[ad_1]

Delmaine Donson/E+ via Getty Images

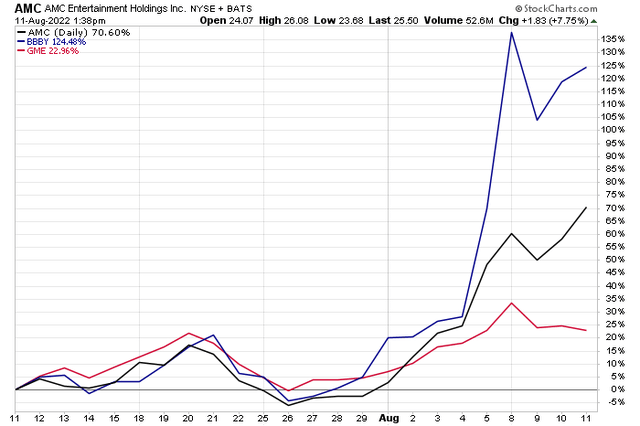

Meme stocks are back! At least for the moment. Shares of formerly popular retail favorites like AMC Entertainment (AMC), GameStop (GME), and Bed Bath & Beyond (BBBY) have surged over the last month amid the broad market rally. Just since July 26, we see those familiar monster rallies among the notorious meme stocks.

AMC, BBBY, GME Are Back In Play

StockCharts.com

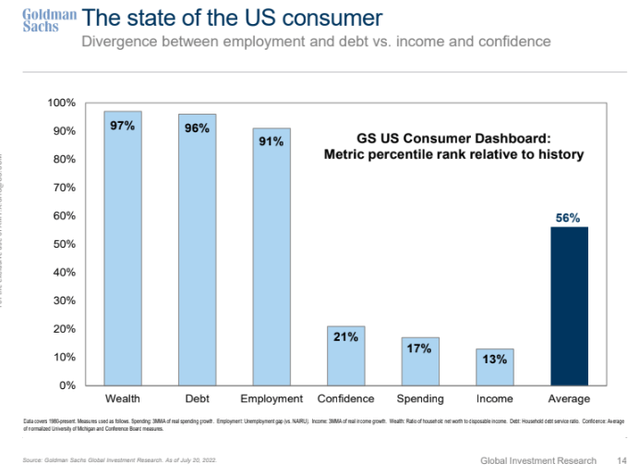

What drove so much of the meme stock frenzy during the first half of last year was excessive liquidity care of several stimulus packages and Covid-related aid bills. Moreover, the Federal Reserve was still incredibly easy with its monetary policy then. Combine those fiscal and monetary factors with people working (sitting) at home with popular stock trading apps just a swipe away, and it was the perfect storm for retail investing fervor – particularly in domestic small- and micro-cap stocks.

The consumer remains flush with cash and holding historically low debt levels even amid an environment of so much pessimism with respect to the equity market and broader economy.

Cash Remains In The Bank (Or Trading App) To Trade

Goldman Sachs Investment Research

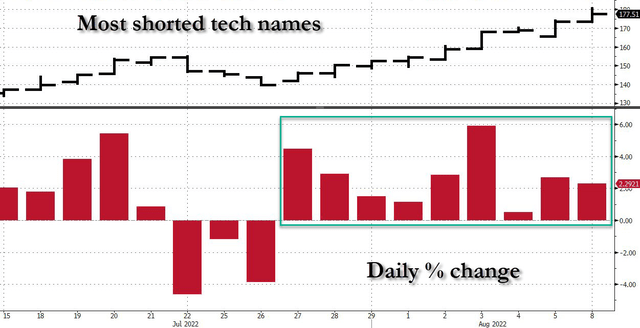

The trend is somewhat widespread, too. Earlier this month and since late July, the basket of most shorted technology stocks rallied an impressive nine consecutive days. So, it is not just the trio of meme names participating.

Heavily Shorted Names See Massive Covering

ZeroHedge

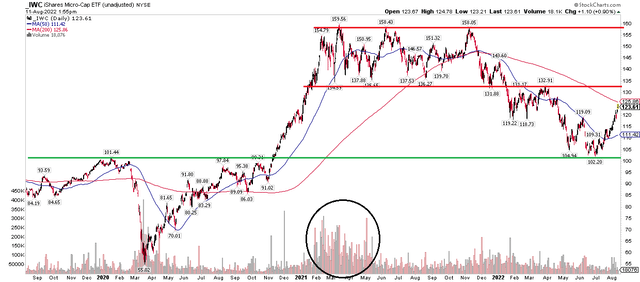

Something I noticed in my work, providing portfolio management analytical services to financial advisors, is that U.S. microcaps saw major outperformance during meme stock mania. Take a look at the technical chart below that the iShares Micro-Cap ETF (NYSEARCA:IWC) experienced extreme volume from late January 2021 through May. Even as equity volumes jumped around volatility earlier this year, IWC did not see action anything like what happened some 15 to 19 months ago.

IWC’s Relative Performance To SPY: Big Rally During Meme Stock Mania

StockCharts.com

IWC Technical Chart: Doing All The Right Things Chart-Wise

StockCharts.com

And we can dig more into the chart as price action tells a compelling (and true) narrative. IWC’s pre-pandemic high of $100 was key resistance about two years ago – the fund failed to breakout from that level during the August through October period ahead of the U.S. elections that year and before the Covid vaccines were developed.

Shares jolted late in 2020, eventually peaking well ahead of the S&P 500’s early January 2022 all-time high. IWC tried three times to hurdle $160 but failed in a rare triple-top pattern. After a months-long stretch of underperformance vs large caps, IWC broke down to kick off 2022. A February-March rally failed, and shares eventually found a floor near $102 – just about a full round-trip to the early 2020 high. I think IWC might find some sellers here around the 200-day moving average (which is still bearishly downward sloping). Moreover, the micro-caps are not far from the old range’s support low in the $131 to $135 zone, even if shares rise above that long-term moving average. Technicians say that what was once support becomes future resistance. Also, consider that IWC is a whopping 10% above its 50-day moving.

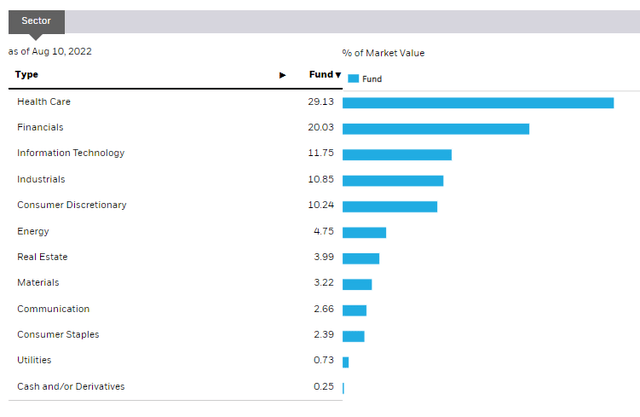

Fundamentally, IWC has a very cheap P/E ratio of just 10.2 using last year’s earnings of only profitable firms in the fund (there are 1,792 holdings in IWC), according to iShares. Investors pay a moderate 0.60% annual expense ratio on the fund, significantly above other index funds for small to large caps that are nearly free. While its price history appears correlated to the relative performance of meme stocks, IWC holders have significant exposure to the Health Care and Financials sectors.

IWC Sector Weights

iShares

The Bottom Line

IWC could have a little more upside to the low $130s from here, but I would be booking profits on gains from recent speculative action. After a 20%-plus rise off IWC’s June low and recent relative strength vs the S&P 500 as meme stocks came back in vogue, the playtime might be short-lived this go-around.

[ad_2]

Source links Google News