[ad_1]

The iShares Global Timber & Forestry ETF (WOOD) has significantly underperformed the broader market offer the last year. WOOD is also now following the market further down. On extreme market weakness, this ETF may make strong long term investment due to the relative value and potential for income production, including the significant timber REIT exposure this ETF has.

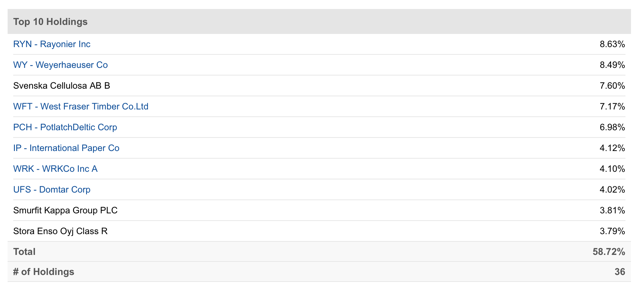

WOOD has significant REIT exposure

WOOD offers exposure to products made of wood, such as lumber, paper and packaging, but it is primarily a timber REIT. The underperformance of the ETF is primarily due to homebuilder weakness and corresponding declines to lumber pricing, though slowing global growth will reduce demand for packaging too.

Both WOOD and the Invesco MSCI Global Timber ETF (CUT) include timer REITs, but WOOD is considerably more concentrated in timber REITs, while CUT’s core holdings are more diversified, but still includes Weyerhaeuser (WY) as its second largest holding.

WOOD’s top 10 holdings (Source: Seeking Alpha)

CUT’s top 10 holdings (Source: Seeking Alpha)

CUT’s top 10 holdings (Source: Seeking Alpha)

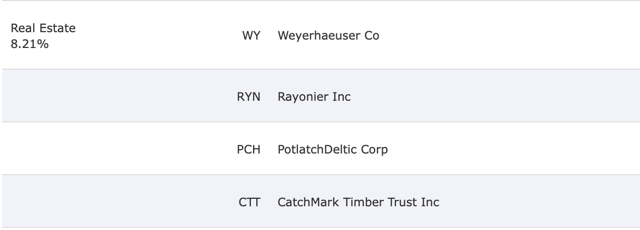

CUT actually has fairly limited REIT exposure and is primarily materials and products oriented. CUT’s total REIT holdings are roughly 8% of its holdings, where WOOD has two REITs at over 8% a piece. This is not a knock on CUT, but rather just that the two ETFs are substantially different in portfolio composition. Below are CUT’s Real estate holdings.

(Source: Invesco)

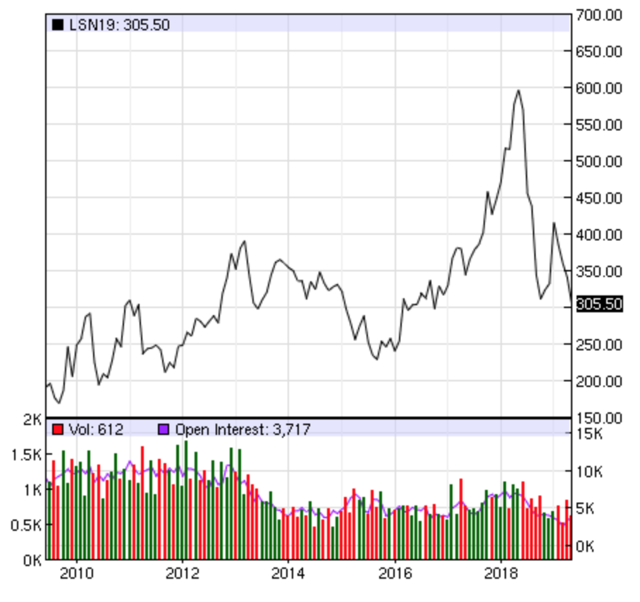

Significant lumber exposure created volatility

The lumber market has been incredibly volatile over the last two years. This is both because interest rates have been volatile, which has a direct effect upon mortgages, and because of possible lumpy purchasing due to trade fears. Pretty much all wood and paper products followed. It appears that lumber is approaching a near term bottom along with most commodities, making timber REITs and lumber exposure interesting long term investments.

Lumber peaked in the first half of 2018 and then began a considerable decline that continued for most of the second half of the year. Lumber then dramatically rebounded to start 2019, but that rebound soon faltered, taking lumber back down to recent lows.

Below is a 2-year chart of the end of day commodity futures price quotes for lumber. (Source: Nasdaq end of day futures price quotes for lumber)

But if we look at a longer term chart for lumber, we see lumber was in a decade long bull market that has been volatile. Below is a 10-year chart of the end of day commodity futures price quotes for lumber. (Source: Nasdaq end of day futures price quotes for lumber)

But if we look at a longer term chart for lumber, we see lumber was in a decade long bull market that has been volatile. Below is a 10-year chart of the end of day commodity futures price quotes for lumber. (Source: Nasdaq end of day futures price quotes for lumber)

Some and possibly a large part of the spiking increase in prices seen in early 2018 was likely due to speculation around trade policies. This most recent decline returns lumber to a reasonably familiar level that has acted as both resistance and support over the years. Since breaking above this level in 2012, it remained as strong support except ford during 2015, when it spent most of the year below current levels. It then returned to it in 2016, and set up a base here for most of that year before beginning the doubling that occurred during 2017 and the first half of 2018. (Source: Zvi Bar & Nasdaq end of day futures price quotes for lumber)

This seems to indicate a reasonable likelihood that lumber prices will find strong support at current levels, but that if they do breach it, lumber could fall another 20 percent from here. Given that interest rates appear likely to stay low, domestic housing may be able to perform reasonably well.

The entire effect of recent federal tax changes is a complicating factor that is likely to hurt some geographies and help others. House price and location preferences may undergo some dramatic changes in the next several years. While this may cause serious problems for some housing companies and local markets, timber itself is likely to remain a required component wherever houses end up being built.

Other issues do concern timber. Forests can be eaten by fire or bugs, and these environmental factors, among others, but they can also have serious effects major upon homebuilder customers. The decline in lumber prices during 2017 and 2018 was primarily due to a reduction in homebuilding. In any event, the effects are felt far beyond merely timber, as most wood, pulp, paper and packaging businesses have declined in unison, though less substantially.

WOOD’s underperformance should soon reverse

WOOD has substantially underperformed the broader market and its peer ETF, CUT, since peaking in May of last year, largely due to its more significant timber REIT exposure. The chart below shoes WOOD significantly outperformed both CUT and the S&P 500 through the first 5 months of 2018, halving appreciated approximately 15% before it and CUT began their significant decline.

(Source: Yahoo! Finance)

WOOD is also now below the low it set in December of 2018, when the broader market bottomed, and declined about 10% in the last month.

WOOD is also now below the low it set in December of 2018, when the broader market bottomed, and declined about 10% in the last month.

(Source: Finviz)

This breakdown along with the broader market here indicates a likelihood that WOOD and CUT will fall further here, as might lumber. Nonetheless, I believe the fact it has now breached that recent low makes it worth keeping on a short list to watch during this current period of volatility.

This breakdown along with the broader market here indicates a likelihood that WOOD and CUT will fall further here, as might lumber. Nonetheless, I believe the fact it has now breached that recent low makes it worth keeping on a short list to watch during this current period of volatility.

WOOD’s exposure to timber REITs has come at a great cost, but that exposure should eventually result in a period of outperformance when lumber prices stabilize and likely appreciate. Moreover, lower interest rates could help reinvigorate dementing housing in various geographies as well as make the ETF’s income production more desirable. WOOD currently yields approximately 2.67 percent.

Conclusion

WOOD is the best ETF for getting diversified exposure to timber REITs. WOOD is in free fall due to its significant timber REIT exposure that has taken the ETF below its 2018 low. Timber REITs are often a generally uncorrelated asset to the broader equity market, but they are currently following equities down too. It is hard to tell when WOOD will bottom, but it appears a good time to keep WOOD on a watch list and to consider accumulating timber REIT exposure on continued weakness.

Disclosure: I am/we are long WY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

[ad_2]

Source link Google News