[ad_1]

da-kuk

Investment Thesis

In my last article on the iShares MSCI India ETF (BATS:INDA), I concluded that investors were facing significant downside risks caused by exuberant valuations. Since then, INDA lost ~10% vs a loss of ~20% for emerging markets and provided better returns than its benchmark despite forex headwinds.

While my fears related to the negative price action haven’t materialized yet, I remain convinced that valuations are close to a historical high on a cyclically adjusted basis which makes Indian equities a risky asset class to own at the moment. The downside risk to this investment is exacerbated by the global macro outlook, where the probability to have a global recession over the next 18 months has increased considerably. As a result, I continue to believe that INDA is likely to underperform other cheaper developed and emerging markets ETFs over the next two years.

What Has Happened Since My Last Article

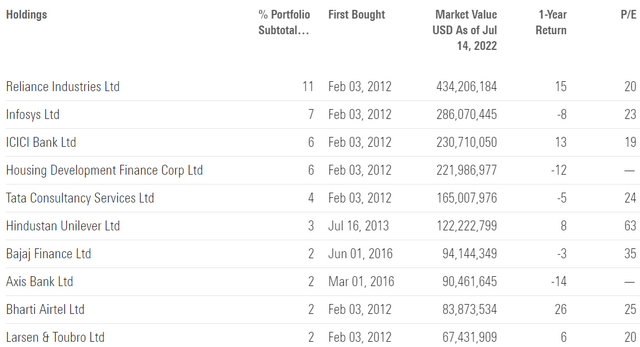

As a reminder, INDA tracks the MSCI India Index and invests in a basket of large and mid-sized companies in India. You will find below a recent breakdown of the top 10 holdings, and you can read more about the strategy in my previous article.

Morningstar

I concluded my previous article with the following statement:

India is likely to grow faster than most western economies. Given the fact that GDP growth is a key driver for equity market performance, I think that investing in India today is appealing to investors who wish to diversify their portfolios and add some emerging market exposure. In terms of valuation, I think the index is expensive at the moment and does not offer any emerging market risk premium. As a result, I think it is better to wait for a 10-20% pullback in Indian equities before purchasing INDA.

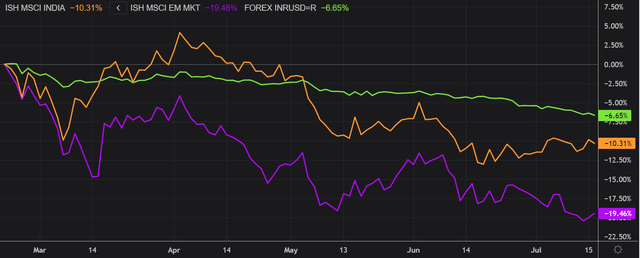

INDA held up relatively well despite all the selling that we had in equity markets. I have compared below INDA’s price performance against the iShares MSCI Emerging Markets ETF (EEM) over the last 6 months to assess which one was a better investment. Since my previous article, INDA lost nearly 10.3% compared to a loss of ~19.5% for EEM. What is even more interesting is that nearly 7% of the drawdown can be attributable to the Indian currency and only a small fraction to equity prices.

Refinitiv Eikon

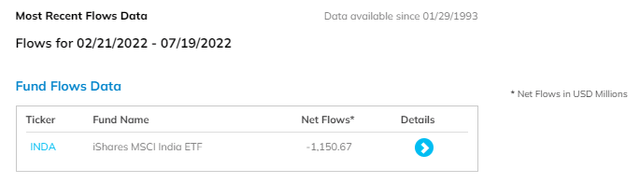

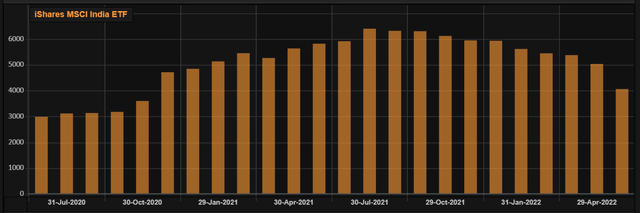

A rising dollar and higher US interest rates have pushed in a large number of investors to repatriate capital that was previously invested in emerging markets. That is reflected in INDA’s net flows which have been marked by $1.15 billion in outflows since late February, representing over 20% of assets under management. A reversal in the dollar is likely to have the opposite effect, but it is still unclear if we have reached that tipping point yet. The Fed is definitely determined to hike rates in order to fight inflation, and they have been so far extremely hawkish, much more than analysts previously anticipated. When that happens, it will be beneficial for Emerging Markets in general.

ETF.com

Refinitiv Eikon

Indian Stocks Near All-Time Highs: Is It A Good Time To Buy?

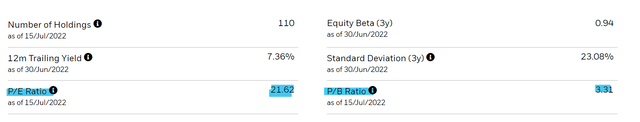

Valuation remains the main risk in my opinion for investors considering INDA. According to iShares, the fund is currently trading at nearly 22x earnings and has a price-to-book ratio of over 3. These multiples are proof that valuations are stretched and that INDA doesn’t provide any emerging market premium.

iShares

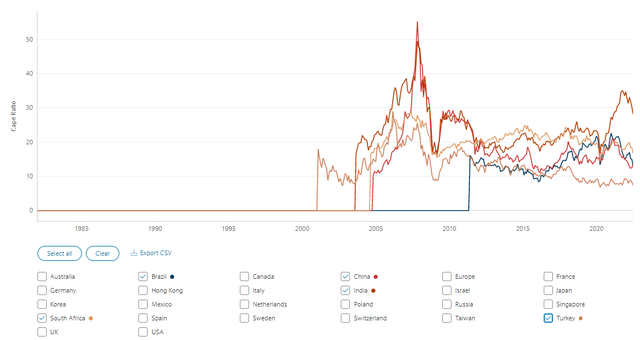

For investors who like to look at the past as a proxy for the future, it’s interesting to note that Indian stocks were only once pricier than they are today. You will have to go back to 2007 to find higher cyclically adjusted multiples. We all know how that story ended when the Global Financial Crisis (“GFC”) unfolded and stock multiples were more than halved for Indian equities. In other words, Indian stocks underperformed developed markets from 2007 to 2009 because they entered a global recession with unsustainable valuations.

Barclays Indices

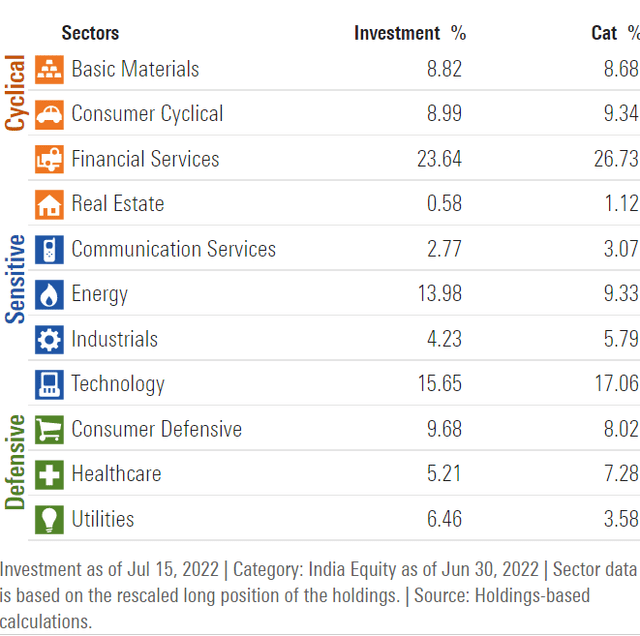

I think a similar scenario could happen again. In that case, I believe INDA will be very volatile. Over 42% of stocks are in cyclical sectors, with an additional ~37% invested in sensitive areas of the economy such as Energy and Industrials. Less than 22% of the portfolio is invested in defensive stocks. As a result, the portfolio is very vulnerable to a recession, and volatility will be the main theme over the next 18 months.

Morningstar

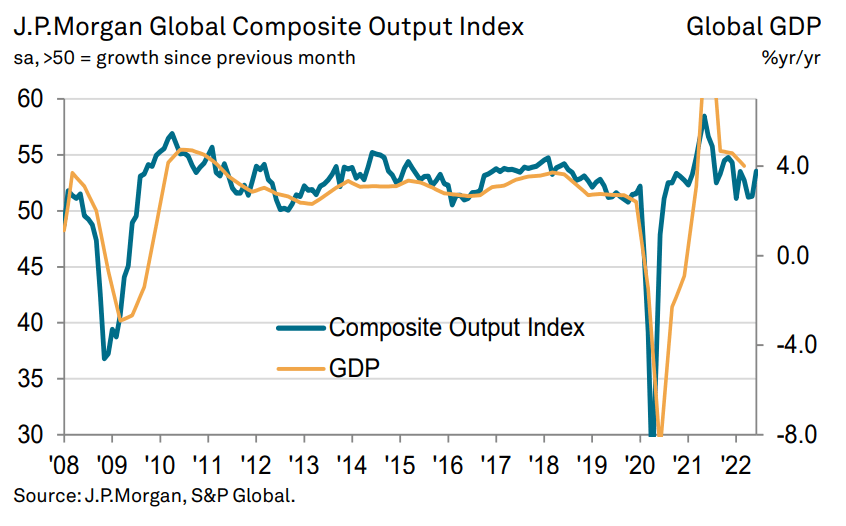

There are several reasons why I feel a global recession is likely to happen over the next 18 months. Consumer sentiment is reaching new lows every month in a number of countries across the world. Consumer pessimism is the primary cause of decreasing demand, causing a bullwhip effect on the economy. That will ultimately affect global PMI data, which has been uplifted in June from 51.3 to 53.5 by the revived upturn in the Chinese economy. Profit estimates are also likely to deteriorate in this context, which could prompt downward estimate revisions. All in all, India is a hot market at a moment in time when risk is increasing in the equity space. As a result, I believe it is better to come back at a later date when valuations will cool off.

JPMorgan

Key Takeaways

While my bearish scenario is still unfolding, I remain confident that valuations on a cyclically adjusted basis are close to a historical high, making Indian stocks a risky investment. The gloomy global macro outlook manifesting in the form of a global recession is adding fuel to the fire. As a result, I believe INDA will underperform other less expensive developed and emerging markets ETFs over the next two years.

[ad_2]

Source links Google News