[ad_1]

wilpunt/E+ via Getty Images

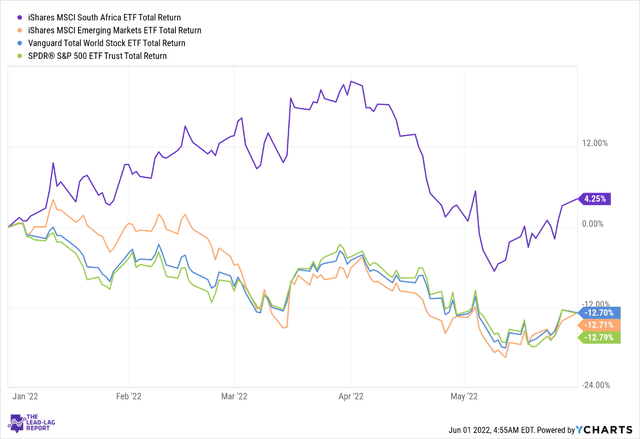

The iShares MSCI South Africa ETF (NYSEARCA:EZA) has been around for close to two decades now and offers investors access to 37 large-and-mid-sized companies based in South Africa. Incidentally, in a year where global equities have had to take it on the chin, EZA has actually fared pretty well, delivering close to mid-single-digit positive returns, even as its peers in the emerging markets, the U.S. markets, and global markets have all witnessed double-digit losses.

YCharts

Can this outperformance continue? Well, here are a few things to consider.

South African conditions

South Africa may be one of the behemoths of the broad African narrative, but is it the most promising African region to be exposed to? That is debatable. Well, according to the IMF, the GDP outlook for the entire Sub-Saharan African region is expected to come in at 3.8% this year; South Africa will only grow at half that pace with an expected figure of 1.9%! It’s also worth considering that these forecasts are unlikely to have considered the adverse impact of the KwaZulu-Natal Floods which saw the death of over 450 people. Given these developments, could we see further downside risks to that growth figure? Recent forecasts suggest that these inclement weather conditions are likely to linger.

One shouldn’t underestimate the impact of this region, as it reportedly contributes around 16% of the South African GDP. Infrastructure damages there have also accounted for around R25bn. South Africa has been beset with power outages and load-shedding which will no doubt weigh on the nation’s industrial output. This will likely put some additional pressure on the supply side, even as the country faces other demons with regards to a steep agricultural import bill.

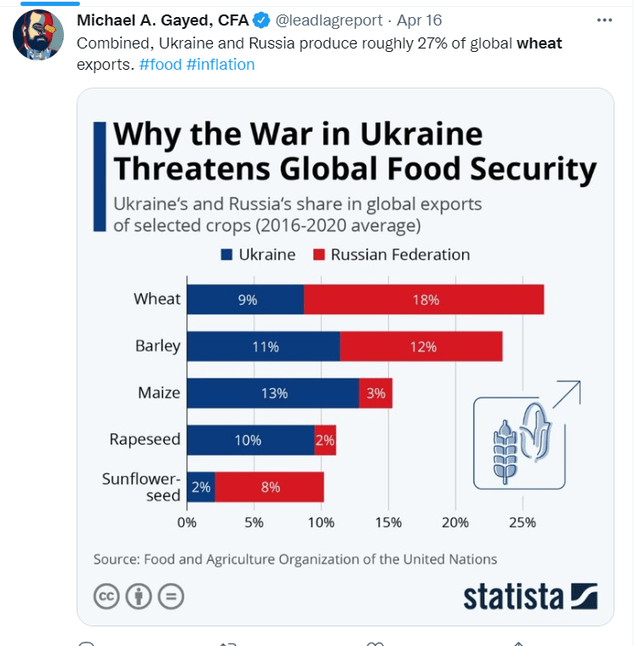

Twitter

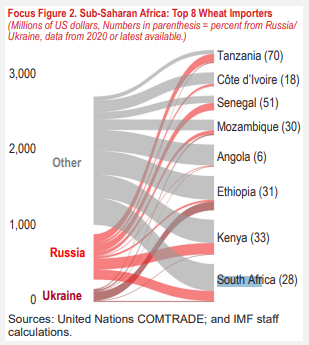

If you’ve followed the timeline of The Lead-Lag Report over recent months, you’d note that I put out a lot of content related to the global agricultural markets. Both these regions have traditionally accounted for 27% of global wheat exports. With this traditional source of supply having been curtailed, and the likes of India too limiting exports, wheat-hungry nations such as South Africa could come under the cosh. Whilst there are other African countries that are worse off, South Africa, too, could suffer as it is amongst the top 8 importers of that commodity.

IMF

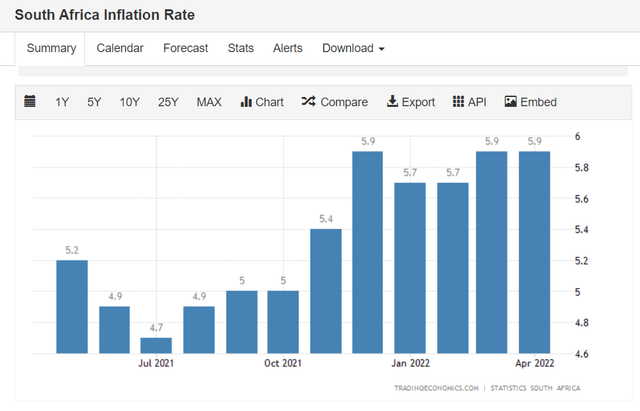

As far as inflation is concerned, the country continues to grapple with this challenge like most other nations across the globe; for 9 months now, inflation has crossed the 5% mark and is currently at levels close to 6%. If there’s an encouraging aspect to be taken from this, one could perhaps say that it is still within the South African central bank’s target range of 3-6%, but I do wonder how long it can continue to trade below this level.

Trading Economics

Regardless, the South African Reserve Bank has been fairly active in tightening rates. Around two weeks back, the South African Reserve Bank lifted its repo rate by 50bps to 4.75%, making it the fourth consecutive rate hike. According to Focus Economics, by the end of 2023, the repo rate in South Africa will likely be at 5.56%, implying further uplift of at least 80bps. This should do a world of good for the South African Rand, which in fairness has coped reasonably better than a lot of other EM currencies this year; on a YTD basis, the USD/ZAR pair is only down by 2.3%. Interestingly over the last couple of weeks, the ZAR has actually appreciated by close to 5%. What has also helped the ZAR so far is South Africa’s ample commodity exports, namely the likes of coal, gold, iron ore, etc.

The other main beneficiary of higher rates will be South African banks, and this is particularly pertinent for holders of EZA, as this sector accounts for the largest weight in the portfolio at 35%. Even before these recent rate hikes in Q2, a report from S&P Global earlier in the year showed that the likes of Absa, Standard Bank Group, and Nedbank could also see significant NII traction to the tune of ZAR 0.7bn-1.5bn, on account of a 100bps liftoff in policy rates. Sector loan growth was expected to come in at between 4-6% but in light of a potential scale down in GDP forecasts for the rest of the year, this may need to be dialed down as well.

Conclusion

Despite outperforming its peers from the emerging market this year, as represented by EEM, it is interesting to note that EZA still trades at a slight discount on a forward P/E basis; the latter can be picked up for a multiple of 9.2x, whilst EEM trades at 10.8x. Whilst South African equities remain one of the most attractively valued regions across the world, investors should be mindful of the fact that at the end of the day, this is a high-beta asset that is probably not meant for everyone. Just for some context, EZA’s beta over the last three years averages 1.37x; whereas when you consider an EEM, the beta works out to only 0.93x.

As noted in The Lead-Lag Report this week, the VIX still remains at an above-average level, and whilst we might witness some bear market rallies in the short-term, the long-term trend still points to further downsides, unless we see a pivot in Fed communication or a halt to the Ukraine fiasco. Crucially, 3 out of my 4 inter-market risk signals still continue to signal risk-off. In an environment such as this, one ought to tread cautiously when loading up on high-beta plays.

[ad_2]

Source links Google News