possibility.

From what I’ve seen, this was the case before 2017 or so, when EVs were extremely niche products, and so less important for the fund or its underlying holdings. As an example, the fund’s performance was almost identical to that of the iShares MSCI Global Metals & Mining Producers ETF (PICK) from inception to 2017. LIT’s decoupling from other mining funds is a recent phenomenon, and could always reverse itself.

Let’s summarize the above.

LIT focuses on lithium mining and lithium battery production companies. As lithium batteries are a key component in EVs, the fund behaves more like a tech fund that like a mining fund. With this in mind, let’s have a look at the fund’s benefits and drawbacks, starting with the benefits.

LIT – Benefits and Investment Thesis

Strong Growth Fundamentals and Expectations

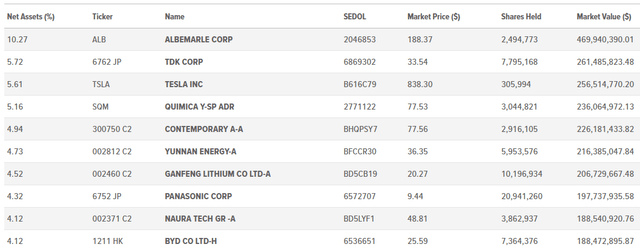

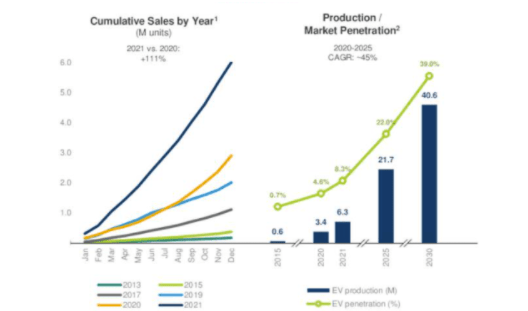

LIT focuses on companies which produce inputs for EVs, and EVs are booming, due to environmental concerns, favorable government regulations, and high gas prices. Double-digit annual growth rates are common in the industry. Most analysts expect strong growth moving forward, with Albermarle expecting 45% CAGR in the EV industry for the next decade or so.

ALB Investor Presentation

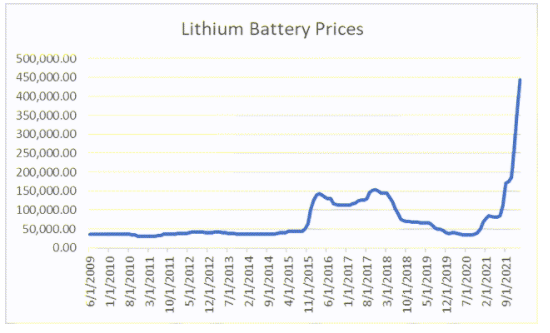

Tesla (TSLA), the EV industry pioneer, is the fastest-growing automaker in the world, and the best-performing one too. Other automakers, including Ford (F) and Volkswagen (OTCPK:VWAGY), are investing quite heavily in EVs too. Countries around the world are strongly supporting the industry, with the UK banning the sale of internal-combustion engine cars by 2030. EVs are the future, which should lead to increased demand for lithium and lithium batteries, ultimately resulting in significant revenue and earnings growth for companies focusing on these products. Demand has skyrocketed these past few months, leading to skyrocketing lithium prices, which should further help boost growth rates moving forward.

Investing.com – Chart by author

LIT’s underlying holdings are incredibly-well-positioned to take advantage of these trends. Which brings me to my next point.

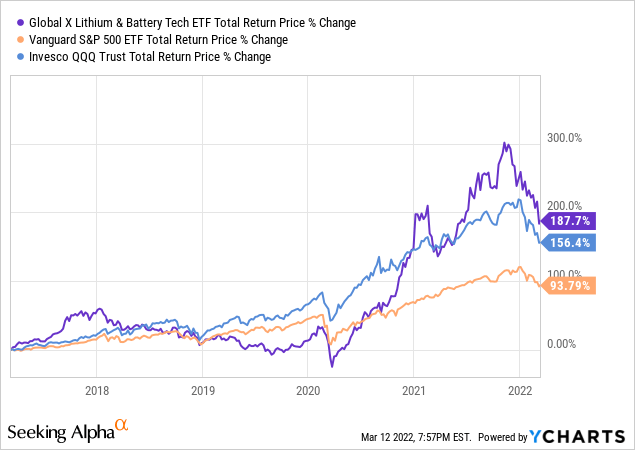

Strong Performance

Strong EV industry growth should lead to significant, market-beating returns for LIT and its shareholders. This has been the case these past few years, with the fund outperforming most relevant equity indexes, as expected.

LIT has outperformed due to the strong fundamentals and growth rates of its underlying holdings. Outperformance should continue as long as strong EV growth remains the norm, which seems quite likely. As such, I expect LIT to outperform in the coming months and years, as has been the case in the past.

LIT – Risks and Negatives

LIT is a strong fund and investment opportunity, but it is not without risks or drawbacks. Two stand out: the fund’s frothy valuation, and bearish investor sentiment. Both have led to moderate underperformance YTD. Let’s have a look at each of these two points.

Frothy Valuation

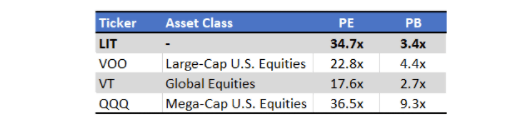

LIT’s share price has skyrocketed these past few years, which has led to a relatively expensive, frothy valuation. The fund currently sports a PE ratio of 34.7x, and a PB ratio of 3.4x. These are relatively high figures, and moderately higher than those of most broad-based equity indexes, including the S&P 500. On a slightly more positive note, the fund is not materially more expensive than tech indexes, including the Nasdaq-100. LIT is an expensive fund, but not more than the average tech fund.

Fund Filings – Chart by Author

Frothy valuations can lead to losses and underperformance, which brings me to my next point.

Bearish Investor Sentiment

LIT’s performance is partly dependent on investor sentiment. Although this is the case for most funds and investments, it is particularly important for growth funds with frothy valuations and low dividend yields. Investments with cheaper valuations and stronger yields might deliver strong returns through income alone, but that will not be the case for LIT and its 0.39% yield. LIT relies on bullish investor sentiment to turn strong underlying revenue and earnings growth into rising share prices and returns. Sentiment has, however, been bearish YTD, as investors grow weary of stocks, industries, and funds with frothy valuations, and rotate into value.

Importantly, investor sentiment remains bearish, which could lead to significant losses and underperformance for the fund moving forward. I think LIT’s fundamentals are of greater importance than bearish market sentiment, and so rate the fund a buy, but market sentiment does matter. As Keynes said, markets can remain irrational longer than you can stay solvent.

Conclusion

LIT offers investors a simple way to profit from the booming EV industry. The fund is a solid investment opportunity, and a buy.

[ad_2]

Source links Google News