[ad_1]

ETF Overview

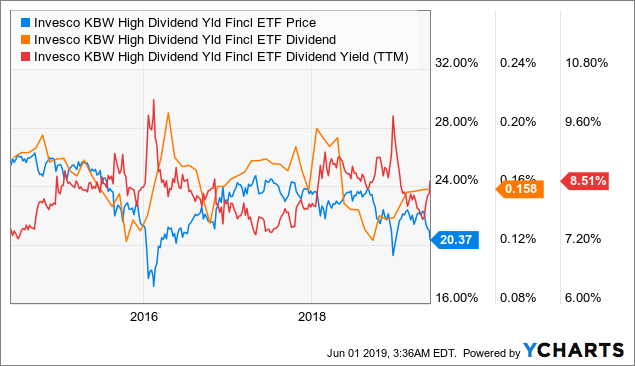

Invesco KBW High Dividend Yield Financial ETF (KBWD) focuses on small-cap high-dividend financial stocks in the U.S. The fund tracks KBW Nasdaq Financial Sector Dividend Yield Index. KBWD’s portfolio is sensitive to interest rates. Nearly half of its portfolio is mortgage REITs which are much more vulnerable in an economic recession. Although it pays an 8.5%-yielding dividend, this dividend may be reduced in an economic downturn. Since the yield curve has inverted recently, we think investors should stay on the sideline and wait till a better entry point.

Data by YCharts

Fund Analysis

A portfolio of 40 small-cap financial stocks

KBWD’s top 5 stocks represent about 20.2% of its total portfolio (see table below). Although not one stock represents over 5% of the entire portfolio, its entire portfolio is concentrated in only 40 stocks. These are small-cap stocks that tend to be more volatile than the broader market. Small-cap stocks are like small boats where large-cap stocks are like big boats on the water. Investors tend to like to stay on larger boats when there is a big wave coming such as an economic recession. Therefore, small-cap stocks can get sold off easily in an economic recession or when fear dominates the entire market.

Source: Morningstar

Financial sector will not do well in an economic recession

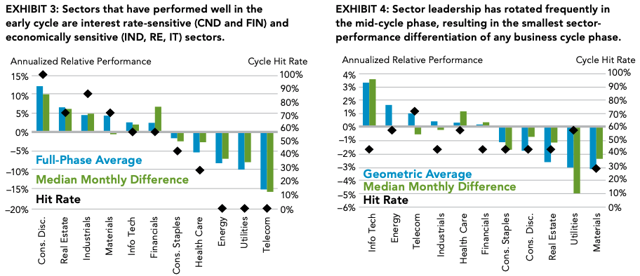

KBWD’s portfolio of financial stocks makes it an interest rate sensitive ETF. Therefore, KBWD can perform well when the economic cycle is in the early or mid-phase when interest rates start to rise or are rising. As can be seen from the chart below, financial sector tends to outperform many other sectors in these two environments.

Source: Fidelity: The Business Cycle Approach to Equity Sector Investing

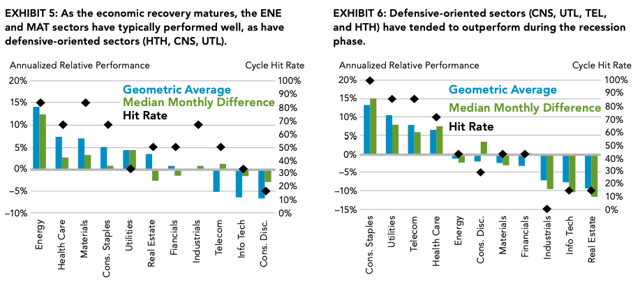

However, its fund performance may not perform as well in the late cycle phase or recession phase (see the two charts below). We continue to hold the view that we are already in the late cycle phase of the current economic cycle. Therefore, we do not expect KBWD to perform well at this point of the cycle. More on the current economic phase will be discussed later in this article.

Source: Fidelity: The Business Cycle Approach to Equity Sector Investing

Exposure to mREITs a two-sided sword

As the table below shows, nearly half of KBWD’s portfolio is related to mortgage REITs. Mortgage REITs provide financing for income-producing real estate by purchasing or originating mortgages and mortgage-backed securities (MBS) and earning income from the interest on these investments.

Source: Morningstar

Like other financial institutions, mREITs also face interest rate risks. Thanks to the fact that these REITs are required to pay 90% of their taxable income to their shareholders in the form of distribution, mREITs have high dividend yields than other financial institutions. KBWD benefits from its exposure to mREITs and has an attractively trailing-12-month 8.5%-yielding dividend. This high dividend yield may sound good for income investors. However, its dividend can be quite lumpy. As can be seen from the chart, its monthly distribution generally swings between $0.12 per share and $0.2 per share.

Data by YCharts

This dividend is also vulnerable in an economic recession. As we know, mREITs are required to pay 90% of its taxable income to their shareholders in the form of distribution. This high payout ratio means that when these mREITs are not able to make as much income (e.g. in an economic downturn), a dividend cut will be necessary.

Management expense ratio

KBWD charges a management expense ratio of 0.35%. This is comparable to other ETFs. For example, iShares U.S. Financials ETF (IYF) charges a MER of 0.43%. However, it is higher than Vanguard Financials ETF’s (VFH) 0.10%.

Investment Strategy:

Where are we in the current economic cycle?

The current economic cycle has been well into its 10th year in the United States. While the economy in the United States continues to run at a full capacity (Q1 2019 U.S. GDP growth rate of 3.2% and unemployment rate of 3.6%), the uncertainties surrounding global trade tensions has the potential to derail the U.S. economy. As can be seen from the graph below, the interest rate spread, U.S. 10-year Treasury constant maturity minus 3-month, has recently been inverted. This is not good news for mREITs and other financial institutions as they make money by borrowing at short-term lending rates and lending out at longer-term rates. Therefore, we do not think KBWD’s fund will perform well in the foreseeable future.

Source: FRED Economic Research

Investor Takeaway

KBWD has a high dividend yield. However, this should not be a core holding of any income investors as its fund price can be volatile. In addition, its dividend may swing quite a bit. Since the yield curve has recently been inverted, we think investors should stay on the sideline, as this is not the time to invest in KBWD. We think investors should wait until the beginning of the next economic cycle.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

[ad_2]

Source link Google News